There are obvious parallels and connections between Bitcoin and Forex trading but there are many differences as well that one needs to know about. In this article, we compare these two and see which one you should go for.

The cryptocurrency and Forex markets

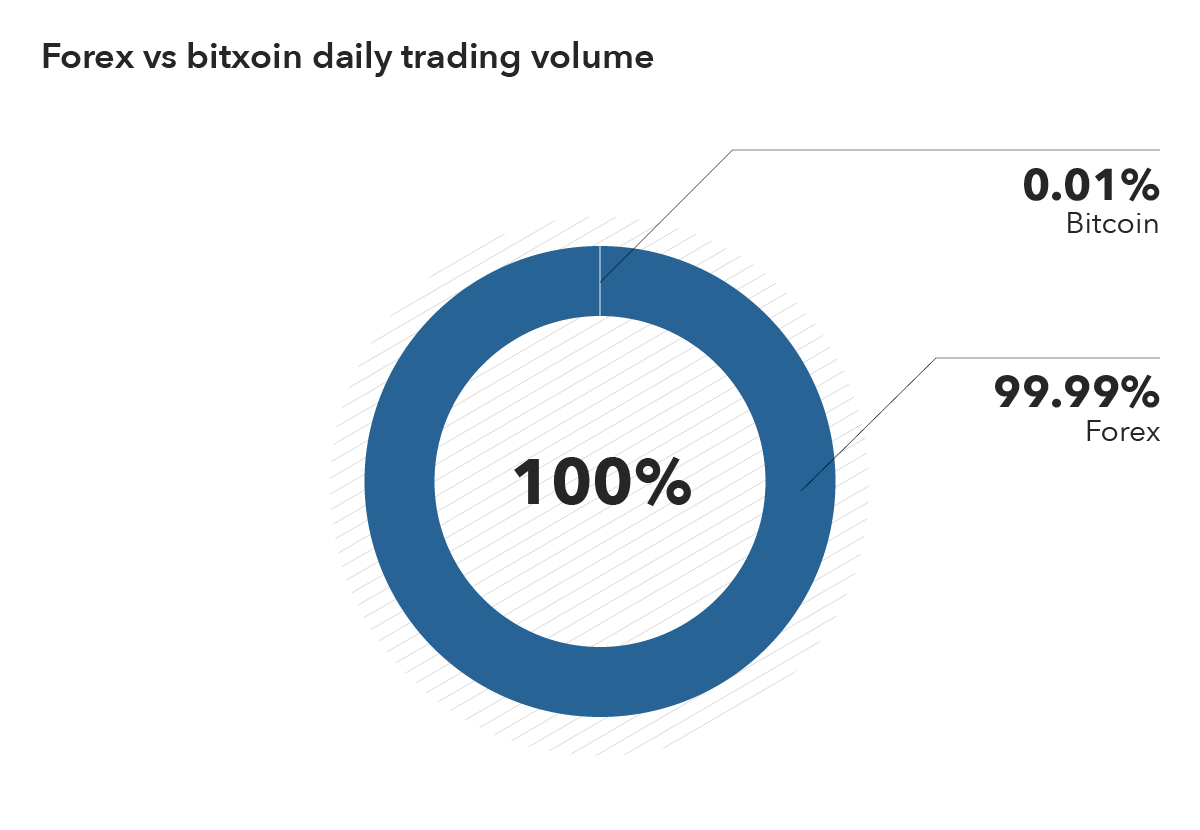

First, let us consider the Forex market. It deals in government-issued currencies all over the globe and doesn’t have a centralized system. This is the largest trading market in the world and over $6 trillion is traded daily in it. The market includes investors, businesses, banks, and institutions that trade to make a profit or do business.

The market was created when the gold standard was established two centuries ago and upon the establishment of the USD as the reserve currency in the 20th century. But, it was the rise in retail and institutional investing that has created the Forex system that one sees today. The internet, too, led to a huge growth in the market, making it easily accessible, and automated a big portion of the process.

Currencies are traded over-the-counter without the overseeing authority of governments presiding over the negotiations between traders. The trade takes place between parties either directly or through a broker. The market is open 5 days a week with various ‘sessions’ around the world overlapping the business hours.

It is a very volatile market, which is what pulls traders towards it since it is what brings about opportunities to make money. Market fluctuations are affected by macroeconomic news, a nation’s economic strength, international relationships, etc.

Now, let us move our focus to the cryptocurrency market. It is perhaps the youngest financial market in the world – only 11 years old – and it deals only with digital assets. It is open all the time and even though there is the option of OTC trading, most of the cryptocurrencies are channeled through exchanges.

Starting in 2009, Bitcoin was the first cryptocurrency to go online, though the first exchanges wouldn’t open for another two years. After that, there was a fast rise in many different types of cryptocurrencies and the ecosystem flourished. The daily trade volume of the market is about $100 billion even though the rules of trade regulations can vary greatly depending on where you live and what is the attitude towards this form of currency.

