Naragot Portfolio is an EA that has a low trading frequency. According to the vendor, it does not trade daily mainly because it capitalizes on large trending movements. As a result, the system does not generate profits weekly. Even then, it manages to make accurate entries most of the time. This statement is misleading. We have assessed the characteristics of the Naragot Portfolio, including its strategy, and discovered that it makes poor trading choices. We will discuss our findings in this review.

Product offering

Naragot Portfolio is currently retailing at $449. According to the vendor, there are only 10 copies left available at this price. Once they are sold out, the sale price will return to its normal value — -$599. A free demo option is also provided for traders who desire to test the robot first before procuring it.

This product was authored by Alexander Mordashov. His portfolio doesn’t tell us anything about his credentials and experiences. However, we have ascertained that he has developed several other systems like Naragot Telegram VPS Monitor, Telegram Notifier, and Naragot Online, etc.

Trading strategy

Naragot Portfolio trades 4 of the most liquid pairs: XAUUSD, EURUSD, USDJPY, and GBPUSD symbols. The other listed features of the EA are provided below:

- Applies a take-profit and stop loss for each position, and they remain unchanged until the trade is closed. The TP is usually higher than or equal to the SL.

- Easy to use.

- No toxic methods such as the martingale, grid, artificial high win-rate, curve fitting, and SL>TP are used.

- Runs on the MT4/5.

Unfortunately, the vendor does not mention the leverage used, the minimum deposit needed, and the brokers the system works best.

In the presentation, Naragot Portfolio is described as a trend-following multi currency trading system that is based on volatility breakout and breakouts of support/resistance levels. However, we are disappointed that the vendor does not take the time to explain these approaches exhaustively.

Trading results

Backtest and live trading results are featured.

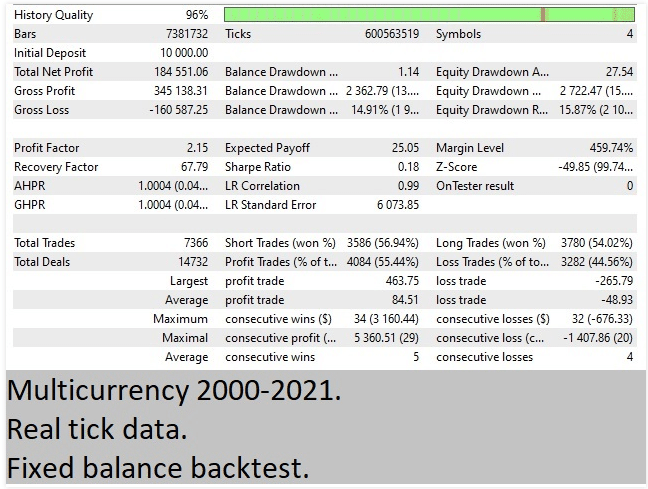

We can see that the robot’s efficiency was tested for around 21 years, from 2000 to 2021. In this case, it turned a deposit of $10,000 to $184,551.06 profit after carrying out 7366 trades. The accuracy rates of short and long trades were 56.94% and 54.02% respectively. These results were very poor. The relative drawdown was 15.87%, while the profit factor was 2.15.

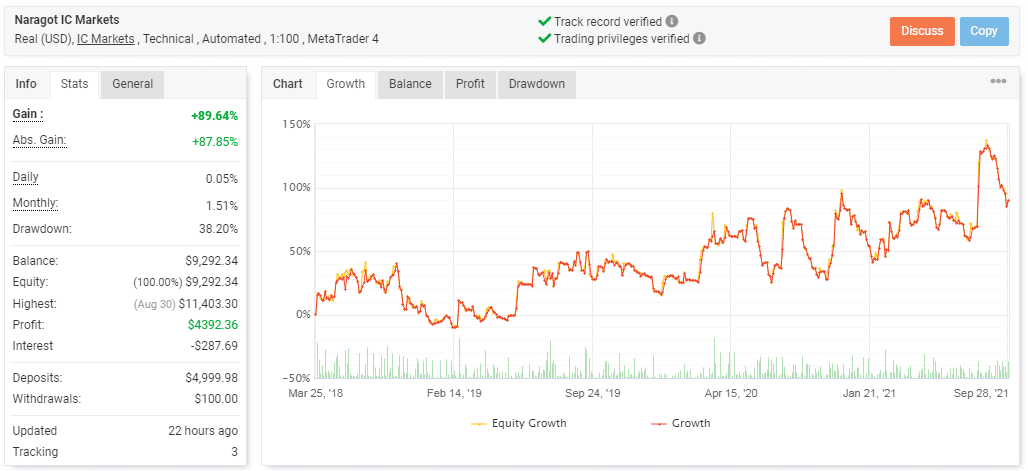

According to the data above, Naragot Portfolio runs a real USD account on the MT4 platform. The low profitability of the account is clearly visible. From March 25, 2018, till now, the EA has only recorded an absolute gain of 87.85%. This is equivalent to a profit of $4392.36. The monthly profit (1.51%) is very small, and the drawdown level is quite high— 38.20%. As such, we have established that the risk/reward ratio is about 25:1.

