The need to gain an edge in trading sees professional traders deploy a wide array of strategies to pursue trading opportunities. While most traders focus on technical analysis and fundamental analysis, others have found a way to profit from statistical models that rely on data analysis.

Quantitative trading, often referred to as quant trading, is a popular trading strategy among institutional investors.

What Is Quantitative Analysis?

Quantitative trading is a market strategy whereby traders rely on mathematical and statistical models to identify and execute trading opportunities. The model relies on research and measurement to strip patterns of behavior and numerical values in the capital markets.

Quantitative analysis differs from other trading strategies partly because it requires lots of computational power, given the amount of research and math analytics that comes into play. Conversely, it is a trading strategy deployed by large institutional investors and hedge funds with the financial muscle to deploy mathematical and statistical models.

Quant traders boost a balanced mix of in-depth mathematics knowledge, trading exposure, and computer skills. Similarly, any aspiring quant trader should be good at mathematics, given the computation amount involved in the trading strategy. Likewise, one ought to have a background in finance and computer programming.

What Quant Traders Do

Quants leverage their vast math knowledge to develop trading techniques. Such traders often build computer programs that administer the trading strategy to market data from the past. The model would often go through backtesting and inevitable enhancement before deployment in real markets.

In-depth knowledge of math is a must in Quant trading, given the amount of research around the trading strategy. A trader should also be able to test various mathematical models and implement multiple trading strategies.

A developed quantitative trading technique would often expose specific patterns in the market while relying on underlying data. Whenever there is a comparison between these patterns and historical climate data, a definite conclusion is made whether to open or close a trade.

Quant traders work in small or large-sized trading firms where the payout is usually handsome, and given the quantitative analysis, they carry to identify trading opportunities. Experienced quants are mostly employed in investment banks, hedge funds, and arbitrage trading firms. However, to get a job in such firms, one must have a specialized master’s degree in the quantitative stream.

How Quant Trading Works

With the help of powerful computers, quant traders rely on data-based models to determine the probability of certain outcomes happening when trading various assets. With the use of automated trading systems, quants rely solely on statistical methods and programming to determine profitable trading opportunities.

When it comes to quant trading, the focus is usually on price and the volume of assets under study. Likewise, any underlying asset parameter that can be distilled into numerical value can be incorporated into the trading strategy. For instance, there are tools programmed to monitor investor sentiments across the market, providing valuable statistical data for making an informed quant trading decision.

Quantitative Trading Systems

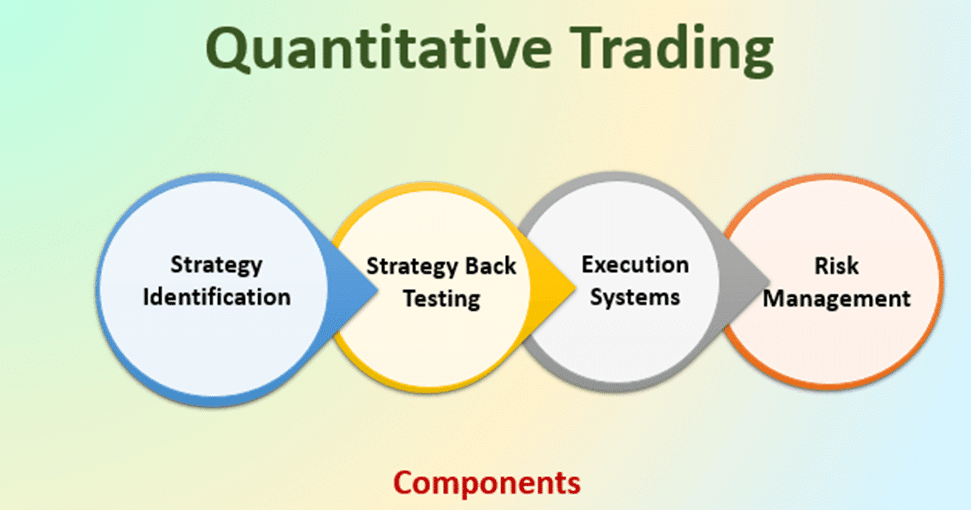

A quantitative trading system has four main components

- Strategy

- Backtesting

- Execution

- Risk Management

Strategy

Quants envision a trading strategy they would use to trade various markets. The strategy involves studying price action in the market as well as carrying out fundamental analysis. While the strategy is usually in the form of a hypothesis, the most crucial step entails turning it into a mathematical model. A quant trader would often collect all the valuable data focusing on volume and price in return used to develop a mathematical model.

Execution

If proved to be highly successful in the backtesting stage, a quant trader would execute the real markets’ quant trading system. Execution can be manual or with the help of automated trading systems. By integrating the quantitative trading system into a computer program, a quant trader would automatically open and close positions based on pre-set rules.

Risk Management

Any trading strategy must come with a risk management provision. Capital allocation is an essential aspect that quant traders consider, covering the size of each trade. How much capital goes into each trade is also taken into consideration.

Backtesting

With the mathematical model in place, a quant trader can apply the strategy to historical data to understand how it is likely to perform in real markets. At this stage, a quant trader will try to optimize the quantitative trading system while ironing out any kinks and tightening any loose ends based on the available data.

How To Become a Quant

Quant trading is not for everyone. It is an ideal trading strategy for people who can collect and use vast amounts of data to make quick and informed trading decisions. As computer-aided algorithms mine data, quant traders mine and analyze the data to identify trading opportunities and develop trading strategies.

If you wish to become a quant trader, then you must portray some of the following traits.

Innovative mindset

Quants are highly innovative as they look at the market and various trading algorithms with an improved mindset. The innovative mindset is what allows them to go against the grain and make decisions that might seem odd but based on proven statistical models.

Love Numbers

Quantitative trading is all about researching and analyzing data to identify trading opportunities. To study and test data and implement various trading strategies requires a firm grasp of mathematical concepts. A firm grasps of math, and quantitative analysis is thus critical to succeeding as a quant trader.

Programming

Quant traders are highly computer literate, with some possessing high computer programming skills. Vast knowledge of various computer languages and coding skills allow traders to integrate quant trading strategies into computer programs. In return, the programs are relied upon to carry out data mining, research, and analyze various trade patterns based on underlying data.

Bottom Line

Quantitative trading is an important trading strategy whereby traders leverage various mathematical models to identify trading opportunities. The strategy allows traders to analyze an immense number of markets across limitless data points. Likewise, the strategy removes emotions from the selection and execution of trades; therefore, alleviating biases that often affects most traders.