SIEA Zen assures traders a balanced risk to reward ratio. As per the vendor, the trading system has been developed from 10 years of experience. Patience, discipline, and a clear edge achieved by the unique analysis of trading volume are cited as the success behind this EA. This product is part of the Stein Investments Expert Advisor series.

Product offering

As per the developer, this product is named Zen because of the awesome performance it provides and the peace of mind it gives to its users. The MQL5 site promotes this product. We can find the various features of the MT5 tool explained including the trading style, news handling, swap management, risk management, and requirements.

Daniel Stein is the developer of this expert advisor and the founder of Stein Investments. He has more than 7 years of experience in the field and has developed 15 products and 9 signals. We could not find a location address or phone number for contacting support. The lack of support methods raises our doubts regarding the reliability of the product.

SIEA Zen

| Type | Fully-automated EA |

| Price | $999 |

| Strategy | Trade volume analysis |

| Compatible Platforms | MT4, MT5 |

| Currency Pairs | 28 currency pairs |

| Timeframe | Any |

| Recommended Min. Deposit | € 2500 |

| Recommended Deposit | €10000 |

| Leverage | from 1:30 |

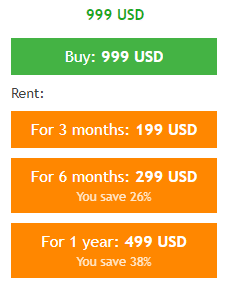

To purchase this MT5 tool you need to pay $999. A few rental packages are also available. For $199 you can use the software for 3 months. The six months and one-year rental packages cost $299 and $499 respectively.

Trading strategy

As per the developer, this expert advisor uses a special volume analysis for identifying imbalance and the intensity to find the reverse entry points. This FX EA works on 28 currency pairs formed by the major currencies namely USD, GBP, JPY, NZD, AUD, CHF, EUR, and CAD. The ATS closes its open positions at the end of each month and begins a fresh cycle in the subsequent month.

On an average, the duration of trade is 4 days. A minimum deposit of € 2500 is recommended by the developer for better profits. Among the important features that this system focuses on includes an integrated new filter that is set to avoid opening new positions during central bank events.

Trading results

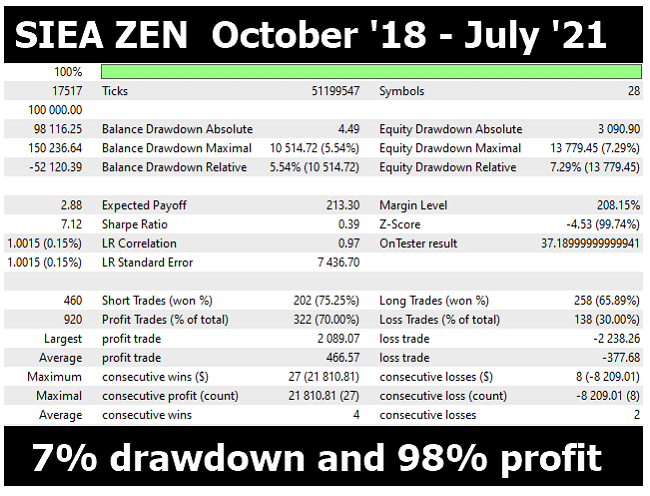

A few backtest reports are present for this FX EA. Here is a strategy tester report of 100% modeling quality done from October 2018 up to July 2021.

For a deposit of $100000, the net profit amounted to $98116.25 and the maximum drawdown was 7.29%. Profitability of 70% and a profit factor of 2.88 are present for the account. While the profits were high and the drawdown was low, the overall profitability was low indicating poor performance and ineffective strategy.

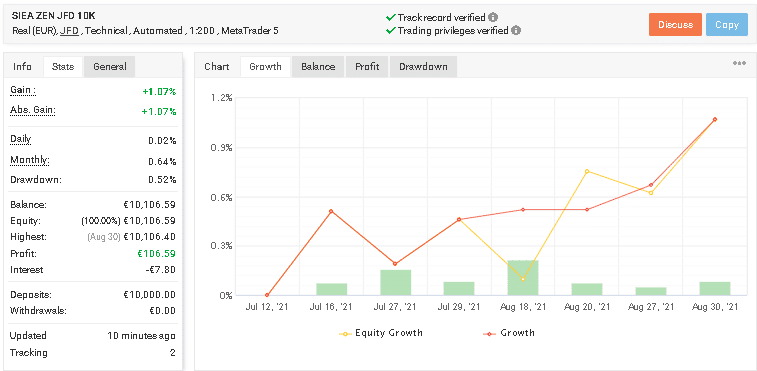

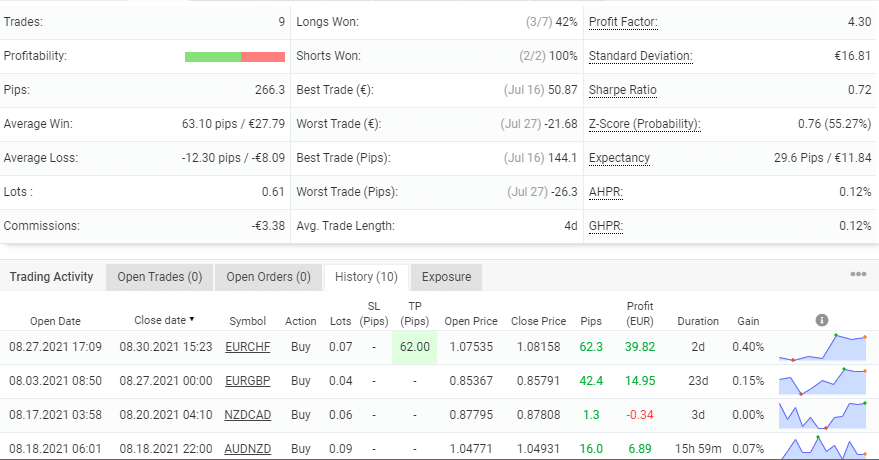

The developer also has real live account results verified by the myfxbook site. Here is a screenshot of the result:

From the trading stats, we can see a similar value of 1.07% for the total profit and absolute profit percentage. A daily profit of 0.02% and a monthly profit of 0.64% are present for the account with a drawdown of 0.52%. For an initial deposit of€10,000, a total of 9 trades have been executed from July 12, 2021, up to August 31, 2021.

The profitability is 56% and the profit factor is 4.30. From the trading history, we can see the lot size varying from 0.04 up to 0.09. The varying lot size, low trade frequency, and poor profit indicate a risky approach and bad performance.

Customer reviews

We could not find user reviews for this ATS on trusted third-party sites like Forexpeacearmy, Trustpilot, etc. However, the MQL5 site has two reviews for this system.

From the above reviews, it is clear that the system is new and will need more time to provide a better insight into the performance. One of the users mentions the low frequency of trades that we observed in the live trading results. With only two reviews we cannot assess the true performance or support the developer offers. Further, the system is new so it is early yet to make assumptions based on the small sample size and the backtests.