The cryptocurrency trading industry is seeing robust growth as the number of participants rises. The sector is now valued at over $1.8 trillion, making it a real asset class.

As with all industries, the sector has come with its own jargon that participants need to know. In this article, we will explain some of the most important crypto trading terms that beginners need to know.

Smart contract

A smart contract is an important concept in the blockchain industry. It refers to the process where a contract between two or more people is based on software. As a result, there is no need to sign papers and even meet the person you are doing business with.

Smart contracts play a pivotal role in the blockchain sector since they make it possible for products like non-fungible tokens (NFT), gaming, and decentralized finance (DeFi) to exist well. It has also helped the creation of many decentralized products like Aave and Uniswap.

Decentralized Finance (DeFi)

DeFi is another important term that is widely used in the blockchain industry. It is an industry that is attempting to change the financial industry by bringing power to the people. As such, instead of dealing with centralized financial institutions like banks and online brokers, one can use those that are decentralized in nature.

In DeFi, governance is mostly done by holders of the network’s token. These holders can vote on whether to increase or reduce fees. They can also vote to move the network from one chain – say Ethereum – to another one like Avalanche and Cronos.

Proof-of-stake (PoS)

Cryptocurrencies are usually created in a complex process. For example, some coins like Ravencoin and Bitcoin are created using mining that involves solving complex mathematical calculations.

Proof-of-stake is a consensus-based method that involves nodes and validators. For a transaction to be completed in a PoS network, the validators need to confirm the deal.

PoS has become a popular approach in the blockchain industry. It is often faster than mining, and the overall costs of processing transactions are substantially lower. For example, a PoS network like Avalanche can process over 4,500 transactions per second. It is also environmentally friendly.

Proof-of-Work (PoW)

Proof-of-Work is a technology that was introduced by Bitcoin and later embraced by other popular networks like Monero, Bitcoin Cash, and Litecoin. It is a process where a network is secured by a group of miners who are located around the world. These people secure the network using a process known as mining, where they solve complex mathematical calculations.

Proof-of-work is known for being more secure than PoS technology. However, it has other limitations, like being significantly slower than other PoS cryptocurrencies. Its transaction costs are also more expensive. For example, Bitcoin has an average transaction cost of about $2.7, while most PoS platforms have transaction costs that are less than $0.01.

Staking

Staking is popular in proof-of-stake technologies. It is a process where ordinary people provide a certain number of coins to the network to secure it. By providing coins to the network, they are eligible to make a certain amount of money every month. Therefore, regardless of the direction of the coin, holders receive money as agreed.

