A price action trader believes that the price and its movement are the most reliable source of information. When a currency starts to rise, it indicates that the investors are buying. Price action is then evaluated based on the buyer’s aggression, historical charts, and real-time price. It takes into consideration price swing highs and lows, trendlines, support, and resistance levels.

What is price action trading?

A price action strategy is a type of forex trading strategy that allows a trader to analyze the market based on actual price fluctuations. It is a simple approach where there are no indicators on the charts and traders do not follow economic news or events to make decisions.

The trader’s entire focus is on the currency’s price action, and they argue that price action reflects all the factors (economic data, events, news) that can affect and cause a market to move. Therefore, rather than trying to comprehend and sort the many distinct aspects affecting a market each day, it’s much easier to just evaluate a market and trade from its price movement.

Pin bar strategy

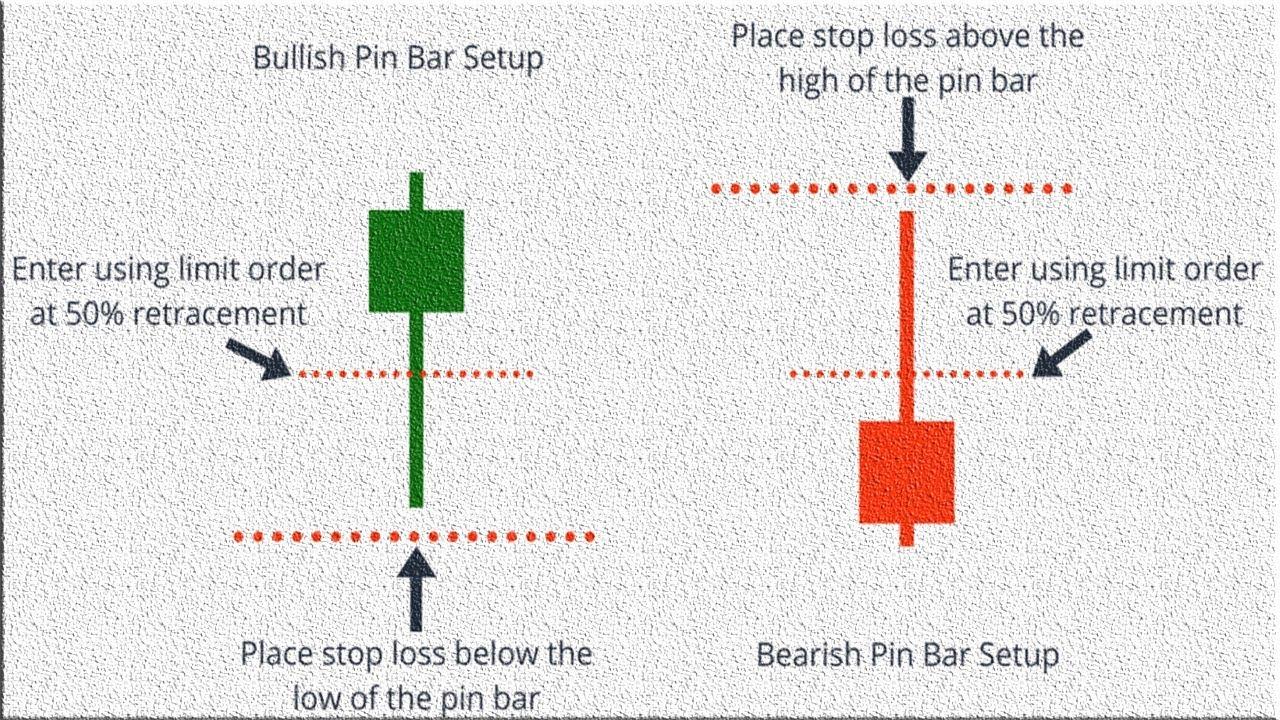

The pin bar pattern is also known as the hammer because of its distinct shape. It resembles a candle with a long wick. It has a different pattern for a bearish setup and a bullish setup.

The setup appears right before the end of a trend. It signifies a shift in the market sentiment and the last buyer or seller attack. The bar has a lengthy wick when traders exit trades made in the previous trend while simultaneously entering trades in the new trend at best possible price. The small body indicates that the opening and closing prices are roughly equal. It signifies that over that time period, neither the buyers nor sellers have made significant changes.