The market is highly volatile, which is considered beneficial by most people. Though the market can be quite susceptible to scams and manipulations, this market is less affected by global events and other financial markets of the world. This is why most crypto traders don’t bother with news and focus on technical analysis.

Similarities between Bitcoin and Forex

There are various ways in which the two markets are similar. Though both of them deal in cryptocurrencies, both markets are volatile and can change within seconds and they rely on the technology of today to operate globally and in the online space.

The simplest similarity on whose basis we can compare the two markets is that they both deal with currencies. Even though not everyone gives the title of ‘currency’ to digital assets, this is the basic instrument that cryptocurrencies are trying to mimic. The markets are also constituted of various players from individual traders to big financial institutions, all of whom are looking to profit from the volatility and conduct businesses and transactions.

One huge similarity between these markets is their dependence on internet technology in their development. Even though the Forex market was here well before the age of the internet, there is no denying that it has exploded ever since its advent, with the internet being the primary way through which one can execute trades. With the crypto market, everything is in the digital space and nothing could be done without computer networks.

Differences between Bitcoin and Forex

Even though there are some major similarities, some jarring differences still prevail between these markets. One of them is the difference between OTC trading and trading on exchanges for Forex and crypto respectively. The natures of these two are quite different as well.

OTC allows liquidity even though it may be facilitated by a broker. One can always get direct access to the market with an account but that usually is very highly regulated. It is better to go through a broker even though s/he is going to charge fees.

The commission will depend on a variety of things, such as:

- The pair that you are looking to trade

- The market conditions

- The institutions involved

Crypto is bought usually on exchanges. The exchange, like a middleman, is going to charge fees. However, it is a single authority that presides over buying/selling with a fixed-rate structure. No form of negotiation is entertained, which simplifies the process to some extent.

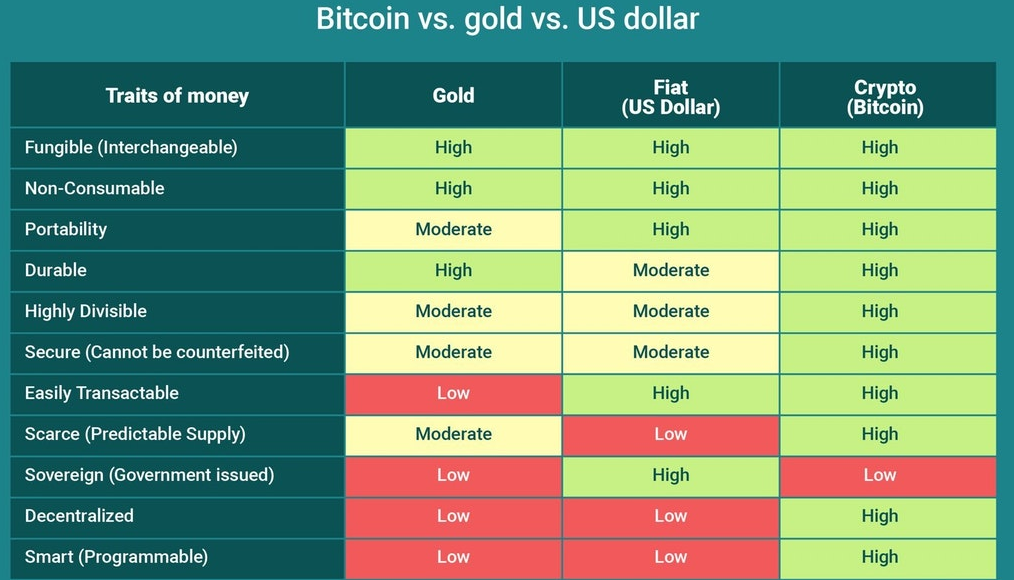

Cryptocurrencies and global currencies are quite different from one another, something that the votaries of both camps like to point out. Global currencies can be pegged to another asset and are well regulated by banks and governments. Their interaction is dependent on a system that has been around for quite some time now.

Cryptocurrencies, on the other hand, don’t have anything of that sort. They are not tied to a bank or country. Although they can be pegged to an asset, they usually aren’t and their value is dependent on speculation and a combination of utility. The value of a digital asset can vary greatly in a market where a number of crypto projects are trying to vie for the same niche.

Which one should you go for?

This question is what most traders would like to ask themselves. The answer to this boils down to mainly which environment suits you better. Forex has a lot of stability and long-established systems with state-of-the-art infrastructure and clearly defined regulations. But, the ceiling may not be as high or extreme as what crypto can offer.

Cryptocurrency has numerous risks involved but the potential for gains is quite huge as well. It has been called the ‘wild west’ market, and for good reason too.