Trading bots, also known as expert advisors or algorithms, have become relatively popular in the Forex trading industry. They have been made particularly popular by the recent rise in high-frequency trading and the introduction of relatively easy programming languages. In this report, we will look at the process of building and deploying quality trading bots.

How trading bots work

For starters, there are three primary approaches to Forex trading. First, you can be a complete manual trader who conducts analysis and makes decisions based on what you see. Second, you can be an algorithmic or automated trader, using bots to know when to initiate positions. Finally, you can be a hybrid trader, which means you can combine manual and automated trading strategies.

A trading bot is a tool that uses programmed tools to make trading decisions. Most traders use these bots to spot market opportunities while others use the bots to identify and initiate opportunities.

For example, you can build a bot that combines both the Relative Strength Index (RSI) and double exponential moving averages. So, in this case, the bot can initiate a buy trade when the RSI gets extremely oversold and when the short and medium-term EMAs make a bullish crossover. Alternatively, it can scan the market and give you signals of the currency pairs that meet the criteria.

Unfortunately, building a trading bot is not for everyone. For one, the skills required are relatively advanced for people without a background in both trading and coding. Fortunately, these people can use thousands of expert advisors and robots that are available in the market. The screenshot below shows several free bots that you can install and use in the MetaTrader.

Examples of free bots

Start with technical analysis knowledge

To build quality trading bots or algorithms, you need to start with having a good understanding of technical analysis and price action, to some extent. That is because, as mentioned, bots are simply automated processes of applying technical analysis. Fortunately, most experienced traders have a good understanding of this type of analysis.

For example, if you are a reversal-focused trader, you possibly initiate a buy trade when oscillators like the Relative Strength Index (RSI), Stochastics, or the Commodity Channel Indicator (CCI) reach oversold levels. You can also combine this with when the 15-day and 25-day exponential moving averages make a bullish crossover. In addition, you possibly add Fibonacci retracements and pitchforks to this analysis.

In the example below, we see that the algorithm may initiate a trade when the 25-day EMA makes a bearish crossover and then exit when they make another crossover.

Coding skills are important

If you know how to trade and have a background in computer science or programming, you have a higher chance of building a quality trading bot.

Ideally, you need to have knowledge of two key programming components. First, you need to have knowledge of data science. Data science is a concept that infuses mathematical calculations and methods to analyze historical data and then make future projections.

Some of the most useful concepts of data science are R programming, exploratory data analysis, statistical inference, and regression models. Background in these data science methods will give you a good foundation for building your predictive models.

Second, you need to have in-depth knowledge of a programming language. Among the most useful ones are Python, C++, Swift, and Javascript. If you have knowledge of either of these programs, you can now start your journey of building your trading algorithm.

Code your algorithm

The next stage in your journey of building a trading algorithm is to do the actual coding. Ideally, you should come up with a solid trading strategy that you have possibly used over the years. This should be a strategy that has worked well. So, you should use your experience as a technical trader and a coder to come up with a working algorithm.

There are two main ways of doing this. First, you can decide to build your algorithm from scratch. Alternatively, you can use platforms that help traders build and backtest their algorithms. There are several platforms that can help you do that.

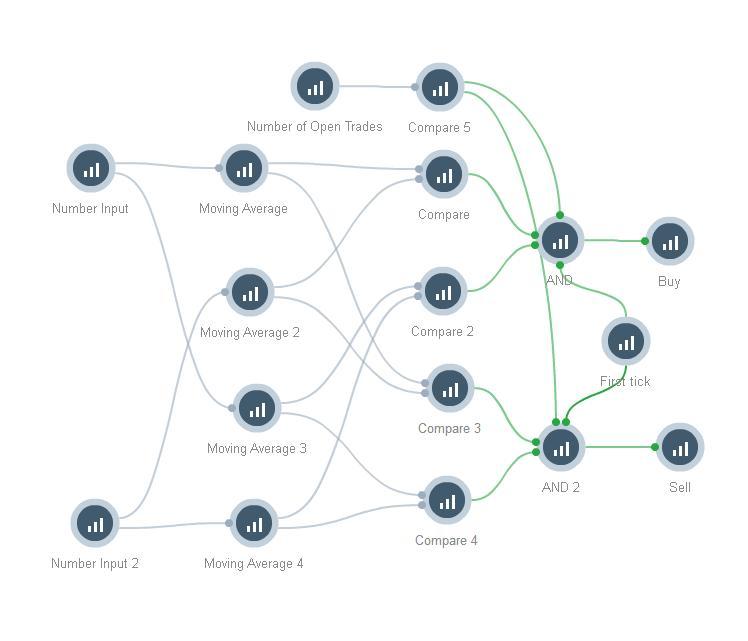

For example, the image below is an example of a trading algorithm built using a drag and drop platform provided by FxPro. As you can see, the general premise of the bot is to compare the various moving averages and then initiate buy or sell positions.

