The British pound is one of the most popular currencies globally. It is the third most popular currency in the world after the US dollar and the euro. As a result, the GBPUSD pair is classified as a forex major together with others like the EURUSD, USDCHF, and USDJPY.

This article will look at the key factors that move the GBPUSD pair and some of the top strategies to day trade the pair.

What moves the GBPUSD?

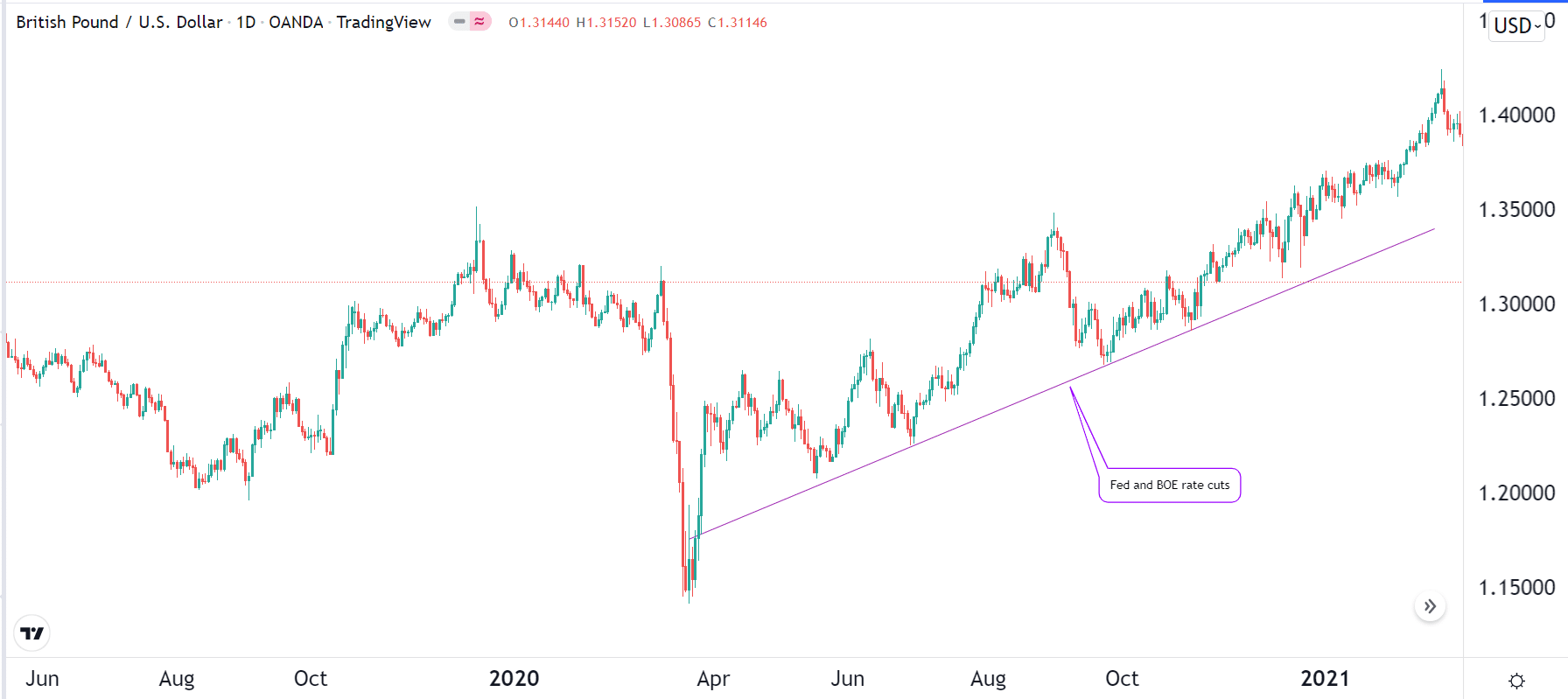

Like all currency pairs, the GBPUSD is moved by several catalysts. First, there are actions by the Federal Reserve and the Bank of England (BOE). As two of the most important central banks in the world, their decisions always have major impacts on the cable.

For example, the GBPUSD pair rose sharply after the Fed and BOE lowered interest rates due to the Covid-19 pandemic. At the time, the banks cut interest rates and embraced a quantitative easing (QE) program.

