The FX market provides traders with multiple opportunities for profit throughout the day. However, where there is a winner, there is always a loser. For that reason, traders need to be on high alert regarding the price fluctuations in this market, and they need to exercise discipline and patience before trading any potential opportunities. To facilitate this, traders have come up with several strategies over the years, some having higher rates of success than others.

Types of trading styles

There are different styles of trading that FX traders will typically adopt, and they vary in the timeframes that trades are kept open. There is no one style that’s better than the other. The choice of trading style boils down to a trader’s personal preferences, the time they have disposable to them for analyzing the markets, and the size of their investment. The styles are listed below.

- Scalping – This involves keeping trades open for just a few minutes in a bid to take advantage of short-term price fluctuations. Such a trader looks for few pips in profit and will often place several trades in the space of a day. Typically, they utilize low timeframe charts to spot these sudden price moves.

- Day trading – As the name suggests, this involves exiting all open trades by the end of the day. Traders who practice this trading style avoid paying overnight fees, as well as the risk of adverse price movements during the night.

- Swing trading – In this style, traders ride market trends, usually for a few days at a time. For instance, for a long trade, a trader would typically exit their position after a swing high is reached.

- Positional trading – This trading style takes advantage of long-term moves, and trades can be left open for months or even years at a time. These traders will mostly utilize fundamental analysis in their trades, but some technical analysis is still necessary to spot trade opportunities.

Top FX trading strategies

1. The 50 pips a day strategy

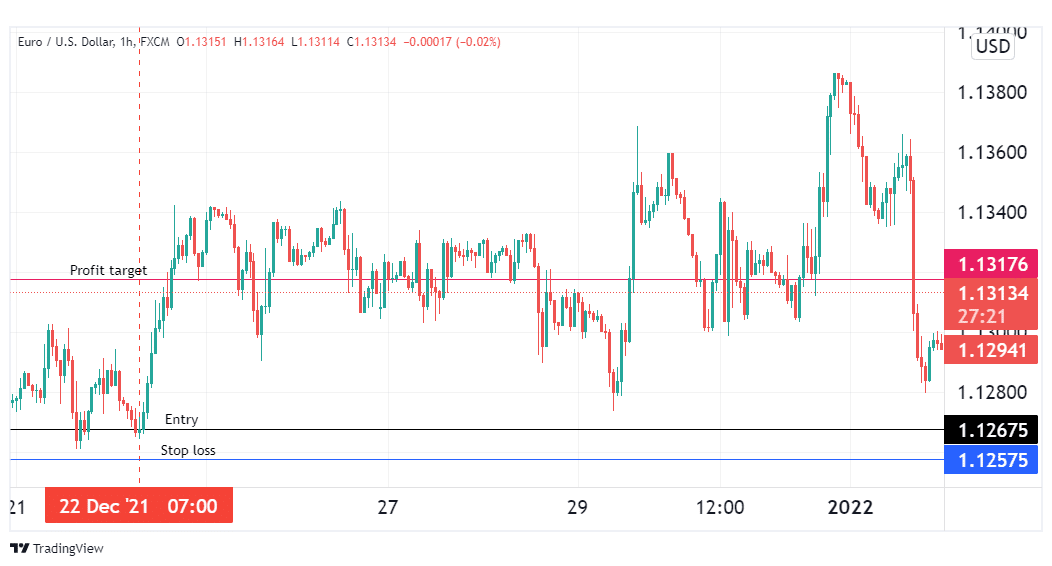

As the nomenclature suggests, this strategy aims for 50 pips in profit, and it is typically used by day traders. To implement this strategy, you first have to pick a currency pair with high liquidity and relatively high volatility, such as EURUSD. Next, wait for the London session to open at 7:00 AM GMT and place two pending orders on opposite sides of the 7:00 AM candlestick (see the illustration below).

After that first London session candlestick closes, prices will follow either an upward or downward direction. This will activate one order and cancel the other. For the activated order, the profit target is set 50 pips away, while the stop loss is set 10 pips away.

2. The daily chart strategy

This involves the use of a daily chart, as these charts tend to filter out the noise and whipsaws prevalent in smaller timeframe charts. Since traders will not be concerned by the smaller price moves, they aim for larger profits, typically around 100 pips or more.

To implement this strategy, you first need to identify the current market direction. To do this, you can use a long-term Moving Average such as the 200-period MA. If prices are above this MA, you will be looking to enter long trades. If they are below the MA, you will have a short trades bias.

After identifying the direction, you can use tools such as the RSI to identify ideal trade entries. Remember never to rush into a trade; take your time, do it right. Further, you may need to utilize larger stop losses, which necessitates the use of as little leverage as possible.

