Currency markets are not always trending. Currency pairs are most of the time in consolidation mode or range-bound. While the focus is always on emerging trends, mastering how to trade ranges is a sure way of staying competitive in the $6 trillion marketplaces.

Trending currencies

The forex markets trend more than the stock market, thereby giving rise to exciting trading opportunities for traders who cherish volatility. The strong trends mostly involve major currency pairs that are extremely volatile backed by high liquidity.

The four major currency pairs at the center of major trends in the forex market include:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

The US and the European Union are home to the most liquid currency pairs that most traders turn to while looking to profit from big market trends. Understandably, the two economic blocks play host to some of the biggest economies and financial hubs.

Likewise, the UK, which has severed ties with the European Union, is also home to one of the most liquid currencies that experience significant volatility in the currency market. Although the country’s economy is smaller than India, its edge in the forex market stems from London being a financial hub.

Similarly, there was a time when the British Pound was a reserve currency, a legacy it has held over the years. The UK being a global forex dealing epicenter, also sees its currency elicit strong interest conversely big trends.

The EUR/USD is the most liquid instrument in the forex market, conversely subject to big trends in response to various market-moving events. The currency pair attracts an upward trading volume of $1 trillion a day, affirming the trading opportunities it always comes with.

EUR/USD edge as the most popular currency pair in the market stems from the fact that it represents two of the largest economic entities. The US with a GDP of $21.423 billion, and the EU with a GDP of $13 trillion.

Trend trading

The strong liquidity is one reason why the EUR/USD comes with some of the biggest trends in the forex market. Economic releases and political development in the EU or the US are known to trigger big trends on either side.

To profit from the trends, traders often use an array of moving averages to determine in which direction the pair is trending, conversely open trades in the direction of the long-term trend.

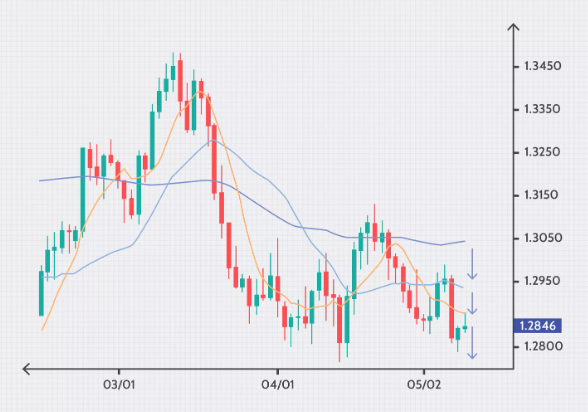

For instance, the 7-day, 20-day, and 65-day simple moving averages are some of the most popular moving averages for determining EUR/USD trending direction.

The chart above shows that 7, 20, 65-day moving averages are all aligned in one direction signaling a strong downward trend. The trend is even stronger when the 7-day moving average is below the 20 days moving average with the 65 days moving average above the two.

In this case, traders will use the opportunity to enter short positions on price retracing back to any of the three moving averages, which act as strong resistance curtailing any upside action.

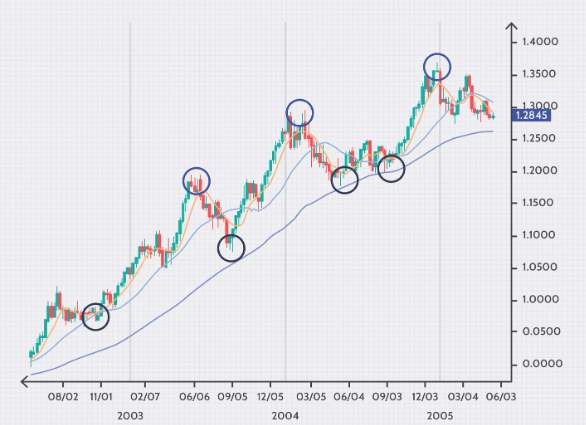

Similarly, whenever the three moving averages point upward with the seven-day moving average above the 20 and 65 moving average, the same signals price is trending upwards.

