In the case of digital assets, capital gains tax may apply. Let’s take an instance where Jim David purchases $1,000 worth of DOGE. When he finally decides to part with his DOGE, it’s worth $1,500. That means Jim made a profit of $500 when he sold his coins. It’s worth noting that this profit is considered an income source. Consequently, Jim has to pay a percentage of the $500 profit in taxes, which he does on his tax return.

So why is crypto tax software so essential? That’s because there are so many restrictions around crypto that are difficult to understand. Cryptocurrency sale is likely to be taxed in many jurisdictions, even if the crypto was a payment rather than purchased as a speculative investment. Five of the top crypto tax software are outlined here, and we explain why they’re the best fit for your needs.

Accointing.com

For those who are new to cryptocurrency and don’t want to use multiple applications to maintain their crypto portfolio, Accointing is the best option.

It puts the user first and is a deep source of crypto market knowledge. A crypto tax calculator with particular results for the United States is also available. There are other calculators that can compute taxes for users based on laws in the United States, the United Kingdom, Australia, Switzerland, Germany, and Austria. Your crypto tracking dashboard, tax-loss harvesting tool, and tracker app are included in all Accointing.com plans. However, the free plan only allows for 25 transactions a year.

There is a tax blog by Accointing that provides helpful step-by-step platform tutorials. Your crypto tax file will be even more accessible with the easy upload method.

Koinly

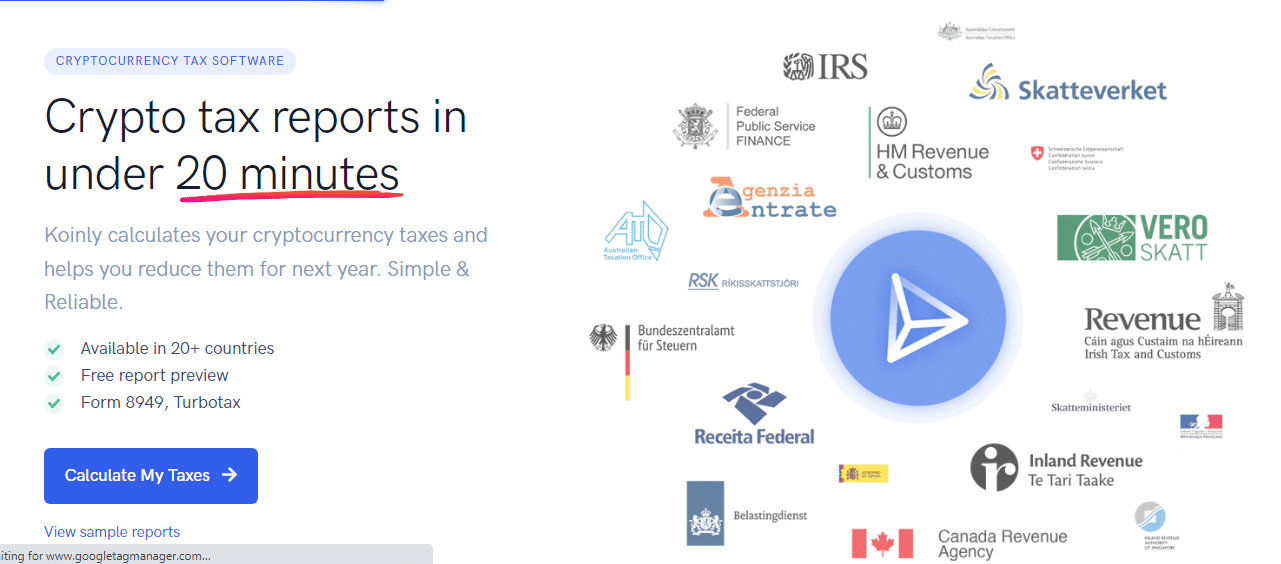

Koinly offers exciting tax features that are not common on other platforms. As an added bonus, Koinly can track gains associated with new types of crypto financing like staking, borrowing, and lending. As far as crypto tax software is concerned, it is widely considered a market leader. Koinly’s international support is a major advantage over most other crypto tax software. There are already more than 20 nations where you can access Koinly from.

This crypto tax software also features a portfolio tracker to keep track of your year-to-date gains and losses in your portfolio. In addition, you may quickly transfer the data to other tax applications. Tracking capital gains taxes over time can help you avoid an unpleasant surprise when tax season arrives.

More goes into making tax filings localized when you move to a new country than merely adjusting a few currency values.

Free trials for up to 10,000 transactions are available on Koinly’s website. However, you’ll have to pay $49 to access many different kinds of reports. You may see a preview of your capital gains with Koinly, and if you’re filing in the US, it can even create filled-out IRS tax forms. Your long and short-term cryptocurrency disposals will be included in the report.

