The financial markets are filled with exciting opportunities in the post-pandemic era. The general community is looking for ways to amplify their monthly income. Copytrading is one of the unique ways to leverage your cash flow by following the trades of a professional trader. It eliminates the need to learn the markets and is rapidly becoming popular amongst the masses.

What is the best copy trading platform in 2022?

The best copy trading platform will ensure a smooth transfer of traders from the provider to the receiver. The latency is minimal, and multiple traders are available to follow. Custom filters are included on the website to help with the selection process.

10 Best copy trading platforms to consider

After thorough research and analysis, we compiled a list of the best copy trading platform. They offer quality returns, multiple packages, and superb customer support with numerous other features.

- TechBerry

- eToro

- FBS

- HotForex

- Pepperstone

- OctaFX

- Vantage

- Naga Markets

- PrimeXBT

- AvaTrade

1. TechBerry

Why TechBerry?

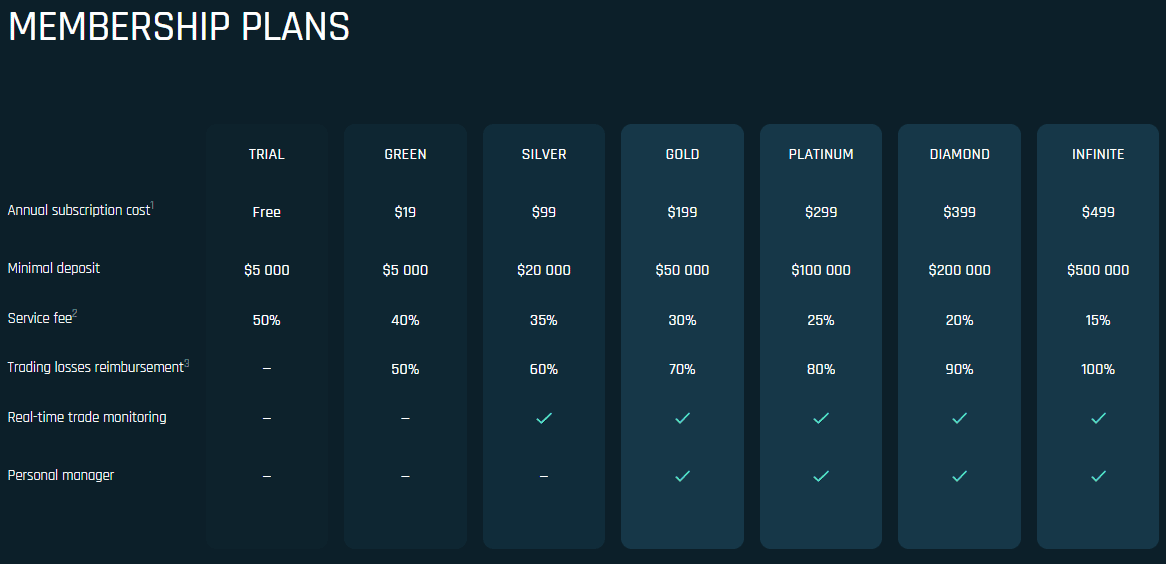

TechBerry offers profitable copy trading services that average 10% gains each month. The platform is accessible via multiple subscription packages that start from as low as $19 charged annually. Loss reimbursement starts at 50% and goes up to 100% for the Infinite plan.

TechBerry offers real-time trade monitoring to its subscribers and uses over 50 reputable brokers that come under the regulation of top authorities. Individuals can employ the plan configurator to estimate the monthly profits.

Core features

- Average of 10% monthly gains

- Full loss reimbursement

- Multiple packages are available

- Low service fee starting at 40%

Pros/Cons

| Pros | Cons |

| High average returns | High initial deposit required |

| Real-time trade monitoring | Integration is only possible with MT 4/5 |

| Access to personal manager | |

| Low annual subscription costs |

Verdict for TechBerry: Best Automated Social Trading Platform

2. eToro

Why eToro?