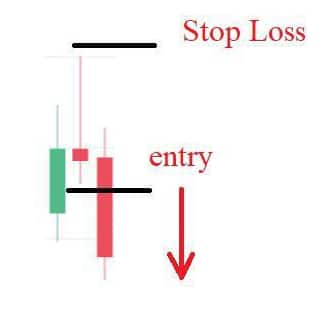

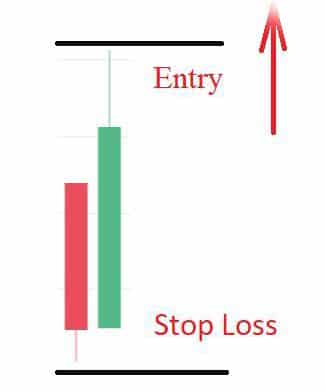

Trading pin bar setup

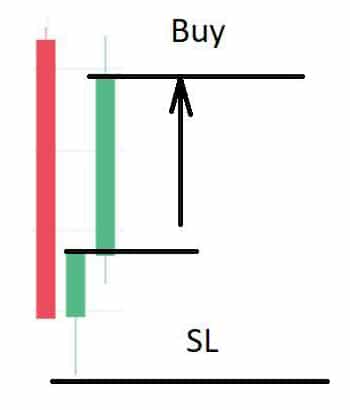

When you expect a trend to reverse at a predetermined moment, we simply wait for the price to enter a favorable price area, then we look for a pin bar. It is advisable not to enter a trade straight after a pin bar but wait for the reversal to be validated.

Because of random movements and market noise, you should establish a stop loss at a distance. For each period, the sufficient distance at which the trade is entered is chosen, but it should be more than the spread.