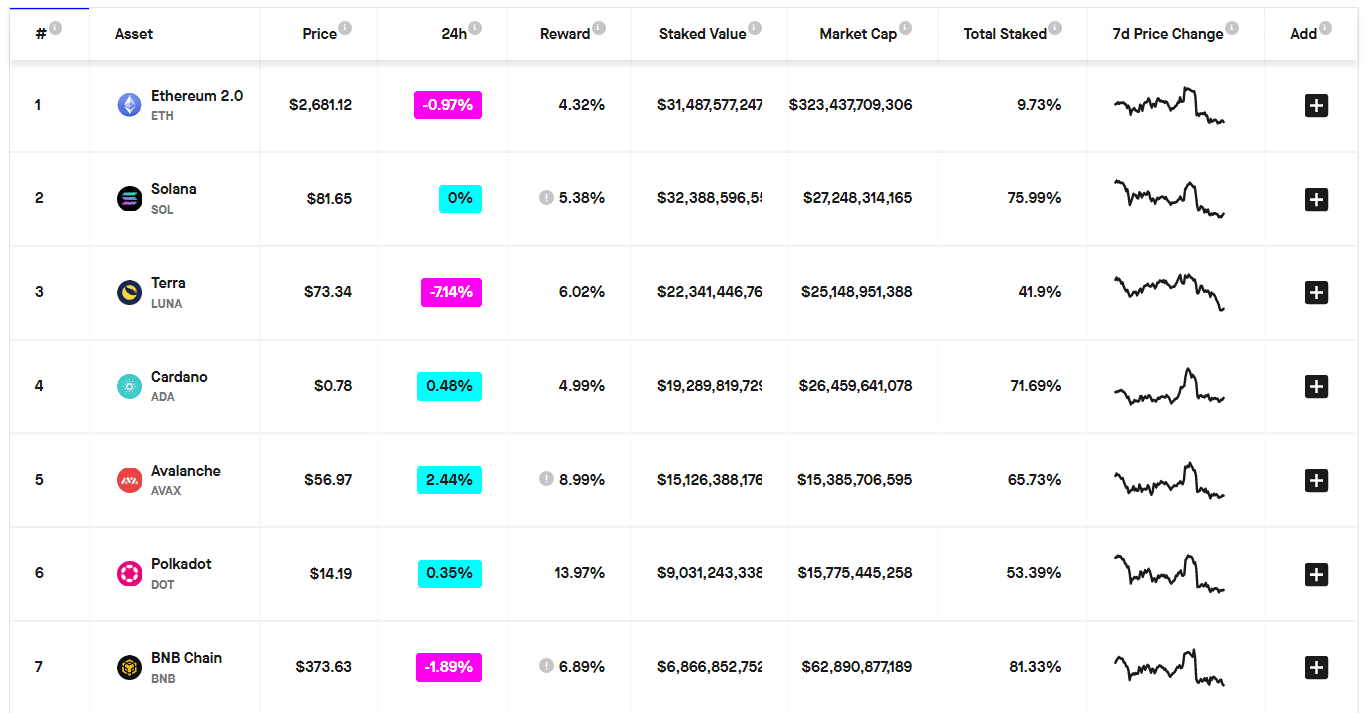

Staking is relatively easy to implement. All you need is to find an exchange that accepts staking. After this, you should buy the coin and then hold it as agreed. Finally, you will be paid a certain amount depending on supply and demand. The chart above shows the returns of several proof-of-stake tokens.

Total value locked (TVL)

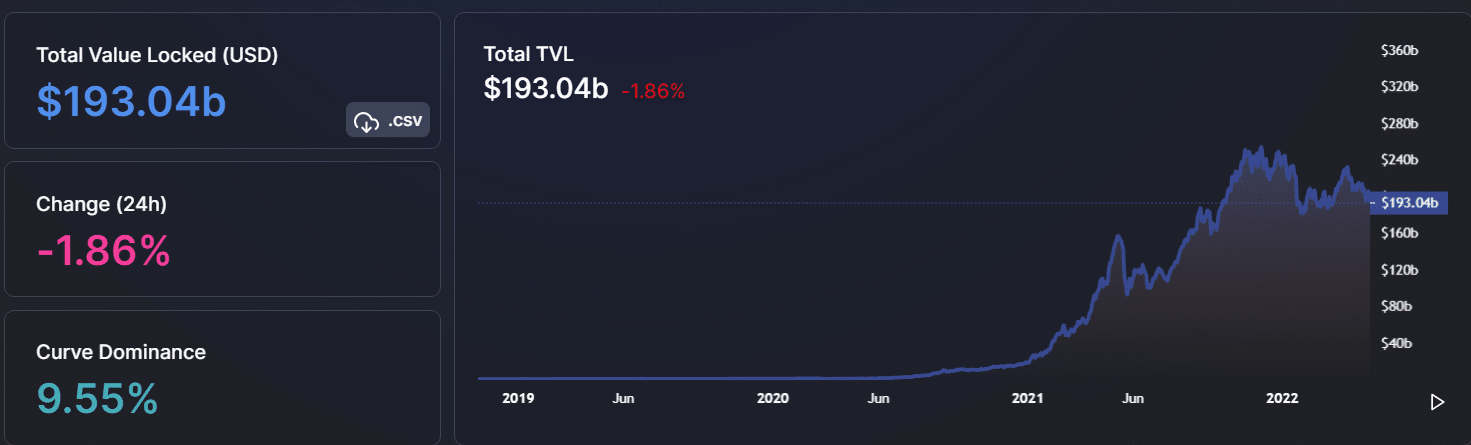

Total Value Locked is a term that is popular in the decentralized finance (DeFi) industry. It is a figure that people use to gauge the performance of a DeFi application. TVL refers to the total amount of money that has been secured in a certain DeFi network. A higher number means that the network is more active than one with a smaller TVL.

For decentralized exchanges like Uniswap, the TVL refers to the money that has been deposited into the network.

On the other hand, in a platform like Anchor Protocol, the TVL refers to the amount of money that has been deposited and those that are provided as collateral in the network. The chart above shows the TVL in the blockchain industry.

Stablecoin

A major challenge in the cryptocurrency industry is the fact that digital coins are highly volatile. For example, at the time of writing, Bitcoin was trading at $36,000. This price is significantly lower than its all-time high of over $66,000. This is the main reason why most people have decided to ignore the blockchain sector.

Stablecoins solve this challenge by using the blockchain industry to secure these coins with stable assets like currencies and gold. These coins are mostly used by traders in the cryptocurrency industry. Some of the most notable stablecoins are Tether, USD Coin, Terra USD, and Binance USD.

Altcoin

An altcoin is a term that refers to other cryptocurrencies that are not Bitcoin. The term comes from the ‘alternative coin.’ In the past few years, the number of altcoins has been in a strong bullish trend. According to CoinGecko, there are now over 13,000 altcoins. On the other hand, CoinMarketCap tracks more than 19,000 altcoins.

Dominance

Dominance is a term that refers to a percentage value of a cryptocurrency or a blockchain platform in their respective industries. For example, at the time of writing, Bitcoin has a market dominance of 41.6%. This means that its current market cap of $684 billion represents about 41% of the entire cryptocurrency industry, which stands at $1.6 trillion.

Meme coin

A meme coin is a form of cryptocurrency that is inspired by social media memes. These coins became more popular in 2021 after Elon Musk started promoting Dogecoin. Today, they have become major players in the industry, with Dogecoin having a market cap of about $17 billion. Other examples of meme coins are Shiba Inu, Floki Inu, and Dogelon Mars.

Summary

There are hundreds of terminologies in the blockchain industry that are relevant to crypto traders and investors. In this article, we have looked at some of the most important ones in the blockchain industry and their meanings.