Climbing is a trading solution that performs high-frequency scalping trading to make profits on your account. We have a presentation with explanations of how the system functions. The developers don’t provide varified trading results. So, let’s take a look at it.

Product offering

It’s the right time to talk about robot features. For your comfort, we compiled the following list.

- The robot was designed to help users place and execute orders automatically.

- It trades most actively at night, i.e. during the Asian and European trading sessions.

- The system can focus on technical analysis in spotting trading opportunities.

- It places SL and TP levels.

- There’s an advanced stop loss management algorithm applied.

- You can purchase this system and give feedback to get Golden Future for free.

- It trades all possible pairs.

- The spreads will be low.

- It calculates the most accurate entry points.

- The win rate reports have been showing steadily high growth.

- It has filters from high spreads and slippages.

- It works with SL and TP options on every order.

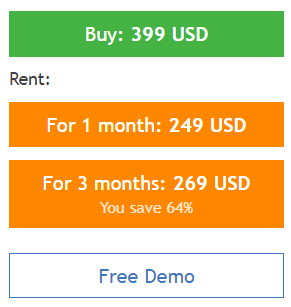

The robot can be bought for $399 for a single real account copy. It has two rental options on the board: $249/month and $269/three months. You are allowed to download a demo copy of the system for free.

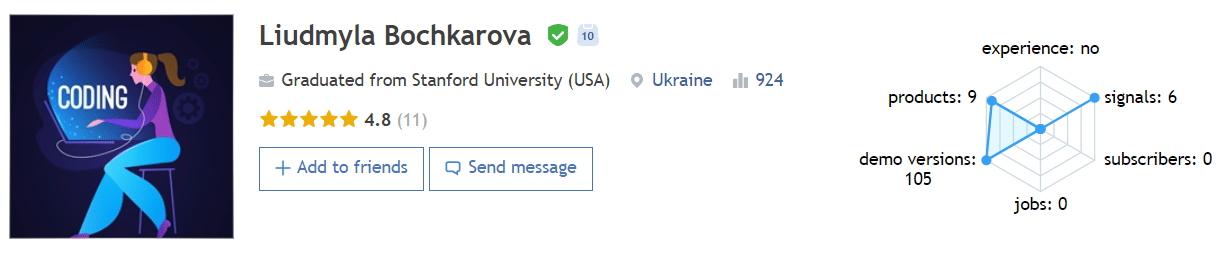

Liudmyla Bochkarova is a developer from Ukraine with a 924 rate who graduated from Stanford. There are 9 products in the portfolio with 6 signals. The products the dev offers have a 4.8 out of 5 rate based on 11 reviews.

Trading strategy

- The dev claims that the robot doesn’t work with a grid or martingale.

- The robot works with a scalping strategy.

- AUDUSD, EURUSD, EURGBP, GBPUSD, and USDCAD are the core pairs to trade.

- The only time frame to trade is M5.

Trading results

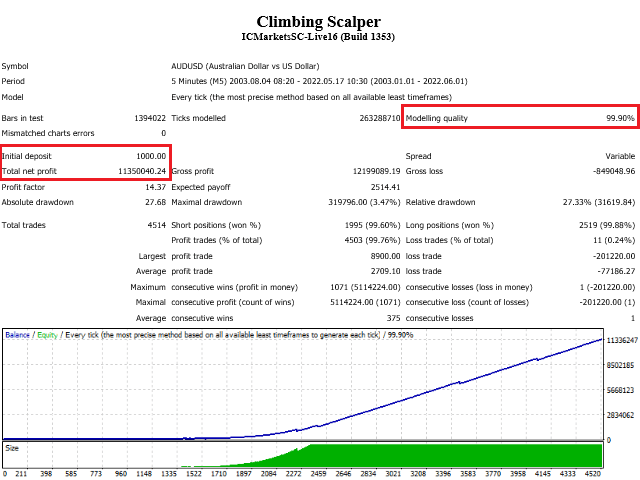

The presentation includes a backtest report that was performed on the data from IC Markets. The core pair to test was AUDUSD on the M5 time frame. The period of data was chosen as 2003-2022. The modeling quality was 99.90%, so spreads are variable. An initial deposit of $1000 has become $11,350,040 of the total net profit. It worked with a good profit factor of 14.37. The maximum drawdown was 3.47%. Climbing executed 4514 deals with a 99% win rate.

In the meantime, the developer skipped providing us with actual trading results. It’s a huge counter argument because the owner doesn’t trust the EA. At the same time, we should check all data verified by Myfxbook, FXBlue, or at least by MQL5. The most important parameters are a win rate, profitability, absolute growth, drawdowns, profit factor, directions distribution, cross pairs, and so on. Without all of this, the price should be three times lower.

Customer reviews

People claimed that the system is profitable and good to go. We don’t know if we can trust them because of the lack of details such as profitability, cross pairs, periods.