A forex trading robot, also known as an expert advisor, is a tool used to automate the trading process. Some robots can execute orders directly, while others can send you an alert when the preset parameters are met. In this article, we will look at some of the best strategies to use with robots in day trading.

How forex robots work

A robot is developed by combining trading and software development strategies. For example, assume that your trading strategy involves buying when the short and longer-term moving averages cross over. In this case, you can create a robot that automatically buys the pair when this crossover happens.

Similarly, if you tend to buy when the Relative Strength Index (RSI) gets extremely oversold, you can create a robot that does that. Alternatively, you can develop a robot that sends you a notification when these parameters are met.

How to build a trading robot

To build a robot from scratch, you will need to have excellent day trading skills. This is because you are basically converting these skills into software format.

Most importantly, you need some programming experience. If you use MetaTrader 4 or 5, you need to have knowledge of the MQL programming language. On the other hand, if you are using TradingView, you will need to have knowledge of the Pine language. Other programming languages popular with day trading are Python, Perl, and C++, among others.

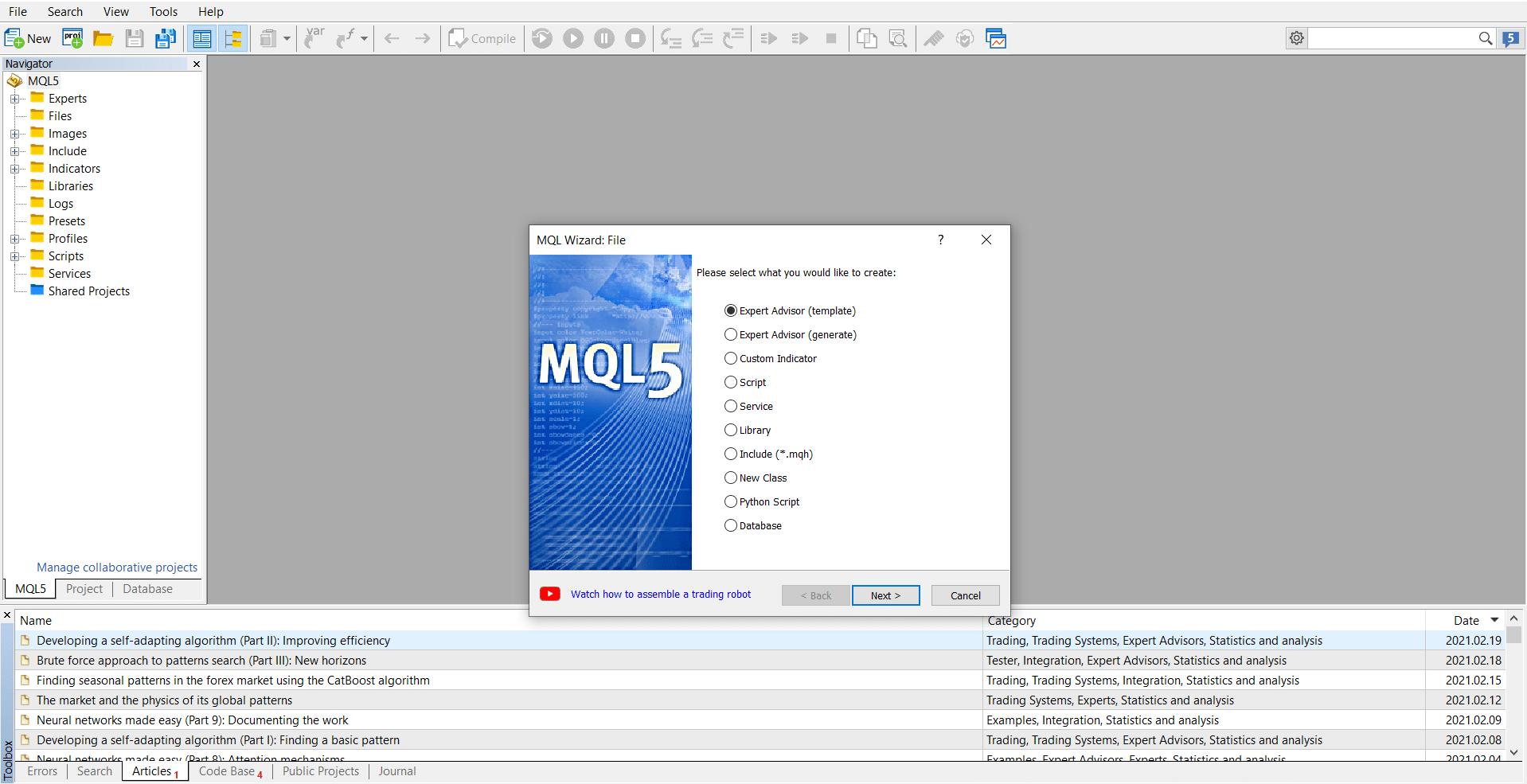

Another approach to building a trading robot is to use pre-built templates. Most platforms like TradingView and MT5 have these templates that you can use. In MT5, you just need to go to Tools followed by MetaQuotes Language Editor. On the next page, click New and select template, as shown below.

