Cryptocurrency and forex trading have become popular ways to make money online. It is estimated that digital currencies worth over $100 billion are traded every day. Currency pairs valued at more than $5 trillion are also traded daily. In this article, we will look at some of the best strategies for trading cryptocurrencies and forex.

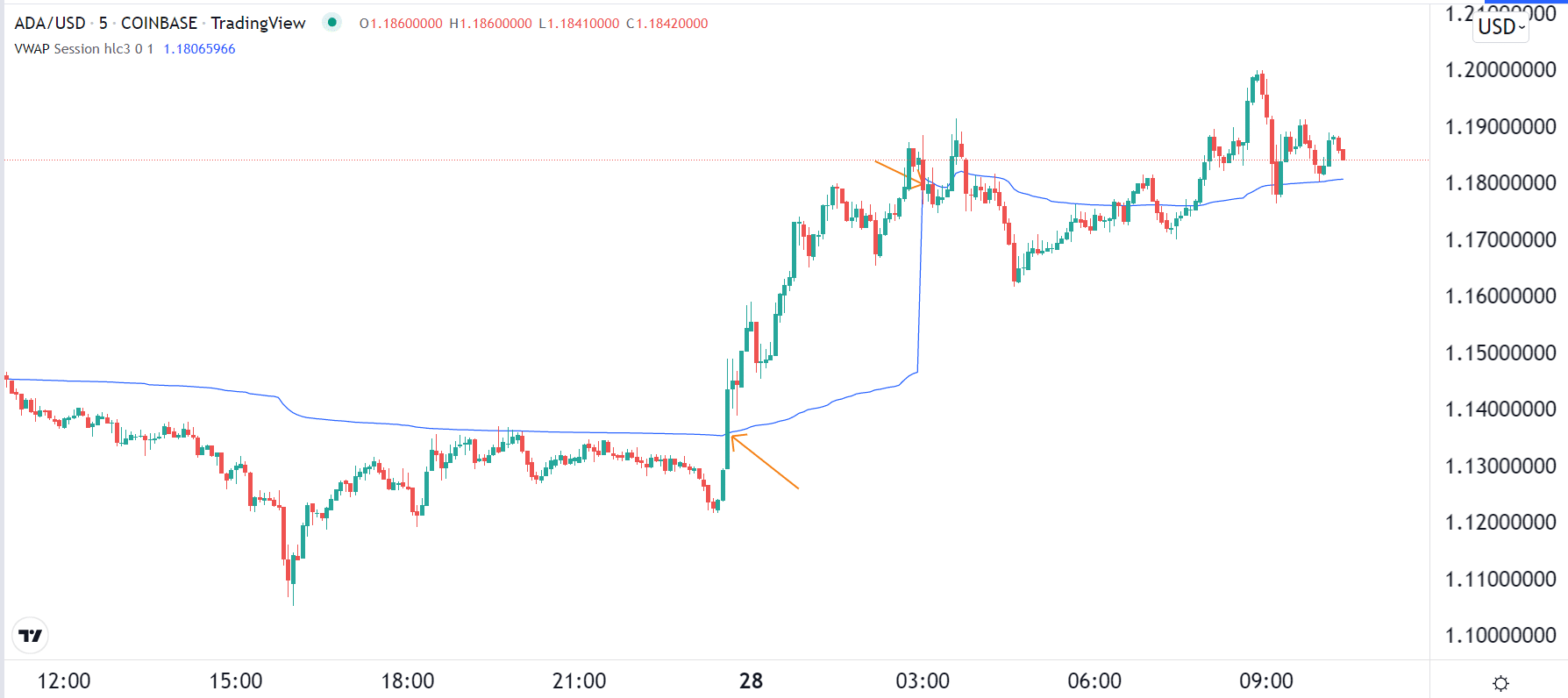

VWAP trading strategy

Volume Weighted Average Price (VWAP) is a unique technical indicator that is primarily used by day traders. Because of how it is calculated and what it seeks to achieve, it cannot be used in other approaches like swing trading and long-term investing.

The VWAP indicator seeks to identify the average price of an asset in a certain period. When applied to a chart, it is usually a line that moves up and down, meaning that it has a close resemblance to different types of Moving Averages. At times, it is possible to add upper and lower bands on VWAP, which makes it resemble Bollinger Bands.

