When the modern forex trade started back in the 1970s, traders had to physically track the market’s movements to identify trade opportunities. In recent years, the strides made by technology have seen the evolution of forex robots, which are capable of autonomously identifying signals and placing trades. All they need in the way of human input is parameter definition, which in essence entails the trader defining the trading strategy that the robot should follow.

So how best can you tune such a robot to trade the Asian session? Before we dive into that, let’s first look at the Asian session and all it entails.

The Asian session

The forex market trades 24 hours a day, from Monday to Friday. This trading day is divided into trading sessions, which are named according to the financial hubs which see the most activity during said sessions. The Asian session refers to the period when Japanese and other neighboring countries’ traders enter the market. For that reason, some sources will refer to it as the Tokyo session.

In Tokyo, this session will start at 9:00 AM and close at 6:00 PM in Japanese Standard Time. For traders in other parts of the world intending to trade this session, this may mean waking at odd hours of the night to catch it.

Take London, for example. Here, traders will have to be up from 00:00 to 09:00 GMT to catch this session in real-time. In New York, this session will be live between the hours of 19:00 and 04:00 EST. Note that this timing is subject to changes in accordance with daylight saving fluctuations.

Characteristics of the Asian session

This session has five distinct characteristics that set it apart from other sessions.

1. Low liquidity

Due to the odd trading hours that most market participants in other parts of the world will need to keep to trade this session, the volume of active traders is usually relatively low. This causes major currency pairs from other regions of the world to be marked by relatively low liquidity. These pairs include EURUSD, GBPUSD, and EURGBP, just to name a few.

2. Low volatility

As aforementioned, the Asian session has far fewer market participants than most other trading sessions. For this reason, prices tend to be in consolidation during this session. Price spikes observed are not as high as during other sessions.

3. Clear support and resistance levels

Due to the above-mentioned low volatility, prices tend to adhere to support and resistance levels much more religiously during this session. Although this means a lower profit potential, it can give risk-averse traders clear entries and exits. Combining these levels with suitable indicators makes for a feasible trading strategy.

Additionally, these clear S/R levels make for easier risk management. Since entries and exits are clearly defined, traders can easily set stop losses according to their desired risk to reward ratio.

4. Opportunities to trade breakouts at session’s close

Since this session is characterized by low volatility, prices tend to break out when the Asian session ends, and the London session begins. Traders looking for huge price moves can trade these breakouts for maximum profits.

Suitable pairs to trade in the Asian session

The best pairs you can trade during this session depend on your individual preferences and trading style. If you’re looking for more volatility, you should trade pairs native to the Asian region, such as JPY, AUD and NZD crosses. If your style is much more risk-averse, you should trade less volatile pairs which are not native to the region. Such pairs include EUR, GBP, and USD crosses.

Asian session trading strategy

We’ve seen that this session is characterized by low liquidity and well-defined support and resistance levels. For that reason, we’ll be employing strategies designed for range-bound markets. One such strategy involves the use of a trend-following indicator like the Bollinger Bands, combined with an oscillator like the MACD.

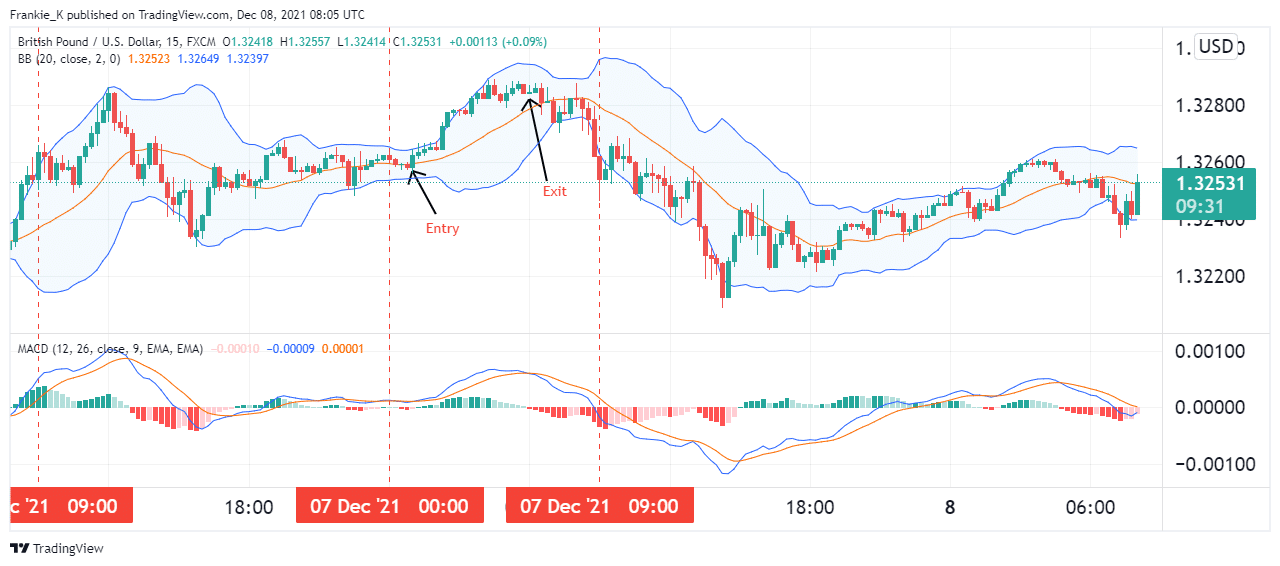

The chart above shows a 15-minute GBPUSD chart. The beginning and end of the Asian session are marked by the red vertical lines on the chart. Using Bollinger Bands, we can easily define the support and resistance levels adhered to by the pair’s price.

For most of the session, prices used the upper and middle band as resistance and support respectively. Using the MACD, we identified a suitable entry for a long trade when the histogram went positive. At this point, a suitable stop-loss would have been the Bollinger Band’s lower band.

The exit signal came when MACD ventured into the negative zone. This was confirmed shortly after when prices broke past the support level. Exiting the trade at this point would have completed a successful long trade.

Adjusting your robot to trade the Asian session

Following the characteristics of this session, we can now easily tune our robot to trade this session. First, we will need to define the hours of activity of our robot and limit them to the session’s trading hours, from 00:00 to 09:00 GMT.

Next, we’ll need to define our strategy. For long trades, we can define our entries as when MACD goes positive, and prices close above Bollinger Band’s middle band. Exits will be activated when MACD goes negative and prices close below Bollinger’s middle band.

Similarly, for short trades, entries will be marked when MACD goes negative, and prices close below Bollinger’s middle band. The exit will be when MACD goes positive, and prices close above the middle band.

Conclusion

The Asian session is marked by relatively low volumes, low liquidity, and volatility. This means that prices stick to resistance and support levels much more strictly than in other sessions. This gives traders opportunities to enter low-risk trades. Therefore, adjusting your robot to trade this session involves limiting its activity to the session’s trading hours and defining a strategy suited for range-bound markets.