For those who are experienced traders in the forex markets, tracking global commodity prices might have become a habit. This is because forex markets are also driven by macroeconomic factors such as inflation and growth.

For example, the rise in commodity prices such as those of iron ore or crude oil typically indicates a rising demand and prices. This is negative for net oil-importing countries but positive for iron ore countries like Australia. So commodity prices have a significant impact on currency pairs like AUDUSD.

However, even in the commodities market, one commodity stands out. Its price moves are broadly uncorrelated to other commodities. In ancient times, in fact, it was not even treated as a commodity but rather as a currency! Yes, you guessed it right, we are talking about gold.

Gold satisfies the modern definition of a commodity – an economic good that is traded in the open market. However, unlike other commodities, gold has little industrial use. Rather it is treated as a store of value because of its limited supply. In fact, several governments and central banks purchase physical gold, adding it to their reserves in case of an economic downturn.

Counter-cyclical nature of gold

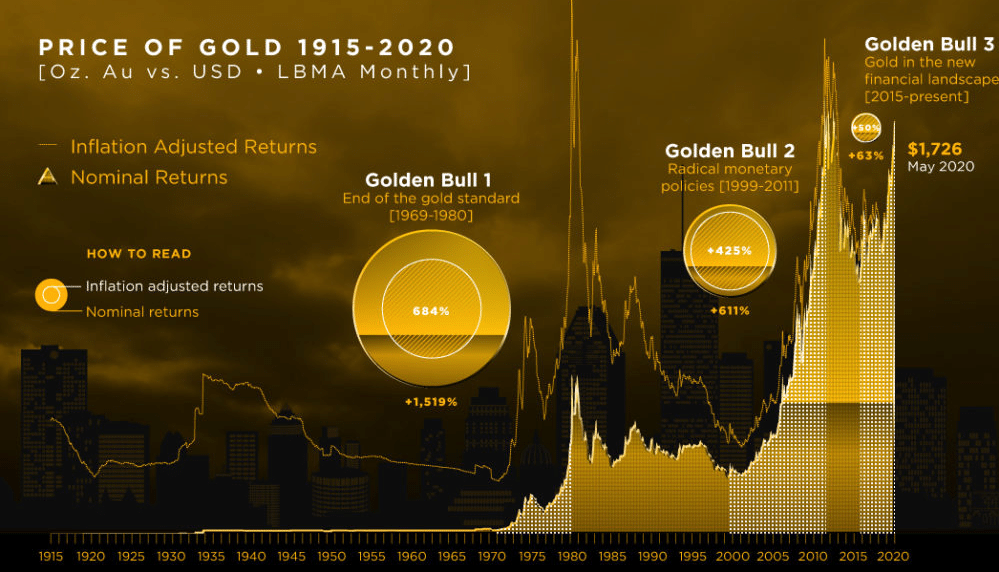

The gold price grows during major recessionary events. Recently in 2020, you might have noticed that gold prices increase during these events. As can be seen below, in the past 100 years, gold prices have seen a massive spike in times of recessions or economic slowdown. This is because, owing to its limited supply, gold is treated as a ‘safe haven’ asset.

Investors flock to gold when they see economic conditions worsening. As a result, gold prices are negatively correlated with traditional growth asset classes such as equities and commodities. That is to say, gold prices rise when these assets fall in value.

So how do the changes in gold prices affect currencies? There are two major ways in which gold price can be interpreted as a signal for forex price moves.

Gold price and USD strength

In the global markets, just like most commodities, the gold price is quoted in USD. But while other commodities have demand and supply dynamics that drive their prices, gold has nearly a fixed supply. As a result, a change in USD strength significantly impacts gold price.

So, for example, if the USD gains, it is possible to purchase more gold with the same amount of USD. This means that the price of gold would fall. If the USD weakens, the gold price increases. Gold and USD are inversely correlated.

Since the major currency pairs traded in the FX markets have USD in one leg or the other, USD strength becomes an important indicator. A majority of the FX trades made in the market involve USD. As a result, the ability to predict USD strength can help predict the direction of these currencies as well.

