Automated trading systems are taking the world by storm as traders and financial institutions look to gain an edge over other market participants. The systems have made it possible for novice and professional investors to trade the most volatile and complicated market with ease.

What Is An Automated Trading System?

Automated trading is a trading system whereby traders rely on computerized trading systems to open positions in the markets. The systems allow traders to set the rules for trading and execute market orders automatically. In addition to executing orders, the systems also monitor orders all in the effort of balancing the risk-reward profile.

Automated trading systems are broadly classified into two; Expert Advisors (EA) and Forex Robots. Expert Advisors are automated trading systems created by highly skilled experienced and professional traders. The skilled professionals write algorithms that analyze the market on behalf of traders and perform all the trading processes.

On the other hand, a forex robot is a software program specifically designed to analyze the market and trade on behalf of traders. The program carries out technical and fundamental analysis to identify ideal trading opportunities.

While Forex robots do make trades on behalf of traders, Expert Advisors don’t. Expert advisors are good at generating trading signals that traders look at and execute whenever possible. Forex robots take automated trading to another level by analyzing and executing trades on behalf of traders.

Automated trading would not be possible if trading algorithms do not power automated trading systems.

What are the Trading Algorithms?

Trading algorithms are computer codes that carry out chart analysis and identify entry and exit points in markets. The codes analyze chart patterns focusing on parameters such as price movement, timing quantity, and volatility levels to identify ideal entry and exit points.

Once underlying market conditions meet predetermined criteria, trading algorithms execute buy or sell orders on behalf of traders. Therefore, the trading algorithms save traders the time and burden of scanning the markets for trading opportunities.

How Robots And EAs Are Changing The Forex Industry

Demand for Expert advisors and Forex robots have continued, to surge given the convenience that the trading assistants bring about. The need to make easy money with little effort has also seen people invest thousands of dollars on automated trading systems to gain an edge in trading.

Gone are the days when traders had to spend hours glued to the screen in search of trading opportunities? Robots and EA have simplified everything given their ability to scan multiple markets at a go. The automated trading systems are capable of scanning numerous charts in a way that even professional traders cannot.

Automated trading systems are also proving to be trader’s best-trading partners, given their ability to scan for opportunities 24 hours a day as long as the market is opened. The best forex robots and EAs also suggest solutions to find profitable trades in unstable markets. Likewise, the systems make it easy to determine perfect entry and exit points.

The global automated trading market is growing at a compound annual growth rate of 11.1%. It is set to grow to $18.8 billion by 2024 from $11.1 billion in 2019.

North America continues to account for a significant share of the algorithmic trading market followed closely by Europe and then Asia. Some of the key drivers of the market include increasing demand for fast, reliable, and effective order execution. The need for market surveillance and low transactional costs has also forced traders to algorithmic systems.

Basic Algorithmic Trading Strategies

Trend Following

Trend following is a common algorithmic trading strategy in which forex robots and EAs leverage various market scenarios to generate profits. In this case, the trading systems study various indicators such as moving averages and channel breakouts to price movements. The algorithmic trading systems rely on the occurrence of desired trends to ascertain price movements rather than relying on predictive movements.

For instance, a forex robot can study readings plotted by the OBV indicator, which indicates trading volume flow. An increase in volume in given direction signals that price is likely to trend in the direction of the OBV indicator.

Arbitrage

Arbitrage is a common algorithm trading strategy whereby forex robots or EA try to take advantage of price discrepancies of the same security in different exchanges. The strategy entails buying dual listed securities in one exchange and selling it in another exchange with a much higher price point.

Likewise, there are forex robots programmed to recognize price differentials across multiple markets and execute trades to generate profits at a larger scale.

Mean Reversion

Mean reversion is a trading strategy based on the fact that security prices often trade within their historical average price. Extreme deviations do occur from time-to-time and present opportunities that automated trading systems make use of to generate profits.

