Every working day, some Americans buy and sell financial assets such as stocks, bonds, indices, commodities, and currencies in their droves. This accounts for trillions of dollars in daily turnover. Due to the large size of these markets, regulation is called for to protect investors. US regulatory bodies include the Securities and Exchange Commission (SEC), the Federal Trading Commission, and the Commodities Futures Trading Commission (CFTC). The latter body publishes a report called the Commitment of Traders (COT) report, which we shall be looking at in this article.

Defining the COT report

By law, large market participants are obliged to declare their trades and the direction of said trades – whether they are long or short. In turn, the CFTC compiles these statistics into one report and publishes it every Friday. However, the report only contains data up to the close of business on the prior Tuesday. It includes holdings of different financial assets by commercial traders, non-commercial institutional traders as well as retail traders.

As FX traders, when we examine this report, we get to know how other institutional forex traders are placing their trades, and this can help inform the direction of our own trades. More importantly, it can give us insights into the best timing of our trades. There are also businesses involved in international trade on the report who use their trades to hedge their exposure to fluctuations in currency prices that may affect their raw materials or other business costs. All in all, the report helps gauge the overall market sentiment, which provides a trading bias for FX traders.

Types of COT reports

The reports published by the CFTC come in four main types. The first is a legacy report, which contains the reportable open interest by both commercial and non-commercial traders. The second is a supplemental report, which consists of the 13 agricultural commodities. It highlights all commercial, non-commercial, and index traders of contracts of these commodities.

There is also a disaggregated COT report, which contains contracts on assets such as petroleum, natural gas, electricity, agricultural products, among others. The final COT report is titled Traders in Financial Futures. It contains information on traders who took out futures contracts on currencies, stocks, and the Bloomberg Commodity Index.

Market participants included in the COT report

- Dealer/Intermediary – This includes liquidity providers such as commercial banks and dealers in securities and swaps. These are the parties who sell financial assets to their clients, the traders. They do not participate in speculating, and thus, this statistic is not especially useful to FX traders.

- Asset managers/institutional – These are the institutions that participate in the forex market, such as pension funds, insurance companies, mutual funds, and portfolio managers of various institutions.

- Leveraged funds – These include hedge funds and money managers or other unregistered funds that are recognized by the CFTC. These managers mainly speculate on the spot and futures forex market on behalf of their clients. For that reason, these are the participants that FX traders should be paying the most attention to.

- Other reportable – These are mainly corporations with foreign interests who use the markets to hedge their exposure to various business risks associated with the volatile nature of the financial markets. Their main aim is not to make money speculating but to reduce their risk of loss.

How to use the COT in forex

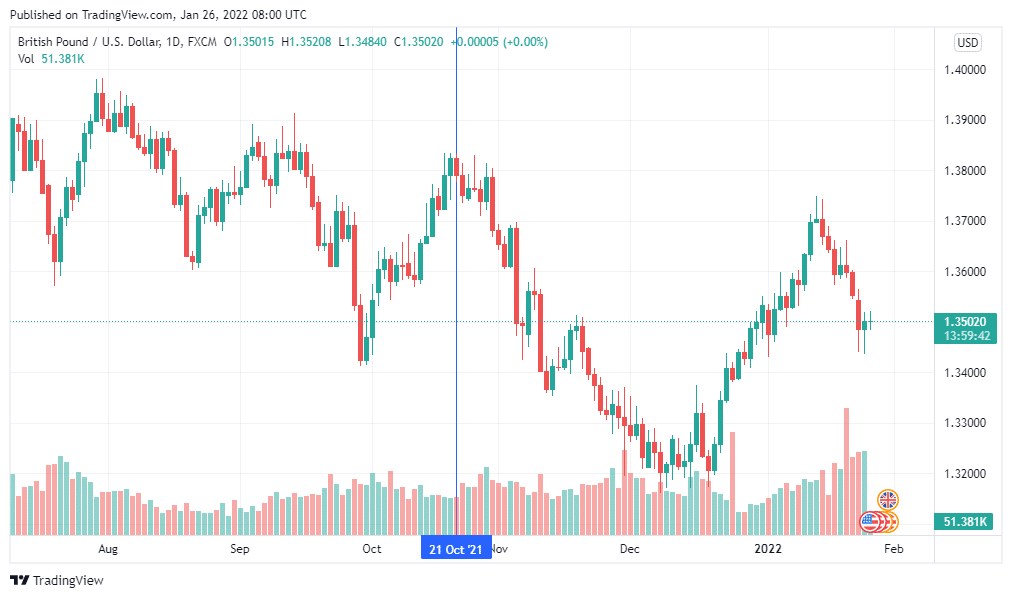

From the GBPUSD chart below, we see that the pair began the month of October on a bull run that persisted for most of the month.

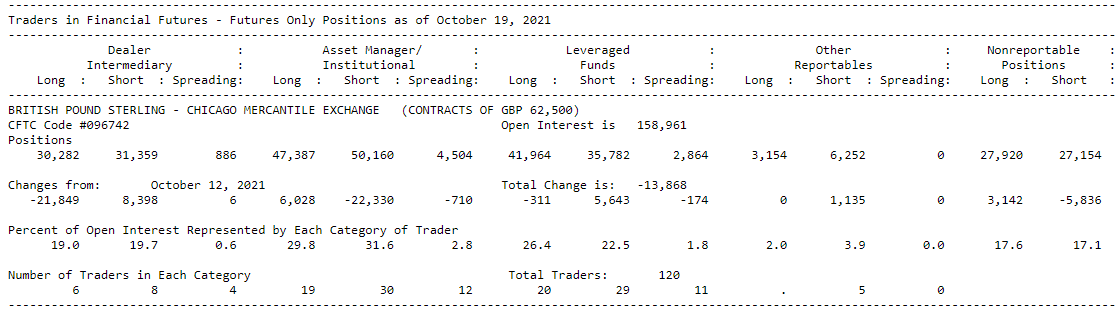

From the participants included in the COT report, we established that the participants who best inform FX traders on market sentiment are leveraged funds. These are the hedge funds that take speculative positions on currency pairs and thus have the same profit-making goals as individual traders.

Switching to the COT report, we see the report released on 22nd October 2021 stipulate a reduction in overall long positions and an increase in the number of hedge funds that went short on the pair. This was a sign of waning bullish momentum and increasing strength by the bears. True to this analysis, the pair went on a long bear run that lasted from the 21st of October till December that year.

However, the market does not always go in tandem with the report. For example, in 2015, the Swiss National Bank removed the currency peg that their currency was previously under. This caused a severe market reaction that had not been previously anticipated, which affected all the CHF currency pairs. Therefore, even when utilizing the COT report, it is of paramount importance to pay attention to fundamental factors that may drastically affect currency prices in an unprecedented manner.

The COT and market sentiment

The best way to trade this report is to use it as an indicator of market sentiment and nothing more. To that end, an ideal strategy would be to find extreme long or short positions. For instance, if the majority of people long a currency, eventually there’ll be no more buyers to move the price higher, and a reversal will be inevitable. However, keep in mind that this report is a lagging indicator, since it is published on Friday but contains data up until the prior Tuesday.

Conclusion

The Commitment of Traders report is a publication that is released by the Commodities and Futures Trading Commission every Friday. It contains data on the positions that major participants in the financial markets took throughout the week. It is a lagging indicator of market sentiment, as the data only includes positions taken as of the prior Tuesday of the report’s release. To that end, it should not be taken as an end all be all indicator. Rather, due diligence into the pair’s fundamentals is essential so as to avoid being taken by surprise by drastic market moves.