Most cryptocurrency exchange platforms used to be only focused on offering a marketplace for the simple purchase and sale of these digital assets. More and more of these sites are now offering ways for crypto investors to earn interest in their investments. Staking is one of these tactics. Proof-of-stake (PoS) blockchains achieve transaction verification using this technique, which assures their efficiency. When picking a staking platform, think about things like the rate of return, the frequency of payouts, and the simplicity with which you may withdraw your staked assets.

How staking works

On a PoS blockchain, validators are required to verify new blocks of transactions and record them immutably on the network. To do this, they must first “pledge” some of the blockchain’s native currency they hold, which is referred to as staking. The more they stake, the higher their chances of being picked to verify new transaction blocks.

If the chosen validator attempts to verify fraudulent or incorrect transactions, they lose a portion of the funds they had staked. This is called slashing. On the other hand, if they successfully validate a new block, they are rewarded with some more of the token they had staked. Remember, during the time it takes to stake and receive the rewards, the crypto coin in question may have risen in value. If that happens, you will profit twice from this venture.

Nowadays, the staking scene has evolved, introducing on-chain and off-chain staking. With this evolution, both beginners and experts can earn income from this venture. Let’s look at what these staking methods entail.

On-chain vs. off-chain staking

In the above description of how staking works, what we described is essentially on-chain staking. It involves staking your coins directly on the PoS blockchain. If you take this path, you would also be required to download the blockchain’s ledger in its entirety onto your computer. Further, you would also need to run a node software with no interruptions, as any downtime would activate slashing of your funds. Clearly, this method is best suited for crypto experts.

However, if you are a beginner, worry not – you can still earn from this venture through off-chain staking. This is often offered by popular exchanges and crypto wallets, which perform validation functions on your behalf. The advantage of this method is some platforms don’t require you to lock up your funds, which means you can withdraw them at any time as you see fit. This method also has fewer barriers to entry as compared to on-chain staking.

Top staking platforms in 2022

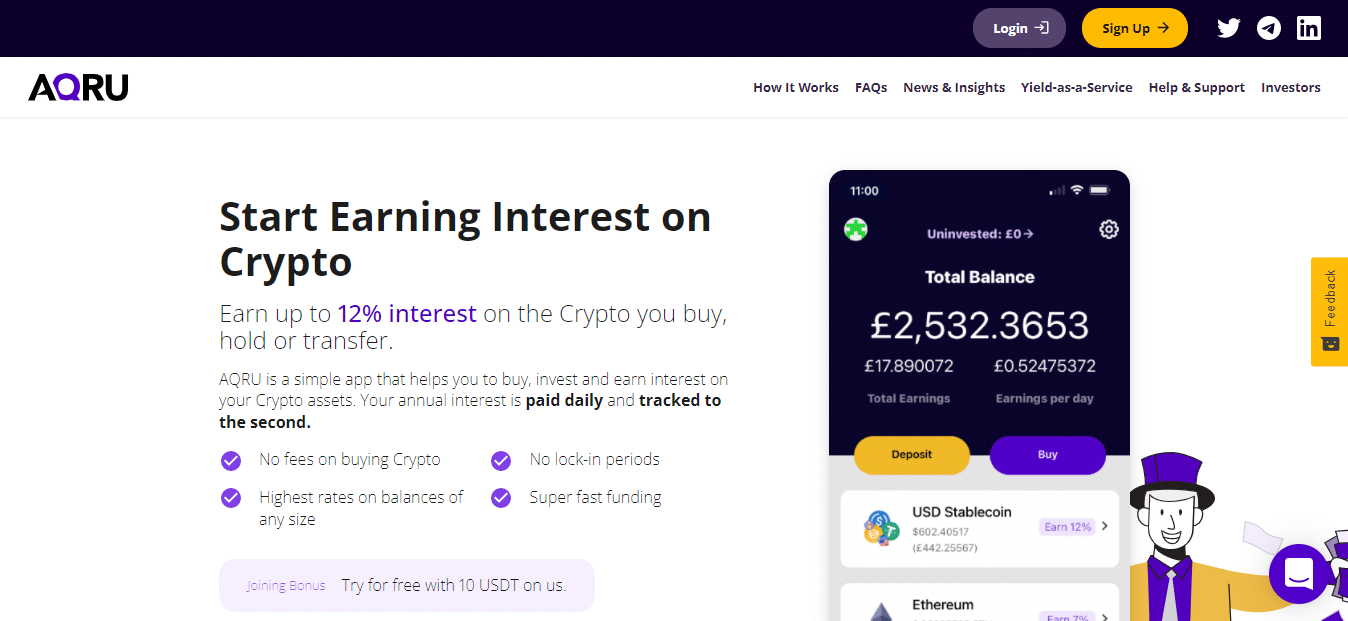

Aqru

This is one of the most intuitive staking platforms in the market, both on their website and mobile app. This makes it suitable for beginners and experts alike. On Aqru, you can deposit and withdraw your funds as either crypto or fiat. Notably, fiat withdrawals are usually free, but crypto withdrawals are charged a flat fee of $20.

