Many people who start trading in Forex believe that they can earn lots of money in a short span of time. However, this is not the case. In reality, forex trading has its own uncertainties, and you cannot predict it with 100% accuracy.

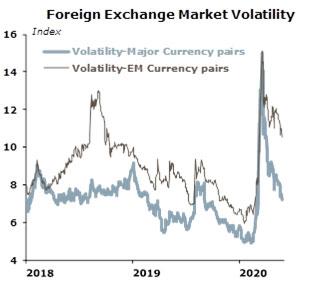

After all, if trading would be so easy, everyone would be doing it. The forex market is never predictable. However, at some points, you might feel that the market is much more changeable than at other times.

As human beings, we are wired to loathe uncertainty, and we like to control things. This is why the volatility in the forex market seems so horrifying, which makes trading in it a huge challenge for everyone, especially beginners.

In this article, you will get to know how to deal with uncertainty and catastrophes in the forex market and minimize your losses.

Understanding the uncertainty

Many people, particularly novices, feel that by predicting the forex market, they can make money. However, this is a misconception and can rather result in the downfall of the trader. Predicting causes a psychological prejudice towards a position, which can obstruct our rational judgment and blind us.

Therefore, traders must trade smartly using a system. The forex market, which constantly oscillates, must dictate your trades. Moreover, if you make a prediction, make sure you wait for the currency to move in order to verify that your prediction is right.

In order to perceive the uncertainty of the forex market, you need to have the right mindset. For this, you first need to familiarize yourself with it and understand it. Stop fearing it and learn more about the market.

Once you do that, you will not feel so scared about the uncertain nature of the market. Plus, you must never give up and trade regularly. This will provide you with some experience, and you will relatively face fewer problems in the industry.

Moreover, you must accept the uncertain reality of the market and take the losses with the wins. Losses are natural in the forex market, and no strategy will make you win every time. You just need to find a strategy that provides you a slight edge in the market, and you are good to go.

Thus, you must be prepared to lose and be wrong a lot of times. This will reduce the severity of the market’s volatility. Moreover, this is what distinguishes new traders from experienced traders. New traders try to fight the uncertainty, while experienced traders accept this reality.

Forex catastrophes – They were, and are to come!

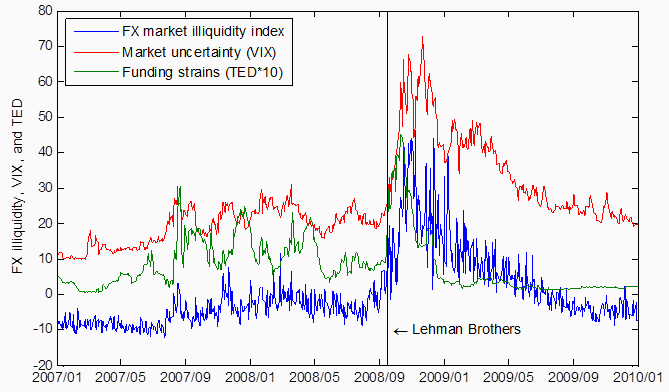

With every new year, there are new changes and developments in the forex market. Global events, such as political turmoil, acts of terrorism, natural disasters, big business news, war outbreaks, etc. affect the forex market.

Events worldwide can instantly affect the currency values and exchange rates due to the global interconnectedness of the forex market. These incidents moved the forex market in the past and will continue to move in the future. Such unforeseen political, natural, and economic catastrophes can lower the value of a currency.

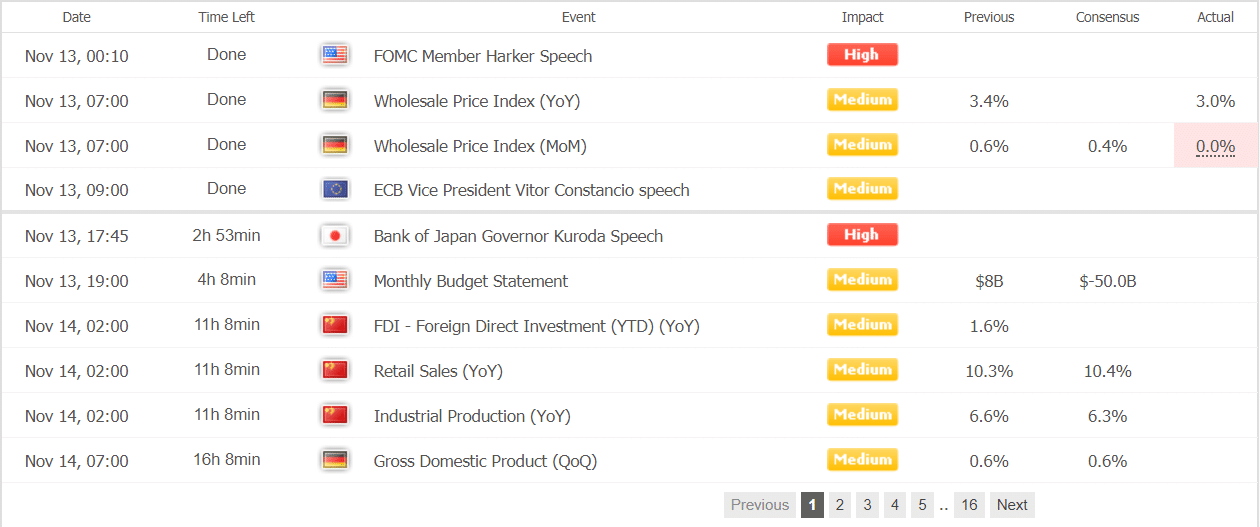

Though it is difficult to plan for such unexpected events in the forex market, the key to deal with such catastrophes in the market is to be prepared for them. Plan all your decisions and make use of various systems, analytical reports, and strategies.

You must know what strategy you must use in various market conditions. Plus, you need to test your strategies and check out their advantages and drawbacks before you apply them. Then, you can apply them at the right time. Do your homework regularly and conduct a detailed analysis before and after making a trade.

Plan your way out

The political, social, and economic events around the world can significantly affect the values of currencies and the volatility of the forex market. This volatility in the forex market and exchange rates are essential for international investing and trading.

Without forex trading, there would not be any international business. The fluctuating values in this industry provide profits to traders all over the world. However, to earn these profits, you need to have a few forex trading strategies.

There are a few strategies that can help you protect your trading capital from unexpected catastrophic market events. These tips will help you to get the most out of your trades, minimize risks, and protect you against heavy losses due to forex volatility. Since the forex market is quite volatile, it is a risky business. Therefore, you must know some strategies and stick to them during unprecedented times.

Some of these tips include:

- Make use of indicators and charts

- Trade around events and news

- Use stop losses

- Stick to your trading strategy

- Keep your position size low

- Keep a trading journal

No matter which strategies and systems you use, you must keep in mind that the forex market is a high-risk market that offers huge earning potential with higher chances of losses. Therefore, in order to prepare yourself for the worst-case scenario, you need to assess your risk factors and the risk-reward ratio in every trade.

You cannot always know what market drivers can occur in the near future, so it’s better to be prepared for the worst-case scenario. Proper risk management can allow you to face the worst without getting scared of it.

Conclusion

The only certain thing in the forex market is uncertainty. Even though you might predict probable price movements, unforeseen events, and surprises in the forex market cannot be predicted. Due to these market surprises and changes, you can lose a lot of money in forex trading.

Therefore, you must develop a trading strategy or process that is flexible and can adapt to such unexpected events. This can minimize your losses. Even though you cannot control forex catastrophes, you can manage your trade setups and risk per trade.