Pending orders refer to instructions to a forex or stockbroker to initiate a trade at a certain level. For example, if a currency pair is trading at 1.1200, you can set a pending order that will buy it when it reaches 1.1250. In this case, you will not need to wait for this level to be reached to buy the order.

Pending orders are different from marker orders, which are the most popular types of orders in the market. A market order directs the broker to buy or sell the financial asset at the exact price. In the example above, a market order would initiate the trade at the exact level.

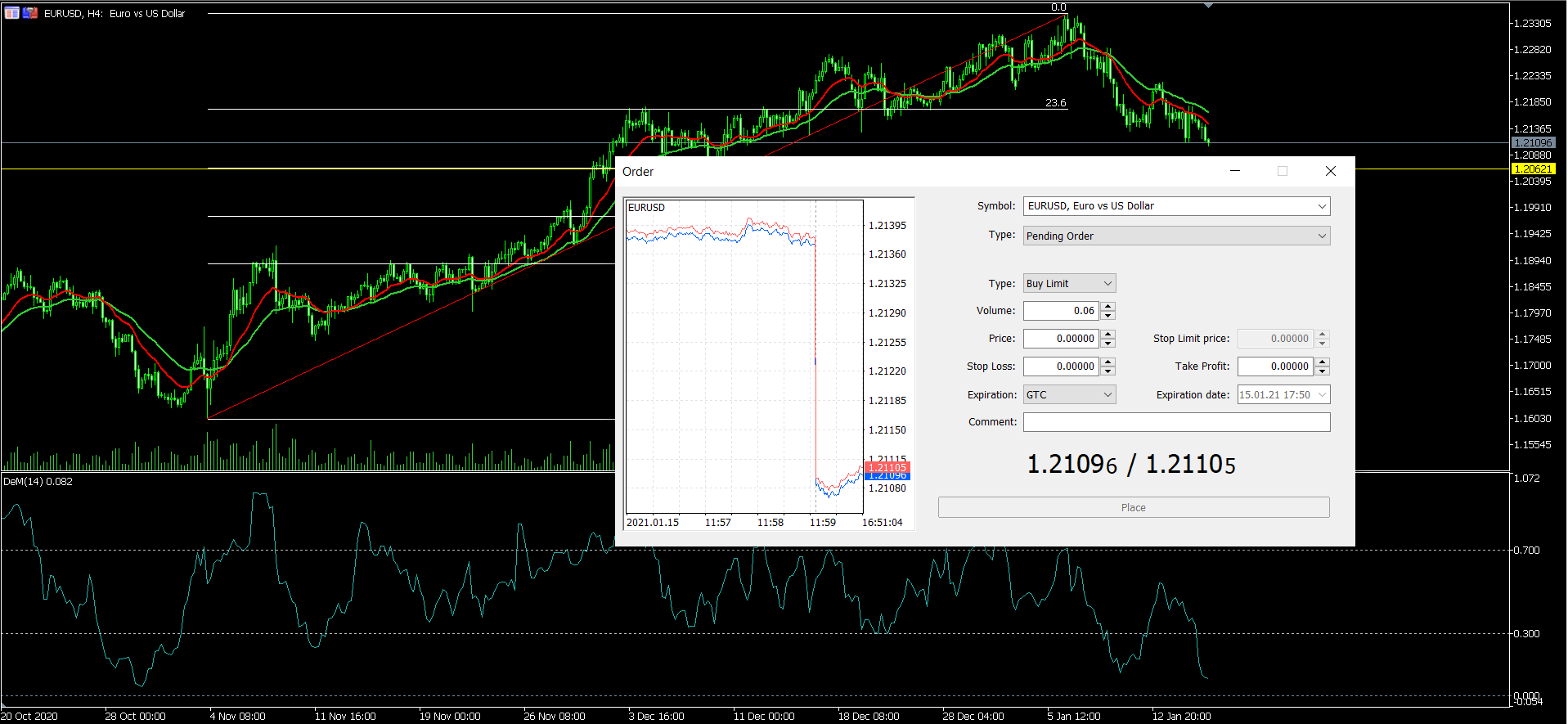

Pending orders are used by traders of all sizes, including retail and institutional professionals, to minimize risks and maximize returns. Most importantly, they are used by people trading manually and those using robots and algorithmic trading. Tools for pending orders are provided by all trading platforms, including the MT4.

