The one truth about forex or any other financial market is there are no guarantees, only probabilities. Dealing with the uncertainty of random outcomes is only possible when we thoroughly understand the law of large numbers.

The same way a casino may lose money in a single game but remain wildly profitable within a year is the same approach trades should use.

What is the law of large numbers?

The law of large numbers (LLN) is a mathematical probability theory that describes the performance of one experiment over a substantial number of times. The more this trial continues, the more the results get close to their expected value.

So, what is the expected value in forex? Since the price can only go up or down, it’s easy to conclude the probability is 50%. On the surface, this figure is actually relatively easy to deal with, yet why do so many traders fail?

Although the probability is 50%, some trading strategies will reflect a higher percentage, and some will show a lower one. How we frame both circumstances drastically affects how we perceive success.

It’s human instinct to desire instant gratification, and often, we are easily tricked into recency bias or judging our success based on recent results.

Although specific strategies should use this logic, even those should also reach the same probability if price can go two ways. Let’s look at a commonly-used and practical example to understand the power of the law.

The coin toss

The coin toss is a simple analogy that is recurrently used to exemplify the LLN in forex primarily because it too has a binary outcome. Let’s imagine in this game, one always chooses heads to win and loses if the coin turns tails.

In a sequence of five tosses, we may miraculously land on heads on every occasion. Statistically, the winning percentage up until this point is 100%, but this does not represent the expected or resulting value of the game itself.

Let’s imagine in the successive five tosses, the coin lands once on heads. After ten tosses, the percentage is now 60% (6 heads, 4 tails).

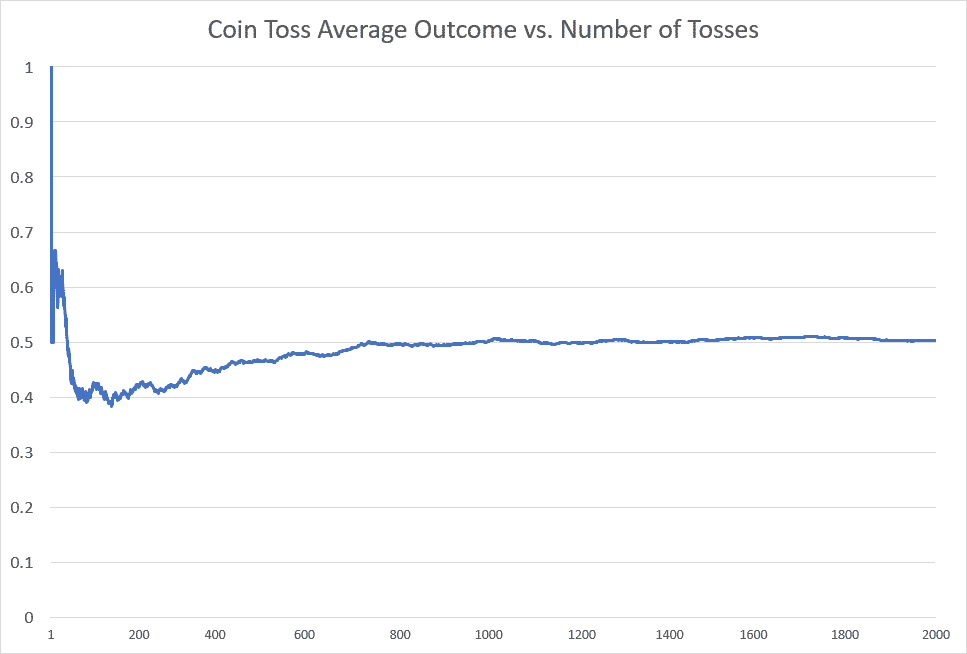

Mathematically, the longer we play this coin toss, the closer the winning figure will reach 50%. We could have a random sequence where we go above and below this point, but through a large number of trials, as we see in the image below, we should reach the expected value.

Trading forex also operates similarly. The aim is not for a high sequence of wins in the interim, but instead that as we trade our strategy over time, the winning percentage mathematically will get close to or be at 50%.

By internalizing this law, we will appreciate no trader wins all the time, nor can one predict a long winning streak due to randomness. Additionally, no matter our belief over a trading idea, the probability always remains the same.

How the law affects trading style and frequency

We know four primary trading styles in forex: scalping, day trading, swing trading, and position trading. Scalpers trade the most frequently, but as one goes up the scale, the frequency reduces considerably to where a position trader may only take perhaps five positions in a year.

So, how does LLN have any bearing on trading style and prevalence?

Higher frequency trading

One of the reasons why traders believe a profitable benefit in trading often is because it numerically increases their chances of making money in a shorter timespan.

What typically occurs is the higher the trade frequency, the winning percentage is likely to reflect above 50% over (in some cases, above 80%), let’s say, ten trades.

We should bear in mind a trader can perform this many positions in a month. In the short run, they will expect to win more regularly, though, over time, they should eventually reach 50%.

Lower frequency trading

Conversely, if we look at a swing trader, they should observe their results over a more extended period because their trading regularity is much lower.

In the short term (let’s say, again, over ten trades), it is likely for their winning percentage to be lower than 50%, which is unlike a scalper or day trader because of the reduced trade constancy.

They naturally need much more time to judge their success because, in the short term, they have a smaller sample size of trades to observe initially. A day trader or scalper has a large sample size to analyze in a quicker period.

What is essential to consider is high-frequency trading doesn’t automatically mean they can make more profits than someone who trades less. In some cases, the opposite can be true due to primarily the risk to reward, but also other monetary factors such as the actual risk per trade, account size, etc.

There technically is no such thing as high probability

Many traders erroneously believe certain set-ups have a higher probability than others due to special technical factors or situations. Regardless of the analysis that goes behind this, ultimately, the chance of a trade failing is technically 50% if the price can only travel up or down.

This point reinforces why one should never place any significance on one trade over another. If we speak of consistency, we should treat every position the same, assuming we are trading the same structure or set-up and are following all its rules to the tee.

Final word

One of the main conclusions about this law is that results are random in the short term; the key is to focus on the long term, where they should move towards 50%. The aim of the LLN is to form the framework for ensuring stable long-term results, a difficult feat in an area dominated by random events.