The VWAP day trading strategy for forex and cryptocurrencies is straightforward. First, you need to identify an asset that is not in consolidation mode. Second, you should narrow down the chart to about 5-minute or even lower than that. Finally, add the VWAP indicator to the chart and identify where it is in relation to the price.

Trading signals emerge when the price moves either upwards or below the VWAP indicator. In most cases, a bullish signal emerges when it moves above the indicator, while a bearish sign comes out when it drops below the indicator. The bullish trend will remain intact as long as it is above the VWAP, while a bearish signal will hold steady when it moves below the indicator, as shown above.

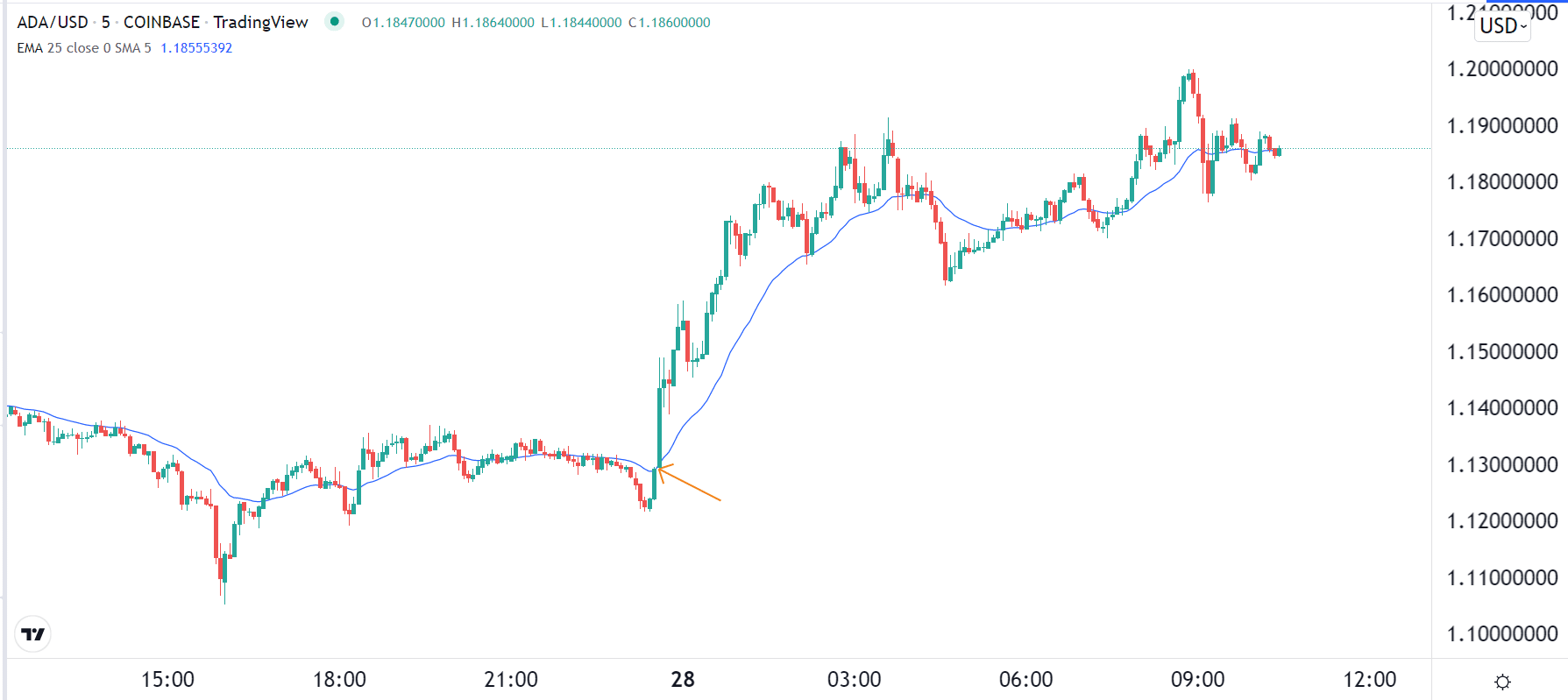

Moving Average day trading strategy

The MA day trading strategy is similar to that of VWAP. Indeed, some people use the two indicators interchangeably.

For starters, a Moving Average is an indicator that seeks to establish the average price of an asset in a certain period of time. Examples of these averages are simple, exponential, weighted, and least squares. While each of these averages is different, they are all used in a similar way.