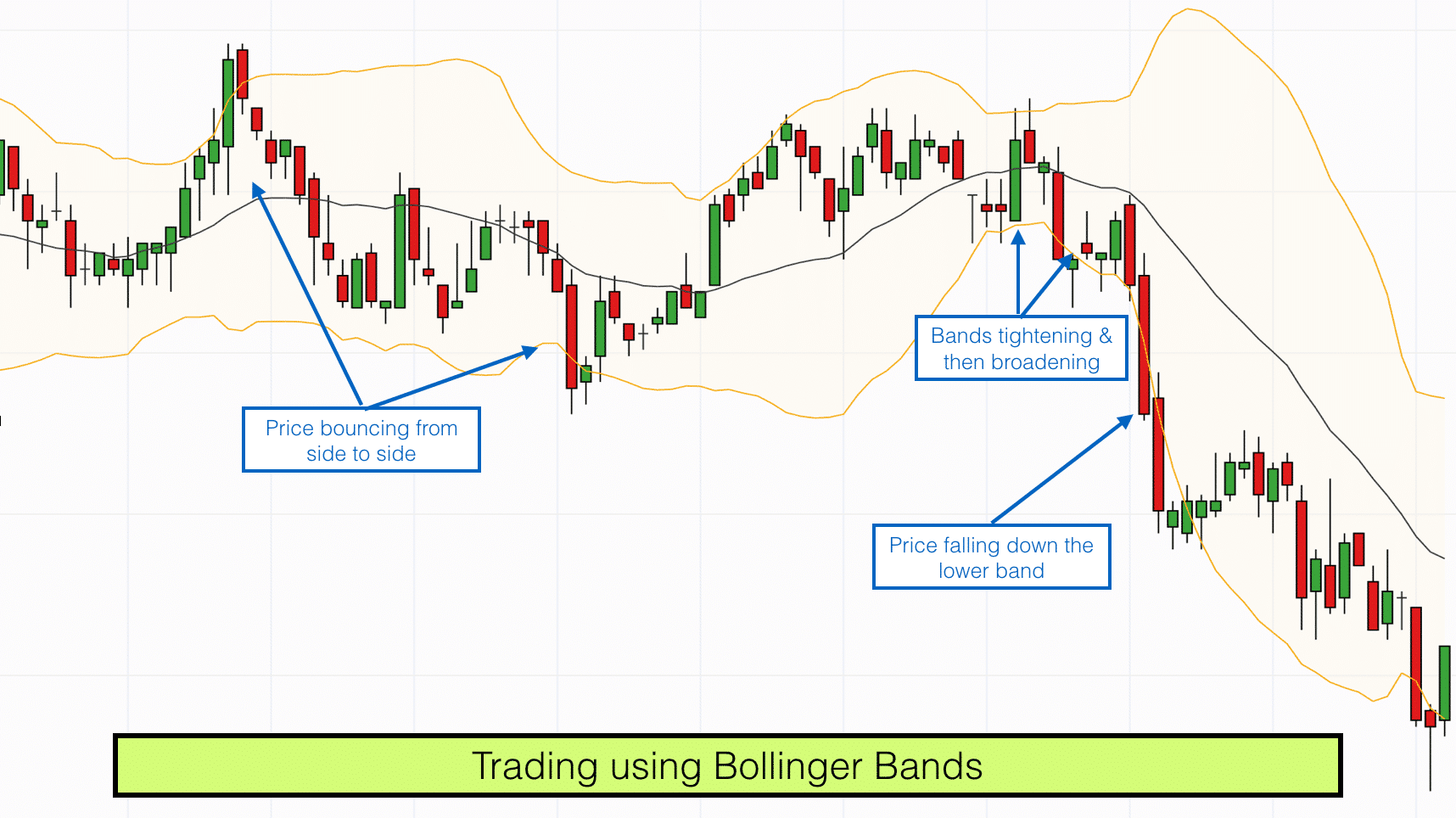

The Bollinger Band is a commonly used trading indicator that allows forex robots and EAs to identify whenever prices of given assets move to extreme levels indicating overbought or oversold conditions.

By comparing long-term averages, the automated trading systems can determine whenever price has deviated. For instance, with Bollinger bands whenever price breaks through the upper band, a forex robot would interpret the same as overbought conversely triggering sell positions in a bid to take advantage of price moving lower mostly towards the inner band.

The most significant risk with this strategy is that forex robots may not account for changes in fundamentals that might cause the price to deviate from the mean price level.

Machine Learning Strategies

Advancements in technology have given rise to machine learning strategies that allow forex robots to have a competitive edge in trading. Machine learning and artificial intelligence are the new technologies pushing automated trading to new heights.

For instance, Natural Language processing changes the way fundamental analysis takes place given the technology’s ability to enhance the processing of news articles, therefore, providing more insights into market movements.

Naïve Bayes is a popular machine learning strategy in algorithmic trading whereby forex robots make trading decisions based on previous statistics and probability. For instance, if security tends to go up 70% after three consecutive days in the red, the Bayes algorithmic will scan the market and trigger buy positions whenever a security tanks for three consecutive days.

Machine learning strategies are also able to read and interpret news reports. By scanning the news reports, forex robots can enter buy positions in case of positive news and trigger sell positions in case of negative news.

How to Create a Forex Robot

Contrary to perception, you do not need advanced programming skills or technical skills to develop a profitable forex robot. It’s become increasingly possible and easy to create an automated trading system without programming skills or hiring the services of a programmer.

All one needs to create a forex robot is a trading platform such as MT4 and an affinity with forex. Likewise, there are forex robot generators available online that make it easy to create a profitable automated trading system without worrying about any code.

With most forex robot generators, all you need is to select the currency pair to trade or stock. Likewise, you will have to choose the time frame you want to trade. There are also provisions to set that dictate when to enter trades based indicators readings and outlay.

Once you select all the basics and click enters, the forex robot generator would do the rest. Once everything is set up, you will get an opportunity to backtest the results and gauge the profitability of the automated trading system.

After that, you will be able to fine-tune everything until the automated trading system delivers maximum profits.

Benefits of Automated Trading Systems

- Minimize emotions throughout the trading process

- Ensures trading is rule-based thus preserving trading discipline crucial to profitability

- Ability to back-test trading rules to determine the viability of an idea

- Improves order entry and exit to changes in market conditions thus higher risk-reward

- Permits trading of multiple accounts or strategies at one time

Bottom Line

Automated trading is the act of participating in the financial markets using a program designed to execute orders based on pre-set rules. With the help of algorithms, automated trading enhances market analysis and ensures positions are opened and closed based on pre-set rules, thus minimizing emotions throughout the trading process.