Volatility when it comes to trading and investment can mean three different things: realized volatility, implied volatility, and expected volatility. In the simplest terms, volatility is the measure of price change during a specified amount of time. When markets experience volatility, it means it can change prices in a short period of time. On the other hand, markets where prices change slowly or are stagnant, are all non-volatile in nature.

When there is an increase in volatility, we should see wide ranges in price accompanied by high volumes and more trading in one direction. When the market ramps there are few sell orders and vice versa. As prices can change dramatically, traders can be less willing to hold positions which can turn a winner into a failure.

Some Tips to Invest When Experiencing Volatile Markets

Market volatility is completely natural and you should not be surprised if you experience it. Whether you manage your own investments, invest in a single fund solution, or have your investments managed by a professional manager, the current market conditions may work to your advantage.

Set an Investment Strategy

Setting an investment strategy beforehand can be helpful when experiencing volatility. Key factors such as your financial goals, your risk tolerance level, and your time horizon should be considered while making it. Your risk tolerance is a reflection of your broader financial situation like your income levels, savings, and debt. The time horizon is determined by counting the number of years left until your planned retirement. Depending on where you fall in the above aspects, your strategy will be either conservative or aggressive or a mix between the two.

Diversification

Volatility during market downturns can have a bad effect in your holdings. To protect them, you can turn to diversification. Spread your investments across three or more asset classes such as stocks, bonds, and short-term investments. Next, go ahead and diversify within each asset class to help offset the risk more. This can mean spreading stocks over sectors, geographic regions, and market caps, using CFDs to diversify positions or betting for the US dollar in one position and betting against it in another. Diversification however does not always ensure profit or protection against loss.

Even if one’s time horizon is long enough to warrant an aggressive growth portfolio, you need to be comfortable when experiencing short-term ups and downs. Think about setting realistic expectations in a portfolio.

Aim for Long-Term Investing

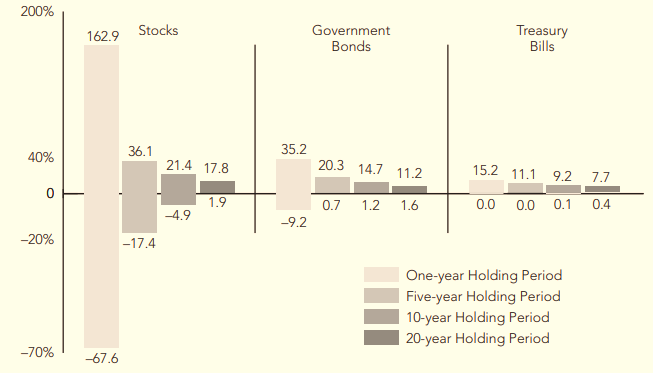

If you are too affected by the jitters caused by short-term fluctuations, focus on the long-term trends and goals. Volatility won’t seem much of a bad force then. Dramatic changes in value in the short-term can be either positive or negative. Traditionally, the time has reduced the risk of holding a diversified portfolio. Consider a hands-off approach when investing for the long term. To do this, you can go for a broker who provides a managed account or a single fund solution. A managed account will allow you to delegate the management of your workplace savings plan to professional investment managers.

Even if one’s time horizon is long enough to warrant an aggressive growth portfolio, you need to be comfortable when experiencing short-term ups and downs. Think about setting realistic expectations in a portfolio.

Use Order Types

When trading in volatility, always use a stop loss as then you will know the exact amount of risk you are taking before entering a trade. Consider using long-term moving averages to set levels to reduce the chances of a price spike that triggers your order when volatility is high. Use limit orders which potentially reduce your risk by buying below the market price. This will not only prevent you from expensive prices trading but will help you to collect rebates, while providing liquidity with your limit orders. As the basics of speculation is simple: buy cheaper and sell at a higher price, you are now efficiently buying into the uptrend rather than trading against it.

Take profit limit orders can be used as well, successful traders know the advantages of their trades and what price they will exit when they win. This will prevent you from trading using your emotions. One can always re-enter the trade when new signals are received.

Aim for Average Gains

When experiencing a volatile market over months or years, you can use a technique called dollar-cost averaging which is a time-tested technique. Simply put aside an amount in each of your planned investments for every pay period. When prices are low, your money “buys” more units of each investment option over the years when prices are low and vice versa. The average price per share of your investments will turn out to be lower than if you invested all your money at the same time. Also, you prevent yourself from acting on the temptation of timing the market.

Stop Yourself from Timing The Market

No matter how experienced a trader is, one can never predict the market. Yet many investors think they can still guess how the market will behave based on rumors or hunches. Unless one guesses correctly when to buy or sell, there are strong chances to miss the markets which can have negative consequences on your trading account. You can get more of the market’s gains in just a few good trading days here and there. This requires being present on the market at all times. Invest in the long run and stick with it throughout the ups and downs of the market.

Final Thoughts

When trading or investing during extreme volatility, always remember to have a well-defined strategy in place which is tested on all market conditions. This will stop you from going head-first into volatile markets, ignoring your pre-defined rules. You should also develop guidelines about what to do when faced with fundamental risk events. This includes central bank meetings, earning releases and others.

Volatility should be handled correctly or else the downsides are plenty. It can present great opportunities as well as amplify losses. No matter how experienced a trader is, he or she should always do their homework thoroughly as well as have a frequent reviewing process for all existing trading decisions.