What do hawks and doves have to do with interest rates in forex? Read on to find out how these concepts work within the world of currency trading.

You may be wondering what birds have to do with interest rates in foreign exchange. It’s not uncommon to hear some Bloomberg news presenter mention the terms’ hawkish’ or ‘dovish’ after announcing the latest interest rate from a central bank.

These words are the jargon analysts use to describe whether central banks feel hawkish or dovish based on the monetary policy they have set to achieve in their respective economies.

Ultimately, understanding this behavior changes interest rates which can have short and long-term impacts on currency valuations. This article will explore the importance of interest rates and how their periodic changes affect the forex markets of the economies they are based on.

How do interest rates affect the forex markets?

Before understanding the differences between hawkish and dovish, it will help to appreciate why interest rates matter so much and why some analysts consider them to be the most significant of all economic indicators.

Defining the interest rate is quite simple: it’s the portion lenders charge borrowers from the principal amount they’ve lent. In even simpler terms, interest is really the price of money.

Since traders are dealing with currencies, it’s the reason why these rates can be influential. Virtually all world economies survive and thrive based on how much they lend and borrow to their citizens and other countries.

The general rule of thumb is that the higher the rate is, the more valuable a currency is perceived, causing a demand. When the interest rate rises, it can bring more money from foreign investors looking to invest in that particular country.

Not only this, savers receive better returns on their savings, inflation becomes lower, and other benefits. Lower interest rates mostly spell the opposite, but they are necessary primarily for reviving the economy.

Central banks are the institutions responsible for changing interest rates. Among their other fiscal duties, these groups control the tug of war between increasing and decreasing interest rates based on their objectives and present economic conditions.

The hawkish and dovish behavior of central banks

Central banks are responsible for several things related to money supply and interest rates, which matter in foreign exchange. In the latter regard, we can best summarise their role as doing either of these things at any one time: managing/reducing inflation or stimulating the economy.

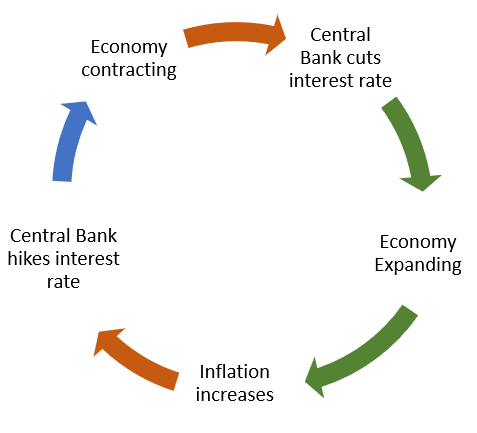

Central banks operate in a never-ending loop of upping and lowering the interest rates, as in the image below:

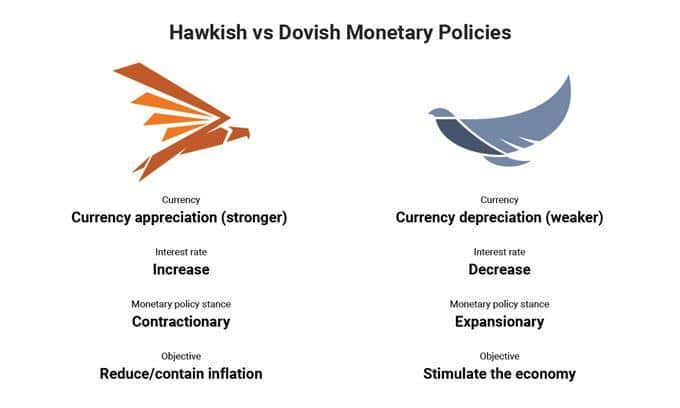

Hawkish (which refers to the more aggressive nature of hawks) is when a central bank talks about increasing interest rates. Analysts perceive this language as banks taking a contractionary stance where they look to tighten monetary policies.

Generally, central banks become hawks when things are hunky-dory in their countries:

- Forecasts on the economy are largely positive.

- Inflation is expected to expand as a result of more spending from citizens.

- The central banks also anticipate more capital flowing into the country.

On the other hand, dovish (referring to the calmer nature of doves) is when a central bank talks about decreasing interest rates. Here, analysts consider the stance to be expansionary, where they seek to loosen monetary policies, thereby stimulating the economy.

In these circumstances, things in the economy would look bleaker:

- Central banks feel pessimistic about the growth of the economy.

- Inflation is expected to decrease if fewer people spend money.

- The central banks also foresee less capital to flow in the country.

The image above summarises the differences between hawkish and dovish and the primary objectives of central banks when switching between the two.

The several ways traders are directly affected by interest rates in forex

For the most part, analysis in interest rates tends to be geared towards the long term. Still, there are some instances where even traders holding their position for only a few days would need to pay attention, specifically with swaps.

A swap is the interest traders pay or receive for keeping their trades overnight. If you plan to hold a position for at least one night, you need to consider how much the swap will be as it will vary based on the traded market and broker.

It also requires a comprehension of the interest rate differentials between the two currencies, which primarily determines the extent of the rollover or swap. These may change from time to time as new announcements are made, all of which you need to observe beforehand.

Such analysis also applies to carry trading for long-term traders who earn interest over several months or years. While this is something happening infrequently, interest rates can cause highly volatile and erratic market behavior, which is the case, particularly with some Federal Reserve news.

It’s not unusual for brokers to temporarily limit their clients from placing orders 15 minutes before and 15 minutes after the announcement to prevent them from partaking in unfavorable conditions.

In some way and at some point in time, you will be affected by interest rates, meaning it’s beneficial to peek at the economic calendar before placing any trade in the markets.

Final word

Many of the eight major central banks in forex have been in the cycle of maintaining negative interest rates or lowering them. In most cases, analysts believe markets always ‘price in’ whichever cycle a currency’s interest rate has been moving towards.

For instance, if a central bank has been consistently increasing interest rates (hawkish), the likelihood is the currency is stronger against other markets.

The trick is monitoring the language a central bank uses before every interest rate announcement to anticipate where exchange rates could go in the future, whether they continue to be hawks or consider dovish behavior.

Having an up-to-the-minute awareness of all these activities is part of the challenge facing fundamental analysts. Aside from regularly consulting the economic calendar, it does take years of experience to master understanding how interest rates move the markets.

Nonetheless, most experts consider this indicator as one of the primary drivers determining exchange rates.