Fibonacci retracements are a mainstream framework that investors can use to draw uphold lines, recognize opposition levels, put in stop-loss requests, and set objective prices. Based on the famous Fibonacci sequence, traders have found them to be valuable in making informed decisions. This article will help you understand what the fuss is all about.

Why Fibonacci retracement?

This method of technical analysis derives its name from the famous mathematical model of the numeric series in which each successive member is equal to the sum of the previous two. The sequence is of 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610. If you divide any member of the string by the next one, the result will be 1.68, also known as the PHI number or the Golden Ratio.

Before the sequence was described by the Italian mathematician, 1.618 was used in the construction of the Egyptian pyramids, and ancient temples and tombs. It also defines the proportions of the main elements of Nature, including human beings, which is one of the main reasons why so many traders believe it also describes the psychology of the market.

This sequence is used for better understanding of statistical data in many sciences, and in finance we use it to calculate the value of the price movement correction in relation to the movements in the existing and future market.

By finding the relation between the new subsequent members and the previous ones, a unique series of numbers is obtained, which very often works in the currency and futures markets.

How are the levels formed?

Another reason for the retracement levels popularity is simplicity – you do not need to apply complicated formulas in your computations. These levels correspond to the percentages of the price range you set for your analysis.

Step 1. Choosing the points

The first step in the process is choosing your points to draw the retracement indicator lines – at least, two of the highs and the lows.

For example, if you track the exchange rate of the British Pound against the US Dollar, and you notice that the pound peaked at $1.55 three times (see below) within a few days. Therefore, if you were trading the currency pair in the Forex market at that time, you would draw the horizontal line at that level (the purple line in the figure below).

If the price of the pound dropped to $1.49 at least twice within the same period, but no below, $1.49 is where you will draw another line.

Step 2. Levels calculation

Once your points of reference are chosen and the lines are drawn. The 23.6% level will be calculated as follows:

($1.55 – ($0.06 x 0.236) = $1.536)

The 61.8% level fall at $12.50, which is the result of similar calculations:

($1.55 – ($0.06 x 0.618) = $1.51292)

What do they indicate?

In the financial market, each level is a designated percentage. The Fibonacci retracement levels are 23.6%, 38.2%, 61.8%, and 78.6%. The indicator is valuable since it tends to be drawn between any two significant value focuses, a high and a low. The marker, at that point, will make the levels between those two points of focus.

These levels are horizontal lines that show the potential areas of support and resistance levels. Each level is related to one of the above proportions or rates and it depicts the previous move reflected in the cost.

How to apply them in forex trading?

The retracement depends on the previous move and the levels signal the traders to be ready for a potential pattern inversion, opposition zone or backing zone. A ricochet is required to follow a part of the earlier decrease, while a remedy is relied upon to backtrack a bit of the earlier development. When a pullback begins, explicit Fibonacci retracement levels are distinguishable for observation. As the remedy moves toward these retracements, chartists should perk up for an expected bullish inversion.

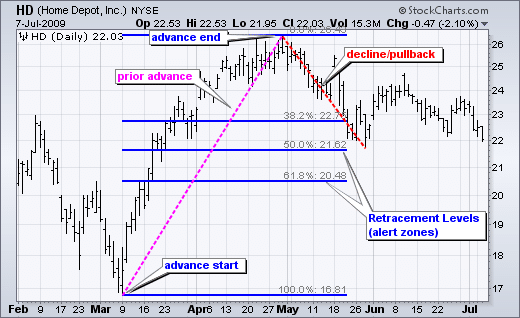

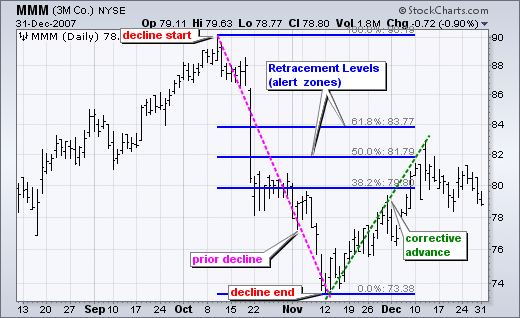

For instance, the first graph below depicts retracing around 50% of the earlier advance. The opposite is true for a bounce after a reduction. As a bounce starts and you can identify a retracement, you should prepare for a potential bearish reversal in the market. The latter graph depicts retracing about 50% of its previous reduction.

Let us look at the figure above, where 38.2% is the lowest retracement level. At the point when a stock’s value rises/falls from 23.6% of its ongoing high/low, it is considered shallow since it is generally trailed by a short pullback.

It isn’t sufficient motivation to wager on a major inversion of the price. While 38.2% and 50% retracements raise the likelihood of a major value inversion, they don’t affirm it. Nor does the 61.8% retracement level affirm a value inversion pattern, although significantly raising its probability.

How to profit Fibonacci retracements?

They can be utilized to draw upheld lines, distinguish opposition levels, set stop losses and even to set objective costs. Fibonacci proportions can even go about as an essential component in a countertrend exchanging system. They are lines that demonstrate the potential areas of help and opposition levels.

Fibonacci retracement is frequently used to recognize the conclusion of recovery or a counter-pattern. Rectifications and counter-pattern ricochets frequently backtrack a segment of the earlier move. While short 23.6% retracements do happen, the 38.2 – 61.8% zone covers the most conceivable outcomes. This zone may appear to be huge, yet it is only an inversion ready zone. Other specialized indicators such as candles, force markers, volume or outline designs can be used to confirm the inversion.

Final thoughts

While the retracement levels show where the price may discover support or resistance, there are no affirmations the price will really stop there. This is the reason other affirmation signals are frequently utilized, for example, the value beginning to skip off the level. Therefore you should always recall that regardless of their monstrous utility, Fibonacci Retracements just assistance spot inversion zones. They don’t pinpoint a level from where costs will switch. Before you take an action, affirm a normal inversion by utilizing other specialized investigation instruments.

Fibonacci proportions appear to assume a part in the financial exchange, just as they do in nature. Technical investors/traders endeavor to utilize them to decide basic focuses where a resource’s value force is probably going to switch.

That is mostly a direct result of their general effortlessness and also due to their relevance to practically any exchanging instrument.