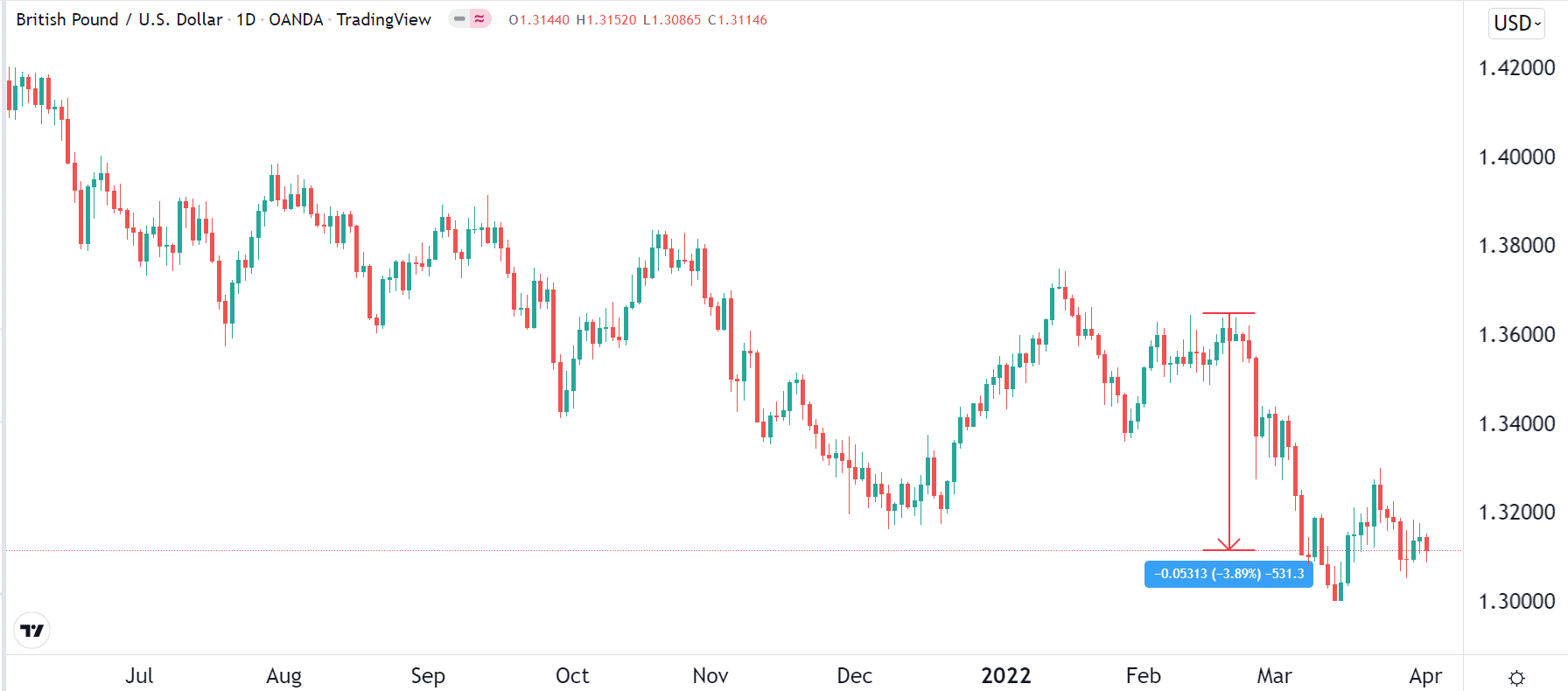

Second, the pair tends to react to geopolitical issues. In most cases, when there are major geopolitical events like wars and conflicts, the pair tends to decline because the US dollar is often viewed as a safe haven. In the chart below, the pair sharply declined when Russia invaded Ukraine.

Third, the pair tends to react to important economic data from the US and the UK. Some of the most important numbers that move the pair are US non-farm payrolls (NFP), initial jobless claims, inflation, consumer confidence, GDP, and manufacturing and services PMI numbers.

These are vital numbers because they help to tell the state of the two economies. Stronger than expected numbers tend to signal that the BOE and the Fed will embrace a more hawkish stance. On the other hand, when these numbers disappoint, they tell that the two banks will have a dovish stance.

Other important movers of the GBPUSD pair are political events such as Brexit and national and state elections. These numbers tend to signal fiscal changes in the two economies.

How to trade GBPUSD?

GBPUSD pairs trading

Pairs trading is an approach where a trader focuses on two currency pairs. The goal is usually to identify two currency pairs that have a positive correlation or those that have an inverse relationship.

One can look at this correlation directly by looking at chart performance or by conducting a correlation analysis. To conduct this analysis in a simple way, you just need to download data of the two currency pairs and then run a correlation analysis using Google Sheets or Microsoft Excel.

If the answer is close to 1, it means that the pairs are closely correlated. On the other hand, if it is close to -1, it is a sign that the two pairs have an inverse relationship. Finally, if it is close to zero, it is a sign that the two don’t have a close relationship.

Therefore, for correlated pairs, if you believe that the GBPUSD cross will rise, you could implement a large bullish trade. To hedge your risk, you can then place a bearish trade on the other pair. If you are right, the bullish trade will make you money while the bearish one will lead to a loss. In this case, your profit will be the difference between the two.

GBPUSD scalping

The other GBPUSD trading strategy is known as scalping. This is a unique approach where traders are mostly focused on the very short term. In it, they open tens of trades every day, intending to generate a profit in each of them.

