Scalping is a trading style based on catching numerous tiny price changes and replicating the same over several small timeframes.

When scalping, the key to returning profit-making is pegged on opening numerous trading positions. In this strategy, a trade typically lasts for some seconds or a few minutes.

The strategy requires a great deal of fast and accurate decision-making by traders. The failure to follow strict risk management may lead to losing a substantial amount of money. This also means that a trader has to spend a great part of the day in front of their computer, finding and getting engaged in hundreds of trading opportunities.

Why traders fancy scalping

Even during periods of prolonged calm in markets, small price movements are an assured thing. This, therefore, means that scalping presents traders with limitless opportunities to generate profits. The other common denominator in scalping is the closure of all positions by the end of the day.

How to find trading entries in scalping?

Speed is one of the key determinants of success in scalping. The faster you can identify, open and exit a trade, the more likely you will increase your profit margin.

It’s not enough to merely be fast when you are scalping. Traders depend on signals to find the entry and exit points to profit from the price fluctuations. As scalping requires swift research and trade execution, traders use signals that are usually auto-generated by a computer program.

Alternatively, some traders employ their own technical analysis indicators in quieter sessions and only use the software in volatile periods.

In both cases, the economic calendar plays a significant role in influencing price action. Many traders prefer being hands-on and in total control of all decision-making. They do this by looking at the bigger picture, which means that they have access to real-time market feed, graphs, technical indicators, and other core factors. In addition, at any given time, they have trading positions open in several markets.

Indicators used in scalping

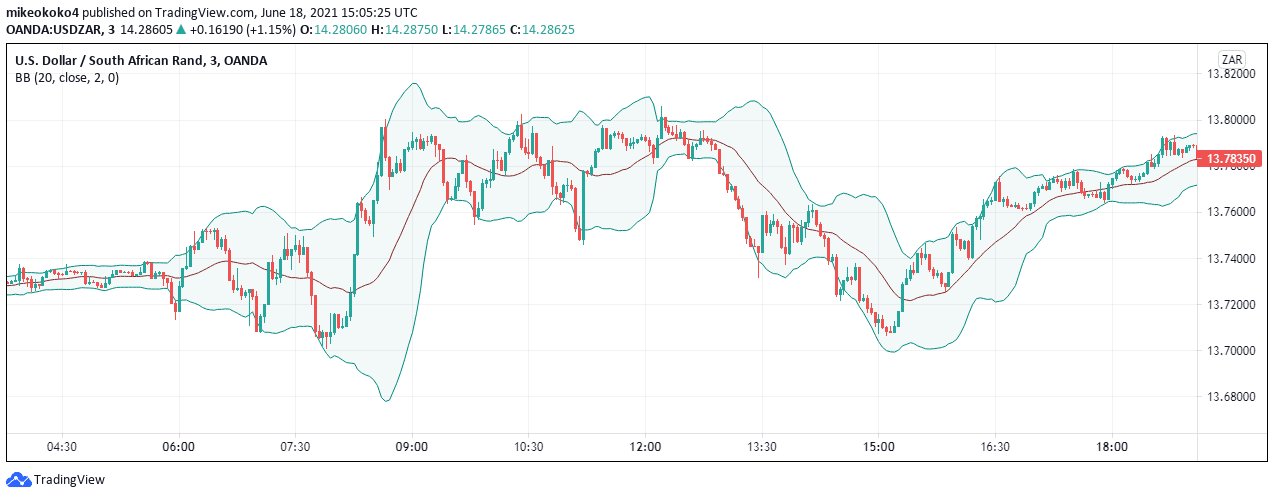

1. Bollinger Bands

Forex traders employ Bollinger Bands to guide them through volatile trading sessions. With scalping being a race against time, Bollinger Bands are useful in showing the likelihood of reversals and breakouts when the bands enveloping the price become narrower or wider.

When the bands become narrower, a breakout is in the offing. When they widen, traders know that a bullish surge is imminent.