Interest rates vary depending on the coin you stake. Stable coins have the highest rates, at 12% APY. BTC and ETH each earn rewards at 7% annually. There are no mandatory lock-up periods, and rewards are paid out daily.

eToro

Staking yields are distributed on a monthly basis. However, eToro deducts a percentage of the profits to cover some of their expenses. Bronze members will receive 75% of their benefits, while silver, gold, and platinum members will receive 85%. Diamond and Platinum Plus package holders receive 90% of their staking rewards.

Crypto.com

This is one of the largest crypto exchanges in the world. It offers several attractive features to its clients, such as crypto loans, credit and debit cards, an NFT marketplace, and a staking service. Staked crypto is lent out to borrowers on the platform, who pay it back with interest, which is then paid out to the staking address.

Interest rates vary according to the coin you stake. Stable coins earn an APY of 12%, while large-cap tokens such as BTC and ETH attract a 6.5% annual interest. If you choose to lock up your coins, this interest rate is bumped up a few points. Additionally, if you choose to stake CRO tokens, the APY is increased further.

Coinbase

Coinbase is a household name among crypto exchanges. In addition to its many attractive features, it offers staking as a service. Currently, it supports the staking of 6 PoS cryptocurrencies and is in the process of increasing this selection. Its interest rates vary from a 0.15% APY on USDC to 5% on Cosmos. Other supported coins include Ethereum 2.0, Algorand, Tezos, and Dai. You can stake as low as $1 in either of these tokens, but the more you stake, the more you earn.

Binance

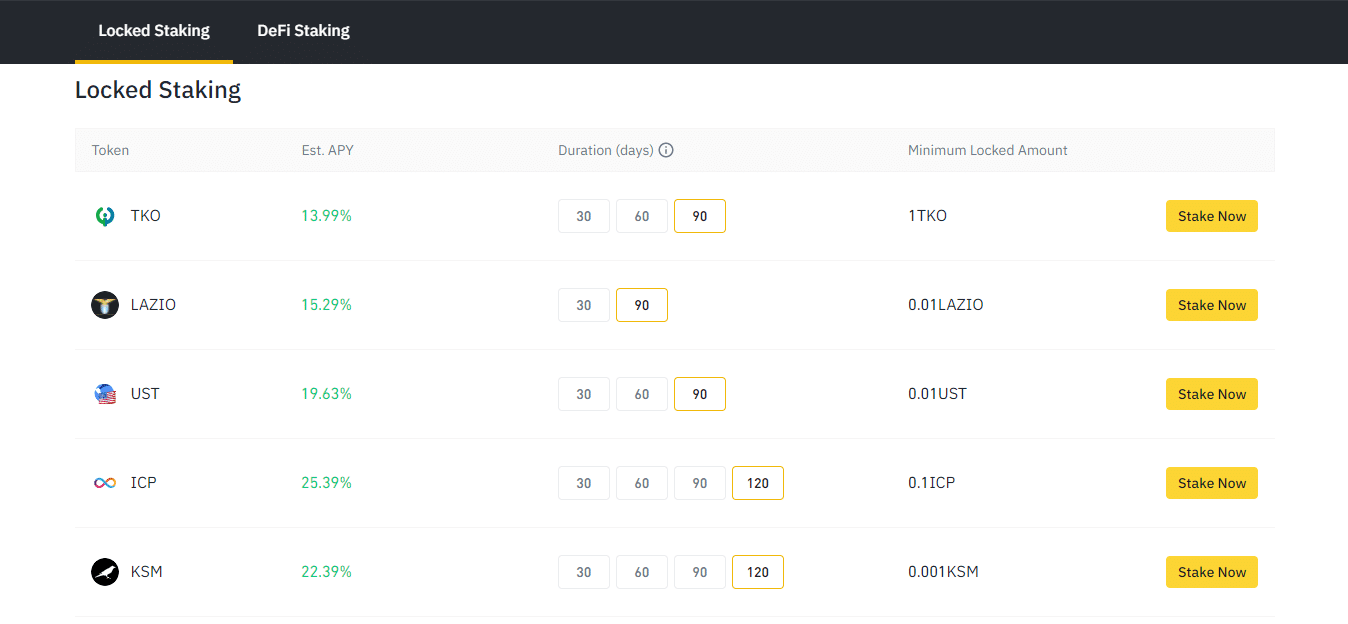

This is the biggest cryptocurrency exchange globally. When it comes to staking, it offers the largest selection of coins for staking, at nearly 100 tokens. Each of these tokens earns interest at different APYs. There is also a locked staking feature that contains optional periods of 10, 30, 60, or 90 days.

Notably, this platform pays higher APYs for shorter lock-up periods. Above is a table showing some of the applicable rates for different coins.

Conclusion

The process through which PoS blockchains assign nodes to validate fresh blocks of transactions on their networks is known as staking. Validators are compensated in the currency they staked in return. Staking off the chain on some exchange platforms is now possible, making it easier than staking directly on the blockchain.