The US dollar is a dominant force in the global financial system. However, you will be mistaken to think it is the most valuable in a field where alternatives are always in plenty.

The greenback loses its edge as the most valuable legal tender partly because of some policies that have come into play in recent years. The passing of trillions of dollars in stimulus packages to combat the COVID-19 shackles have all but continued to fuel weakness.

The dollar lags some fiats that accrue their edge on friendly budgetary policies and natural resources exposure. There are more dollars in circulation than any other currency, which could also explain its weakness compared to peers with limited supply.

Below are some of the best alternatives known for their strong purchasing power?

Swiss franc (1 CHF = 1.09 USD)

Seen as a safe haven, the Swiss Franc has always stood its ground against the greenback at the valuation top. Its edge as one of the most valuable with stronger purchasing power stems from its stable political system and robust financial system.

Also, Switzerland is one of the wealthiest nations, backed by some of the highest gold reserves. The franc is well-supported by strict regulatory policies and low debt levels that have continued to strengthen its purchasing power.

Euro (1 Euro = 1.20 USD)

Euro strength stems from the fact that it is backed by some of the biggest and stable economies. Adopted in 1999, it comes a close second as a world reserve money and official legal tender for 19 member states.

One euro equivalent to 1.20 USD affirms the common currency edge against the buck. Economic growth in France and Germany has all but continued to affirm its edge against the buck. In addition, it is one of the most used legal tenders on international trades, which has continued to strengthen its value.

