In stark contrast to technical analysis, fundamental analysis actually looks at the constitutional and intrinsic factors that may affect the price movement of a commodity. This type of examination takes into consideration not the trend of market forces, but the aspects actually affecting the market forces to behave in a certain way. These may be factors such as socio-political scenario, economic variables, and trends of the industry – read on to understand what fundamental analysis is and the tools at your disposal.

What is fundamental analysis in the market?

The term ‘Fundamental Analysis’ is a broad umbrella term covering aspects of trading based on the influence of supply and demand for currencies, commodities, and equities. In other words, it is a change of perception when comparing it to technical analysis as it refers to looking at the factors of supply and demand by analyzing economic, social, and political forces to determine the future price. These factors may be macroeconomic or microeconomic and have the potential to affect the future or current price of the security adversely. Even though this form of analysis is not restricted to any asset, it is more widely used to forecast a company’s stock trends.

Why do traders use fundamental analysis?

As the name suggests, fundamental analysis is not based on the technical aspects of the market. It is usually used to make long-term decisions based at the right moment on a distant vision of the market after taking multiple factors and events into account.

For instance, if a country is doing well in the sense that it has a healthy GDP growth, lower unemployment rate, and decent monetary and security policies in place, the demand for its currency is likely to be higher. Say, if a country boasts of all the aforementioned factors, and if you analyze it in the right way, you are more likely to make a fruitful investment decision.

Make sure you understand the inter-connected reasons and factors behind certain events that either directly or indirectly impact a country’s economy and monetary policy, ultimately affecting the level of demand for its currency. The idea behind such analysis is to simply understand the basic fundamentals (before proceeding into technicalities) to make financial decisions based on the outlook of the country/economy and not just the price movement.

Popular tools of fundamental analysis

Although there are many tools to analyze the market, they can be divided into quantitative and qualitative. As is the usual definition, the quantitative factors relate to solid numbers and can be measured with precision (revenue, GDP, loss), and the qualitative factors pertain to the nature of things (management decisions, brand value). Some of the important tools used for fundamental analysis are detailed below.

Economic reports and financial statements

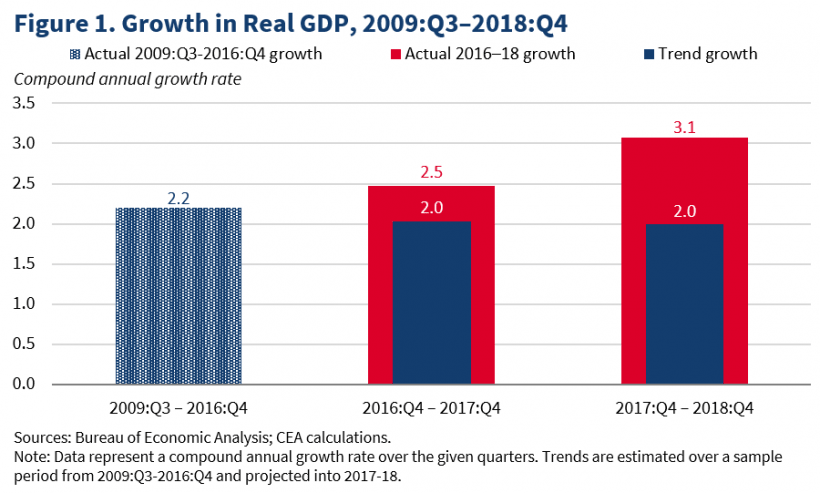

Around the world, many countries frequently update their economic growth and development by computing factors such as their Gross Domestic Product (GDP), unemployment rates, Non-farm Payrolls (NFP), retail sales, and inflation rates, etc. An example of such is the US GDP chart given below.

These are several indicators that highlight an economy’s growth and development that ultimately affects the market adversely. Such data is usually available on the respective country’s government’s websites as well as in published economic reports of repute.

Not restricted to economies, fundamental analysis can also be done by taking into account the industry trends or the performance of a company. In simple terms, make sure to assess the balance sheet, income, and cash flows of the company you’re considering. Akin to a country’s data, details of a company can be usually found on their website or on the data bank of the stock exchange they are registered on. Be fair warned not to believe any singular report exclusively and only make informed decisions after doing considerable research into both sides of the proverbial coin.

