Automated trading is the process of using a robot or an expert advisor that opens and closes trades automatically. In forex, a well-created robot will analyze several currencies at once, identify opportunities, and then open the trade. It will also set the stop-loss and take-profit based on how the algorithm is set. In this article, we will look at some of the best practices when using an automated trading system.

Backtest it first

There are two main ways of using automated trading software. First, you can buy it from one of the popular marketplaces like MQL5 and MQL4. These are the default marketplaces for traders using MT4 and MT5. The marketplaces have thousands of robots built by traders from around the world. You can also buy the robot directly from a seller.

Second, you can build the robot by yourself. This is often a challenge for many traders because most of them don’t have coding experience.

Regardless of how you acquire the expert advisor, it is important that you backtest it well on a demo account. Backtesting refers to the process of using historic data to check the effectiveness of the robot. Fortunately, many trading platforms like the MT4, NinjaTrader, and TradingView have a feature that lets you backtest the robot fast.

The process is relatively easy. With your robot installed, select the strategy tester tool, enter your trading parameters, and then run the test. Some of these parameters are the preferred currency pair to test, the duration of the test period, and the chart period to assess. The chart period can be daily, weekly, monthly, hourly, or even minutes. Running the test will show you how profitable the robot is.

Still, the automated strategy testers are not enough. You should use the robot on a demo account continuously for about a month or two to see how effective it is. Finally, after seeing its effectiveness, the next step is to apply it to your real trading account.

