Overview

Taking advantage of interest rates through carry trades in forex is one of the many strategies in the industry. The carry trade in forex refers to holding a position on a currency pair with a positive interest differential. Carry trades aren’t necessarily typical trading strategies that open and close positions at specific points, but rather to earn interest over an extended period. It’s essential to understand the concept of interest rates, their differentials, and swaps to take advantage of the carry trade.

Interest rates and differentials

It’s necessary to preface by stating that the carry trade is beneficial for position size traders. Rightly reaping the benefits of this type of trade requires one to hold positions for several months or longer.

Differentials are about exploiting the differences between low and high-interest rates. For example, in the GBP/USD pair, if GBP’s interest rate is 5% while that of USD is 1%, the interest differential would be 4%. If we were to buy GBP/USD (in turn buying GBP), we would earn daily interest according to how our broker calculates the swap, which is the process of ‘swapping’ interest rate differentials. Our broker would credit us the swap since we’d technically be investing in the currency with a better interest rate. Inversely, if we were to sell GBP/USD, we would incur a daily swap.

How swaps are calculated

There is no universal formula for calculating swaps since brokers use slightly varied calculations. Most brokers have their own swap calculators pre-configured with their swap rates, which likely already have a mark-up. Also, even if a positive interest differential exists, the swap may be close to zero or slightly negative due to the mark-up. We can only estimate whether a swap will be positive or negative and to what extent, depending on the pair traded. A common calculation for swap is:

1 lot pip value X number of lots X swap rate X number of nights / 10

- 1 lot pip value: This would depend on the pair traded, but it would take 1 unit of the base currency divided by the quote price. For example, if the price of USD/CHF were 0.200, the pip value for one lot would be 5 (1 divided by 0.20).

- The number of lots depends on whether your position size is in standard lots (100 000 units), mini lots (10 000 units), micro lots (1 000 units), or nano lots (100 units).

Tips for finding a carry trade scenario

The general premise of a carry trade is that the high-yield currency should substantially cover the risk taken on the position regardless if it loses. Traders may look to employ a short-term strategy utilizing smaller time-frames for their entries. However, unlike a traditional trade, the entry is not as critical since the aim is to hold the position for very long while collecting the swaps. Any normal appreciation or depreciation of price is a bonus.

- The first step in identifying a potential carry trade is looking for as wide of a positive interest differential as possible. Finding this information gives the best chance for a profitable carry trade. Historically, currencies that make up exotic pairs, the likes of Mexico, South Africa, and Russia, tend to have very high-interest rates compared to countries like the United States.

Other instruments with positive interest differentials are commodities such as gold and silver. When currency interest rates are low, commodities tend to rise in value due to the cost of holding inventory. It may also help to always keep an eye on when the central banks of these respective countries announce a new interest decision, whether they will change the rate in any way or not. Most central banks have interest rate announcements eight times a year.

While this number sounds frequent, central banks rarely significantly alter the rate. Especially where there is a substantial difference between the high-yielding and low-yielding rates, even a slightly noticeable change won’t severely affect the interest rate differential overall. Therefore, we can reasonably expect much of these rates to stay the same for at least a few years.

- The second step is to treat a carry trade as a normal position, except that the stop loss must be wider than usual to ensure one stays within higher time-frame ranges. If we intend to hold a position for some months or longer, the stop loss must be larger to accommodate the inevitable fluctuations. We can utilize the Average True Range (ATR) indicator to work out the range, and the RSI to find a spot to enter on a dip. For an extra ‘buffer,’ we should double the ATR as our stop (so if ATR is 30, the stop should be 60). On the daily time-frame, the optimal entry would be when the RSI peaks below or above the 50 line.

- We should also consider what the bigger trend is. Although any carry trade could result in positive swaps, the position itself may be against the bigger trend. We may want to look at pairs where we are trading with the bigger trend and where the swaps cover the risk regardless of whether the actual position is in a negative or not.

- Traders should also shop around as not all brokers pay the same swaps. The aim is to look for the brokers that pay the best swaps while also offering minimal spreads.

Example of a real-life carry trade

The trade scenario below encapsulates all the above points:

- The European Central Bank has kept a 0% interest rate for more than four years. XAU/EUR has had a positive interest differential since.

