Forex and contracts for difference (CFD) trading is a risky business, with more than 80% of all retail traders losing money. Indeed, all online brokers are required by law to give out a warning about the risks involved. Therefore, to succeed, you need to have a combination of forex trading skills and risk management. The latter helps ensure that you make maximum returns while minimizing your risk exposure. Here are the best risk management strategies in forex trading.

Stop loss, trailing stop loss, and take profit

A stop loss is an important risk management tool that can help you avoid making significant and unwanted losses. The tool, which is available on most trading platforms, stops a trade immediately when it reaches a certain level.

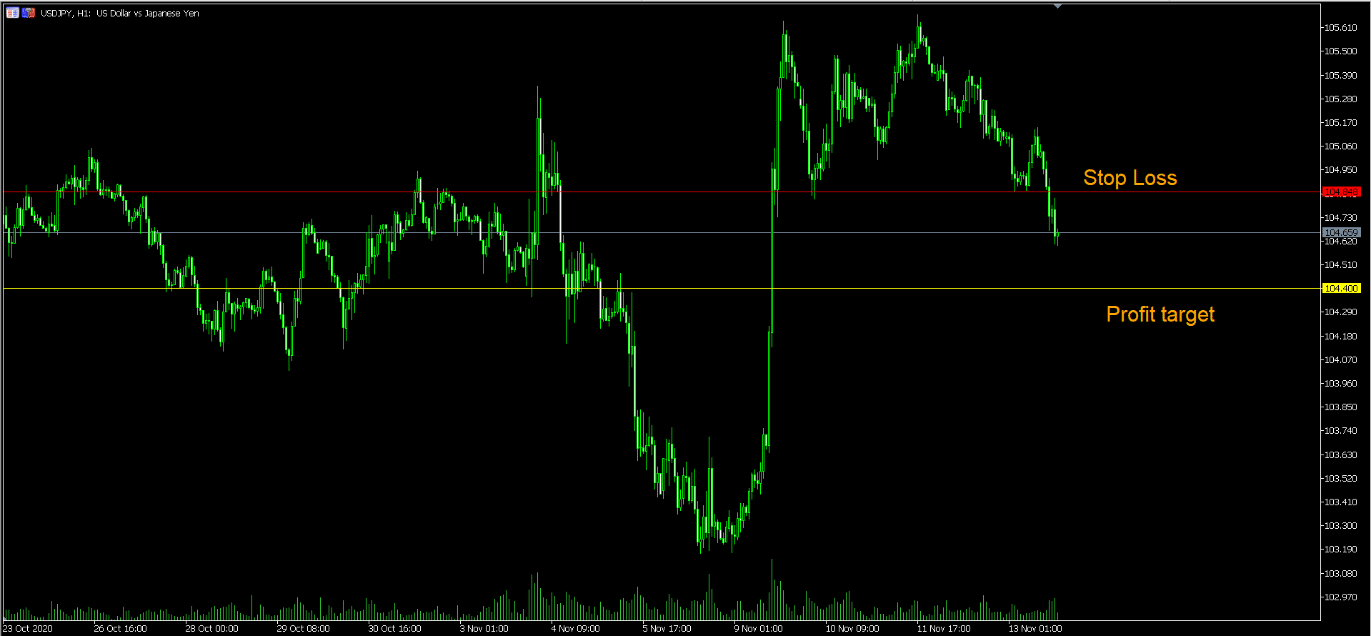

For example, the USD/JPY pair is trading at 104.63 and heading downwards as of this writing. If you believe that the trend will continue, you can short the pair and target a profit at 104.5. However, there is also a possibility that the pair will bounce back and start rising. To prevent making substantial losses, you can place a stop loss at 104.85. With a stop loss, the trade will stop automatically when the pair reaches 104.85.

While a stop loss is a good tool, most professional traders prefer a trailing stop loss, which moves with the currency pair. In the example above, if the USD/JPY pair dropped to 104.45 and then reversed to 104.84, the trailing stop would preserve the initial profit.

A take profit is a tool that automatically stops a trade when the profit target is reached. In the above example, the take profit would be at 104.40.

There are several benefits of using these tools:

- They help you be protected in case of a major unexpected event.

- They help you trade according to your risk and reward ratios.

- They help swing, and long-term traders protect their trades against overnight risks.

- Stop loss and take profits to help part-time traders set-up their trades and leave them running.

Leverage and margin

Most online brokers offer a feature known as leverage, which is sort of a loan that increases your buying or shorting power. In the European Union, the maximum leverage a broker can offer to retail traders is 1:30. Internationally, the leverage can be as high as 1:500.

