Gone are the days when people had to spend hours glued to the screen analyzing the markets, searching for trading opportunities. Technology advancement means less time spent exploring, let alone opening and tracking positions. Algorithmic trading is the latest sensation sweeping the capital markets.

What is algorithmic trading?

Algorithmic trading is the process by which all trading activities and processes are automated. In this case, people rely on computer programs to execute and close positions, ensuring minimal human interactions.

The new structure is made possible by computer programs pre-programmed with instructions that analyze various instruments focusing on price, volume, news feeds, and patterns.

While it might seem like a simple process, the new structure leverages complex formulas merged with various models and human oversight. It also uses computer codes and chart analysis to trigger and close positions. The result is a rule-based algorithm that makes buy and sell decisions based on the pre-set rules.

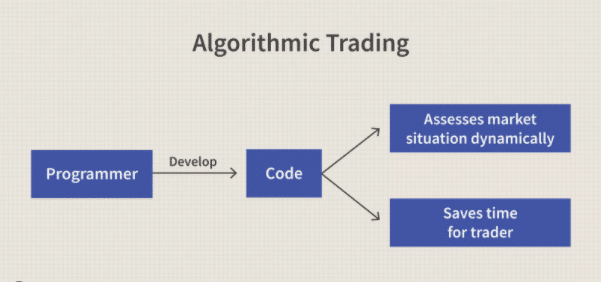

Instead of spending time on the screen to open and close positions, algos do this on the human behalf once pre-set conditions are met.

How it works

Algorithmic trading systems analyze dozens of financial instruments selecting those that meet set out criteria. Positions are only opened once set out conditions are fulfilled, be it on volume or price action, are met.

While the automation aspect allows a system to analyze hundreds of instruments at a go, it can also make tens of thousands of trades in a second.

Requirements to algo trading

One must have in-depth computer programming knowledge to program a strategy for analyzing the markets and executing trades. In this case, most people hire programmers who can write their preferred trading rules in code and embed them into a trading platform.

Reliable network connectivity is essential if an automated system is to work efficiently. Network connection ensures the system is tuned in to the market all the time, thus carrying out analysis of various instruments searching for profitable opportunities.

Access to level II quotes and technical indicators are also essential to ensure an algo can conduct in-depth technical and fundamental analysis. Trading decisions are based on how indicators react to price actions and how the overall market reacts to news feeds.

Types of algorithmic trading

Broadly speaking, it can be classified into the types we describe below.

Statistical

It is an automated form of trading whereby a system is programmed to pursue trading opportunities after analyzing historical data. In this case, a computer program makes trading decisions upon examining instruments’ past price action.

By focusing on historical data, the algorithmic trading system can identify support and resistance levels and areas with huge trading volumes from market participants. Similarly, the decision to enter or close positions is based on how the price behaved at specific levels in the past.

Auto hedging

Auto hedging is a strategy whereby an automated trading system generates opportunities based on the amount of risk one can tolerate. The system can generate rules that reduce risk exposure regardless of the instrument under study.

The strategies are synonymous with the hedging of portfolios to minimize risk exposure. It also entails rebalancing portfolios to cut underperforming positions and gain exposure to popular sectors.

Algorithmic execution strategy

It is an algo trading plan whose main objective is to try and meet an objective at a given time. The objective could be to try and reduce market exposure in a given position or try and minimize the market impact on a portfolio.

Likewise, the strategy could revolve around identifying opportunities and executing trades as quickly as possible. The system might be programmed to execute rapidly and close positions within a short span to lock in as many small profits as possible.

The common strategies deployed include those below.

