The global financial market is huge both in trade volume and dollar value. Millions of investors from across the world participate in the market every day. These many people can get exposure to various investment instruments through many avenues. Some of the avenues are leveraged instruments such as contracts for difference (CFDs) and spread betting.

You probably have some idea about what margin trading is all about. Margin trading has opened the global financial market to many retail traders whose capital would otherwise exclude them. But perhaps your knowledge of the market falls short when it comes to more complex derivatives such as CFDs and spread betting. If you feel this description applies to you, then worry not because this article will explain everything there is to know about these instruments and how you can leverage expert advisors (EAs) to increase profit probability.

Spread betting explained

The vastness of the financial market is made possible by the availability of thousands of markets in which traders can participate. How is it possible to have thousands of markets with fewer assets? The answer is simply — derivatives. Sometimes investors want exposure to certain assets without acquiring the actual asset. To this end, the buy instruments that track the market price of the underlying assets. These instruments are what traders call derivatives, and spread betting is their embodiment.

Consider an investor who would like to acquire shares of Berkshire Hathaway Inc. Class A (NYSE: BRK.A) stock. BRK.A stands tall as the costliest per share stock in the entire world. In case the investor is unable to fund the purchase of the stock, he has to enlist the help of derivatives. This way, the investor will successfully gain exposure to BRK.A by wagering the price gyrations. Even better, the investor can take the bear or bull side, as long as he follows the direction of the insights from his analysis.

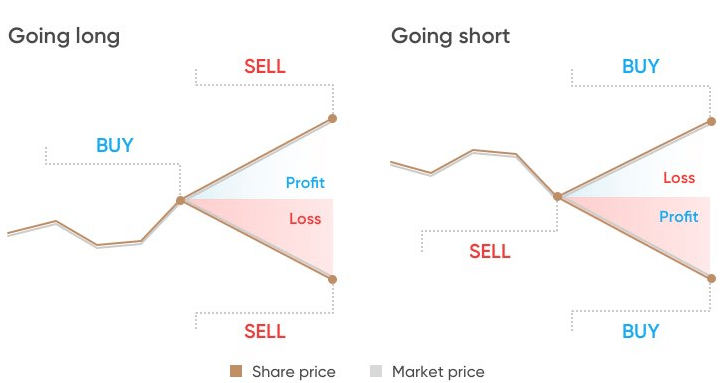

Say, after both fundamental and technical analysis, the investor believes there is a strong bull case for BRK.A. Accordingly, he puts in an order specifying a long position. When the stock does take an upward trajectory, the investor stands a chance to net a profit. Otherwise, any opposite movement means losses. Similarly, you can push a sell order to your broker if your intelligence points to a possible slump in the future. Here, you profit when the price does decline, but a price rise spells losses for you.

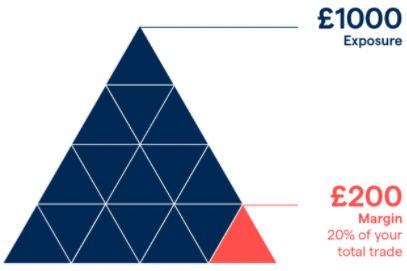

Spread betting is even more interesting as it means you can trade on a margin. This is to say that you can take exposure in the market that far outweighs the stake. Margin trading exposes your position to huge profits when the market plays along, but you could also incur huge losses in the event of a turn-around.

What about CFDs?

This financial instrument is also a derivative. Instead of having to put up a stake equal to a stock’s market price, you can trade the movement of the stock’s price. Similarly, you can decide to take any side of the market – if your analysis points to a bear market, you are welcome to short the stock, and vice versa.

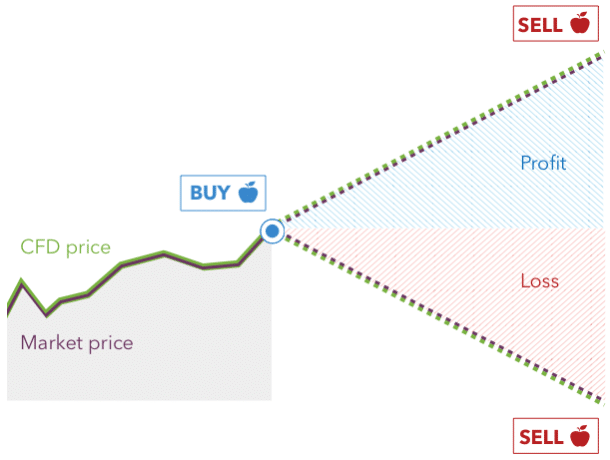

Here, you enter an agreement with a broker/dealer to settle trades in the form of cash. Traders in this niche earn a profit/loss from the open and close price of the position.

A CFDs trader can adopt either a long-term (long position) or short-term (short position) trading strategy. Consider an investor who intends to grab some Apple Inc. shares from the market. If insights from his analysis points to a bull market and he purchases the stock, he will earn a profit when the position closes higher. Conversely, the trade could generate some unsavory losses if the market goes awry relative to the position taken.

Comparing spread betting and CFDs: similarities

- Leveraged positions – both SB and CFDs trading service providers allow traders to leverage their positions. Traders can amplify their profits when the market goes in the direction of their position or amplify their losses when the opposite happens.

- Margin trading – with a small capital, traders of both SB and CFDs can take on a huge exposure to an asset or market. Margin trading is one of the things that make derivatives trading interesting.

- Maintaining margin – traders in both cases have to maintain their margin by adding to capital if their position makes more losses than anticipated. You will be margin called whether you are SB trading or CFDs trading.

- Traders make losses or profits based on the difference between the price when opening a position and the price when closing a position.

Spread betting (SB) vs. CFDs: differences

- In some jurisdictions like the United Kingdom, CFDs trading, unlike SB trading, attracts capital gains tax. As such, net profit is lower for CFDs than SB for the same value of trade.

- Many jurisdictions, including the US, criminalize spread betting, but it is legal in the UK. CFDs trading is legal in many countries globally as opposed to SB trading. SB trading is legal in just a handful of industrialized countries.

- Traders can access spread betting services only over the counter, but CFDs orders are easily accessible in the market.

- CFDs position can go on for as long as possible, even for years but spread betting has a fixed expiration date.

Risks involved in spread betting and CFD trading

Let us say from the outset that both spread betting and CFDs trading are high-risk trading strategies. Perhaps this is why they are illegal in the US, Japan, Australia, and various other industrialized countries. But what are these risks?

Both trading strategies allow traders to take leveraged positions. This technique amplifies profits and losses by the same magnitude. If the market moves against your position, then you risk losing more funds than your capital.

In a volatile market, your account’s balance might be wiped out unexpectedly when prices change rapidly. If no funds exist in your account, the broker might close out your active positions without a notice to cover the heightened losses.

Conclusion

Derivatives trading has made it possible for retail traders to access markets initially out of their depth. Such strategies include spread betting and CFDs trading. However, the trades’ nature heightens the risks faced, although the profit potential is also very persuasive.