If you have a $1,000 account and use a 1:30 leverage, it means that you can trade currency pairs worth $30,000. Similarly, if you use a 1:500 leverage, it means that you can trade currencies worth $500,000. To use this leverage, you will need collateral, which is known as margin.

Leverage is an important tool to maximize your profits. Obviously, trading with $10,000 can make you more money than trading at $1,000.

However, leverage is a major risk in the forex market. For example, with your $1,000, the maximum loss you can make per trade is $0. However, with the borrowed money and with no negative loss protection, it is possible to lose more money than you have in your account.

Therefore, we recommend that you start with small leverage and increase it as you gain more experience.

Pending orders usage

There are two main types of orders in forex – market execution and pending orders. In market execution, the orders are initiated at the current price. In pending orders, the trades are executed only when the price reaches a predetermined level. There are several types of limit orders:

- Buy limit. In this order, a buy trade is executed when the price drops to or below a certain predetermined level.

- Sell limit. Here, the sell order is executed when the price rises to or above a certain price.

- Buy stop. A buy stop tells a broker to buy a currency pair when the price reaches a certain point.

- Sell stop. Like the buy stop, this order directs a broker to sell a currency pair when it reaches a certain point.

There are two main reasons why pending orders are better at risk management than market orders:

- They help prevent slippage, which happens between when you execute a trade and when the broker implements it. For example, you can open a buy trade at 1.1200 and is executed at 1.1205, which can be substantial.

- Pending orders help ensure that orders are executed when a trend has already been established. For example, if a pair is trading at 1.1200, and you believe that it will need to move above 1.1220 to reach 1.1250, you can open a buy stop trade at 1.1221. Similarly, if you believe that the price will drop to 1.1150, you can place a sell stop at 1.1180.

Understanding currency correlations

Another risk management strategy in forex trading is currency correlations. This concept refers to the fact that some currency pairs tend to move in a similar direction while others move in the exact opposite direction. Therefore, if you trade multiple trades instantly, opening perfectly correlated currency pairs can put you at risk.

For example, if the EUR/USD and GBP/USD tend to move in the same direction, buying the two pairs at a go can put you at risk if the prices drop suddenly.

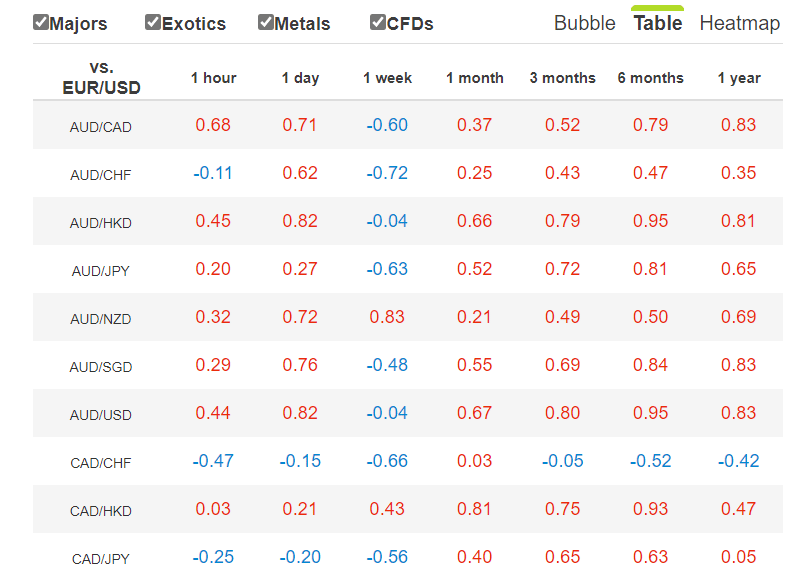

You can reduce this risk by using the mathematical concept of correlation, which seeks to identify relationships between items. Since this calculation can take too long, the best approach is to use the free currency correlation tools available on the internet.

Correlation figures range between -1 and +1. A figure of -1 means that the two pairs are not related, meaning that they move in different directions. The figure close to 1 means that they are correlated and that they move in a similar direction. If the correlation is close to zero, it means that the two are not related. For example, below, we see that in the past six months, the EUR/USD pair and AUD/USD are almost correlated.