3. The hourly chart strategy

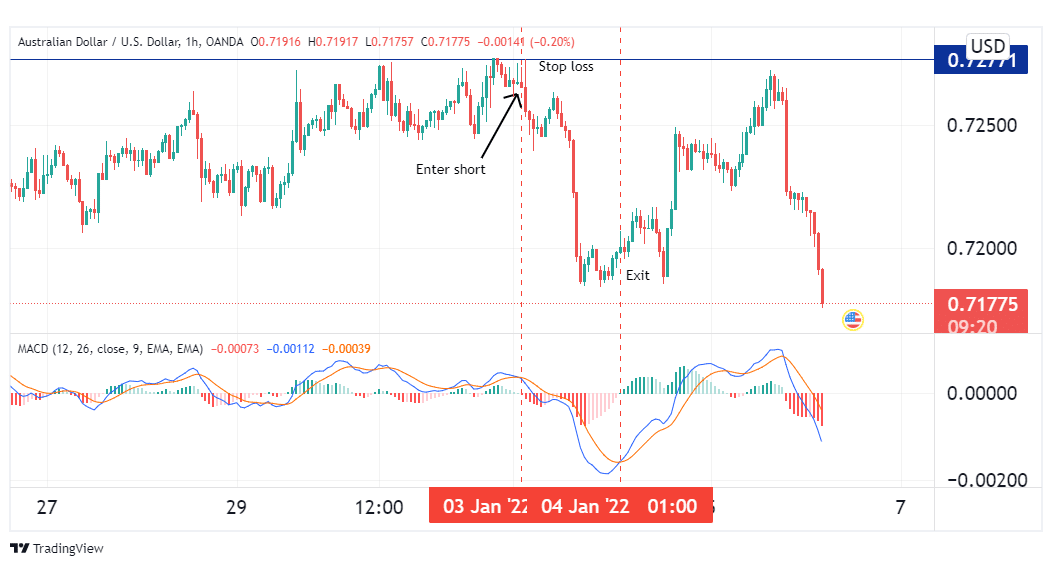

On the 1-hour chart, the best indicator to utilize for timing entries and exits is the MACD. When the MACD histogram crosses above the zero line, it prompts the trader to enter a buy trade. Such a trade would necessitate a stop loss at the most recent swing low.

Conversely, if the MACD histogram stays below zero (see the example below), it would necessitate the opening of a short trade. Alt: The hourly chart strategy in practice.

The stop loss for such a trade can be placed at or above the most recent swing high.

4. Weekly chart strategy

Utilizing a weekly chart presents traders with far more reliability and stability than shorter timeframe charts. Since small price fluctuations are not taken into account, profit targets are much larger, and so are stop losses. For this reason, traders should avoid over-utilizing leverage when employing this strategy.

