Despite being a meme coin, Dogecoin (DOGE) is undoubtedly a pioneering cryptocurrency. Up until 2020, there were barely any meme tokens. However, from this point, Dogecoin became one of the most talked-about digital currencies (and still is) and even one of Elon Musk’s favorites.

Moreover, DOGE spawned a craze of meme coins, many of which borrowed part of its name or Shiba Inu symbol. 2021 was the project’s most stellar year as, from January to May, the price increased by almost 15 000%.

Such impressive gains are unprecedented in such a short period, even for cryptocurrencies. Yet, as they say, all good things come to an end since similar returns have not been experienced.

This tells us one thing: investors are shorting Dogecoin in spades. If this is something you’d like to learn yourself, stick around!

‘Going short’ in the crypto markets

Going short means selling a particular financial instrument that one believes will become undervalued to make profits. Ordinarily, you can only sell DOGE if you bought the actual coin at some point. However, thanks to derivatives, you don’t need to own the underlying asset.

More importantly, you can go long (buy) or go short at any moment. As with virtually all derivatives, leverage or margin is involved, a ‘gearing’ tool allowing one to trade far bigger positions with a relatively smaller account.

We express leverage as a ratio like 100x or 1:100, reflecting how many times your capital is multiplied. In this particular instance, it means you can control up to 100 times the value of a coin. For example, if you only had $100 to trade, you could handle DOGE worth up to $10 000.

Of course, this is a noticeable amplification, meaning it’s a double-edged sword as gains and losses would be magnified equally. Therefore, a slight increase in DOGE’s value could quickly wipe you out or provide you with substantial profits.

As with all derivatives, a spread or commission fee will apply for each successful trade as compensation for the broker or exchange facilitating the deal. Lastly, because leverage in crypto is a form of borrowing, interest (called a rollover or swap) applies after a certain number of hours.

Several types of derivatives exist in crypto, but you’ll typically see four kinds:

- Spot: A spot derivative is the most accessible type as you trade the instrument at its current value. However, this market tends to be the least leveraged in cryptocurrencies.

- Futures: A future is an agreement to trade a cryptocurrency at a specific price at a predetermined future date. Futures have a particular expiry date for settlement, although you are free to close your position well before this point.

- Perpetual swaps (‘perps’): These have become increasingly popular in cryptocurrency. Perps are simply futures contracts with no expiry date. Such derivatives usually have the highest margin as you can get leverage up to 200x.

- Options: An option affords traders the right, but not the obligation, to trade a coin at a pre-determined ‘strike price’ and expiry date. Options are similar to futures.

However, instead of actually buying or selling the asset in question, you bet on whether it will be higher or lower than a particular value after a specific date by paying a premium.

When should you short Dogecoin?

You should have conviction in your desire to short DOGE and thoroughly understand your decision-making process. As previously mentioned, traders sell a market they believe will lose value at some point in the future.

Certain technical and fundamental drivers constantly affect Dogecoin’s price, which one should analyze beforehand. Fundamental analysis is generally considered more significant as it looks at the underlying or intrinsic value of the coin.

You should be more cautious of a meme token like Dogecoin as it tends to be driven by social media influencer posts like those from Elon Musk and others. Technical analysis deals with repeatable patterns or structures, indicators, time-frames, etc., all of which are also influential.

Many traders use a combination of the two. Regardless, the point is to form a solid trading idea to sell the coin to maximize your chances of the price going in your direction.

Step-by-step instructions for shorting Dogecoin

Let’s now go into the typical steps to follow when going short on Dogecoin.

- Picking the derivative and market: Firstly, you’d need to decide on the type of derivative and pair.

By pair, we mean the market to which Dogecoin is paired. In many cases, the most frequently quoted price is against the US dollar. However, you can find several fiat currency (and even other cryptos like BTC, ETH, etc.) markets paired against the meme coin.