Example of a trading bot

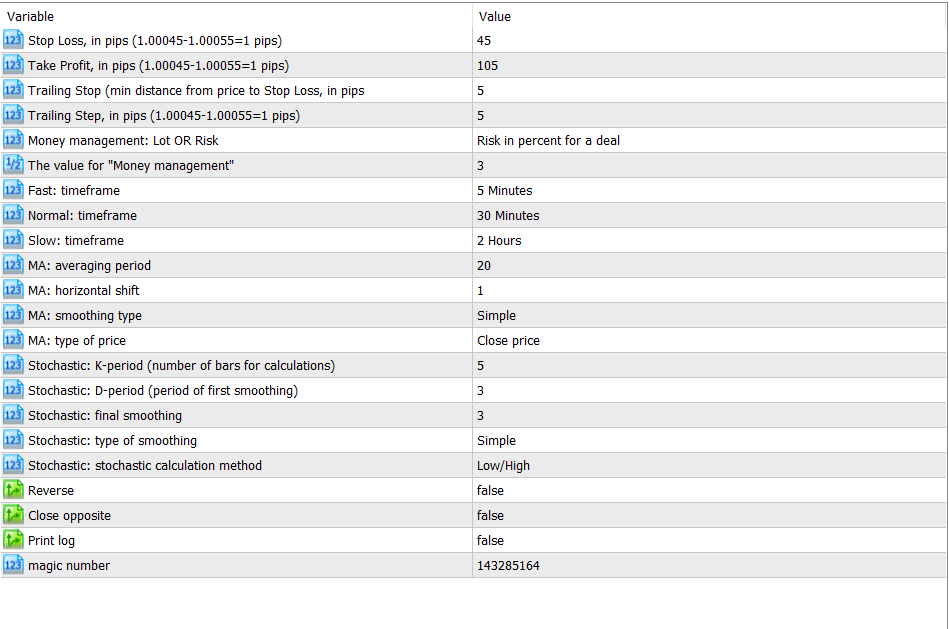

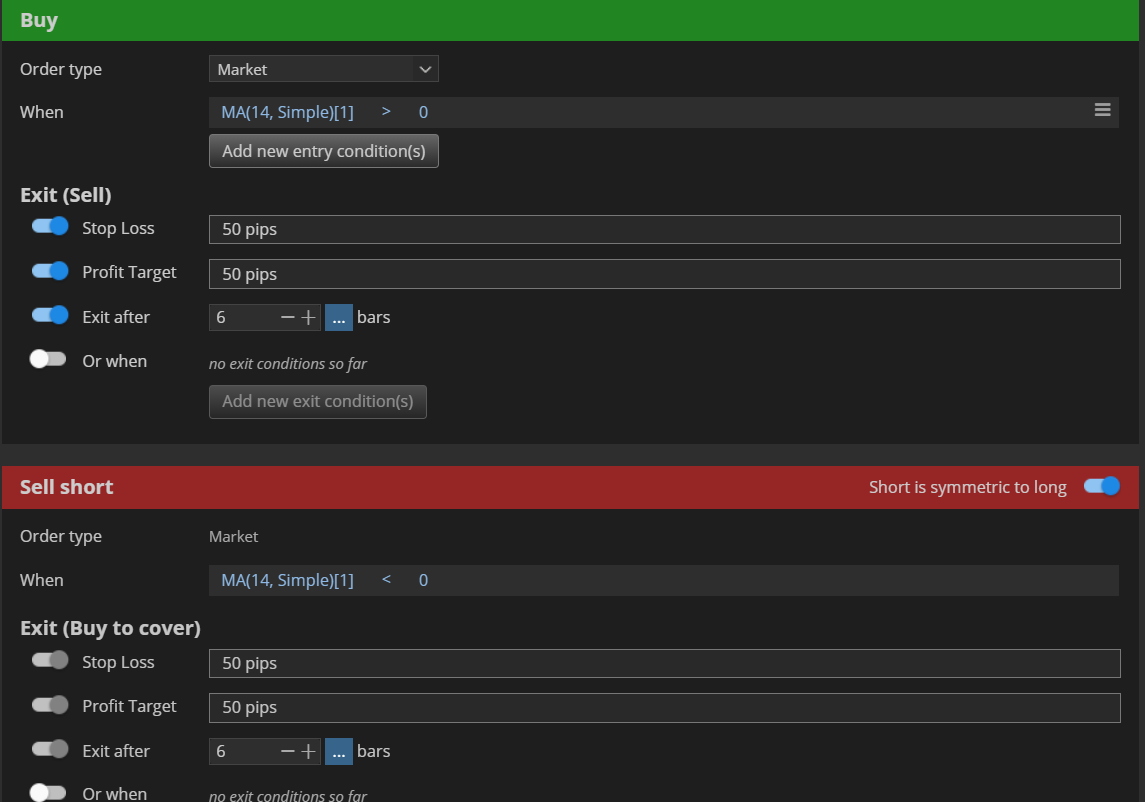

Here is another example of a trading bot:

Trading bot example

Other platforms that will help you build trading bots are AlgoWizard and QuantConnect. As shown below, with AlgoWizard, you can easily build an algorithm and backtest it by simply putting in the rules.