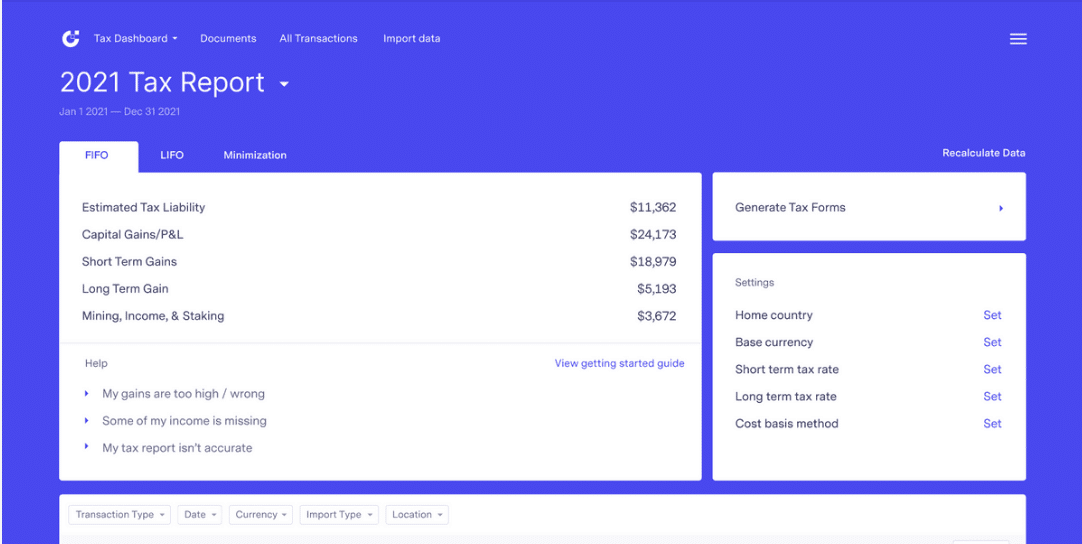

TokenTax

TokenTax features some of the most expensive alternatives, but it also provides unique services for those who can afford to spend a little extra. Starting at $65, you can get a CPA to help you with your crypto taxes. With TokenTax’s “white glove” service, the tax professionals can file your tax returns for you, but they can also assist you in piecing together your previous gains and losses from defunct exchanges.

For TokenTax, tax reduction and tax loss harvesting are two of the company’s core competencies. TokenTax seeks to reduce taxpayers’ tax burdens by facilitating the recovery of tax losses (where legal). Because of this focus, traders might gain advantages from trades that didn’t go as planned. Other parts of cryptocurrency trading, such as margin trading, are also part of the IRS-compliant methodology.

TokenTax also allows users to set up accounts without paying for the application. This allows people who are inquisitive about the product to get a feel for it without filling out a form. A CPA and a full tax filing team are also available for hiring with TokenTax, which sets it apart from the majority of the company’s competitors. Those who want to use TokenTax only for crypto-related tax computations can easily import their results into TurboTax to meet their total tax reporting needs.

CryptoTrader.Tax

It’s a well-known tax program that has more than a hundred thousand customers. Additionally, it syncs across a large number of exchanges, provides up-to-date profit and loss data, and supports over 10,000 different digital assets.

It works with TurboTax and TaxDirect and more than 200 cryptocurrency exchanges. In addition, it is compatible with the most common wallets on the market today. Short-term and long-term sales reports, crypto income statements, international gain/loss statements, and much more may all be generated quickly and easily with this software. Tax-loss harvesting is even an option in this simple tax software.

ZenLedger

Zenledger supports more than 30 DeFi Protocols, and it integrates with more than 400 exchanges. You can even have access to a tax professional for free with a free plan, and it specializes in cryptocurrencies and NFTs. However, this plan only allows you to keep track of up to 25 transactions at a time. Those who are in possession of their assets may find this to be a viable choice. To access tax reports, download them, use tax-loss harvesting or unified accounting, you’ll have to pay a fee.

ZenLedger’s tax-loss harvesting function is a handy feature. You can use tax-loss harvesting to reduce your tax bill by selling assets at a loss. When you sell assets at a loss, the goal is to replace them with assets of a comparable value so that your portfolio composition does not change. For those who use many exchanges, wallets, and crypto projects, this means they may import their transaction history and assets into a single place.

In summary

Most government tax agencies like the IRS consider cryptocurrencies to be property rather than currency when it comes to taxation. Put another way; you don’t owe taxes on your cryptocurrency gains until you sell them. Cryptocurrency newbies and veterans alike will have to deal with tax issues. It’s imperative that you compute crypto taxes correctly as tax rules take effect.