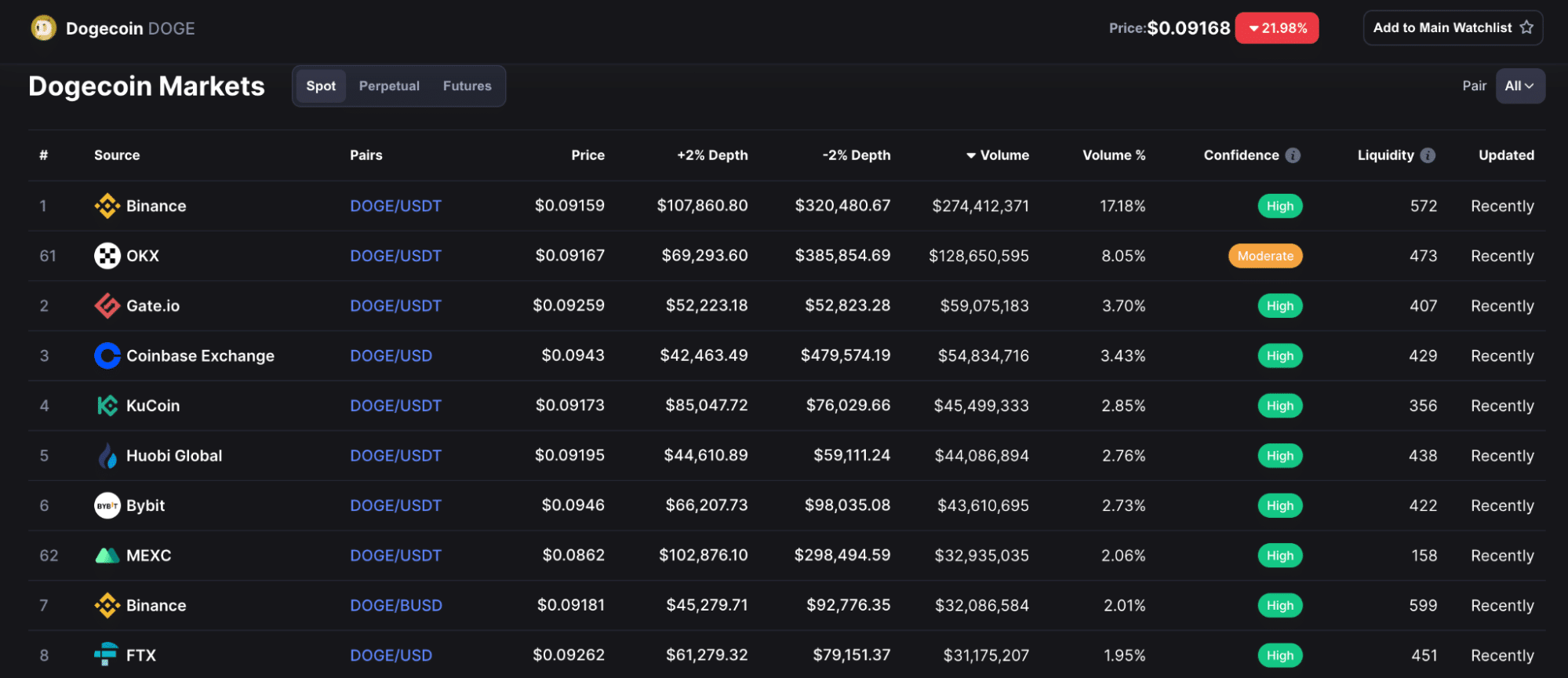

You can view the list of popular Dogecoin markets across most exchanges on CoinMarketCap. The image below is an example of the available pairs found on the many popular platforms as per this website.

- Choosing the exchange: As expected, many services offer derivatives for Dogecoin. The most popular of these include Binance, OKX, Coinbase, Gate.io, KuCoin, Huobi, and numerous others.

Several factors come into play in choosing the best exchange, but the most crucial are the fees or trading costs, the security, and the market range.

- Depositing the money: At this point, you will have to fund your account according to the currency of the DOGE market. For instance, if you’re trading DOGEUSDT, you’d need to deposit Tether into the exchange and transfer it to their platform.

- Order setting: When trading DOGE, you’ll have different orders such as market (which executes instantly), stop/limit (which execute at a later date), stop loss, and take profit. The most important of these is the stop loss, as it limits your losses to a predefined and manageable amount.

Curtain thoughts

Like many other cryptocurrencies, DOGE’s price has fallen substantially, which is currently presenting many opportunities to short this instrument. Much of this decline is of no fault to Dogecoin since the crypto market at large has been in sustained bearishness for several fundamental reasons.

There could be other factors unique to Dogecoin responsible for its decline in some cases. Regardless of whether you’re going long or short, you should be confident in your actions and form solid confirmation factors to back up your decision.