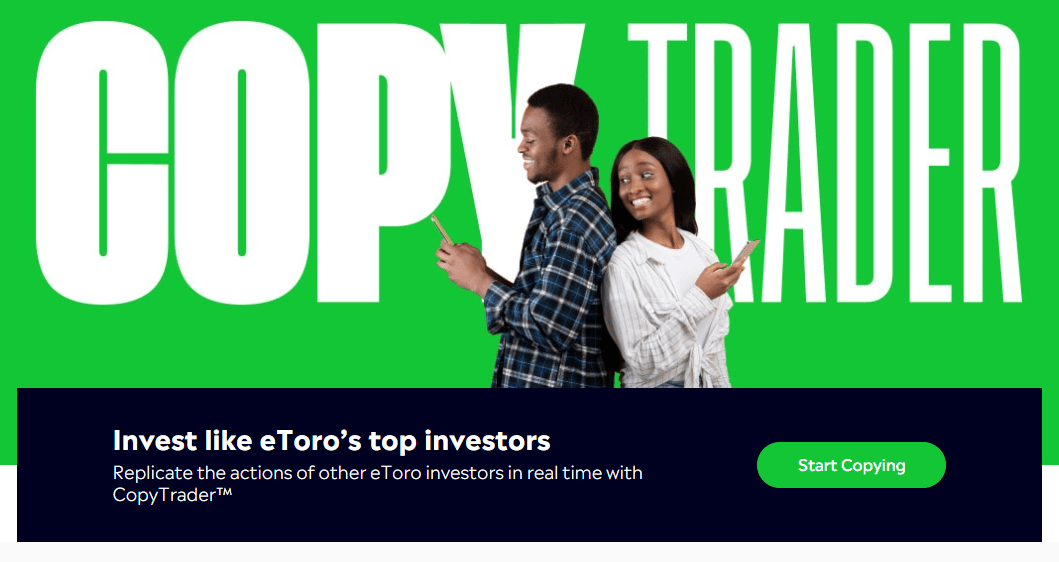

eToro is a popular social trading platform established back in 2007. It offers free-of-cost social trading services with a beginner-friendly interface. There are over 25 million global traders present on eToro. Various professional traders are available, offering their signals for copy trading purposes.

Traders can use an all-advanced filter to find out the best service providers. After selecting the portfolio of your choice, set the desired investment amount and click on the copy button to start trading.

Core features

- Extensive live records

- Multiple portfolios with the ability to filter them

- Copy up to 100 traders simultaneously

- A free $100000 demo for testing

Pros/Cons

| Pros | Cons |

| Beginner-friendly mobile and web interface | A slightly high minimum of $200 |

| No charges for copy trading | High spread for CFDs |

| Instant execution | |

| 0% commission on stocks |

Verdict for eToro: Good Free Copy Trading Platform

3. FBS

Why FBS?

FBS has different account options such as cent, zero spread, micro, standard, and ECN. Traders have access to the high leverage of 1:3000 and 24/7 customer support. Multiple instruments are available for trading, such as forex, metals, indices, energies, crypto, etc.

The broker currently supports trading via MT 4 and 5 platforms and FBS Trader. The copy trading program at FBS features one-tap investing, performance tracking, no prior market knowledge requirement, and multiple deposit/withdrawal methods.

Core features

- Multiple account types

- Detailed analytics and education section

- Multiple promotions and rewards

- Various deposit and withdrawal methods

Pros/Cons

| Pros | Cons |

| Easy payment processing | A high commission on ECN and zero spread account |

| A low minimum deposit of $1 | High leverage can be risky |

| No requotes | |

| Affiliate program to earn commission |

Verdict for FBS: Excellent All Rounded Broker

4. HotForex

Why HotForex?