Example of building algorithms using AlgoWizard

Backtesting your trading bots

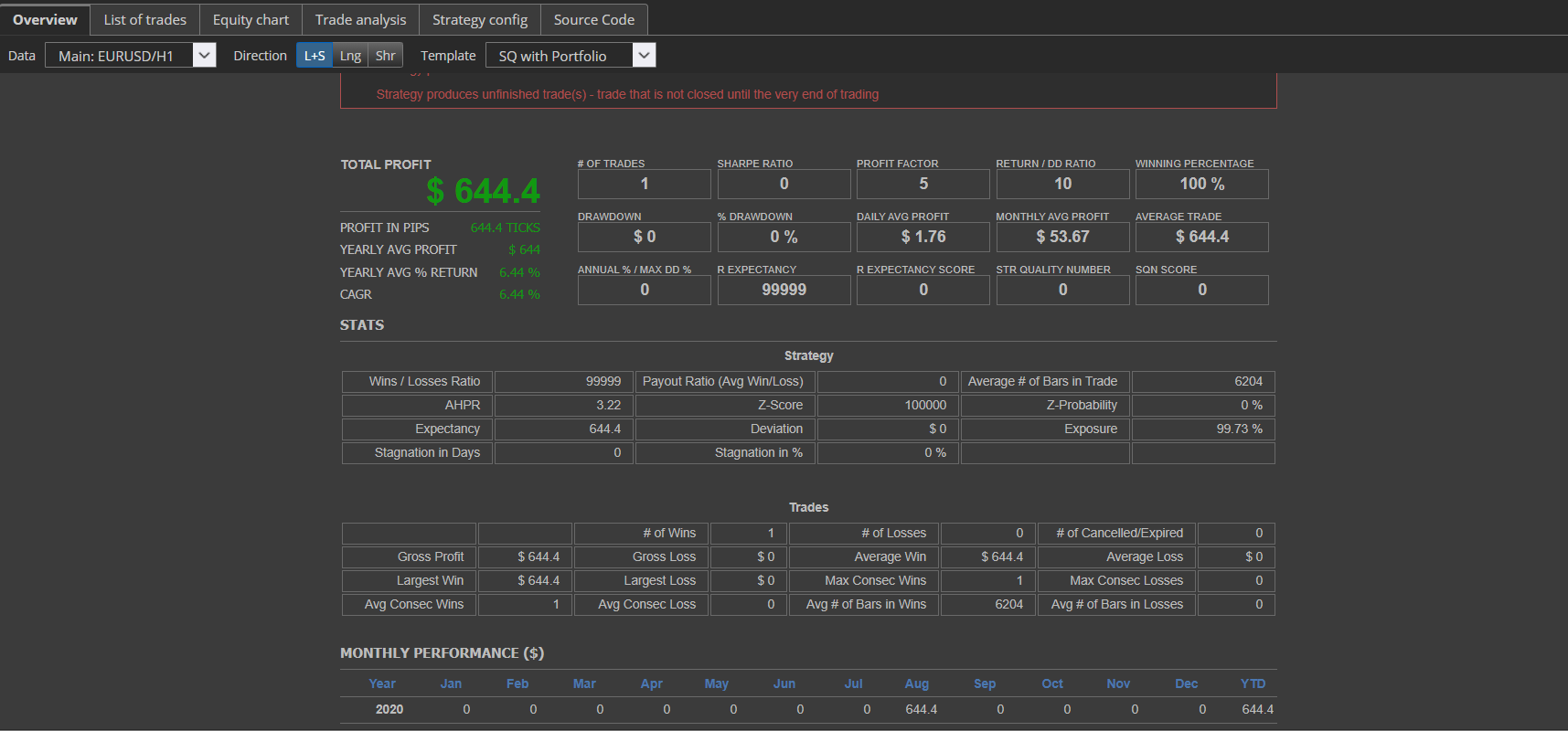

After you have built your trading bot, the final step is to back-test it. This is a process where you use historical data to test the performance of the algorithm you have built. Fortunately, this process is usually relatively easy to perform because most trading platforms have that option. For example, the screenshot below shows a backtest result of the algorithm we have built using AlgoWizard.