Generating a robot in MT5

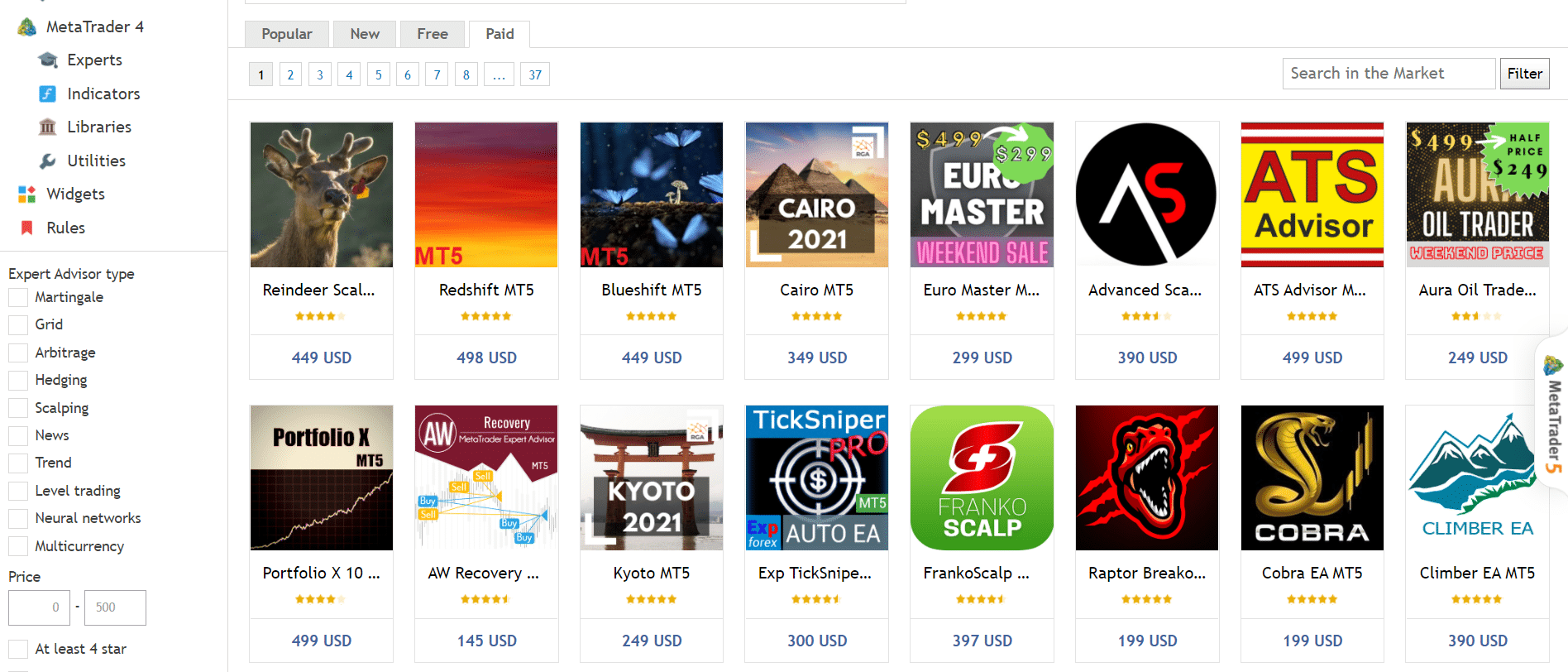

Finally, you can buy a pre-built trading robot. You can buy one directly from the developer’s website, or you can use popular marketplaces like the MQL5/4. The latter is the most popular source to buy these robots for traders using the MT4 or 5. You can do this directly from the platform, which will redirect you to the marketplace, where you can complete the transaction. These robots range from zero dollars to hundreds of dollars, as shown below.

MQL5 marketplace

Precautions when buying the robot

Buying a robot can sound tempting. However, there are several things you need to do before doing so. First, always dig deeper before you buy the robot. For example, if you are buying from an independent website, read reviews before you spend your money. A simple Google search can give you more details about these robots.

Second, request a free trial before buying the robot. If a developer seriously believes that their robots work, they will offer you a free trial. Use the free trial period to learn more about the robot and to use it in a demo account. You should only pay for a robot that you believe works as advertised.