There are several approaches to day trade using MAs. First, you can wait for an MA crossover to initiate a trade. To do this, you need to identify the best type to focus on. Most people prefer using the exponential Moving Average (EMA) because of its responsiveness.

Second, note the best timeframe to use. Again, there is no fixed period that you must use, although a 25-period is commonly used.

The third step is to wait until you see the price move above or below the Moving Average. A buy trade will be executed when it moves above the average, while a bearish trade happens when it moves below the price, as shown below.

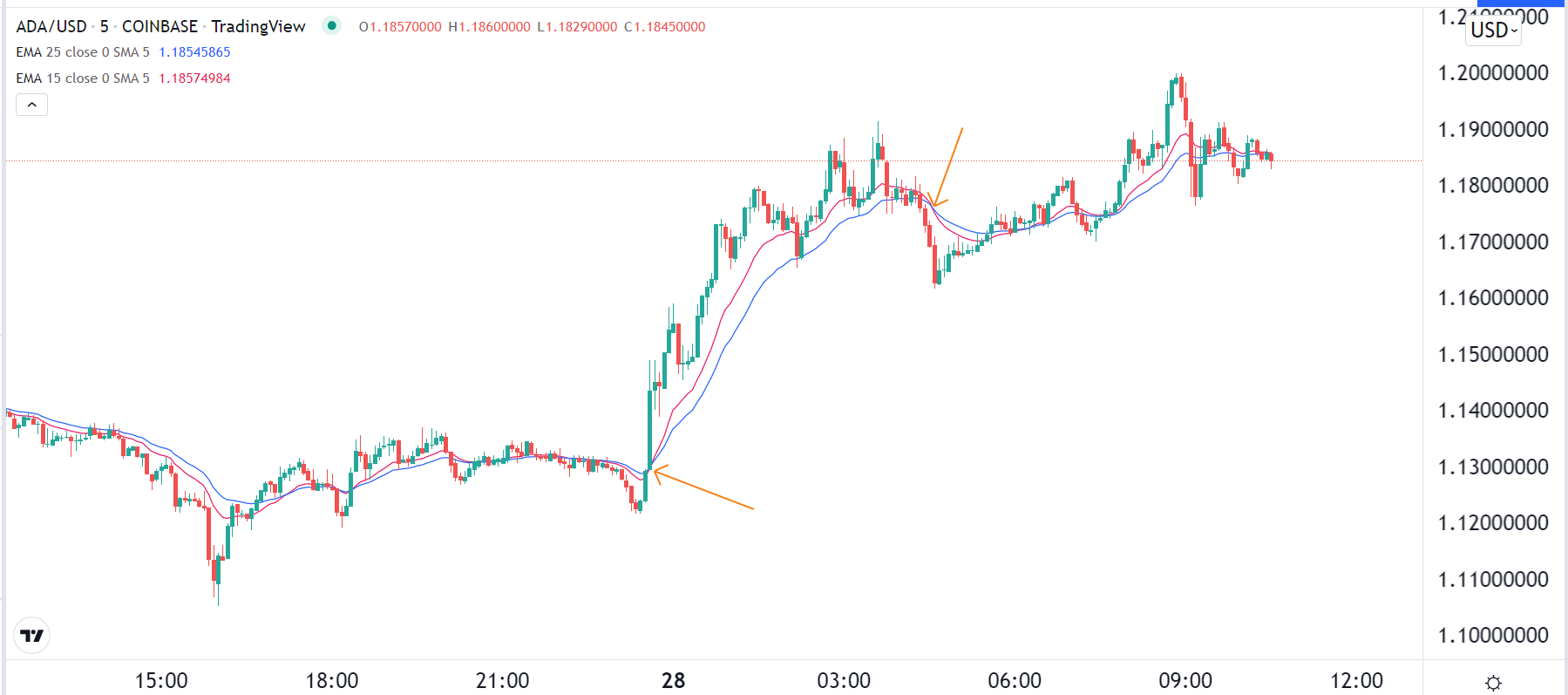

Double MA crossover strategy

Another forex and cryptocurrency trading approach is known as a double MA crossover. It is based on the popular strategy known as death or golden cross. A golden cross happens when the 200-day and 50-day MA cross.

The idea is to find two MAs of different lengths and apply them to a chart. A bullish signal emerges when the two averages cross one another and vice versa. After initiating such a trade, you just need to wait until the price moves below the MA.