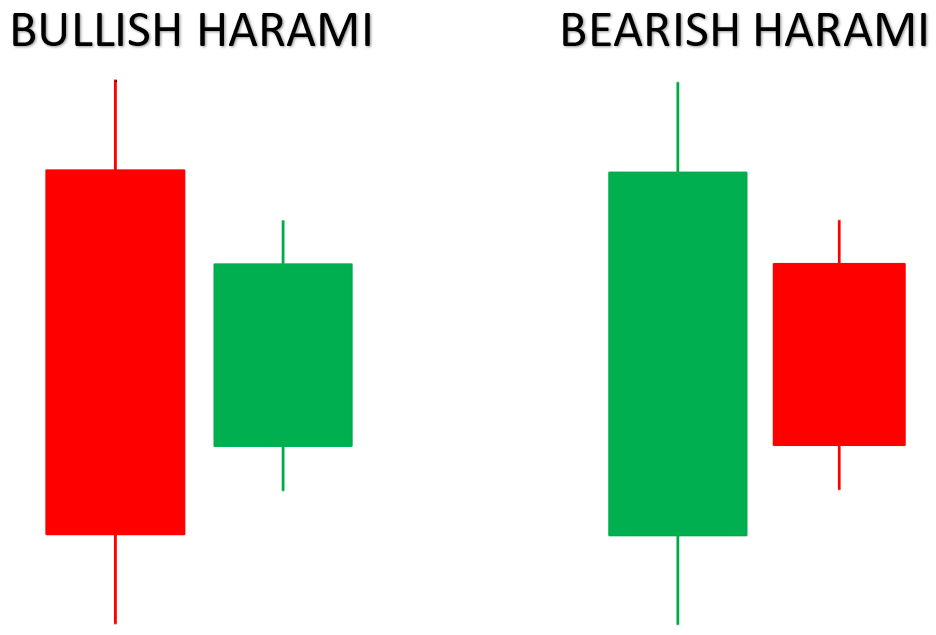

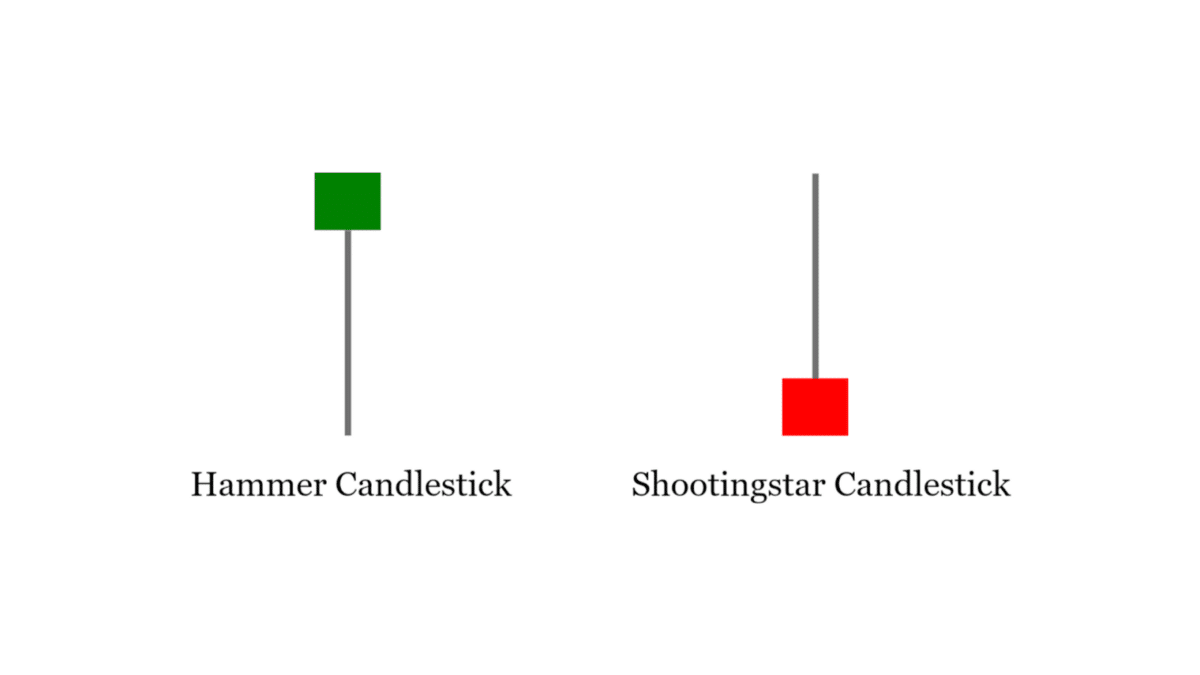

In this approach, traders may use common tools to spot ideal entries and exits, as well as price action setups such as engulfing candles, hammers, shooting stars, and haramis.

(see the examples above).

5. The 4-hour strategy

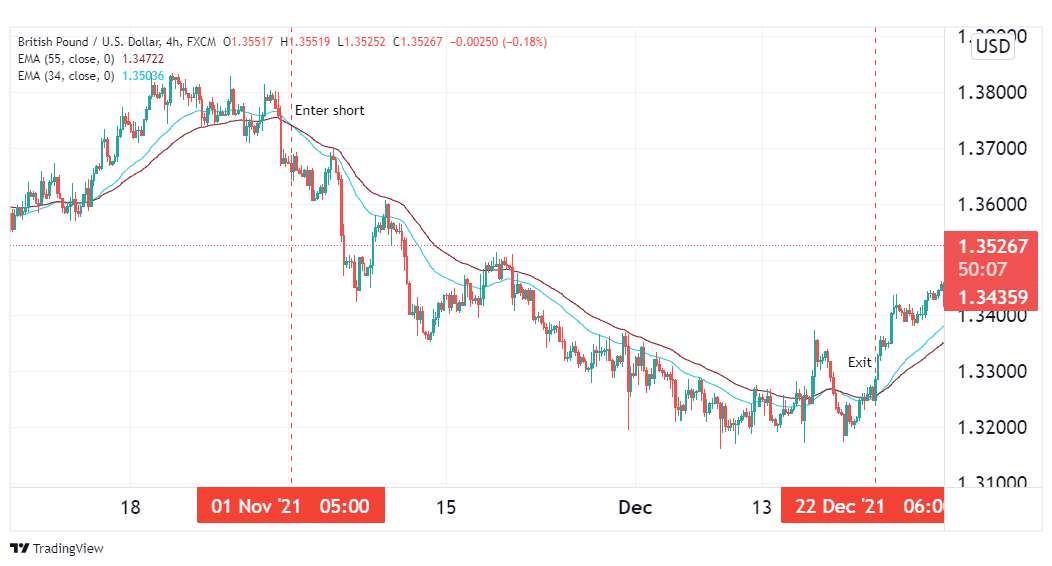

This is a common strategy used by swing traders. Using a 4-hour chart, they scour the markets for trade opportunities. They also utilize a lower timeframe chart, usually the hourly chart, to locate precise entry and exit positions.

To utilize this strategy, you need two MAs of different lengths. For best results, we recommend using a 55-period EMA and a 34-period EMA. When the 34-period MA crosses above the 55-period MA and prices trend above both lines, it prompts us to enter long trades.

When the 34-period MA crosses below its counterpart and prices move below both lines, it calls for a short trade. The illustration above shows an example of the short trade using the method.

Conclusion

Various trading styles suit different types of traders. Before choosing any one style, you should consider your personal preferences and the amount of time you can dedicate to actively analyzing the markets in a day. Once you have that figured out, you can choose among the 50-pip strategy, the hourly chart strategy, the 4-hour chart strategy, the weekly or daily chart strategy to utilize for your FX trading in 2022.