Gold is traded not just by commodity traders but also by large financial institutions such as central banks. These institutions buy or sell gold based on their view of the economic conditions. A large purchase of gold might indicate an imminent weakening of the USD.

As a result, the gold price often becomes a leading indicator for USD. If gold price sees a massive spike, it might mean that currency pairs such as EURUSD and GBPUSD may also shoot up, as traders might want to sell USD against EUR or GBP as well.

A forex trader who purely tracks technical indicators may not be able to foresee this move. But a trader keeping a close eye on gold prices will quickly be able to flag this off as an indicator for a sharp move in the forex markets. Tracking gold price becomes an essential arrow in the quiver of a successful forex trader.

Currency specific impact of gold prices

Above, we saw an indirect impact of gold price on currency pairs, that is, through the change in USD strength. However, there are certain currencies where the impact of the gold price is more direct and rather disproportionate. This is because certain currencies have a fundamental relationship with gold.

Take, for example, the AUDUSD pair. The currency pair obviously is impacted by the change in USD strength as it’s quoted in US dollars. However, the more prominent impact comes from the AUD move.

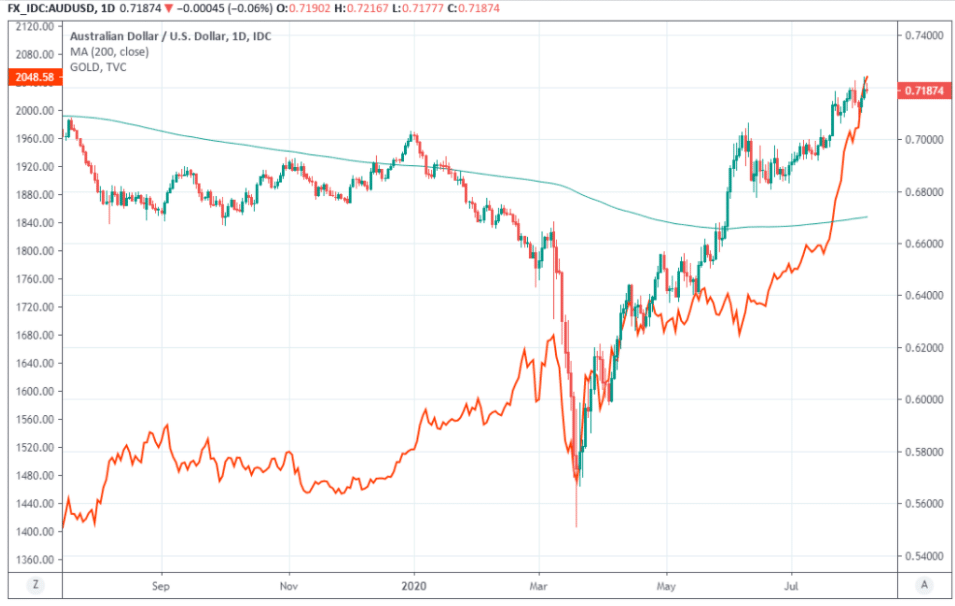

This is because Australia is one of the major gold miners of the world. It mines $5 billion of gold every year. This naturally leads to a strong correlation between gold prices and the Australian economy. As you can see, the correlation broke down marginally in early 2020 due to the Covid-19 pandemic. However, the correlation reverted subsequently, and as you can see below, gold price and AUDUSD moved almost in tandem.

Gold prices reflect not just the existing supply-demand of gold but also the extent of mining being done in Australia. Since Australia’s economy is significantly involved in the process, investors are tracking AUDUSD. The correlation is amplified as market participants would react sharply to AUDUSD in response to any change in the gold price.

Another country having a significant economic activity in gold is Switzerland. Switzerland has the world’s highest gold reserves. This makes the USDCHF currency pair sensitive to gold price moves.

We saw two distinct ways in which gold price is a strong leading indicator for Forex trading. However, one must keep in mind that the relationship between the two is long-term in nature. Hence, the trader must hold to the position even if the correlation doesn’t materialize in the short term. If used properly, the gold price indicator becomes a powerful tool to generate profits.