Successful professionals have a morning routine. This includes people in all industries, either teaching, or athletic, or medicine. It also includes professional traders and investors. Indeed, a routine is part of the factors that separate successful and amateur traders. In this report, we will look at the benefits of having a morning routine and how you can create one from scratch.

Pros of having a morning routine

There are three main benefits of having a good morning trading routine. Here is what the morning schedule does for you:

- It saves you time. A good morning trading routine saves you a substantial amount of time by narrowing down your focus.

- It identifies potential trades. The routine helps you identify potential trades fast enough.

- It makes you more organized. Having a good morning routine helps you be well-organized, which is a good thing in trading.

Checking out the news

News forms the foundation of fundamental analysis in the market. They are the primary reasons why some currency pairs do better than others. For example, on August 28 this year, the USD/JPY pair dropped by 1.65% after Japan’s prime minister, Shinzo Abe, announced his resignation.

USD/JPY reacts to Abe’s resignation

Fortunately, there are many quality news sources for forex traders, such as Investing, Reuters, and Bloomberg. Also, we recommend that you check-out Bloomberg and CNBC television channels to get an idea about the top stories that happened overnight. Most importantly, these news sources will give you more details of what is to come during the day.

Personally, I start my day looking at the Financial Times and then the Wall Street Journal and Bloomberg. In some cases, I write down the key events on a piece of paper or in digital notes. By writing them down, I am able to keep track of what is going on in the market without forgetting.

Checking out the economic calendar

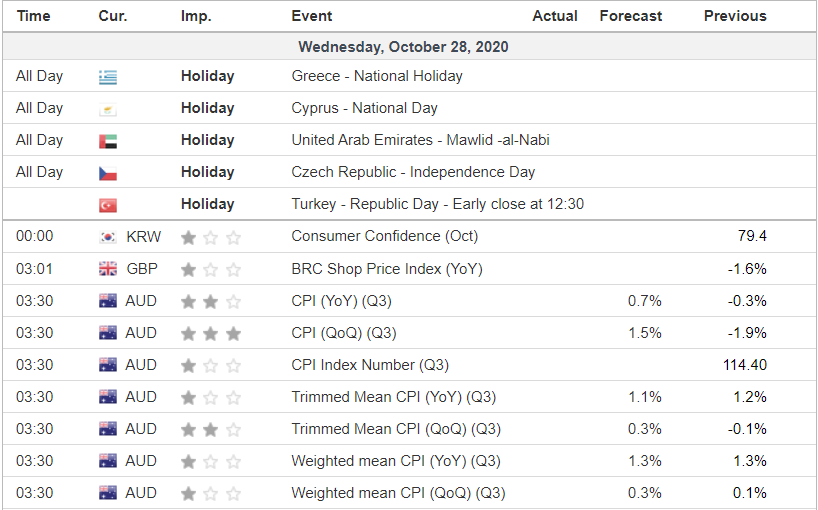

For starters, an economic calendar is a tool that provides you with a timeline of key events in the market. It arranges data from around the world and helps traders know what to expect during the day. It also helps them review what happened on the previous day and what will happen in the coming days. For example, the EUR/USD price may remain in a tight range today because traders are waiting for the Federal decision regarding interest rates that will come on the following day.

After spending an hour or 30 minutes reading the news, I spend a few minutes looking at the calendar. On this, I look at the key events that happened yesterday and how the specific pairs reacted. I then look at the day’s events and read more about them. For example, if the Federal Reserve is delivering its rate decision, I read more about the expectations of traders. Finally, I look at the following day’s events.

The image below shows what an economic calendar looks like. In this case, we are sure that the Australian dollar will likely be volatile when the consumer price index (CPI) data is released. We are also sure that the Turkish lira will be in a tight range since the country will have a bank holiday.

Economic calendar example

Looking at the top movers

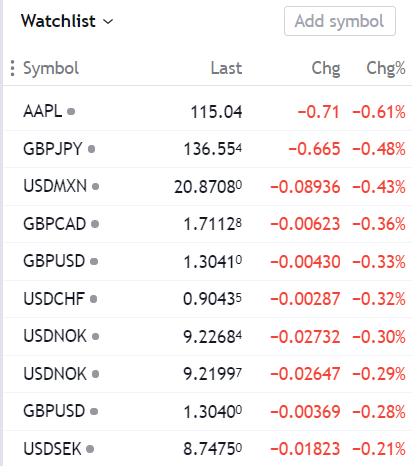

The next approach in creating a morning routine is to look at the top movers. The goal is to identify the most volatile currency pairs and those that will potentially make good trades for the day. With so many currency pairs in the market, successful traders use various tools to identify these movers.

Personally, I use a relatively new tool known as Webull, which allows one to create a portfolio or watchlist of key currency pairs. With this list, you can narrow down the top upward and downward movers, as shown in the chart below. The chart shows that the USD/TRY is the most active pair in my watchlist, followed by the EUR/USD and the AUD/USD.

Top movers example

You can also use TradingView to find top movers, as shown below. In this shot, we see that GBP/JPY is the worst-performing pair on the watchlist.

Top movers example

After checking out the top movers, the next part is looking at the reason why they are moving. For example, in the case of GBP/JPY, you can try and find more information on the key catalysts moving the pair.

Technical analysis, journalizing, and set alerts

The next part of the morning routine is conducting technical analysis, entering the details in a journal, and setting alerts. On technical analysis, some of the tools you can use are moving averages, relative strength index (RSI), and stochastics. You can also use tools like the Fibonacci retracement, Andrews pitchfork, and Gann squares, among others, to identify signals. You can also use approaches like the head and shoulders, ABCD pattern, and Elliot wave to analyze the information. At this stage, you can start trading.

A better approach is to put all this information in a journal and then set alerts to act when a criterion is reached. A journal entry maybe something like this:

The GBP/JPY pair is trading at 136.55. The week’s highest point was 137.54. At the current price, the pair is at the pivot point. Therefore, if it moves below the pivot, it will increase the chances that it will move to the first support.

In this case, you can create an alert to be notified when the pair tests 136.30. Once it does that, you can place the take profit slightly above the first support at 135. In this case, the stop loss will be at the previous pivot at 137.17.

Example of a morning routine

Final thoughts

Having a plan is an essential thing that separates experienced and novice traders. One approach of having a good plan is to have a simple and effective morning routine. In this report, we have looked at a simple approach that most experienced day traders follow. They read the news, check the economic calendar, check the top movers, and then put these entries in a journal and execute trades. As you start, these processes may take more than one hour. However, as you gain more experience, the entire process may take less than 30 minutes.