The indicator is especially effective when used in trading pairs with low volatility because they can generate larger profits.

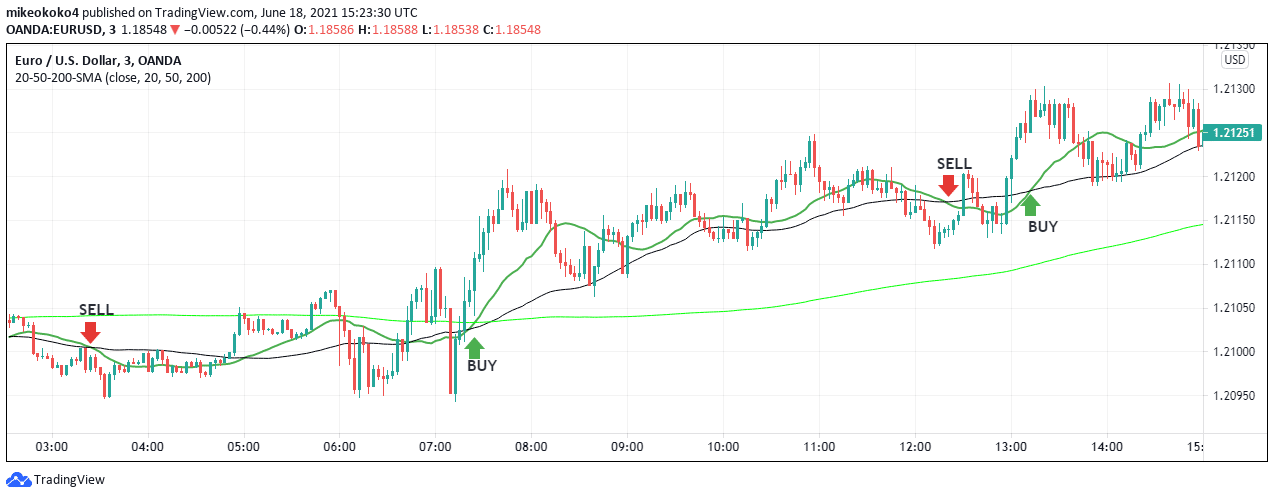

2. Moving averages

Traders can get entry and exit points by using various Moving Averages. Some of the most popular ones are Simple and Exponential Moving Averages. Traders can set the calculation periods for the indicators to analyze the long-term or a short-term price history.

50-period and 7-period Moving Averages are useful in Forex. Scalpers find trading opportunities when short-period MA crosses the long-period MA. When the crossing is from above, a bearish trend follows. Conversely, when the shorter period line moves above the long period one, we get a buy signal.

For example, in the EUR/USD chart above, scalpers will move in and follow the trend established after the 20-period MA crosses the 50-period MA at the points shown by the arrows.

