Cryptocurrency trading is a lucrative full-time and part-time activity. Judging by people who use products by FTX, Coinbase, and Binance, there are millions of digital currency traders in the market today. In this article, we will focus on some of the best-automated crypto trading strategies that experienced and inexperienced traders can use.

Why automated strategies?

Automated strategies refer to programmed software that analyzes and then executes trades when certain market conditions are met. For example, you can create a strategy that opens a trade when the 25-day and 15-day Moving Averages make a crossover in the hourly chart. The strategy will do the hard work of analysis for you and then execute the trades.

There are several benefits of using automated strategies in the market. First, since cryptocurrencies are traded every day, these bots can work for you for a longer period. They can also work at night when you are asleep.

Second, when applied well, these strategies can be highly profitable. In fact, some people have managed to make as much as 20% monthly returns when using automated strategies. Further, they are ideal approaches to use among new traders who don’t have experience in the market.

While these strategies are good, they also have their downside. For example, some bots don’t have a good track record of generating strong results for their users. Also, in most cases, these strategies are based on chart patterns and technical indicators. For this reason, they don’t include considerations on fundamentals like news and on-chain activity.

With this in mind, here are some of the top five automated crypto strategies that anyone can use.

Buy the dip bot

Buying the dip is one of the most common terms in the financial market. It refers to a situation where investors or traders buy an asset whose price has declined sharply within a short or extended period. The goal of buying the dip is to take advantage of the low price and benefit as it rises.

In some cases, buying the dip can be a profitable form of trading. It is particularly highly beneficial when there is a regular price bounce.

An alternative to buying the dip is known as selling the rip. Instead of buying an asset whose price has dropped sharply, it is the process of selling or shorting an asset whose price has declined.