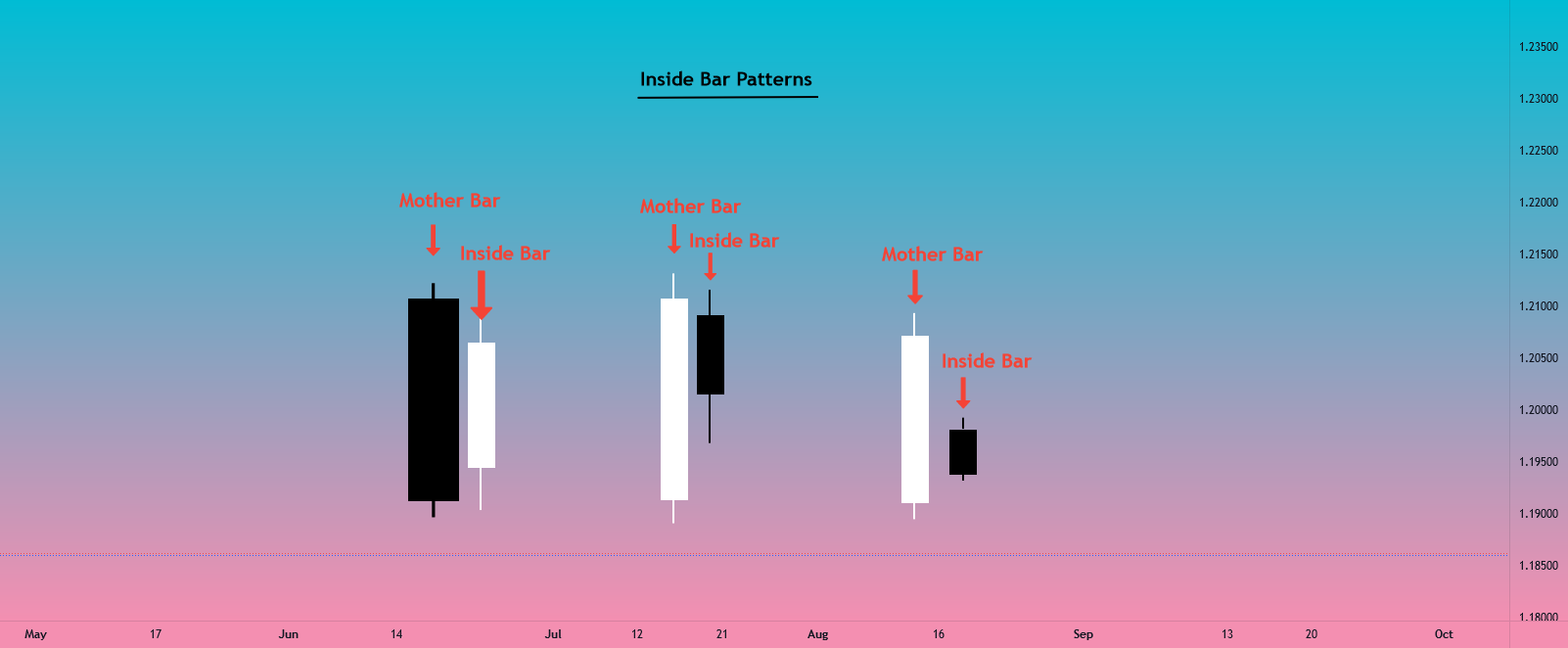

Inside bar strategy

An inside bar pattern is a two-bar approach in which the inner bar is smaller than the outer bar and lies between the outer bar’s high and low range.

It commonly appears during a market consolidation period but can also signify a market turning point.

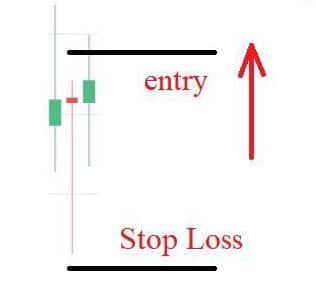

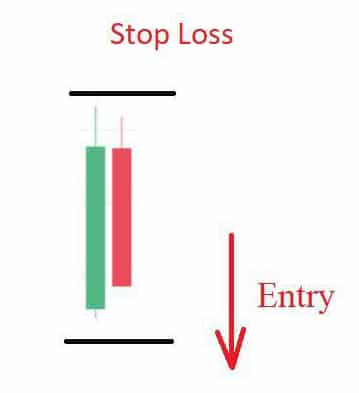

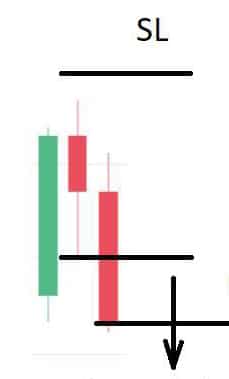

Trading inside bar patterns

An inside signifies either a breakout or reversal pattern in forex trading. It could indicate both a trend reversal and a continuation. To trade an inside bar, a buy stop and a sell stop are ideal. You are recommended to place a stop loss beyond the mother bar’s opposite end. This strategy is not always effective because the mother bar might be too big. Thus, your profit is always limited.

Sometimes the reward/risk ratio is unfavorable. Thus you are recommended to place a stop loss slightly beyond the next strong level. This method is logical, but if the price returns to the level, the decision was incorrect, and the breakout level was incorrect.

Head and shoulder reversal trade strategy (H&S)

H&S is one of the most common price action patterns. It arises when a trend has reached its limit.

In the charts above, you can see the spots for entry and stop-loss levels.

How to trade head and shoulder reversal strategy

The pattern’s first bar continues in the direction of the trend, and the second bar moves in the opposite direction with a point range equal to the first. To decrease the risk, we choose a greater distance, which is not less than the spread, and place an order when the price breaks above the setup’s high in a bullish trend or below the pattern’s low in a bearish trend. You can place a stop loss beyond the pattern’s extreme.

Pivot point reversal strategy

The pivot. Thus point reversal strategy is made of three bars. It frequently appears following a rapid trend.

In the charts above, you can see where you can enter the market and where would be the invalidation point of a trade, a stop-loss level.

Trading pivot point reversal

In a bearish situation, the price rises and reaches a new all-time high. The following bar has a lower high and low and closes the previous day’s low. In a bullish scenario, the price falls and strikes a new low. The low of the following bar shall not be lower than the low of the preceding bar, and the bar should close higher than the high of the previous bar.

Retracement entry strategy

Retracement entry is a period in which price reveres a recent move, either upwards or downwards. It’s essentially a price reversal from a recent trend. It is a safer strategy because you can set a stop loss at a more safe level on the chart, and you will be able to enter the market at a greater probability level.

If you select a conventional stop loss instead of a tighter one, the risk-return can be marginally increased. A 100-pip stop and 200-pip target, for example, can simply be converted to a 100-pip stop and a 250-pip target. This is because a retrace entry allows you to enter the market when it has more room to run in your favor thus, the price has pulled back, and so has more space to move before retracing.

Conclusion

Price action strategy is a type of forex trading strategy that is focused on the features of a currency price fluctuation. All the decisions on the price movement are made by just looking at the analysis of the price chart. The strategies used in the price chart include retracement entry, pivot point reversal, head and shoulder reversal, inside bar, and pin bar strategy.