Finally, always read the fine prints of these robots. In other words, learn the details of how it works and how you can set it up in the market. For example, a robot can be developed to trade crude oil on the hourly chart. Therefore, it might fail if you use it on the EUR/USD on the 30-minute chart.

Backtesting a trading robot

Backtesting is one of the most important aspects of using a trading robot. It refers to the process of using historical data to forecast the direction of a currency pair. Fortunately, all trading platforms like the MT4/5, TradingView, and NinjaTrader have tools to help you backtest the indicator.

To access the strategy tester in MT4/5, you need to go to view or use the shortcut of Ctrl +R. After this, you need to select the robot you want to test, the currency pair or symbol, the period you want to analyze, and the delays. Further, you should add the modeling strategy you want to use and the optimization. You should then run the robot and see the result.

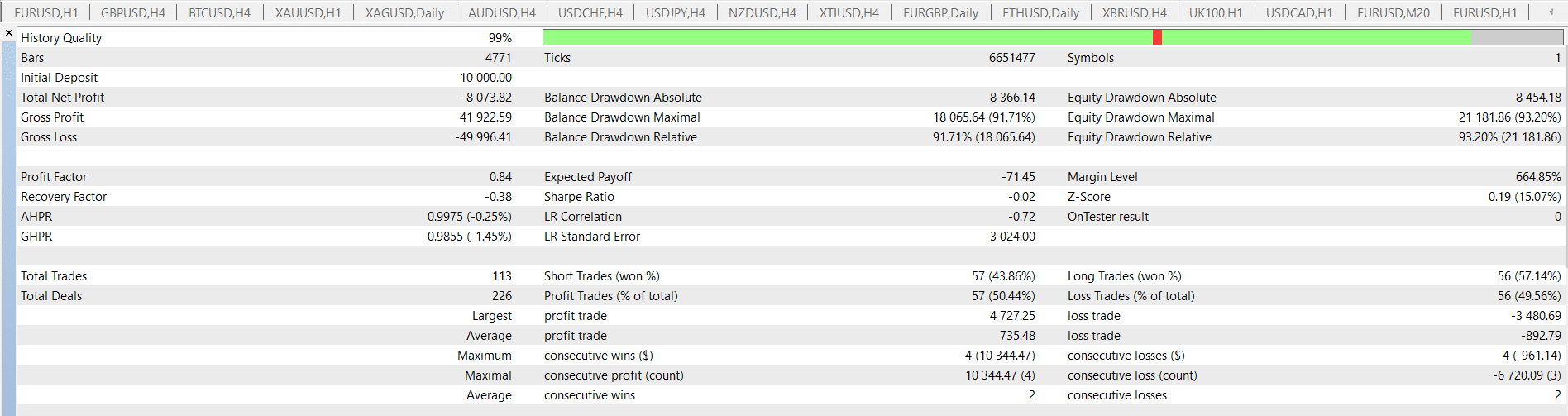

The chart below shows the results of the MAPSAR robot that was embedded in MT5. We have analyzed the 30-minute GBP/USD pair in a period of four months. In the backtest, we have assumed that we have a $10,000 account with a leverage of 1:500.