How to use pending orders in the MT4

Benefits of using pending orders in forex

There are several benefits of using pending orders when trading forex. They include:

- Saving time. As a trader, you don’t need to sit and wait for a certain level to be reached. With pending orders, you can set the trade-up and leave.

- Useful in trading breakouts. When a forex pair is consolidating, a pending order can help you make money on the side of the breakout.

- Reducing slippage. Slippage happens when you place a trade at a certain level only for it to be executed at another level. This often happens in periods of high volatility. Using a pending order can help you reduce that.

- Trading the open. When trading stocks, the open is usually the most opportunistic period. A pending order can help you capture some of these early movements.

Types of pending orders

Broadly, there are four main types of pending orders in the market: Buy and sell limit and buy and sell stops. Other less popular pending orders are buy stop limit and sell stop limit.

Buy stop

Buy stop is an order type where you place a buy order at the top of the current level. For example, if the EUR/USD is trading at 1.1200, you can place a buy stop at 1.1230. In this case, if the price continues going up, the 1.1230 will become your new market order. As such, you will benefit when the price continues to go upwards.

For example, in the EUR/USD pair below, we see that it formed a descending channel after it reached the 23.6% Fibonacci retracement level. Therefore, if you were unsure of the eventual breakout, you could have placed a buy stop trade at the 23.6% retracement at 1.2171. In this case, the trade would have been initiated only if the price reached this level.

Buy stop example

Sell stop

Sell stop is the exact opposite of a buy stop. It is a situation where you place a sell trade below the existing price. In this case, if the price continues to drop, the sell stop level will become the new market order.

In the example below, we are using the same chart as shown above. In addition to the buy stop, you could have placed a sell stop trade at the 1.2065 level. If the price dropped to this level, it would become the market order. As a result, you would benefit if it continued declining. In this example, as you can see, only the buy stop was initiated.

Sell stop example

Buy limit

A buy limit is a buy trade that is initiated below the current market price. The idea is that if the currency pair is trading at 1.1200, you can expect it to drop to 1.1185 and then resume the upward trend. When you do this, 1.1185 will become your new market order, and you will benefit when the price continues to rise.

For example, in the USD/ZAR chart below, we see that the pair has started rising. However, it has found some resistance. Therefore, if you believe that the price will drop to 14.89 and then rebound, you can place a buy limit at that level.

Buy limit example

Sell limit

A sell limit trade is the exact opposite of a buy limit. It refers to a situation where you place a sell order above the current price. The hope is that the currency pair will rise, reach that level, and then resume the downward trend.

In the USD/ZAR pair example, you could assume that it will rise to the 23.6% Fibonacci retracement level and then start falling. As a result, you could place a sell limit order at that level, as shown below.

Sell limit example

How to use pending orders in robo-trading

As mentioned above, robo trading is the practice of using algorithms to initiate trades. In most cases, robo trading uses market orders since the orders are only executed when a certain criterion is reached.

However, it is also possible to combine the concept of pending orders in robo-trading. For example, you can build a short-term robot that uses the concept of bracket orders.

A bracket order is a pending order that is accompanied by an opposite order. They also have stop losses. In other words, you have an original order that is then sandwiched by other pending orders. You can tweak the details of your robot every day to match the situation in the market.

Final thoughts

Pending orders are excellent features of the market because they help you open trades when your preferred criteria happen. They also help you to trade even when you are not around. However, they also have their risks. For example, in the last example above, if the USD/ZAR pair rose to 15.85 and then reversed, it means that you would have missed that opportunity.