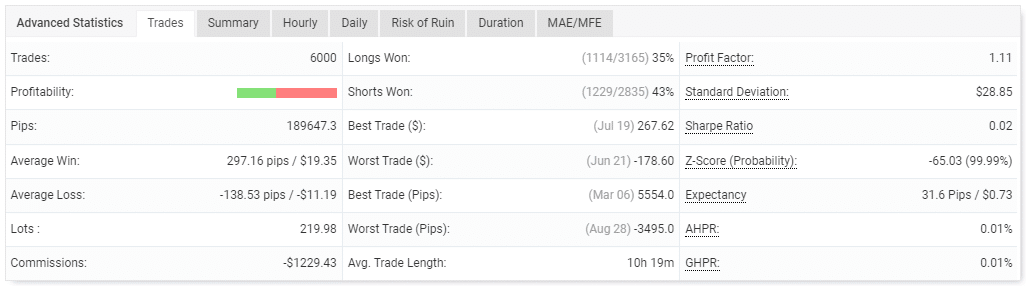

Although the system has completed a substantial amount of trades (6,000), their performance is beyond disappointing. A majority of the long (35%) and short positions (43%) are unsuccessful. The profit factor of 1.11 further illustrates the mediocre performance of the robot.

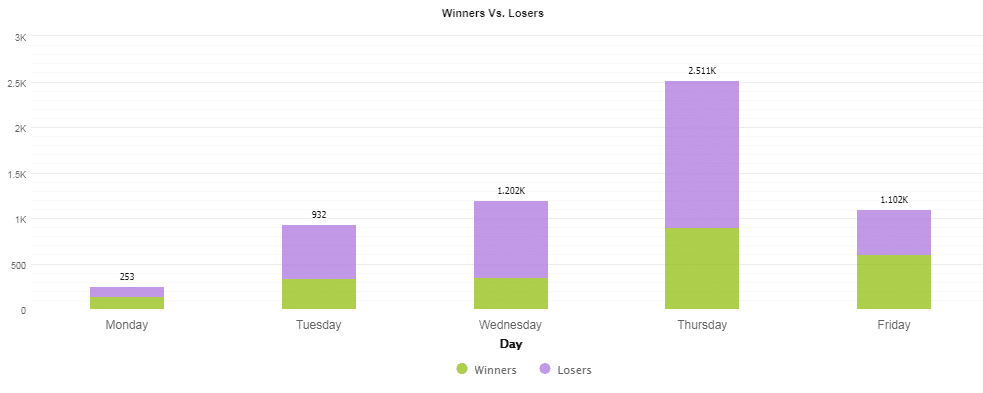

It is evident that the robot lost trades most of the time. Although it traded throughout the week, its activity peaked on Thursday as it completed 2.51k orders.

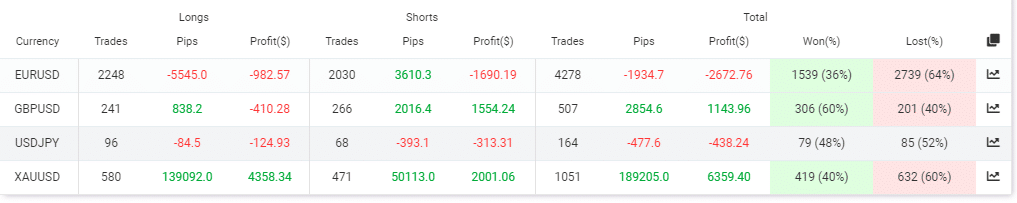

Out of the 4 currency pairs used in trading, 2 were profitable; the GBPUSD and XAUUSD symbols. The EURUSD pair suffered immense losses (-$2672.76).

The EA began the year by making losses. August was the only month that reported considerable gains.

Customer reviews

Naragot Portfolio has a total of 18 mixed reviews on mql5. Many of the customers commend the EA, but we have also learned that it is not effective at all. According to the few discontented clients, the system makes scarce wins and loses many trades. We concur with them. The ‘trading results’ clearly show its dismal performance.