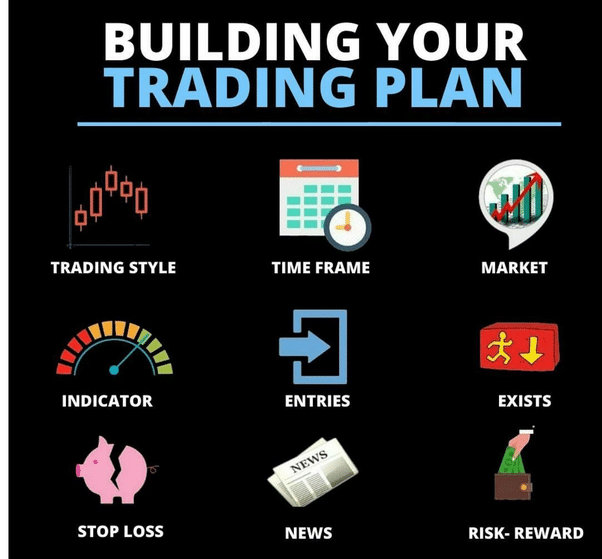

A good trading plan is like a solid blueprint or map for trading and a professional trader cannot survive in the markets without it. Once you have defined your trading goals, it is time to develop a trading plan and make sure it works.

You should use these important trading principles to evaluate your trading strategy:

Easily Understandable

It may be shocking to you, but the best trading systems have no more than ten rules. The more rules there is in a trading strategy, the more curve-fitted it is to past data. This kind of over-optimized system has lower chances of generating profits in real markets. It is essential to understand your rules and execute your strategy easily. Keep in mind that the volatile market moves and changes very fast. So, there is not much time to calculate complicated formulas before making trading decisions. If you look at successful floor traders, you will see that they make thousands of dollars every day by only using a calculator.

Trading Liquid and Electronic Markets

Trading electronic markets are strongly recommended due to the lower commissions and instant fills. You need to plan your exit according to the information on whether your order was filled and what the price was. Before knowing if your entry order is filled, you must never place an exit order. While trading non-electronic or open outcry markets, you may have to wait before receiving your fill. Your profitable trade may turn into a loss by that time because of the change of direction in the market.

While trading electronic markets, you receive your files immediately, so, you can place your exit orders at once. You can avoid slippage by trading liquid markets, which can save you thousands of dollars.

Realistic Expectations

Keep in mind that losses are part of trading and are no trading system that does not have losses. Sometimes, you may come across trading systems with a winning percentage of over 90% and impressively low drawdown that may seem impossible. Before you get tempted to use it, make sure to look at the details. It may turn out that the system is curve-fitted, and it is only tested on a few trades. So, keep your expectations realistic and look for a trading system with a winning percentage of 60 %-80 %, a profit factor of 1.3-2.5, and a maximum drawdown of 10%-20% on the yearly profit.

Risk and Reward Balance

The rule of trading is like betting at a casino. The more your risk, the more you can earn, but at the same time, the risk of loss is going to be also high. So, it is essential to find a healthy balance between risk and reward. The ideal ratio for risk and reward is 1:1.5 or more, which means that you should be able to make at least $1.50 for every dollar you risk.

To balance risk and reward perfectly, make sure to use small stop losses in your trading strategy, your profit targets should be bigger than the stop losses. So, if you see a strategy that has a small profit target of $100 but the stop loss is $2,000, stay away from it. The winning percentage of this strategy is indeed great, but your trading account can be wiped out with only 2-3 losses.

Find a Suitable System

With higher trading frequency, your chances to have a losing month are low, and vice versa. For example, if the winning percentage of your trading strategy is 70% but it generates only one trade every month, then one losing trade is enough to have a losing month. This way, you can have many losing months before even making any profit.

Instead, a strategy with five trades a week is better because then you can have 20 trades per month on average. With the same winning percentage of 70%, the chances of having a winning month are extremely high with this strategy. Having as many winning months as possible is the goal of all traders.

Automate Exits

Emotions are one of the biggest reasons for human errors in trading. These mistakes must be avoided by any means, especially when the market moves fast. It is natural to experience panic and indecision but giving in to those emotions will result in a great loss.

You should be able to determine your exit points easily. Using the bracket orders is the best solution for exit points. Bracket orders are offered by most trading platforms. They allow traders to attach a profit target, as well as a stop loss to the entry. This way, trade can be put on autopilot, and the trading system closes your position at certain levels.

Test Your Strategy

By back-testing more trades without curve-fitting, you can make sure that the chances of your trading strategy being successful are higher in the future. The more trades are there your back-testing, the smaller the chances of the error are. As a result, you can produce more profits. For a valid performance report, test your trading system for more than 200 trades. If you do this, the margin of error starts to decrease.

Choose Valid Back-testing Period

When you are back-testing a trading strategy, it is important to check since when the strategy is being used. For example, the E-mini S&P trading strategy has existed since 1997, but nobody was trading it at that time. So, if you want to test it, you should only back-test it for the last few years.

It is foolish to assume that once the markets can be electronically traded, they remain the same. Lower commissions and faster fills allow a different kind of trading strategy, which makes the market behave differently during the times when they are only traded by pit traders.

Conclusion

By including these trading principles to your trading plan, you can increase the rate of successful trades with minimum risks of losing your money.