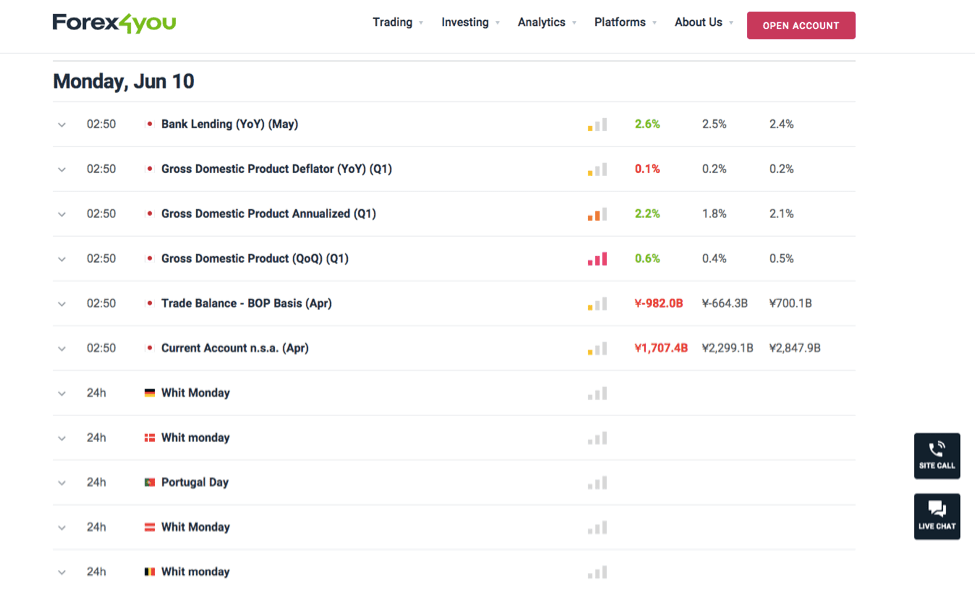

Economic calendars and global news

One of the most used tools of fundamental analysis is the scheduled or expected real-life market or economic events that ultimately affect the market. This includes the monthly reports on unemployment, statements of the central (federal) banks, International Monetary Fund (IMF), and details of the mergers and acquisitions of companies, etc. Factors to be considered are indicators such as GDP, CPI, PMI, Trade Balance, liabilities and earnings, etc.

Apart from economic reports and statements, current news is another crucial source of information. The news is basically the catalyst for short-term volatility movements. It goes without saying that some countries(or companies) are just never on good terms with each other. Tensions between two or more entities can affect the overall outlook and market sentiment. In a global market it is quite difficult to avoid being affected by the occurrences and mutual relationships of other entities.

For instance, conflict in African countries may affect the supply of oil and gold, which may ultimately change the demand and supply of certain commodities of the involved countries as well as their neighbors. On the other hand, relative calm for a longer period may also threaten the demand since the supply remains constant without any issues. Predicting future scenarios based on these factors is difficult; however, it is always wise to be aware of all the current sentiment and keep yourself and your trading decisions clear.

News can be from sources such as television, online news portals, radio, podcasts, newspapers, others from the country/ industry of your concern, and its neighbors and allies. News pertaining to the changes or occurrences in a particular industry is crucial, too and always make sure to trust news only from legitimate sources.

Final thoughts

While the effect of some fundamental factors is often more glaring and long-lasting than others, it could actually be detrimental to not take into consideration all the allied factors affecting the market on a daily basis. Also, please understand that the list of factors detailed here is not exhaustive – there are many more big and small factors that demand analysis to develop a well-rounded and fool-proof strategy in order to maximize future profits.

Proponents of technical analysis often discredit the importance of fundamental analysis. However, it is crucial to note that it is impossible to function in isolation in a market as global as the one we see today. Additionally, the effect of factors such as brand value and geopolitical relations to the market can not be completely washed away.

It is also true that in trading, no amount of analysis – fundamental or technical – will give you an accurate ‘potion’ to mint money on the market. There is always a small chance of error or miscalculation, which can jeopardize everything in an instant. Hence, the only advice that will allow you to keep your sanity intact is to keep your eyes and ears open, analyze each factor and event closely, and not take any losses too personally.