In this case, traders look to enter long positions on price bouncing off upon touching one of the moving averages. From the chart above, it is clear that the price never breached the 65 SMA and only continued edging higher upon bouncing off the 7 and 20 SMA’s.

Commodity currencies

Major currencies are not the only ones that generate big trends in the forex market. Commodity currencies USD/CAD, AUD/USD, and NZD/USD also elicit strong interest; thus, big trends have played in international trade.

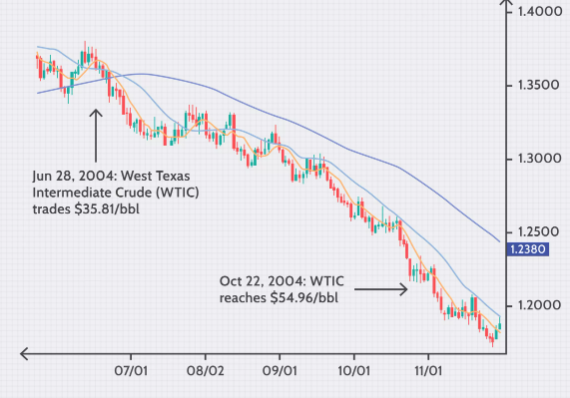

Australia, New Zealand, and Canada are some of the biggest exporters of commodities. Likewise, their currencies often trend very strongly in response to the demand of their primary exports. Canada is one of the biggest oil exporters and sees its currency trend in tandem with oil prices.

Oil is one of the most volatile commodities, often triggering wild swings on the Canadian dollar. Similarly, as oil prices increase, the Canadian dollar is known to strengthen across the board as the economy always stands a better chance of generating more money. Likewise, a significant decline in oil prices often takes a toll on the CAD, given that the commodity accounts for nearly 10% of the country’s GDP.

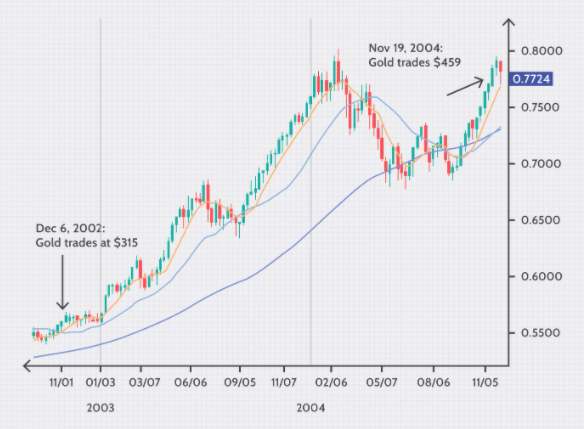

The Australian dollar is also susceptible to precious metals’ prices under being the second-largest exporter of gold. Conversely, the Aussie trades in tandem with gold, as shown in the chart below.

Range-bound currencies

Not all currency pairs are ideal for trend trading. With the forex market range bound most of the time, some pairs offer perfect trading conditions. Currency crosses are ideal pairs for traders not fond of big trends in the market.

Currency crosses are simply currencies that don’t have the US dollar as part of the pairing. The pairs include EUR/GBP, EUR/JPY, and EUR/CHF.

With range-bound strategies, the idea is to identify support and resistance levels. The support and resistance levels act as parameters for the range whereby one enters a long position as soon as price bounces off the support and exits as soon as it is rejected at resistance.

With range-bound strategies, the idea is to sell overbought conditions, which often occurs at resistance levels, and buy-in oversold conditions at support levels.

Cross currencies are ideal for this strategy as they are mostly made up of culturally and economically similar countries’ currencies. Any imbalance between the two countries often results in a return to balance.

Conclusion

It is essential to master various trading strategies as forex markets are not always trending. In contrast, major currencies offer ideal trend trading opportunities. Currency crosses are ideal for looking to profit from stable markets.