How much have you been making from your forex trading career? Do you have specific strategies you have been using? And how likely are they to help turn around your fortune? The last thing you need is being stuck with an ineffective trading strategy that either doesn’t make you money or makes you just enough to keep you afloat.

Neither do you want to invest in any of the numerous expensive but untested ‘high-yield’ strategies being peddled around. Read on to discover some highly-effective but often underestimated forex trading strategies that should ride on if you hope to make real pips all year round.

1. Position trading

Also referred to as the longer-term trading approach, it allows you to hold on to one or several forex pairs for weeks or even months. By riding on this strategy, your biggest bet is maximizing on the take-home profit resulting from a significant shift in price. Expectedly, your position should not be influenced by daily or weekly charts and trends. Granted, and given the flexibility offered by this strategy, you don’t even have to quit employment and devote your time to industry research.

Position trading pros

- You only get to spend a little time trading as your buy and sell positions are weeks or months apart

- You don’t get stressed by small, by-minute or hourly, price fluctuations

- Can recover from overnight price risk rundowns.

Cons

- You need an extensive understanding of market and industry influencers if you are to make a meaningful profit

- Only ideal for traders with a large capital base

- The little trades made annually limit profitability.

2. Doji candlestick (price action) pattern strategy

Doji candlesticks form throughout the chart and at different timeframes, making it some of the most common source of price action. However, they remain one of the most undervalued resources. By mastering how to read and decode the Doji candlesticks, you climb a notch higher on your quest to dominating the forex market. There are also by-minute and hourly Doji candlesticks that benefit the day traders most.

Pros of the candlestick trading strategy

- Highly effective for day trading

- Allows you to make money all-year round

- Eliminates the overnight risk as you get to close a position at day end.

Cons

- Stressful as you have to keep market watch

- Simple negligence opens you up to massive losses

3. Swing (Weekly) trading strategy

Refers to the holding onto a trading position for days or weeks, also known as medium-trading. In this case, you are holding onto a forex pair in anticipation of a future event, known as swing event, likely to influence the markets in your favor. Like in position trading, this strategy requires you to have a solid understanding of the market, or at least devote a portion of your time towards it.

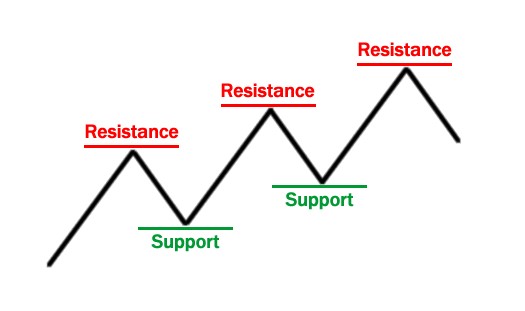

Here, the trading decision is influenced by such factors as daily or four-hour price actions. Key factors to keep a close check on when using the swing trade strategy include the buy-support and sell-resistance levels as well as the moving averages as they ultimately influence your take-home profit.

Swing trading strategy pros

- Trading and market analysis doesn’t eat most of the time thus possible to trade part-time

- Less stressful compared to daily trades

- Able to ride and maximize on medium price trends that drag for days

Cons

- Exposes you to overnight market risks

- Requires significant capital investment

- Slight market changes may result in significant losses

4. Scalping trading strategy

This is one of the riskiest forex trading strategies but also the most profitable for the forex industry masters. Considering the high risk and need for deep trading skills to maintain your balances let alone make a profit, it is advisable that novice traders keep off forex scalping strategy. Through scalping, the trader is trying to beat the bid/offer spreads as quickly as possible.

It involves buying and holding onto a forex pair for a few minutes, even seconds at times, and selling it back as soon as it posts a profit. Critical forex analyses, trading speed as well as stable and fast internet connection come in handy. A slight lag in either may put your trades in jeopardy, forcing you to hold onto a position as you wait for them to turn around sell at a loss.

Scalp trading pros

- Allows you to make profits all-day every year

- Presents numerous trading opportunities form different markets and currency pairs on a daily basis

- Doesn’t require a huge initial investment

Cons

- Quite volatile and requires huge risk tolerance

- Highly stressful as you have keep tabs on by-minute price actions

- You need expensive trading software that helps your trades match market speeds

5. Transition trading strategy

While this trading concept may be relatively new, it has a lot of potent. Just like the name suggests, it involves transitioning your trades from time to time by trailing the stop loss. You start by identifying a currency pair with the most potent of turning profitable and entering the trade at a given time.

The only difference between transition trading and most other forms of trade is, instead of trading with fixed targets, you get to adjust the stop loss to this point and target profit to an even higher level. For instance, if you enter a trade with a one-hour timeframe and it turns bullish, you get to extend the targets instead of taking out profits.

Transition trading pros

- Doesn’t require special trading skills or tools

- Allows you to ride monster daily trends

- The risk exposure to your trade is minimal

Cons

- Requires thorough understanding and interpretation of the price action at different timeframes

- Only a few trades translate to day-long profitability trends.

Find your best

There are several factors you have to keep in mind when deciding on a forex trading strategy. For instance, how much money, time and resources do you intend to devote to the trade? With a huge capital base and little time, it is only fair that you consider position or swing trading. Have fairly enough capital, a thorough grasp of the industry, and fast internet speeds as well as access to a premium trading software? Take a shot at scalping or transition trading. Note that while a given strategy may have been discounted by others, it may end up offering you a lifeline.