A good example of this is shown in the chart above. The buy trade is initiated when the 15-period and 25-period MAs cross one another.

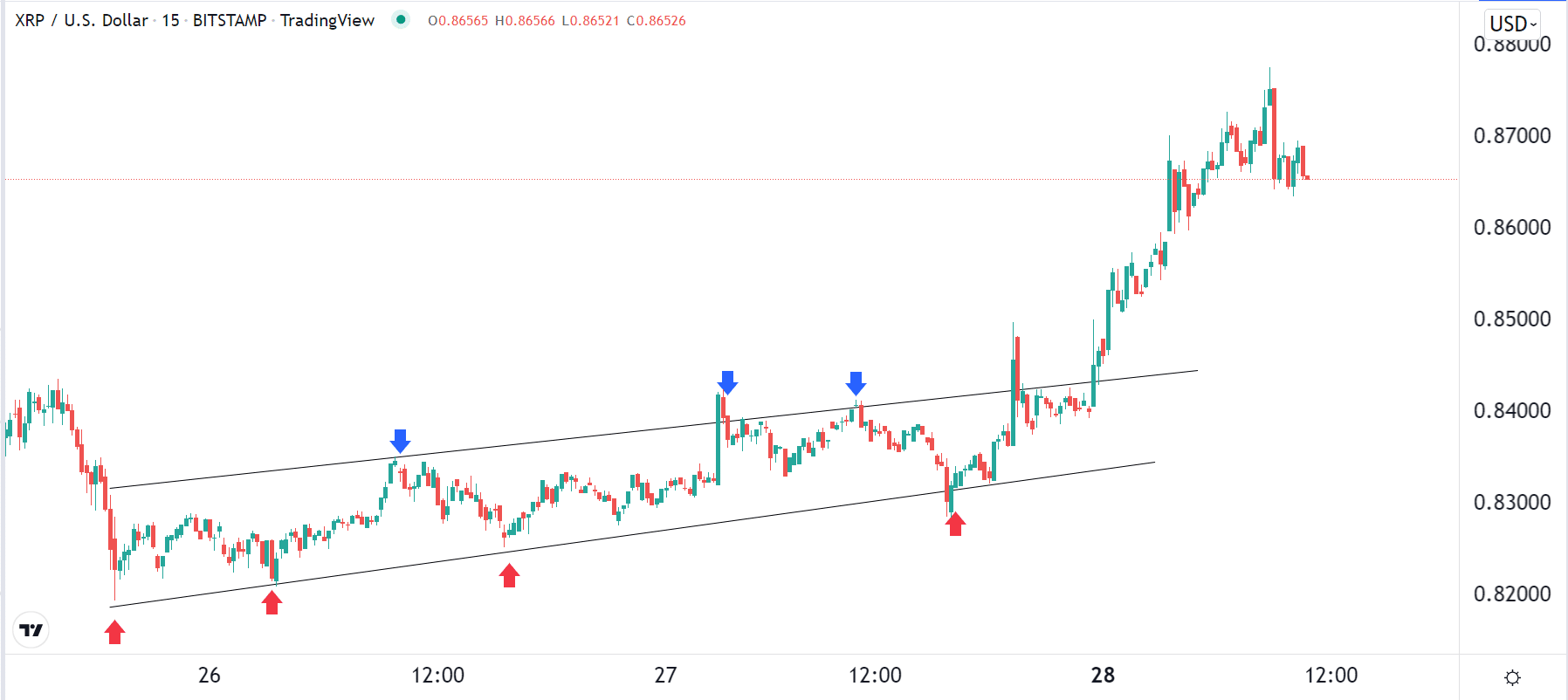

Channel and breakouts

Channels are an important part of day trading the cryptocurrencies and forex market. A channel is formed when a cryptocurrency or a forex pair has established support and resistance levels. Support is a location where it has struggled to move below, while resistance is where it fails to move above.

In a perfectly formed channel, a trader can buy the asset when it hits the support level and then exit the trade when it moves to the resistance. These perfectly-formed channels are quite rare, though. A good example of a channel is shown in the XRP chart below.

Another way to day trade channels is to trade breakouts.

There are several approaches to day trade channel breakouts. A favorite one is to use pending orders, where you place a buy stop above the resistance and a sell-stop below the support. The asset will trigger the buy-stop if it moves above the channel and vice versa. You can then set a take-profit and a stop-loss to protect your trade.

