A trading strategy is an essential trading tool for anyone looking to make a fortune trading in the financial markets. While there are many excellent trading strategies that one can copy, it is essential to develop a strategy that fits one’s goals and ambitions.

Most traders spend hundreds or even thousands of dollars looking for a perfect trading strategy. That should never be the case, in an era where one can leverage a wide array of tools and information online to come up with a unique trading system.

Creating a trading strategy is as simple as accessing charts, reflecting on the time frame, and remaining inquisitive and objective in mind. A good trading strategy is not only easy to follow but can also earn a lot of money. It is because it is much easier to understand and develop a strategy that one has created from scratch.

Creating a unique trading system is simple if you go through the following steps.

Market/Instrument Selection

The capital markets come with a variety of instruments that one can trade and squeeze in some profits. In this case, it is vital to have an idea which instrument would be much easier to trade on the risk-reward front.

For amateurs, if you choose to trade forex, it is essential to understand the factors that cause currency pairs prices to move up and down. Likewise, it would help if you learned about the different models of forex brokers, trading requirements in the form of margin, and the best time to trade the currency pairs.

Stocks are also widely traded in the capital markets. Likewise, you must know the various factors that influence stock prices whenever the market is opened, from earning reports to mergers and acquisitions as well as underlying products.

Besides, one can trade bonds, stock indices, commodities. Cryptocurrencies are other markets/instruments that one can trade in the vast capital markets.

In this case, the point is to learn the specifics for each market, focusing on the factors that influence trader’s sentiments on each security or instrument conversely price action. It is also important to master some of the risks involved in trading given instruments. For instance, cryptocurrencies are synonymous with extreme levels of volatility.

Fundamentals Do Matter

Regardless of the financial instrument that one decides to trade, it is important to note that underlying factors are influencing the price action in the capital markets. In the forex market news releases touching on employment data, retail sales figures, and interest decisions and GDP data, sway trader’s sentiments on currencies, conversely influencing price action.

Therefore, any trading system should have a provision for analyzing various news releases likely to influence the price of the underlying security.

Trading and Analysis: Timeframes

While coming up with a trading system, it is important to settle on a time frame that suits one’s goals and ambitions. For traders looking to squeeze small but quick profits, scalping would be an ideal trading strategy.

With scalping, the focus is usually on short time frames, i.e., one-minute or five-minute charts. In this case, the trading strategy focuses on analyzing chart patterns and price action in the small time frames to identify ideal entry points.

On the other hand, swing trading is a trading strategy that entails opening and closing trades before the end of the day. Likewise, traders are deploying this strategy to focus on hourly charts to study and analyze chart patterns.

For traders looking to profit from long-term price movements, the focus is usually on daily, weekly, or monthly time frames. In this case, traders open trades and run for days, weeks, or even months. Trade analysis, in this case, is done while focusing on chart patterns that occur in the long-term time frames.

Define Entry and Exit Points

Any trading strategy should define in advance when to trigger entry and exit points. The use of indicators and the study of candlesticks patterns is crucial to defining entry and exit points.