Forex correlations

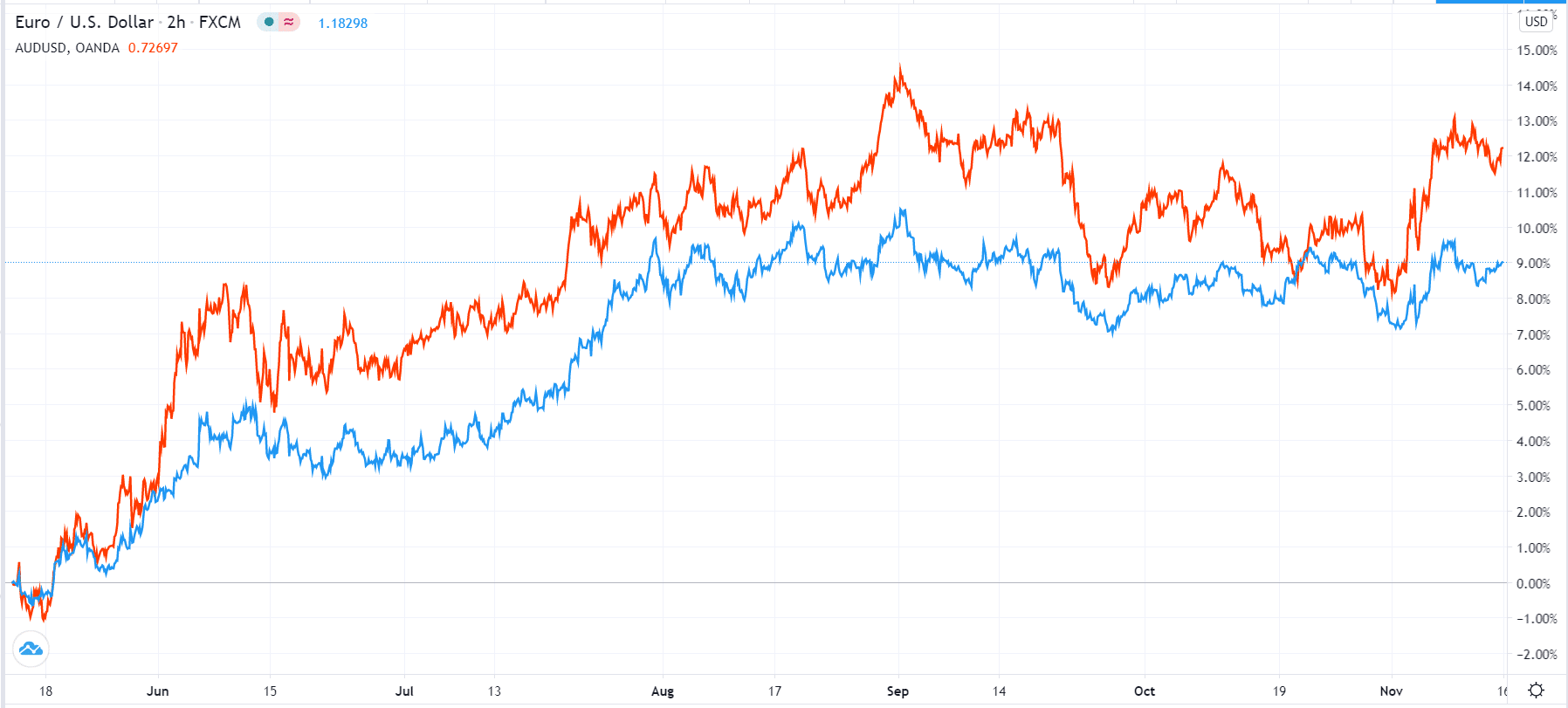

Now, look at a six-month chart of the EUR/USD and AUD/USD pair.

Your mental status

Another important risk management strategy in forex is your mental status, often known as psychology. In fact, most forex traders lose money because of failing to properly manage their mental status. For example, they open a bigger trade after a big loss hoping to recoup some of their losses. Others open a similar trade after making a profit.

This is wrong. Instead, you should only open trades after doing some intense technical and fundamental analysis. Also, you should ensure that all trades you open are in line with your day trading strategies. For example, if you are a trend follower, you should avoid trading reversals in haste.

Also, you should always assess your mental state before you trade. If you are going through a tough situation like sickness or death, we recommend that you avoid trading. In such cases, staying away from the market can save you a lot of money.

Final thoughts

Risk management is an important aspect of forex trading. Without it, most traders and even investors tend to lose a lot of money. For example, a few years ago, Bill Ackman, who is one of the most respected investors in Wall Street, lost more than $4 billion in a single investment simply because he did not have a good risk management strategy. Using the approaches we have mentioned here will help you avoid these risks.