Forex and crypto price action

The next popular way to trade forex and cryptocurrencies is known as price action. It is simply the process of identifying chart patterns and then trading them well. There are several types of chart and candlestick patterns.

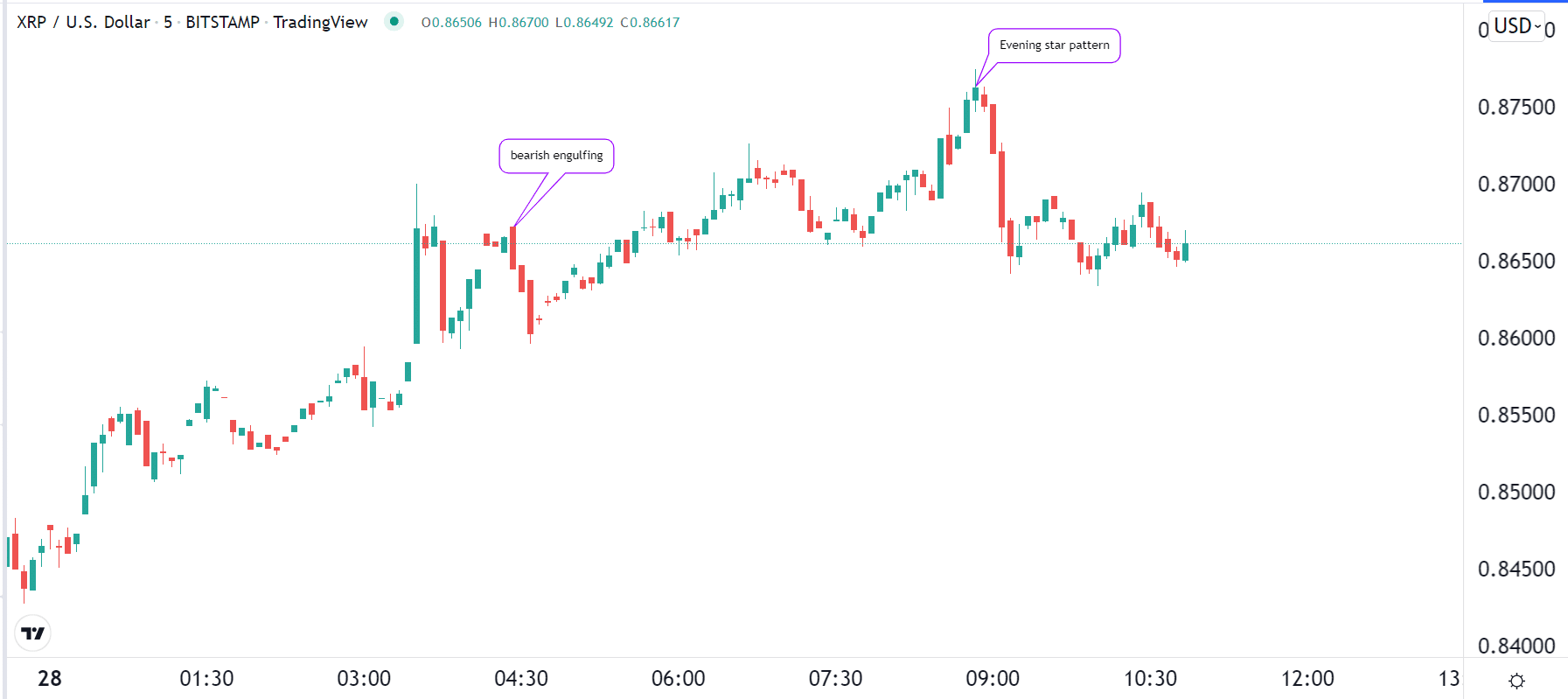

Examples of candlestick patterns are doji, engulfing, and hammer. When doji and engulfing patterns form, it can be a sign that a reversal pattern is about to appear. As such, you can initiate a trade toward the opposite side. For example, in the chart below, we see that reversals happened when bearish engulfing and evening star patterns formed.

Meanwhile, there are chart patterns like triangles, cup and handle, pennants, flags, and rectangles. When these ones form, they can give you an indication of what to expect. For example, an ascending triangle pattern tells you that the asset may keep rising.

Summary

There are many strategies to use in day trading cryptocurrencies, although we believe that these ones are the most useful. The approaches you can use to trade the assets are copy trading, scalping, gap trading, and momentum, among others.