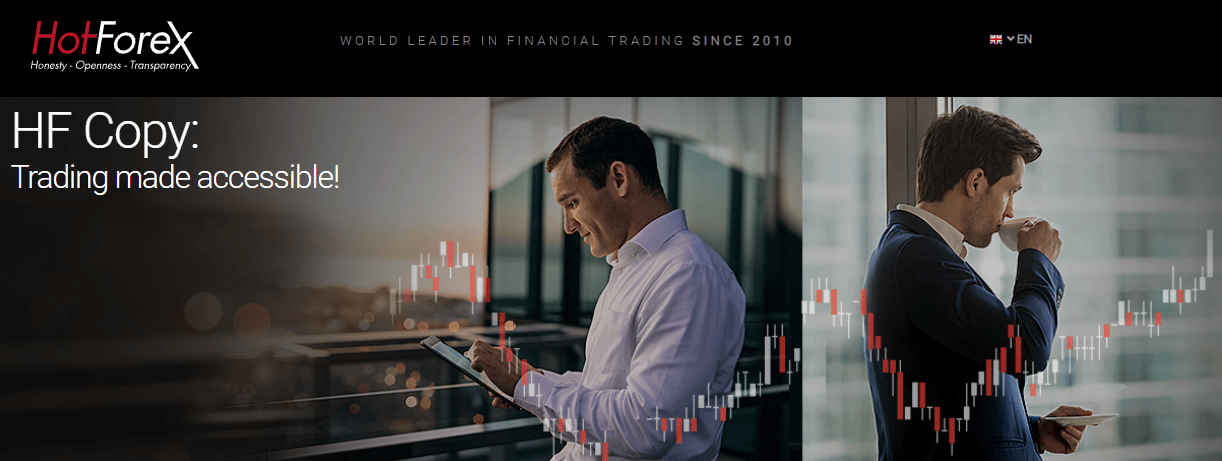

HotForex has over 1200+ instruments for trading in their portfolio. The broker comes under the regulation of the Financial Conduct Authority (United Kingdom), Financial Sector Conduct Authority (South Africa), Financial Services Authority (Seychelles), etc. There are no deposit fees, and traders can fund their accounts via bank transfers, credit/debit cards, and e-wallets.

HotForex offers diverse trading strategies in the copy trading department. Professional traders can register as providers and charge up to 50% in performance fees, while followers can monitor, deposit, and withdraw anytime. Traders have full control of their accounts and funds.

Core features

- Leverage of up to 1:1000

- Webinars and educational videos

- 15 + deposit methods

- 60+ industry awards

| Pros | Cons |

| Daily market analysis and Q&A sessions | Performance fees can be high for copy trading |

| 18 trading tools are available | Available only on MT 4 and 5 |

| 100% trading bonus | |

| No fees on deposits |

Verdict for HotForex: Good Education and Research

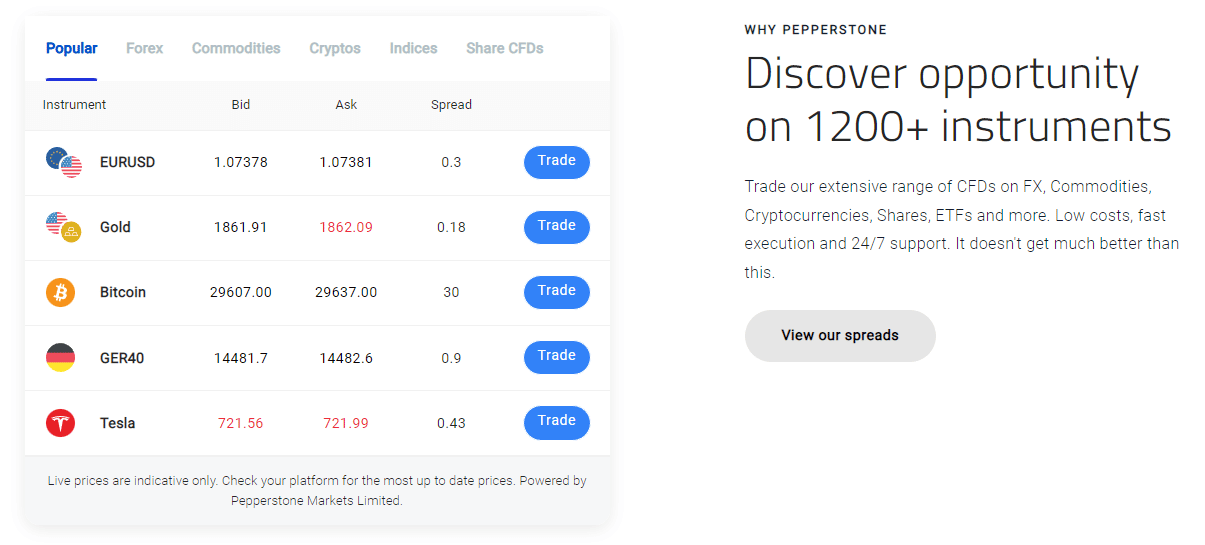

5. Pepperstone

Why Pepperstone?