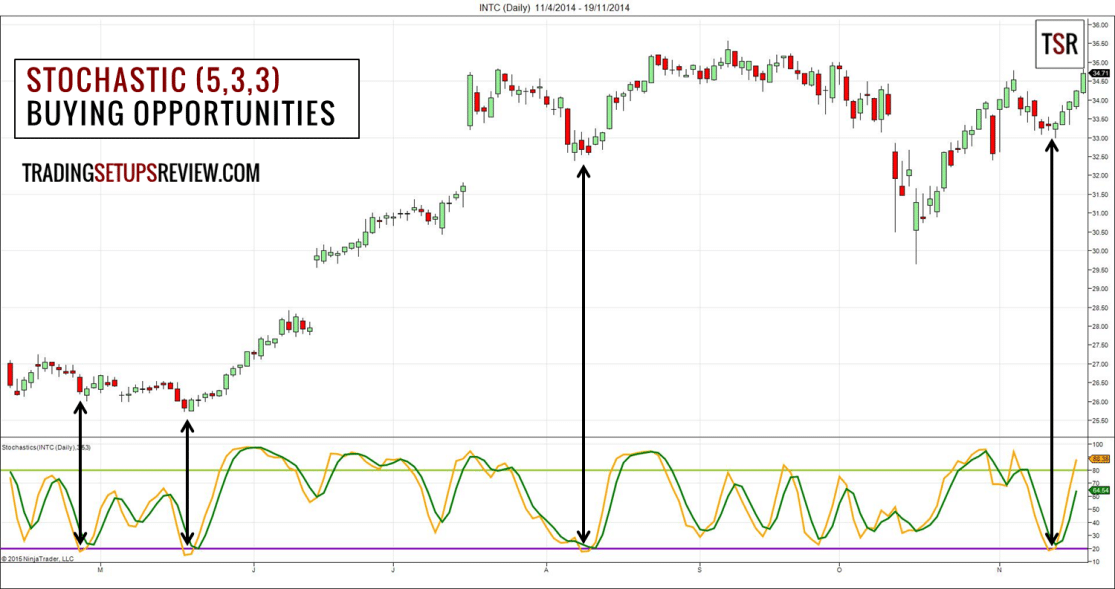

The use of indicators is crucial as they come in handy in defining oversold and overbought conditions. Therefore, it is crucial to settle on indicators that can provide valuable information on where to enter and exit trades.

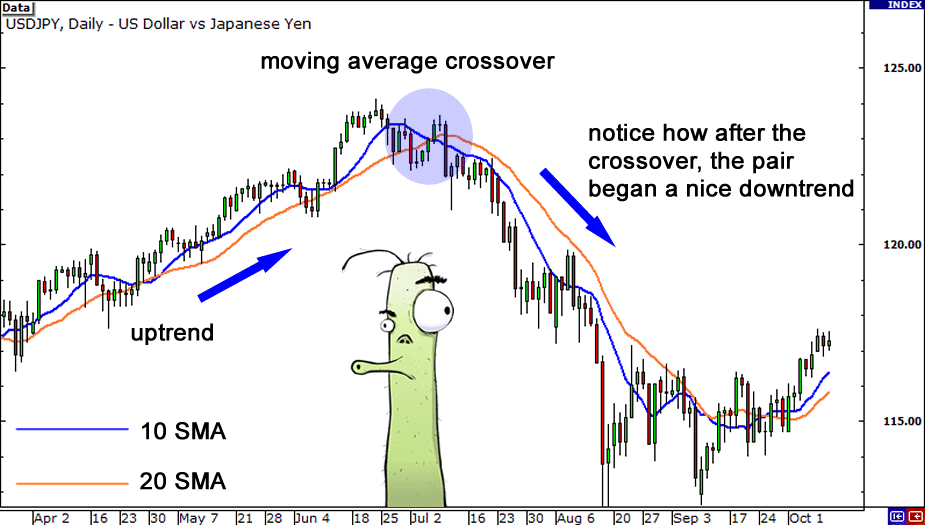

It is also important to understand that indicators are designed for different market conditions. For instance, moving averages can provide reliable entry points during trends and not the best during consolidations.

Oscillators such as the Stochastic Indicator are ideal for defining entry and exit points during ranges and not the best during ranges. Momentum indicators, on the other hand, work best for identifying entry points during trends and reversals.

Moving averages are ideal indicators for defining support and resistance levels. `While the focus is usually on entry points, it is also important to clearly define when to cut losses or lock in profits. A trading strategy can rely on trailing stops for exiting open positions. Another way to exit a position is to exit when the price hits a given target. How you calculate the target is dependent on the profit amount, you wish to lock-in. Some traders use support and resistance levels to set targets.

Define Your Risk

A trading system or strategy is as good as the risk management strategies deployed to protect the underlying capital from adverse events in the market. Risk management is essential as it allows one to define the amount of risk they are willing and ready to lose with each trade.

While most traders don’t talk about losing, professional traders spend more time protecting their capital by focusing on what they could potentially lose before thinking about how much they are likely to win.

Therefore, any given trading system should have ground rules on where to set a stop loss to protect a trading account on an opened position going south. In addition to setting stop-losses, it is essential to settle on a trading size that does not pressure the underlying capital and margin.

Test Your Trading System

A sound trading system is one that has been fine-tuned and proven to work in different market conditions.

Likewise, the best way to test a system is to find a charting software package and try to back-test a given trading system. Brokers do offer demo accounts and APIs that allow traders to back-test trading systems risk-free before trading in live markets.

While back-testing a given trading system, it is important, to be honest with yourself, recording all the wins and losses. If you are happy with the results, you can move forth into a live trading account.

Follow the Rules

No matter how good a trading system is, it always boils down to implementation. Likewise, it is important to write down all the trading system rules and strive to follow them to the letter. Discipline is an important attribute when it comes to trading in the capital markets. No trading systems will ever work if a trader does not stick to the rules for opening and closing positions

Conclusion

Trading the system is essential if one is to be successful in trading currencies in the forex market. It is essential to create a trading strategy and test it on a time frame that fits and suits a given preference. Given that strategy fall in and out over different time frames or market cycles, changes must be carried from time to time in response to varying market conditions.