No matter how simple or complex a trading system, or strategy is, it must undergo different types of tests before you can launch it into the live market. Since the Forex market, in particular, is highly volatile and unpredictable, you need to check whether your system can withstand periods of high drawdowns when your account is prone to get drained. In order to accurately gauge the system’s profitability, it is vital to conduct both types of tests.

Why should you test a trading strategy?

Prior to placing trades using real money, you naturally need to make sure you have good odds of getting high returns from them. Thus, the trading system or scheme needs to be tested for profitability. You also ought to know about the market situations in which the strategy will be most effective.

Additionally, there are several trading platforms these days with different settings, and you need to know how to use your trading scheme with them. Testing your strategy allows you to familiarize yourself with these platforms.

What is a backtest?

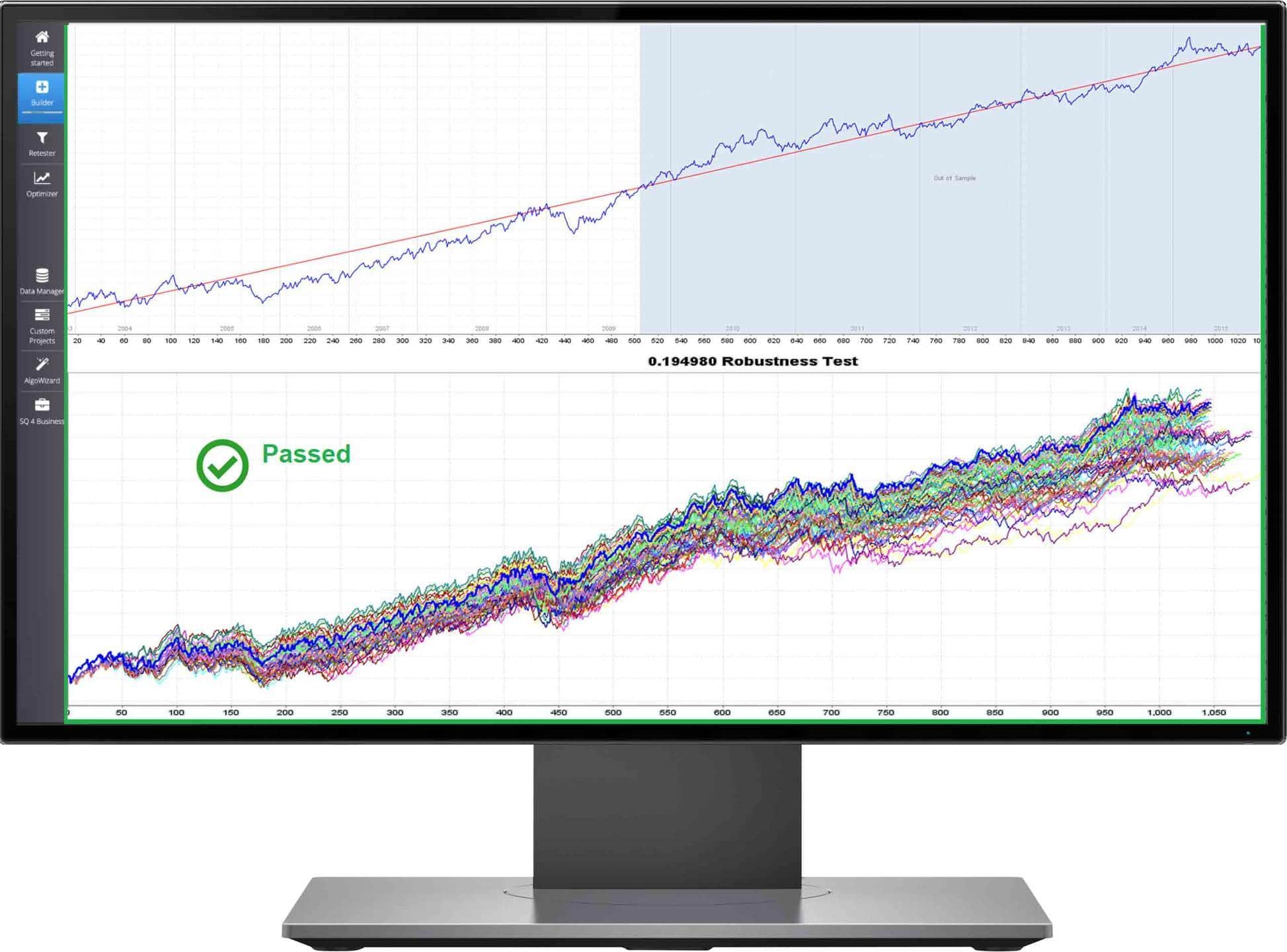

During a backtest, a trading scheme is used with archival information to determine how it would have fared during a particular period. The majority of the trading platforms you will find these days have backtesting functionalities built into them. This allows you to test the trading scheme’s efficacy without investing real money.

Whether you are testing a basic strategy involving moving averages or a complex one with several indicators and inputs, backtesting lets you assess them all. Every quantifiable trading strategy can undergo a backtest. Many traders collaborate with expert developers to create conclusive versions of their trading schemes.

The backtesting process requires the developer to program the trading strategy into the trading platform’s exclusive algorithm. Some custom user variables can be included by the developer so that the system can be adjusted by the trader.

What is a forward test?

In forward testing, individuals assess the system’s performance based on another data set. Here, the environment is built to mimic a live trading scenario, and the rationale of the strategy is tested carefully. Forward testing can be described as mock trading where everything is executed like real trade, and the opening and closing points, along with the gains and losses, are noted down, in spite of no real money being used.

During a forward test, a trader must religiously adhere to the trading strategy’s logic, in order to accurately gauge its reliability. After optimizing a trading model, you should forward test it to ascertain the profitability and work out how it will be impacted by factors like liquidity and volatility.

Advantages of forward testing

Here are the various advantages of forward testing:

- A lot of elements are not considered in backtesting, such as the influence of major financial releases, the geopolitical climate of the nations whose currency pairs you are investing in, trader sentiment, unpredictable conflicts and events, how different financial instruments affect the currency pairs, etc. So backtesting is conducted in order to decide whether it is worth it to forward test the system.

- Forward testing permits for more precise computation of gain and risk levels. For example, if the gain percentage of a trading system is 20% during forward trading, it is too low. Ideally, the profitability should be similar to that which was reached during the backtest. If the win rate is lower, you should consider tweaking the strategy a little.

- Several experienced traders would argue that market volatility has an adverse effect on the win rate of a trading system. A decent trading scheme, however, should know how to react to these market shifts. Forward testing reveals details about how a system performs during such rapid market shifts, thus, in turn, allowing the trader to assess the impact of these crises.

- It lets you check if the proper parameters were chosen during the backtest. You can also determine whether your system is over-optimized.

How to conduct forward testing

Prior to conducting this test, you need to decide whether to use a demo or a live account. Although most individuals prefer using a demo account because they don’t want to take any chances, you can also use a live trading account having an extremely small balance. For this purpose, you can select a brokerage that lets you trade in tiny lots.

After deciding on the trading account type, you should keep an eye on the outcomes. While manual monitoring is possible, you can use a website like FXBlue or Myfxbook to keep track of your dealings. This lets you save time, which can be utilized for analyzing the trading outcomes.

The number of trades you conduct during a forward test should be based on the selected timeframe. You should at least place 100 trades prior to making adjustments to your system. After the test is complete, you should compare the result with that of the backtest. If they are vastly different, you should check the rules and risk levels, including the market circumstances.

Backtesting vs. forward testing

During the enhancement of backtesting data, the system parameters stand the risk of being overfitted. Although the settings can be modified to place the long and short trades on the right occasions, the price shifts may not be predicted correctly. Since forward testing permits for the easy detection of overfitting, the genuine worth of the scheme can be seen by the traders.

Conclusion

It is wise to be extra careful with your money while dealing in currency pairs. Backtesting data is just one of the many protective layers you want around your system. When both the testing results are similar, you know there is a decent chance your system will yield good outcomes in the live market.