Forex automation has become the new norm lately. A lot of traders are trying out forex automated software in order to alleviate some of their trading workload. This article educates you about forex automated programs so you can get started with them without any hassles. So, without further ado, let us begin.

What is forex automated trading software?

As the name suggests, forex automated software refers to a hands-free trading system. It is also known as robot or robo trading, black-box trading, and algorithmic trading. Since this is a mechanical and automated system, it eliminates all the negative aspects of humans when it comes to trading. A forex robot is logical, unemotional, and smart. Unlike humans, forex trading software works 24/7 like a robot.

Forex robots vs. expert advisors

With new technological advancements, forex trading has also changed over the years. From manual trading to robot trading, traders have started using different forex trading options. Among these, two popular ways are automatic trading robots and expert advisors or EAs.

Both of these are trading software that traders use to trade the forex market. You have to create both of them using your expertise and experience in trading with the help of algorithms. This way these programs can scan market trends and discover entry and exit points.

However, one major difference between these two is forex robots automatically trade on your behalf but EAs necessitate you to approve a trade manually. Forex robots handle the whole process on their own. But, EAs send you the trading signals and then you have to decide if you want to open or close a trading position.

The working of automated forex trading

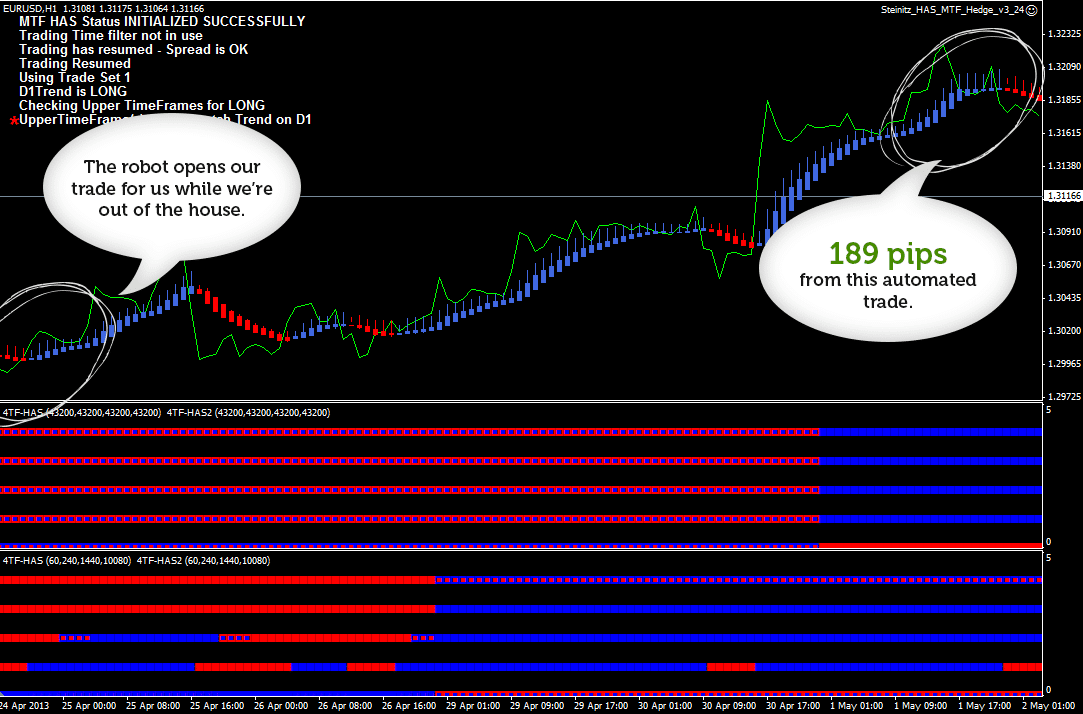

Automatic forex trading uses software to examine currency price charts, along with other activities in the market, over different timeframes. Such a program also recognizes the main trading signals, like important news that can have an impact on the currency variations and transactions, price volatility patterns, and differences in spreads. These signals allow traders to identify currency pairs in which they can trade and earn money.

Let us explain the working of an automated forex trading program through an example. When forex trading software recognizes a currency pair trade that meets the set rules for profitability with the help of the parameters set by the user, it sends a sell or purchase alert to the trader and automatically makes the trade.

Top 4 FAQs about forex robots and automated trading

Now, let us look at the most common queries of traders regarding forex robots and automated trading software.

1. Can you earn money from forex automated trading?

Yes, you can earn money from forex automated trading. A lot of traders use algorithmic trading. However, before you actually purchase or design one of your own, you must test it thoroughly. Many platforms enable backtesting through which you can know if the forex strategy really works and if you can earn money from it. In this procedure, the past price information is used.

You can use a demo trading account for backtesting so that you don’t lose your hard-earned money. And, when you are sure, then you can put in real money on an automated trading program. In order to create your own automated trading strategies, you just have to code your manual strategies with the help of a scripting language.

2. Do forex robots really work?

Yes, forex robots are quite effective and prove to be lucrative for traders. However, this doesn’t mean that they are 100% effective. This is because they too can be wrong. They have the ability to go through millions of trading charts within a few seconds but the information they deliver from it can be wrong.

This is because forex automated systems are mechanical. They cannot predict upcoming events or trend changes due to any major events. Forex robots depend on their programming and historical data. This is why traders should analyze their automated systems occasionally so they can make adjustments to them. Plus, traders should not entirely rely on forex robots for trading.

3. Can forex robots lose?

Most of the forex automated software trade within a specific range. They make some pips within this range that functions in a slow timeframe. Moreover, the software might not employ a stop loss and it generally has low targets.

This is why forex robots make small profits within a limited time span. However, this method does not work during times of strong and unexpected market movements. In such situations, you might lose the money that you gained from the small profits.

Therefore, yes, forex robots can lose. Even though you might come across many forex robots claiming to be the best ones and promising to make profits, they generally work during positive trends and lose in uncertain periods.

4. Is automated trading a scam?

A lot of automated trading systems guarantee high profits in return for paying a small amount of money. Even though you can find many scams in the automated trading sector, there are still some that are genuine. The key is to identify the scams and avoid them. If you feel that something sounds too good to be true, then trust your instincts.

Some of the ways to avoid scams include:

- Check that your chosen system offers a trial period since most of the scam websites do not offer it.

- Make sure you thoroughly read the reviews of any automated trading program you select. You can go through the customer testimonials and reviews on financial regulatory or third-party websites.

- Conduct meticulous research on the software you pick in order to know all about it. Plus, don’t forget to read its terms and conditions before you purchase it.

- If you are paying for trading software, ensure that you inspect everything about it before you put your money in it. Ask questions about your chosen system. Otherwise, you can lose your money if it turns out to be a scam.

Conclusion

Using automated forex trading software can help you if you know how to use it to your advantage. Even though it is automatic, it requires your trading experience and expertise. No matter if you are a novice, experienced, or veteran trader, you can effectively use an automated trading program. Just keep in mind that it is not foolproof.