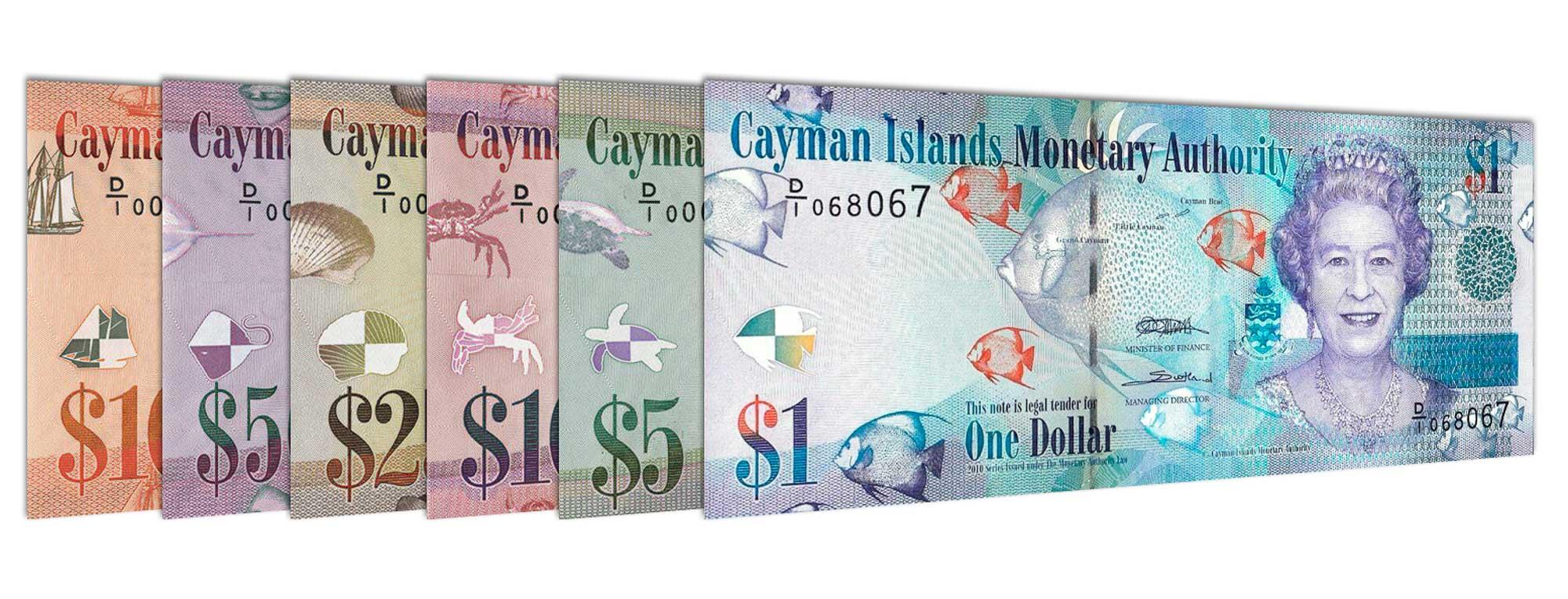

Cayman Islands dollars (1 KYD = 1.20 USD)

The Cayman Islands is best known as a tax haven. Likewise, the British territory has one of the strongest legal tenders in the world. KYD has continued to strengthen against its peers by virtue of the territory’s solid financial system supported by some of the most significant financial institutions.

The Cayman Islands is known to provide banking licenses to banks, hedge funds, and insurance companies.

Gibraltar pound (1 GIP= 1.40 USD)

Gibraltar’s economy might not come close to that of the US. However, the nation boasts of one of the strongest legal tenders in the form of the Gibraltar pound. With one GIP equivalent to about 1.40 USD, it is clear the greenback is a no match.

The GIP’s strong purchasing power can also be attributed to the country’s robust financial services industry and online gaming industry. In addition, the economy is well supported by the thriving tourism industry.

Pound sterling (1 GBP = 1.40 USD)

The UK’s native fiat has always been stronger than the buck. Even though it has lost significant value in recent years, one pound is still worth more than the greenback. Low inflation levels in the UK are one of the reasons the sterling has always commanded a much stronger purchasing power.

There are far fewer pounds in circulation compared to the greenback, which could also be the reason why the latter lags when it comes to strength.

Jordanian dinar (1 JOD = 1.41 USD)

While the Middle East has always been the epicenter of political instability, several bills still command a hefty valuation compared to the greenback. The Jordanian dinar is one such that holds the upper hand against its peers.

The JOD does not significantly influence the global financial system despite boasting of sufficient purchasing power. It is mainly used within the kingdom.

Oman rial (1 OMR = 2.60 USD)

Oman Rial is another fiat that has some weight against the greenback. Introduced in 1973, it has continued to strengthen in value due to its vast oil reserves. While 1OMR is worth 2.60 USD, its value is usually susceptible to oil prices.

A spike in oil prices translates to more profits from the lucrative business, which often results in the strengthening of the Omani Rial. Likewise, a plunge in oil prices often results in weakness in the rial against the buck.

A tight regulatory policy has also helped support the Omani rial’s value against its peers. The state comes with the financial restrictions as policymakers seek to protect the money supply amid a raging battle in the region. The policies have had a significant impact on the inflation rate, therefore, impacting the rial.

Bahrain dinar (1 BHD = 2.65 USD)

Bahrain is another state known for its rich oil reserves, which has been the factor behind Dinar’s strength against the greenback. Populated with just over a million people, it is one of the wealthiest nations thanks to vast black gold reserves.

Similarly, one Bahrain native coinage is worth more, well supported by the lucrative oil business. The fact that there are far fewer Dinars in circulation also affirms its strength against its peers. In addition, it is only used within the Persian Gulf Island state.

Bahrain also boasts a modest and relatively stable inflation rate that offers support to the Dinar even as others remain under pressure.

Kuwait dinar (1 KWD = 3.32USD)

Heavy oil exports supported by political stability affirm Kuwait’s edge as home to the world’s strongest legal tender. Substantial black gold production and political stability continue to affirm wealth that, in return, offer support to the native currency.

The nation has also amassed a significant amount of sovereign wealth through the proceeds of the booming black gold business. A booming oil business should affirm the Kuwait Dinar status as the strongest legal tender.

Conclusion

The US dollar is the most powerful currency. However, it is not the strongest. Its strength has been chiefly affected by widening deficits and stringent policies designed to stabilize the US economy.