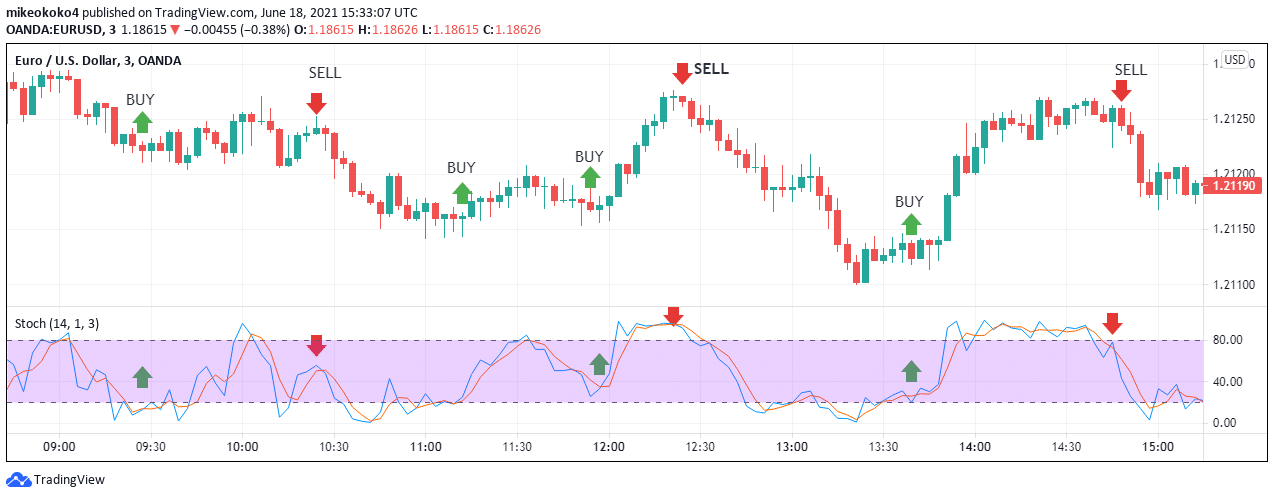

3. Stochastic oscillator

The stochastic oscillator uses the movements of two indicator lines to signal imminent changes in the direction of the current trend. The oscillator analyses the current price of a currency pair and compares it against its price movement in recent times.

Scalpers look for opportunities when the %K line and the %D line intersect. Their intersection signals an imminent bullish or bearish run. Traders buy when the %K line crosses the %D line and moves above it. If the %K line crosses the %D line and moves below it, then scalpers know that it’s time to sell.

For example, in the EUR/ USD chart below, scalpers will buy at the spot shown by the green arrow when the %K line moves above the %D line. They will then exit when the %K line crosses below it.

Alternatively, they can sell after the %K line dropped below the %D line and cover their short trade when the %K line recovers above the %D.

What are the best times to scalp?

To optimize returns through scalping, you need to trade during times when there is high liquidity. This is because high liquidity results in more active price action, thereby providing several opportunities to profit.

The best trading times for scalpers are the New York session between 13:00 GMT and 22:00 GMT and the London session from 08:00 GMT to 17:00 GMT. These are the two sessions with the highest liquidity and volatility. The Asian market also offers good liquidity, but price action is relatively calm. Therefore, trading failed breakouts provides better chances of high returns.

How to cover spreads when scalping?

Since scalping involves opening up multiple trading positions, forex spreads may eat up a significant portion of your funds on any particular day. Therefore, it is prudent that you assess the spreads offered by different brokers to know which ones offer the best deal.

If scalping forex, the major pairs will offer you better spreads than minor pairs or exotics due to majors’ high trading volume. In addition, you should also incorporate other transaction costs, such as commissions.

Advantages of scalping

- The level of risk exposure is minimized due to the short duration of trading. In essence, even if the market continues to go against your position for weeks, you will have exited it long before the losses are compounded.

- There is a higher win rate: Typically, it is not too difficult to make small fractions of profit from small price movements. When this is replicated after several trades, you can end up with a sizable profit.

- Scalpers get numerous trading opportunities to profit from because they are only interested in small price movements.

- Scalping isn’t affected by fundamentals due to the short spans holding positions. This creates a safety net for traders and minimizes the disturbance.

Disadvantages of scalping

- To make any meaningful returns from forex scalping, traders must have a relatively large capital.

- Scalping requires traders to be highly skilled, have excellent decision-making skills while managing to stay disciplined under pressure. Many people cannot handle that.

Due to the short trading windows running into seconds and minutes, traders end up spending a lot of time concentrating on price action. Taking your eyes off the charts can lead to significant losses within a few minutes.

The need to use large sums of money in fast-paced short-interval trading increases the level of risk in scalping relative to other trading approaches.

Bottom line

Scalping is a rewarding tactic in trading. However, the risk levels involved are also significantly higher than in other approaches to trade. Therefore, you must have sufficient skills, time, dedication, and financial resources to be a successful scalper.

Find out how to use the scalping tactic with smart bots on the 1-minute chart.