The results show that in this period, the robot opened 113 trades. In total, it made a gross profit of $41,922 and a gross loss of $49,222. As a result, the net loss was more than $8,000.

MAPSAR backtest

You should backtest the indicator in different conditions to see what works and what doesn’t.

Risk management when using robots

Another important aspect when using trading robots is risk management. For starters, this is the process of maximizing profits and minimizing risks. You should always strive to use the best risk management strategies when using robots. That’s because, as you will find out, there is no robot that is 100% perfect.

There are several things you can do to manage risks when using robots. First, you can ensure that all your trades have a stop loss and a take-profit. These two tools will ensure that you will only lose money that you can afford. You should use these two tools well based on your risk appetite.

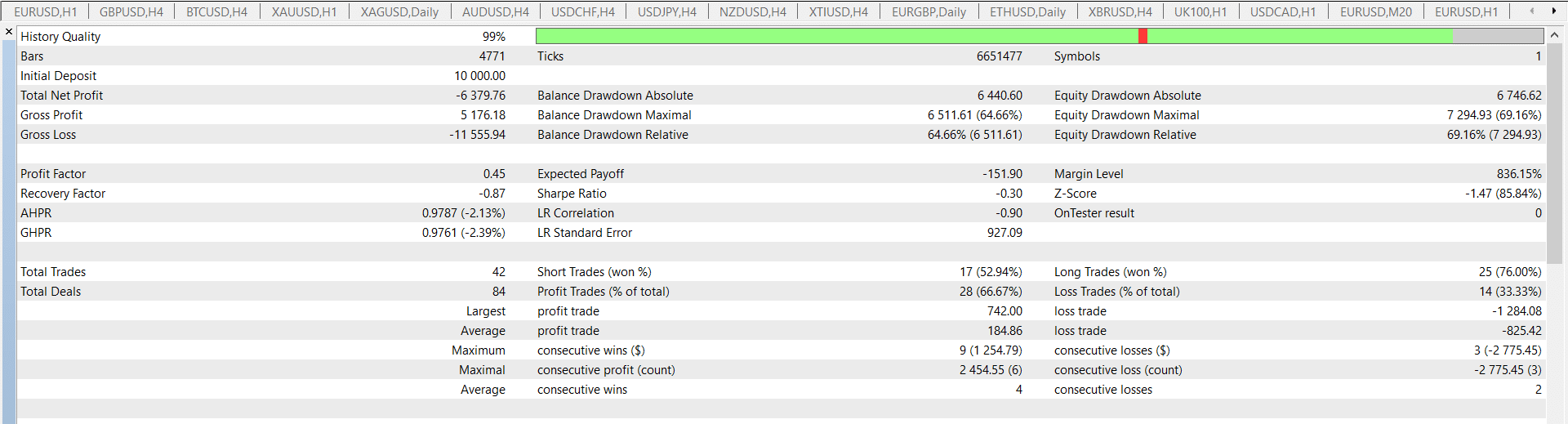

Second, you should always manage your leverage well. Using excess leverage can lead to significant losses. For example, the chart below shows that the same backtest showed above generated a net loss of more than $6,000. That was a smaller loss because the backtest below used the leverage of 1:100 instead of 1:500.

Using leverage in robots

Finally, always observe the trades in the early days of using the robot. Doing this will help you see how it is working. After months of testing it, you can leave it and let it work.

Final thoughts

Day trading using robots is an excellent strategy of day trading. For one, robots can open and close trades even when you are not around. However, they require a lot of caution, especially among new traders. In this article, we have looked at some of the best strategies you can use and how to mitigate the risks.