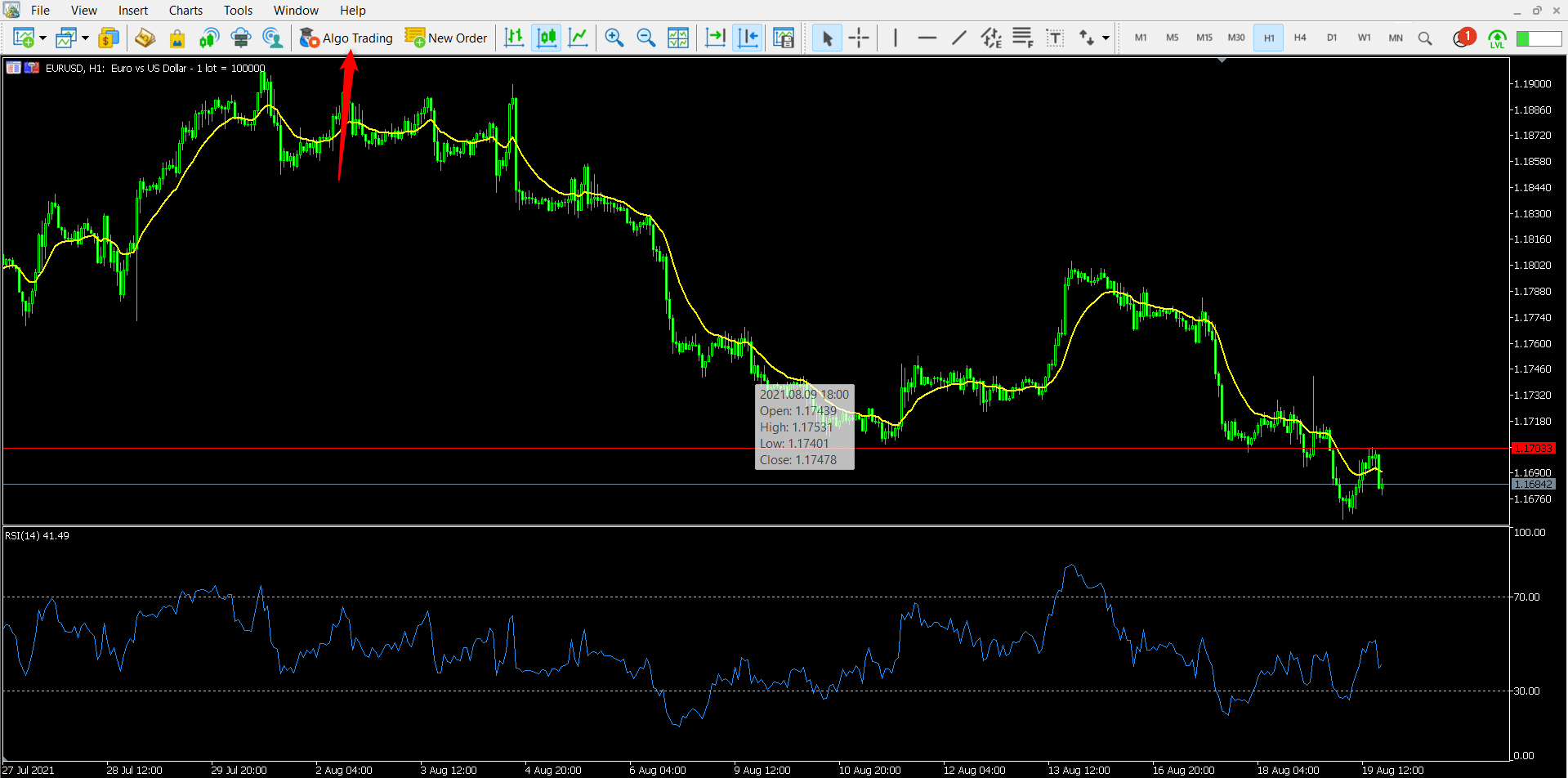

Check the algo trading button

The trading robot only works when you have activated the feature in the trading platform. The MT5 has a button known as algo trading, while the MT4’s button is known as Auto Trading. The chart below shows the algo trading button in the MT5.

Algo trading button on MT5

Checking whether the button is on or off regularly is an important thing. For one, it can help you avoid the market when there is elevated volatility. In such periods, the robot will often execute trades that are ill-timed.

Additionally, turning the button off means that the robot will not open trades when you are not around. This is notable since many traders who use expert advisors monitor their trades constantly. Therefore, if you leave the button on, the bot will likely open many trades when you are not around.

Monitor your trades

Many advanced robot traders don’t always check out what their expert advisors are doing. Besides, most of them have used the tool for many years and know how it performs. This is substantially different for relatively new traders who are recommended to continually monitor what their trading robots are doing.

In most cases, you should turn the auto trader button on when you start your trading and identify some of the opportunities it opens. When it opens a trade, you should take a deep dive into it and see whether it makes sense.

For example, you could apply fundamental or price action analysis to see whether the trade is logical. Also, you could intervene when it opens a trade before an important economic event. Some of the most popular events in the market are the nonfarm payrolls, speeches by key policymakers like the Federal Reserve chair, and political events.

In most cases when there are such events, we tend to see elevated volatility in the financial market. In such periods, the bot’s trades could be riskier. Therefore, monitoring the trades can help you avoid the situation where a trade is opened before key events.

Leverage

Leverage is an important concept in forex trading. It refers to a situation where the broker provides you with funds to help you maximize your profitability. However, leverage is said to be a double-edged sword. This means that it will typically lead to higher profitability if the trade goes right and higher losses if the trades go wrong.

Therefore, in your early days of using the robot, we recommend that you use the leverage conservatively. Ideally, use relatively small leverage when you are starting to use the bot. If you are in Europe and Australia, the maximum size of leverage you can use is 1:30. In other countries, some brokers offer a leverage of more than 1:500.

Using small leverage will help you minimize the risk of making substantial losses in the financial market. You should then increase the size of your leverage as you see the performance of the bot.

Lot sizes and stops

The next important best practice when trading using bots is to check out your lot sizes. The robot will mostly open trades in the lot sizes that you specify. Therefore, we recommend that you start with a relatively small lot size. While this will not make you a lot of money, it will help you see the effectiveness of the bot. Like with leverage, you should increase the size of your lot sizes as you see the efficacy of the indicator.

Another important concept in automated trading is stop-loss. A stop-loss is a tool that stops a trade automatically when it reaches a certain loss threshold. A take-profit, on the other hand, is a tool that stops the trade when it reaches your preferred profit level. You should ensure that your bot has well-defined stops based on your trading strategy.

Summary

Automated trading is a relatively popular way to trade these days. In this article, we have looked at what it is, how it works, and some of the best practices to use. If you are new to using bots, we suggest that you do sufficient research and test the robot’s performance on a demo account before you jump in a live account.