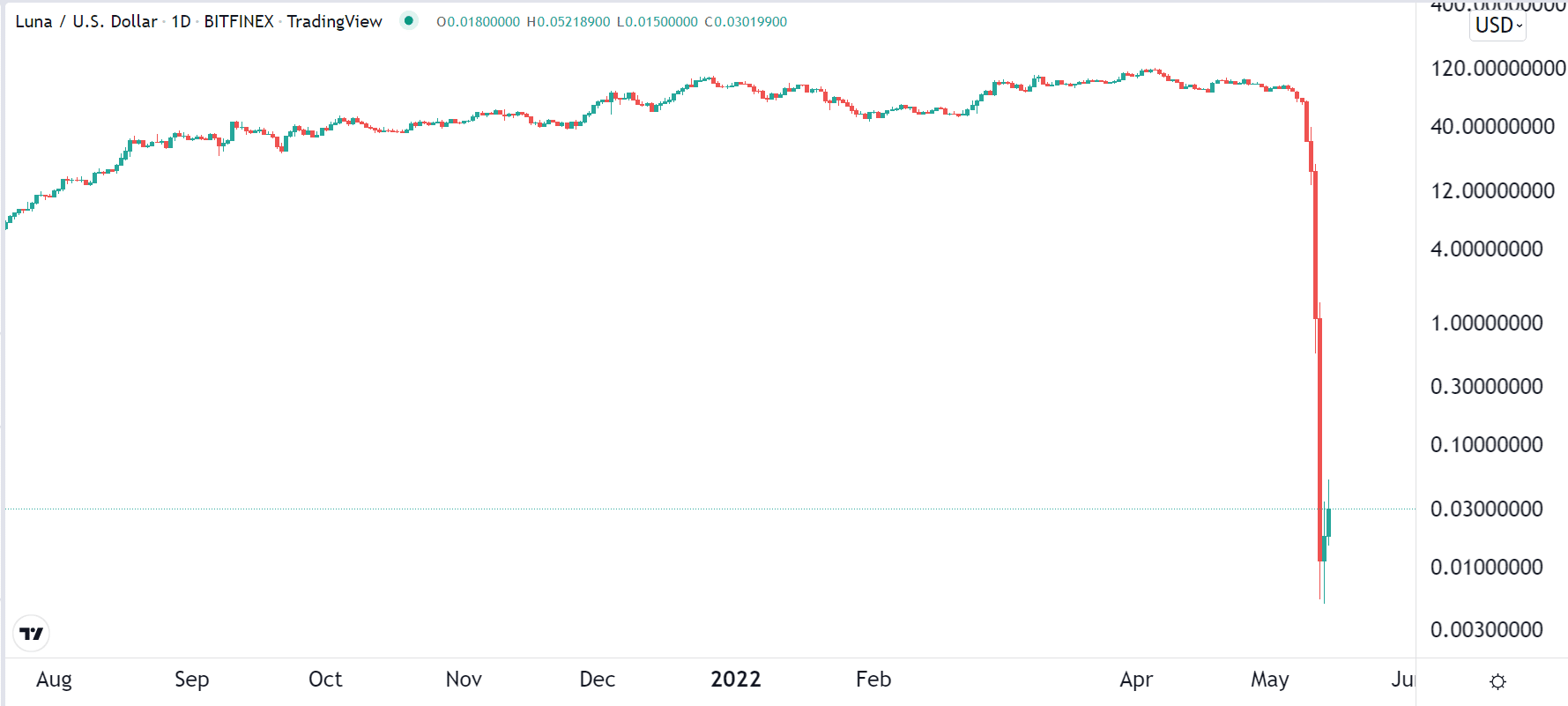

While buying the dip can be profitable, it is also risky. A good example of this is when LUNA crashed from over $50 to below $0.005 within a few days. People who executed BTD strategies lost a lot of money.

Scalper bot

Scalping is a form of day trading that involves buying and selling financial assets within a short period. Traders use this approach with the goal of making a tiny profit for every trade that they execute and then repeat it several times per day. In some cases, a scalper will open and close more than 100 trades per day.

A scalper bot is designed to do exactly this. Once implemented in a chart, the bot will use several strategies to open and close trades within a short period. At times, it can even execute a trade and then close it within a few seconds.

For this approach to work well, it needs to have risk management approaches like stop-loss or a take-profit to ensure that all trades are protected.

A common disadvantage of using a scalper bot is that there are fees associated with trading. Assume that the broker charges just $1 for each trade, then it means that you will pay $100 if the bot executes 100 trades in a day.

Flat bot

Another automated trading strategy is known as the flat bot. This is a bot that is most useful in periods of low market volatility, especially when the market is moving sideways. In this case, the bot is usually built to time the market when the bullish or bearish breakout happens.

For example, if a cryptocurrency is trading at a range of between $10 and $11, the flat bot can open a bullish trade when it believes that the coin is starting an upward trend above $11.

The grid trading bot

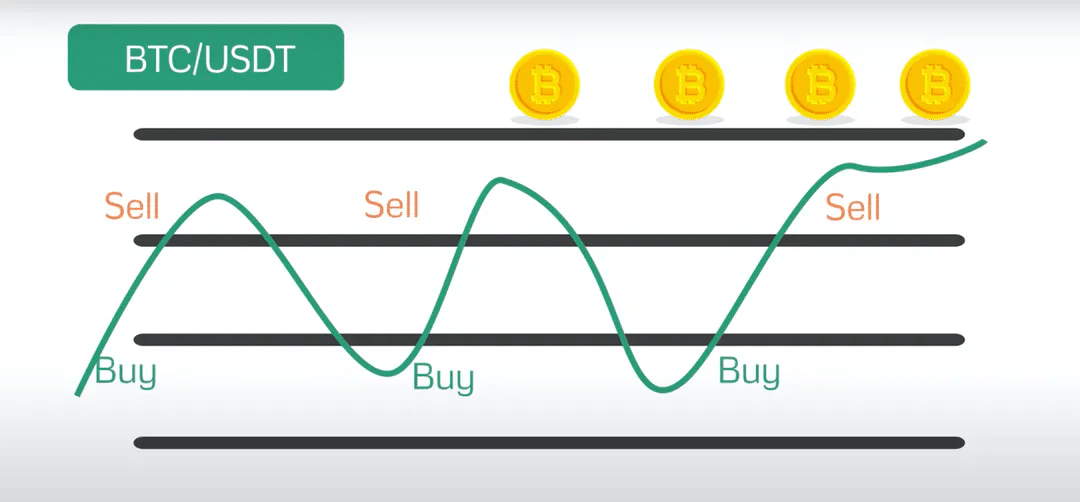

Another popular trading strategy is known as the grid strategy. This bot usually works very well in a period when an asset is moving in a horizontal direction. In many instances, the bot is more successful when the price fluctuations are more frequent and wide.

The first step of creating a grid bot is to select the range that you want to use and then select the number of grids you want to use. If you select more grids, it will mean that the bot will execute more trades and vice versa. As the number of trades rises, the profit will also decrease because of the fees charged by the broker.

In summary, in a grid strategy, when a buy order is executed, another sell order will be created above the buy. At the same time, when a sell order is made, a new buy order is also made below the price. A good example of this is shown above.

Dollar-Cost Averaging bot

This is an automated strategy that buys cryptocurrencies in intervals as their price drops. The goal is to distribute the purchase price over time. For example, instead of buying a cryptocurrency at $10 with $10,000, you can execute three at different levels. In case your bullish thesis is correct, you will be more profitable if you used DCA than if you bought the coin at the original price.

Summary

There are many automated strategies in cryptocurrency trading. In this article, we have looked at how these strategies are created. Further, we have identified the five most popular strategies that one can use to trade digital coins. At the same time, these strategies can be used to trade other financial assets like stocks and forex.