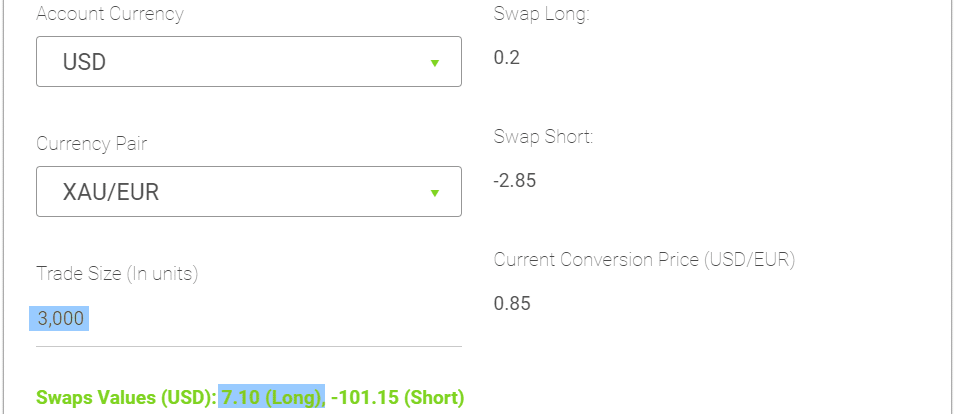

- ICMarkets offers a positive swap for long positions (buying) at $7.10 for a 0.03 position (hence 3000 units) on the pair (see below).

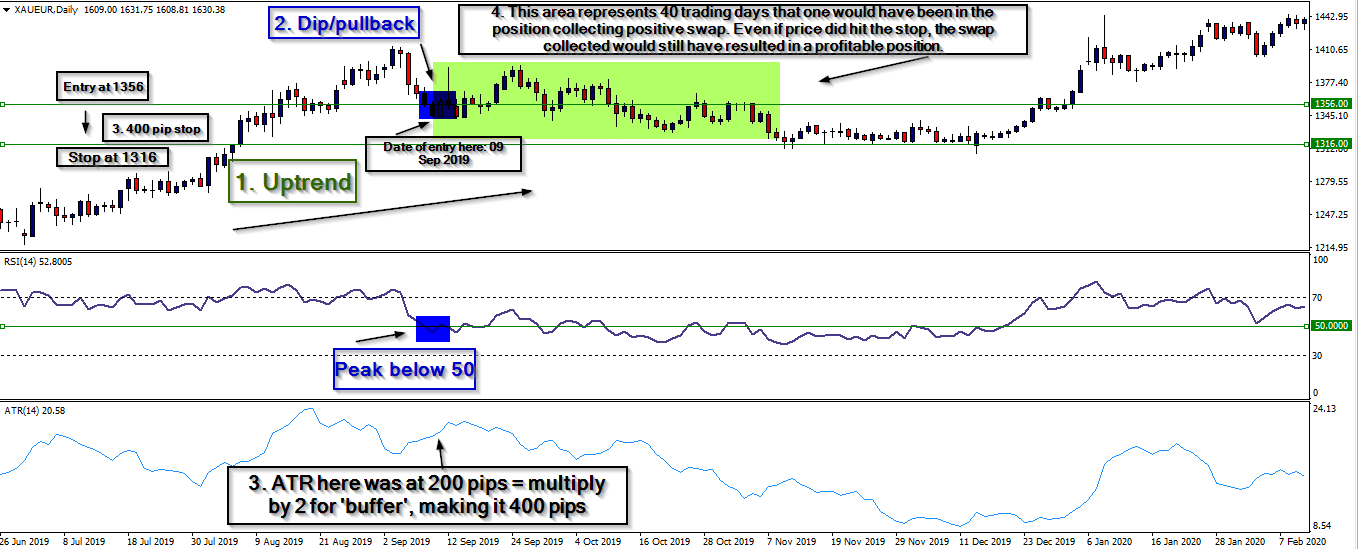

- This pair was in a bullish uptrend on the daily time-frame (point 1). A buy position makes sense in this scenario.

- The dip or pullback mentioned above has been highlighted (50 mark on the RSI), along with a 400 pip stop as per ATR (points 2 and 3). The highlighted price would have been the entry (1356) and the stop loss at (1316).

- A position with a 0.3 lot size with a 400 stop would have been a risk of $120.

- (Point 4) Holding the position for at least 40 trading days (2 months) would have netted a positive swap of $369.20 ($7.10 X 52 days). We multiply the swap by 52 instead of 40 trading days as brokers usually charge or credit swaps three times on Wednesdays. Even though the price would have hit the stop loss, subtracting from the risk, we still would have netted $249.20 ($369.20 – $120).

Conclusion

A carry trade can be a passive strategy to a trader’s arsenal to take advantage of interest rates. As with any trade, there are many considerations to ensure risk management is in place.