Pepperstone is a no-dealing desk broker with a 99.95% fill rate on the orders. The broker offers MT 4/5 and cTrader as major trading platforms and tight spreads with the razor account option. To ensure top-notch security, the brokerage comes under the regulation of the Cyprus Securities and Exchange Commission (Cyprus), Financial Conduct Authority (United Kingdom), and Australian Securities and Investments Commission (Australia).

Pepperstone does not have its own social trading services but supports it via third-party platforms. Traders can select an appropriate signal provider on Myfxbook, MQL 5 marketplace, and Duplitrade and connect it to their account at the broker.

Core features

- Over 1200 instruments available to trade

- 10% rebates on FX and gold trades

- Tight spreads with fast execution speeds

- Supports multiple trading software

| Pros | Cons |

| Quick deposit and withdrawals | No personal copy trading platform |

| Easy sign-up | No micro or cent account |

| Regulated via two tier-one regulators | |

| Suports MetaTrader and cTrader |

Verdict for Pepperstone: Trusted Broker with Platform Technology

6. OctaFX

Why OctaFX?

OctaFX offers swap-free trading for all traders and provides support in multiple languages. The broker charges no commissions on deposits and withdrawals and has negative balance protection for investors. Traders can start trading with as low as $100 in funds on 35 currency pairs, gold, silver, 3 energies, 10 indices, and 30 cryptocurrencies. The platform supports hedging scalping and expert advisors.

The copy-trading section on the website has a dedicated area for the master trader and the copier. Investors can allocate their funds to the trader of their choice and withdraw them whenever necessary. It is also possible to monitor the trades manually. All the orders are executed in less than 5 ms.

Core features

- Portfolio diversification via copy trading

- Manual management of funds

- Available on Apple, Android, and Web

- Supports multiple languages

| Pros | Cons |

| Swap-free trading | Slightly high spreads |

| A few deposit options | Only two account types |

| No free withdrawals | |

| Multiple trading tools are available |

Verdict for OctaFX: Best Swap Free Broker

7. Vantage

Why Vantage?

Vantage offers CFD trading on forex, commodities, indices, and shares with a leverage of up to 1:500. The broker has RAW ECN accounts with commissions as low as $3 per lot side. Traders can start with a minimum deposit of $200 and enjoy zero commissions on funding their accounts. Customer support is available 24/7 via Telegram chat and the online ticket. The learn to trade section is dedicated to new investors for establishing their feet in the financial industry.

Social trading is supported by Zulutrade, Myfxbook, and Duplitrade at Vantage. Traders can choose from over 10000 signal providers over these platforms and enjoy automated copy trading. They can customize each position according to their liking and witness live performance records.

Core features

- Institutional grade liquidity

- Low commission per lot side

- 24/7 customer support

- Exclusive mobile app

| Pros | Cons |

| Low spreads with attractive commission | Limited number of trading instruments |

