Position sizing is one of the most critical forex trading secrets and a crucial money-making hack in the highly lucrative capital markets. In its purest form, it refers to the amount of money or capital that a trader allocates to each trade as part of risk management.

Regardless of whether one is engaged in manual trading or automated forex trading, position sizing accounts for 91% of the overall performance. We are willing to bet that bad trading decisions are usually accompanied by money management and position sizing errors. The size of each position in an investment portfolio or trading account is by far the most essential factor in addition to choosing the right security and timing the market. This is a crucial component for successful management of funds or capital when it comes to investing in the capital markets.

Any firm trading plan should make it easy for a trader to determine the ideal size of any given trade depending on market conditions as well as account size. An effective position-sizing plan could make a big difference in growing a trading account or taking it to zero.

In addition to using the best forex indicators for automated trading, more attention should always be focused on position and risk management if one is to survive the various cycles in the capital markets.

Determining Position Sizes

When it comes to deciding position sizes in the forex market, professional traders rely on two main methods. The methods play a pivotal role in ascertaining the amount of risk per trade.

Percentage of Portfolio

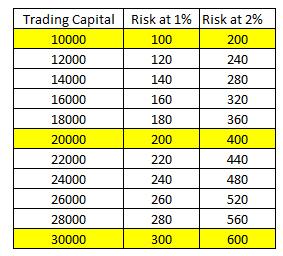

Percentage portfolio is a widely used position sizing methodology in conjunction with forex expert advisors and automated FX trading. The method entails risking a fixed percentage of an account on any given trade.

In this case, a trader can opt to risk 1% on each trade. If the account has $25,000, then the trader would time his entry and exit points such that he can only lose $250 on each position opened. The percentage point would, in this case, reduce as the account grows. Conversely, for large accounts such as $1,000,000, the percentage point on each trade might not be 1% but 0.5%.

Fixed Dollar Amount

The fixed dollar amount is a proprietary trading strategy whereby traders cap out their account size. In this case, a trader refrains from increasing the position sizes as their account grows. The capping out affects all forex-trading instruments consequently averting the stressful trading psychology that comes with risking a large amount on each trade.

The fixed dollar position sizing strategy works well with traders new to the trading business or those with a limited amount of capital. The fixed dollar amount helps in capital preservation by limiting the amount of risk taken per trade.

Stop Placement

In addition to sticking to clear-cut guidelines on position sizing, it is also important to deploy stop orders as a way of having a point to exit on each trade. Brokers offer different types of forex orders for managing trades. Similarly, stop orders are a particular type of forex product that limits the accumulation of losses that can pile up while trading on big position sizes.

Therefore, stop orders make it possible to quantify the exact risk that each trade poses on a trading account. Position sizing, as well as the use of stop orders, is often used hand in hand with various forex charting tools for risk management.

The Importance of Proper Position Sizing

Proper position sizing lowers the inherent risk in fluctuating markets. In times of increased volatility in the markets, position sizing determines a great deal the amount of profits as well as losses that traders incur over a short period. Therefore any serious trader should stick to a position size that they are comfortable with and adjust it to their performance. Expand your position size if you’re feeling the edge and decrease positions when the trend is not that clear or you’re losing the control. The simple rule of the market is that you cannot control your profits, because the market is irrational and ambiguous. However traders can control their losses and correct position sizing together with stop losses can improve the overall performance significantly.

Skill is especially vital to newbies in the capital markets. By taking too much risk on taking large position sizes in a bid to accumulate profits faster, such traders would be exposing themselves to more significant risks. That can easily lead to a zero account balance. Position sizing is an important money management strategy regardless of whether one is engaged in algorithmic FX trading or manual trading.

Bottom line

Mastering position sizing is crucial to a successful career in trading in the financial markets. Any serious trader should establish in advance the amount of money they would readily take in as a loss, should the inevitable happen, and trade goes against them. To do so, position sizing is vital in addition to using a stop-loss order.

While position sizing, it is essential to remember that risking too little lowers the chances of growing an account faster. Similarly, risking too much increases the risk of depleting an account in a hurry. Therefore, it is crucial to go with a position size that balances the risk and reward.