Backtest example

How to use bots in trading

After building and backtesting your trading bots, the next approach is to use them in the market. The process of doing this is relatively easy. First, you need to download and save the code in a format that is acceptable on your trading platform. Second, you need to add it to the trading platform. For MetaTrader, you do that by just saving the algorithm on the right folder. In most cases, you can access this folder using the following path. In the example below, replace ‘crisp’ with your computer name.

C:\Users\crisp\AppData\Roaming\MetaQuotes\Terminal\AA83D37273C82D98B8142D95DC50B638\MQL5\Experts\Advisors

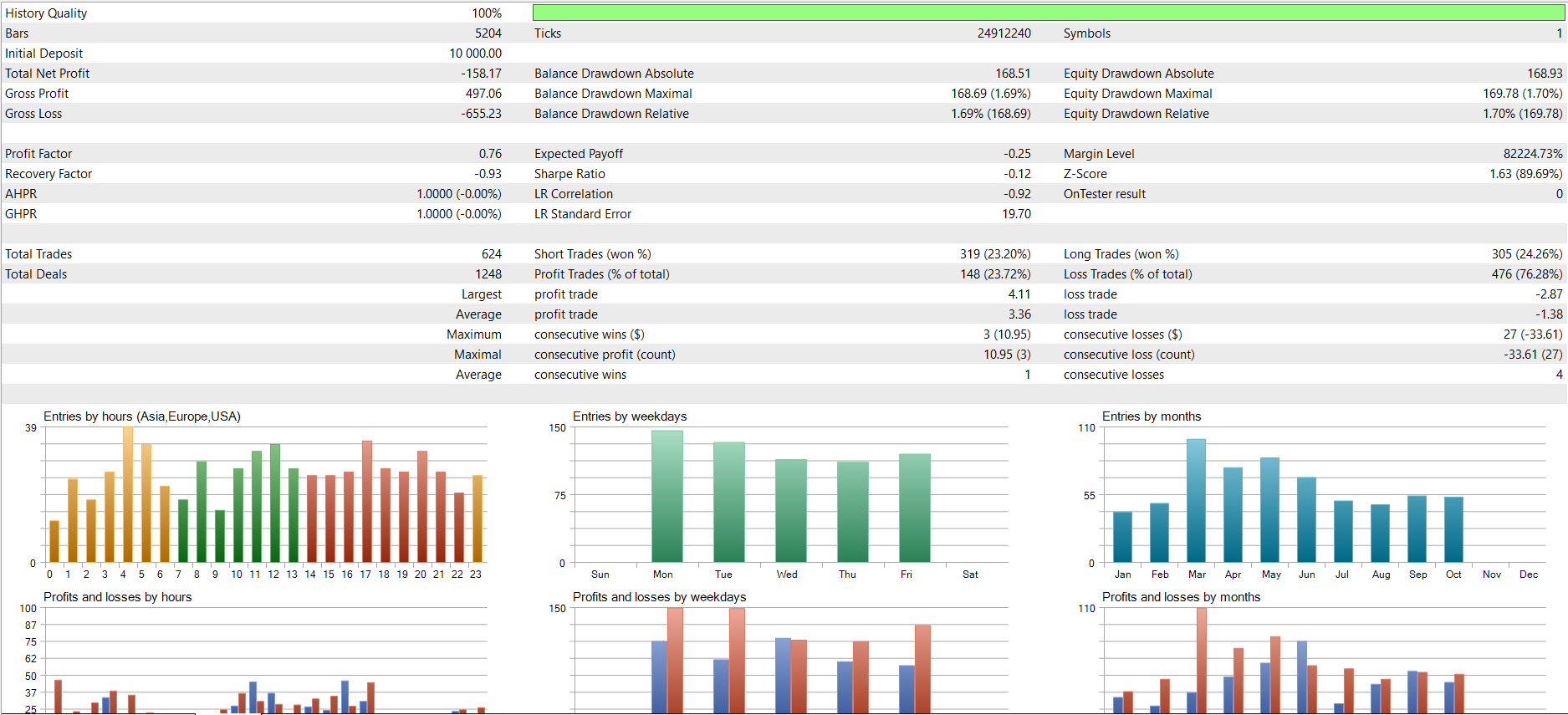

After installing, it is necessary that you test it once again. To do this, you should go to view and then select the strategy tester tool. You can also access this tool by using ctrl+R. You should then select key information and run the tester. You should only use it if it produces results similar to your original tests. The following image shows a sample strategy test result.

Sample strategy tester result

Final thoughts

Trading bots are important tools you can use to simplify your trading. Indeed, most high-profile traders in large banks and hedge funds combine algorithms with manual trading. However, as a trader, you should spend a few months or years to successfully build and use algorithms. Indeed, most new traders have lost a ton of money buying and using algorithms and bots in the market.