| Multiple partnership programs | Few deposit methods |

| Fast and easy sign-up | |

| Various liquidity providers |

Verdict for Vantage: Multiplatform Social Trading

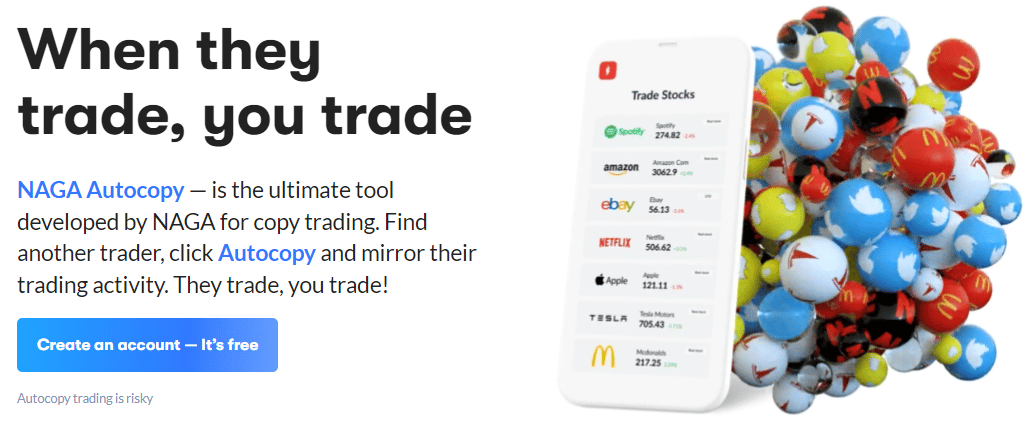

8. Naga Markets

Why Naga Markets?

Naga Markets comes under the regulation of the Cyprus Securities and Exchange Commission (Cyprus). The broker does not have any hidden fee and only charges €0.99 per trade on stock trading. The platform hosts a community of over a million traders where they can copy trade other investors for just €1. It is possible to set custom risk management during copy trading. A custom calculator is also present to calculate the amount of profits you can earn.

The broker provides traders with multiple educational materials and tools to help with trading. The website is available in 9 different languages to cater to the needs of all.

Core features

- An intuitive mobile trading app

- Naga pay card for mobile shopping

- No limit on trading volume

- A huge trading community

| Pros | Cons |

| Multiple copy premium packages | High copy trading fee |

| Various funding options | Regulated by a single authority |

| Military-grade protection of funds |

Verdict for Naga Markets: Nice Social Trading App

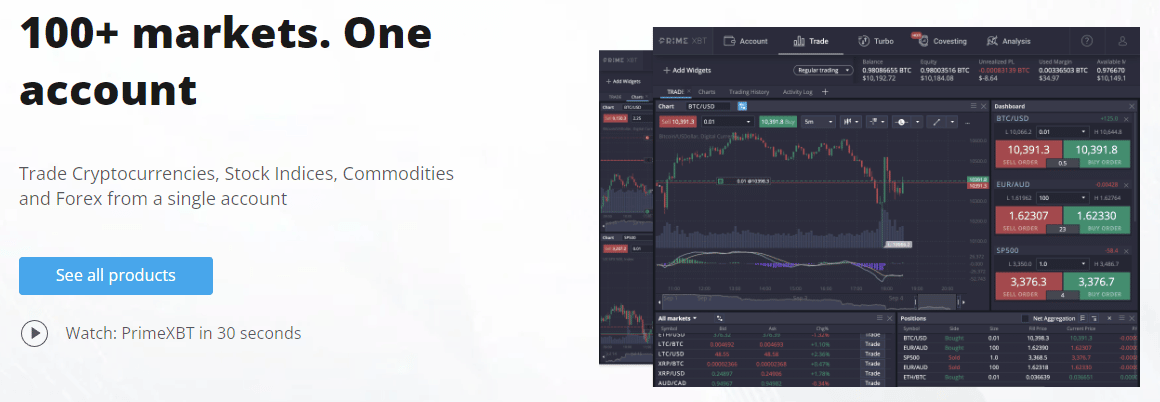

9. PrimeXBT

Why PrimeXBT?

PrimeXBT has been regarded as the best platform for margin trading by ADVFN International Financial Awards. With an average execution speed of less than 7.12ms the broker carries out more than 12000 trades each second. Lucrative interest is offered on crypto investment standing at 14% APY. Traders can participate in multiple contests and earn real money while trading virtual funds

Covesting copy trading module is specifically designed for traders who wish to use signal services with full automation. The platform features multiple portfolios, their rating, active days, number of followers, and more for a detailed analysis.

