In the context of forex trading, the term scalping refers to a trading style, where the traders purchase a currency pair and hold it for a short period of time with the aim of making a profit. It falls under the category of a day trading strategy, based on short and quick transactions which aim to generate profits from small price changes. Traders who engage in this, better known as scalpers believe that minor price moves are much easier to follow when compared to larger ones, and can thus implement up to 200 trades per day.

Scalping can be seen as the closes thing to market-making where the trader tries to buy at the bid and consequently tries to sell it at the ask price, taking the spread as profit. Each of these numerous trades possesses a small profit objective. Because the trader’s profit consists of an accumulation of smaller profits, each loss should also be limited. Also, the time frame for a scalp trade can be as little as 1 minute.

Different Scalping Tools Available

The nature of scalping involves lots of orders, quick ins and outs of trades, and purchasing and selling within a very narrow price range. Because of this, there are some tools without which a scalper cannot trade properly: Information, Market analysis tools, and order management tools.

Market Analysis Tools

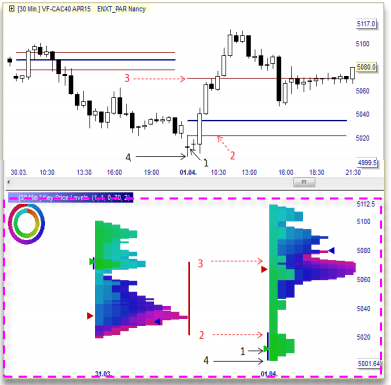

Volume and price levels are of utmost importance to a scalper as it requires knowing at which price levels market participants are buying or selling. As a scalper, you will essentially be looking for a level where buyers buy, which is where you will make your small profit. In this context, you can LiveStatistics and Key Price Levels.

- LiveStatistics allow traders to define a market based on different parameters in real-time. It produces projections of the current market price in the chart, based on past events and their price developments.

- Key Price Levels is a tool that provides detailed insight into executed orders. It projects the key price levels of the previous day on the chart.

Order Management Tools

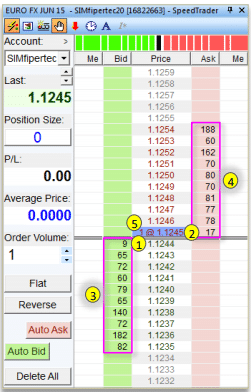

Since scalping involves placing orders in quick succession and with great precision. This means that your target will be only a few points away. Your close orders need to be placed automatically when the position is opened. Since they trade around the bid-ask price, the orders get executed immediately if orders are not placed at the right level. Once opened, the size, average price, and profit/loss of the position need to be clearly visible in the chart and order book. You will thus need separate tools for both placing orders and managing the open orders when it comes to scalping.

To Place Orders

Scalping needs new orders to be placed with precision and quickly. Some of the tools that can help a scalper in this respect include:

- Automated bracket orders: Automated bracket orders are a tool that automatically places the stop order and target order. Whatever platform one chooses, it needs to possess a variety when it comes to calculating stop and target. It also has to offer the possibility of closing at different price levels.

- Orders via a chart: Scalper who prefers using charts can place orders in the same way, using the order book. All types of buy orders are usually placed in the green column, and the sell orders are placed in the red column.

Managing Open Orders

Once you place an order, you need to be able to change this quickly with efficiency and unparalleled accuracy. Thus the trader should be able to modify an order in one step with one instruction. Traders using charts should be able to click the order in the chart and slide it to a different price level.

Information

There’s no doubt that scalpers require correct information as much as possible since they cannot afford to lose several trades. Since the main aim here is to generate a small profit, traders must also close when any small loss is incurred. In order to be correct the first time, traders require tools that provide accurate and real-time information about any possible price movement.

Here, scalpers can use the information provided by tools such as the order book, which covers open orders, and the Time&Scales screen, which covers all executed orders.

Advantages of using Scalping in the Forex Market

- Scalping as a strategy is ideal for a retail forex trader as the barrier to entry is low.

- Because scalping requires less of a grasp on the market and existing trading theories, it’s a popular strategy with newcomers.

- Scalping allows traders to get in and out of trading positions easily in the forex market as it’s a large and liquid market.

- Scalping is suitable for those who hate waiting for the closure of a trade. Since positions in this trading strategy are generally held for a small timeframe, there is a lower chance of reversals which can negatively affect a trading position.

Disadvantages of using Scalping in Forex

- Scalping requires traders to take on an increased amount of leverage to make small trades worthwhile. However, using leverage can go both ways, and is considered as a “double-edged sword”. This is because leverage has the potential to magnify profits, as well as magnify losses. Thus, scalpers require a larger deposit amount that can handle the leverage, something which most novice traders won’t have.

- Since the profit from individual trades is smaller, it becomes a challenging ordeal for a trader to reach their financial goals. For instance, a mere 5-pip yield on trade is insufficient for most traders.

- Good trades in scalping can only yield a 1:1 risk-reward ratio or less. This means that one trading loss can cancel out any profits from previous smaller trades.

- Scalpers can experience frequent and substantial losses if trades move adversely. This usually happens if the trader does not have an exit strategy or a stop loss trade.

Final Thoughts

As a strategy, scalping is not suitable for every type of trader, in spite of its popularity as a perceived safe trading style. Just as the violent price swings and volatility of the currency market can add to a scalper’s gains, they can amplify losses as well. Thus traders should gather complete knowledge including how to get in and out of scalping trades to be successful in the long run.