Pionex is a cryptocurrency exchange that offers traders 16 built-in automated trading bots. Every robot is based on a different strategy according to the market conditions. Margin Grid Bot is one of them, with several other algorithms like DCA, grid trading, Rebalancing, etc. Traders can use the robot to trade 346 coins with a low fee of 0.05%. Before investing in the product traders should understand its working methodology, trading approach, profitability, and risk management. We will review all these in our article to see if Margin Grid Bot is worth our investment.

About Margin Grid Bot

The platform offers two models of a Margin Grid Bot: lock token to loan USDT and vice versa. The robot provides 0.2X, 0.5X, 1X, 2X, 3X, 4X leverage options. It is based on the averaging strategy that profits from the fluctuating market, and trades on both up and downtrends.

| Payment Options: | Credit Card |

| Price: | Free; 0.05% fees |

| Supported Exchanges: | Pionex |

Margin Grid Bot features

The key characteristics of Margin Grid Bot include:

- Traders with no coding knowledge can set up the bots and configure the parameters.

- It performs automated 24/7 trading by scanning the market for the best positions.

- Margin Grid Bots have advanced features like stop loss, take profit, trigger price, and slippage control.

How does it work?

Traders can start trading with Margin Grid Bot in the following steps:

- Go to the Pionex.com website and log in to your account

- Select the bot from the right side of the page and click create

- Select (Loan ETH/Loan USDT), which implies the bot will use your USDT to loan ETH and short ETH, or your ETH to loan USDT and long ETH

- Configure the parameters like upper price, lower price, grids, margin, leverage, and more

- Choose the trading amount, and it will calculate how much you can borrow

- Start trading

Compatible exchanges

Margin Grid Bot is available on the Pionex exchange.

How does Margin Grid Bot stand out?

Margin Grid Bot offers several features and advanced settings to cater to the needs of both beginners and professionals. They do not only work on fluctuating markets but also profit from the uprising or downtrend of the coin prices.

Best for: trading without selling your coins

At Margin Grid Bot, traders can lock their Ethereum or any other coins as collateral to loan the appropriate amounts for trading. While the bot is running, your tokens will not be touched, but you can still profit by using them.

Pricing

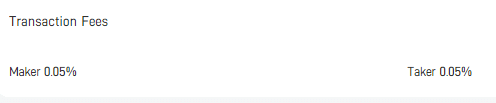

There are no monthly or annual subscription plans to use bots at Pionex. They are completely free to use. Only a 0.05 percent maker/taker fee is charged on trades executed on the platform.

How safe is Margin Grid Bot?

The safety and security at the Pionex platform are available through an identity verification system and two-factor authentication that enhances the protection of user accounts.

Margin Grid Bot reputation

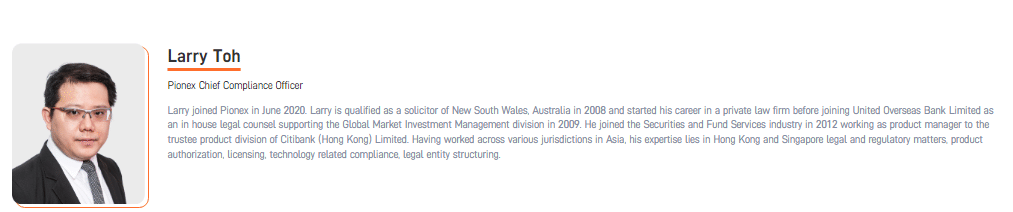

The Pionex platform is a legit platform operating under U.S. FinCEN’s MSB (Money Services Business). It was launched in 2019 and managed by the BitUniverse team. The company exists in Singapore, with Larry Toh as the CCO.

Is it a good choice for beginners?

Margin Grid Bot is easy to set up and requires no coding skills to configure its parameters. All the settings are explained, and traders are recommended to read them before investing.