Core features

- Advanced copy trading module

- Upto 14% APY on crypto investments

- 24/7 customer support

- Various trading contests

| Pros | Cons |

| Various cryptocurrencies are available | Does not support MT 4/5 platforms |

| Advanced trading app | |

| A high trading volume | |

| 50% referral commission |

Verdict for PrimeXBT: Good Desktop Trading Software

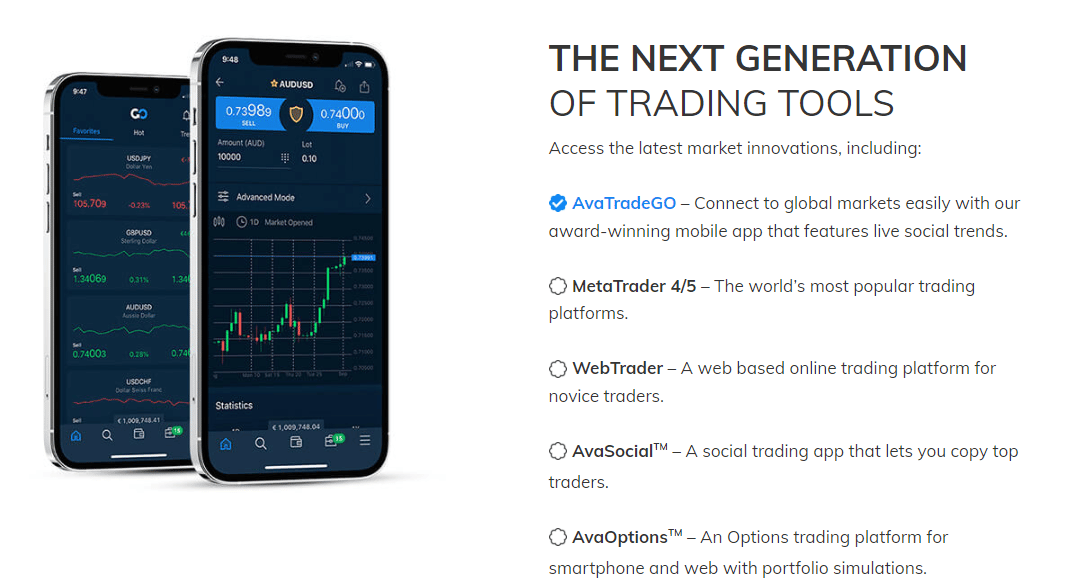

10. AvaTrade

Why AvaTrade?

AvaTrade has comprehensive trading guides and videos to help novice traders. The broker comes under the regulation of multiple financial authorities. It has various mobile and desktop applications to offer the best in terms of charting, orders, and execution speeds. Traders can trade CFDs on bonds and treasuries, ETFs, stocks, and metals. Wire transfer, credit cards, and e-wallets are major deposit options.

Avatrade supports Zulutrade, Duplitrade, and Avasocial, as the best copy trading app. Investors can witness the portfolios of various traders and select an appropriate one based on their needs.

Core features

- Minimum deposit of $100

- Multiple trading instruments

- Education section for traders of all levels

- A dedicated social trading app

| Pros | Cons |

| Mutliple trading software | Does not accept US clients |

| Excellent rating on Trustpilot | High inactivity fee |

| Dedicated options trading platform | |

| Unique social trading qualities |

What is copy trading and how does it work?

Copy trading involves following trades from other accounts onto your for producing a similar performance, i.e., gains or losses. The process can be carried out manually or automatically.

- Manual. This involves copying trades from other traders after receiving them onto your social media account or email.

- Automatic. Trading robots such as forex copiers can transfer trades from one platform to another within milliseconds. Nowadays, brokers offer PAMM accounts that allocate a certain number of funds to a potential investor. This is a more distant form of automated copy trading.

Some vendors may demand access to your account credentials for copy trading purposes. While this does not provide them with withdrawal rights, it can still prove to be dangerous.

Copy trading vs. social trading

As the name indicates, social trading allows traders to participate in a general community and learn from the executions of professionals. No trades are copied onto your portfolio. Meanwhile, copy trading aims to generate the same output as the parent account without offering the means to learn. This form of trading is best for those easily swindled by their emotions while trading.

Copy Trading Vs Social Trading

Choices

|

own trading decisions. |

|

Trading Style

|

|

|

|

| Risk | |

|

|

Why use copy trading?

Copy trading software is a sound way to generate a good amount of passive income on your portfolio. It does not require any effort from the trader as the service provider carries out all the analysis and decisions. Multiple platforms support copy trading with built-in risk management tools to avoid losses.