For example, assume that you have a $10,000 account and you are focusing on making a profit of about $10 per trade. If you are a scalper and you open 20 trades per day, this means that you will have a profit of $200 assuming that all your trades were profitable. In one month, you will have about $6,000, which is a good performance.

In most cases, scalpers rely on a 1-minute or a 5-minute chart. This is unlike swing traders who focus on 30-minute and 1-hour charts.

One benefit of scalping is that the trader does not expose themselves to overnight trades. On the other hand, a key disadvantage is that opening so many trades per day can be costly. Also, there is a concern of slippage, which happens when a trade is executed at a different price from expected.

GBPUSD swing trading

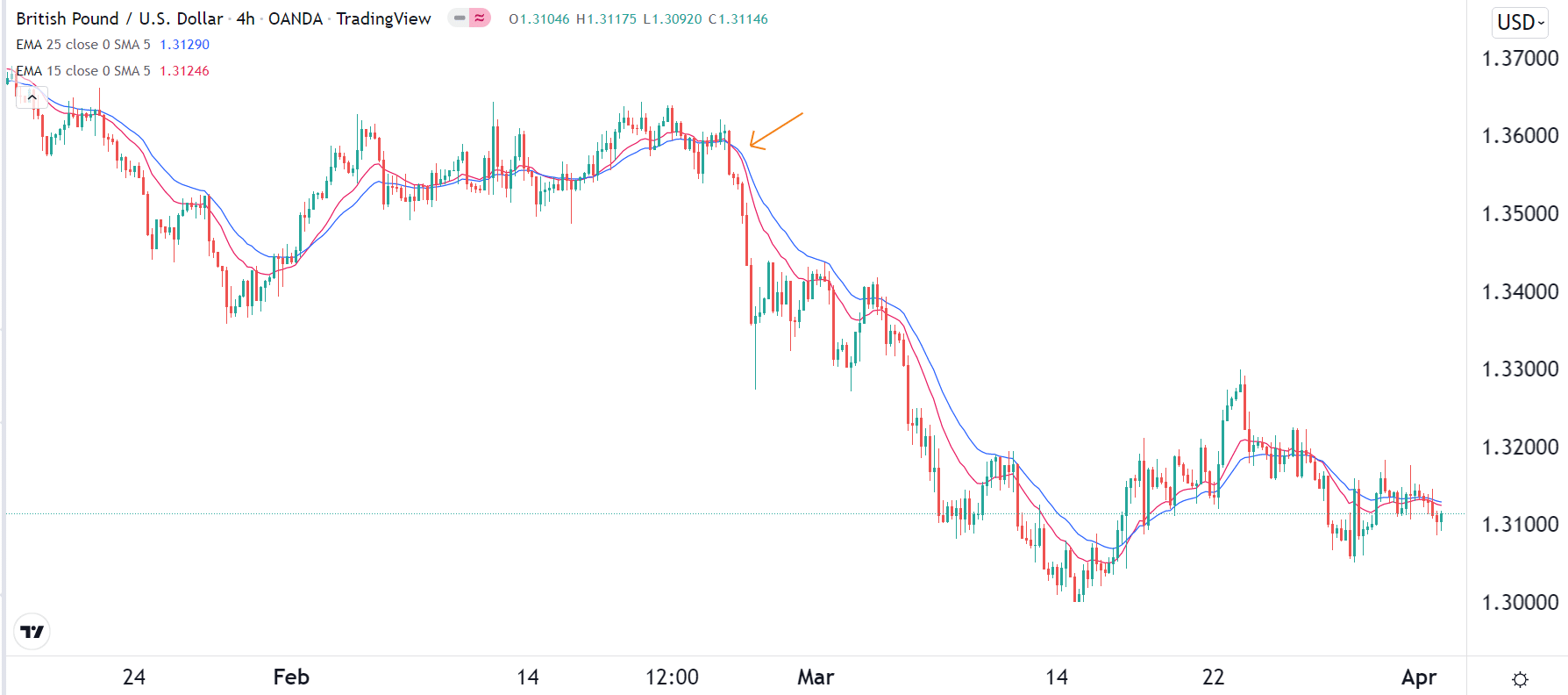

Another style to trade the GBPUSD pair is known as swing. It is an approach where the trader buys or sells a currency pair and holds the trade for a few days. This way of trading is all about identifying a signal and riding the move for a long period.

For example, you may find that the GBPUSD pair has formed a bearish crossover based on Moving Averages. In this case, the pair will likely maintain a bearish trend as long as it is below the two MAs. A good example of this is shown in the chart below.

While swing trading can be a profitable way to trade the GBPUSD pair, a major drawback is that it exposes you to overnight risks. It is always recommended to protect your trades using a stop-loss and a take-profit to prevent these risks.

Summary

There are other strategies that people use when trading the GBPUSD pair. In this article, we have focused on some of the most popular ones. The Elliot Wave, chart patterns like triangles, pennants, and wedges are other common ways to analyze markets. Some traders also use complex harmonic patterns such as XABCD and Cypher.