Trend following

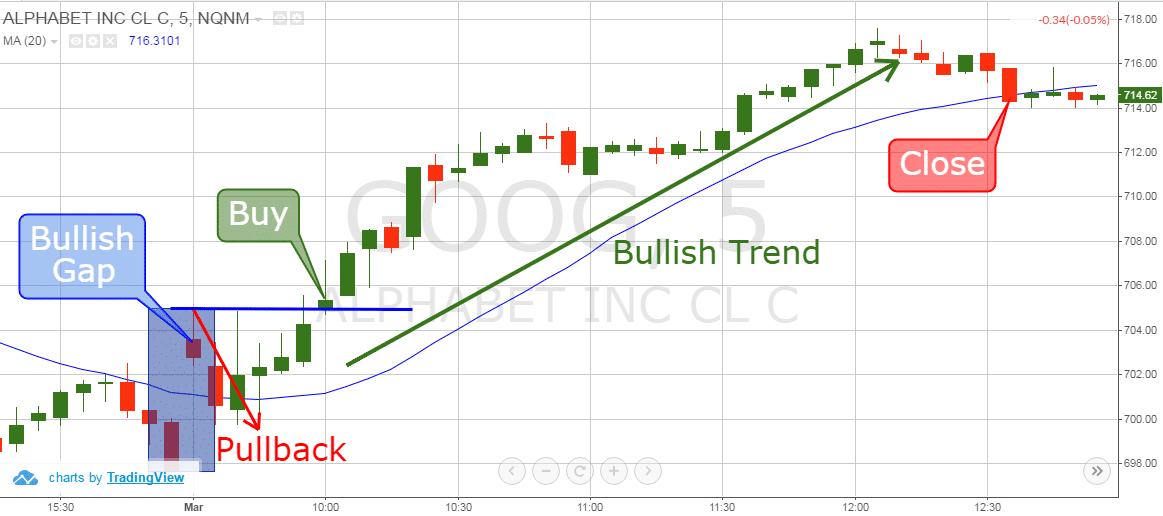

With this strategy, automated systems are programmed to follow trends and only open positions once a long-term trend is validated. Using technical indicators such as moving averages channels is a common phenomenon that allows automated systems to detect a long-term trend in its early stages.

Unlike other strategies, trend following does not require computer programs to make any predictions. Positions are only opened once a long-term trend is confirmed. Additionally, a position is closed once a security reverses and starts moving in the opposite direction to the underlying trend.

Most algorithmic trading systems rely on the 50 and 200-day moving averages as part of the strategy. In this case, a buy position would be opened as soon as the 50-MA rises above the 200-MA, signaling the start of an uptrend. The position would be closed as quickly as the 50MA reverses its course and closes below the 200MA.

Similarly, the short position would be opened as soon as a 50 MA moves and closes below the 200MA to signal the start of a bearish run.

Arbitrage

Arbitrage is an Algorithmic trading strategy that seeks to profit from inefficiency when it comes to security pricing in more than one market. The strategy works well when security is listed in more than one market.

With this strategy, programmed systems would buy dual-listed security at a lower price in one market and sell it simultaneously at a higher price in another market. The profit will be the difference between the two prices.

Range trading

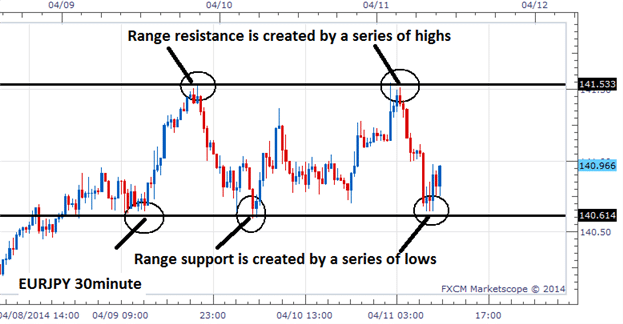

Contrary to the common perception, security prices are not always trending. Likewise, some systems have been programmed to identify periods of consolidations and look to profit from them. In this case, a trading system might be programmed to identify support and resistance levels.

Positions are opened as soon as price retreats to a resistance level and closed as soon as it tanks to the support level. In return, another position is opened at the support level to take advantage of price rallying back to the resistance level.

The benefits

Algorithmic trading stands out partly because it ensures positions are opened at the best market price at any given time. Given that everything is done automatically and at a much faster pace than humans, trades are opened and closed at points that can ensure optimum returns.

Algorithmic trading is time-saving as one does not need to spend hours glued to the screen analyzing the market, searching for opportunities. Everything from opening to closing positions is done automatically.

Algorithmic trading is rule-based, consequently removing emotion from trading. The room for human error is minimum as everything is executed based on pre-set rules.