Is copy trading risky?

Copy-trading poses no risks as the funds are stored in your portfolio. The trading copying process is automated or manual, where the withdrawal rights are with the trader. The only risks come from trading itself. Investors should look out for proper performance reports and general records of the service provider.

What is the minimum copy trading investment?

The minimum copy trading investment depends on your risk appetite. The industry now allows traders to open up cent accounts, allowing you to trade even smaller lot sizes. The amount of returns would depend on your initial investment and capital allocation. A 1% return on a million dollars equals $10000, while on $100, it will stand at $1.

How much do copy trading platforms charge?

Most of the brokers in the financial industry would allow you to copy trade without any additional costs. Local professional traders who offer their trades via social media channels or copiers may charge anywhere from $50 up to $500 or even more, depending on the performance.

Pros of copy trading

We can summarize the pros of copy trading as follows:

- Suitable for traders of all levels

- Does not require any prior market experience

- Allows a decent passive income on your funds

- There are a range of professional traders offering lucrative performances

- A good way to diversify your portfolio

Cons of copy trading

We can summarize the cons of copy trading as follows:

- Many fraudsters offer fake copy trading services that can scam beginners

- Manual copy trading can be tedious

Is it worth it?

Copytrading can be highly beneficial for beginners who are at a considerable risk of losing money at the initial stages of trading. It can also help with the learning curve as some professionals use copy trading to teach their traders. That being said, copy trading may definitely be worth your time.

Where is copy trading accepted?

There are no restrictions on copy trading based on borders. It may only be limited by your broker in rare cases where the company fails to offer PAMM services. Traders from all over the world can open an account with a brokerage and mimic trades from professionals manually or automatically.

How to open a copy trading account?

Opening a copy trading account at your broker is simple and requires only a few minutes. To begin with, choose a suitable brokerage and sign up. Head over to the PAMM or copy trading section and select a qualified trader to follow. Allocate the proper amount of funds and begin mimicking positions.

Can you copy multiple traders simultaneously?

It is possible to follow several different accounts in a single instance using a trade copier. However, traders should be vary of the maximum number of positions their brokers allow. You can also allocate funds to different traders in the portfolio on your brokerage.

Is prior trading experience a must to engage in copy trading?

There is no prior trading experience required to start copy trading. The whole process is simple, which only requires you to sign up, deposit funds, select a trader, and begin copy trading.

Manual copy trading may demand small knowledge of instruments and analogies such as stop loss, take profit, and break even.

Is copy trading profitable?

The profitability of copy trading solely depends on the professional trader providing executions to your portfolio. As the market conditions change, the overall up and downside may fluctuate. The best service providers list their stats on reputable performance tracking websites.

How to choose traders to copy?

Let us go through the vital points investors should keep in mind before selecting any copy trading portfolio.

Make a research

Do a thorough analysis of copy trading, brokers, and the possible pros and cons. Knowledge is power holds true when dealing in the financial markets.

Risk

Take a note of the current drawdown from the performance records if available. Trading is risky; however, the best traders control the downside with their professional expertise. This drastically increases the overall risk/reward scenario, which is important while investing.

Average trade duration

The average trade duration should match your trading style. If you are looking to make a living as a swing trader, it will help follow a trader who holds their positions for the long term.

Assets

Ensure that your broker supports trading on the same instruments that the provider is currently analyzing. The difference in assets can result in a changed performance and, in worse cases, a high drawdown.

What markets can you access with copy trading?

The scope of copy trading is broad as investors can choose to follow the stock, forex, futures, etc. traders. Some providers trade multiple instruments on a single account, eliminating the need to follow various traders to diversify your portfolio.

Copy trading platforms summary

Copy trading is one of the perfect ways to make a decent passive income on your portfolio. It can significantly help new traders avoid the initial losing curve in the initial stages of their careers. Almost all brokers support copy trading system and offer lower spreads with fast execution to smooth out the process. While selecting any signal, investors should look out for the drawdown and the duration for which the product is live. Avoid mimicking accounts with significant risks or high leverage.