In the forex market, success often depends on the traders’ ability to identify trends and ideal entry and exit points. But, currency pairs don’t always have a trend. There are periods where price remains restrained within the range. That is why traders have to identify the different stages of a forex trend while trading.

As the number of traders increases, the price action activity of a currency pair can shift from trending to being directionless. These latter periods can make it impossible for traders to profit through trend trading. In such situations, scalping, range trading, and hedging are seen as ideal strategies. In this article, we take a look at the four stages of a forex trend that traders must be aware of.

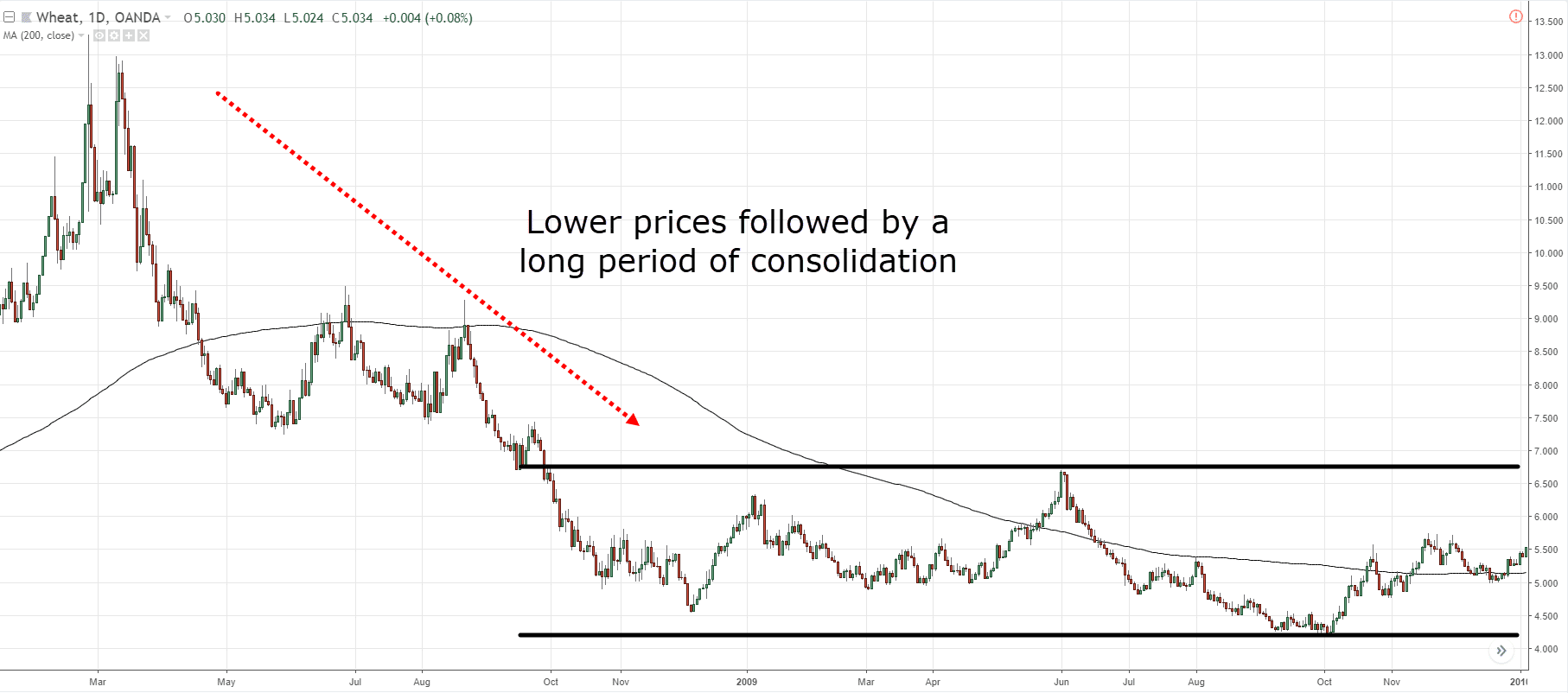

Stage 1: Accumulation Phase

This phase comes after a fall in prices and is indicative of a consolidation phase. The phase can last for weeks or months in which the price moves within a range. The bears and bulls forces are in equilibrium.

Some other basic characteristics that define this phase are as follows:

- Can appear to have long periods of consolidations

- Volatility is low because of a lack of interest

- After a price drop, the 200-day moving average flattens out

- The ratio of up days to down days is approximately equal

- The price fluctuates around the 200-day moving average

With the market in an accumulation phase, it is better to trade the range itself. A trader can buy at the range lows(the support) and short at the highs of that act as a resistance level. The stop loss should be placed outside the range.

The middle of the range is a very poor location for a trade entry, as the price can quite easily swing back to the highs or lows. This would stop you out of your position at the support and resistance area.

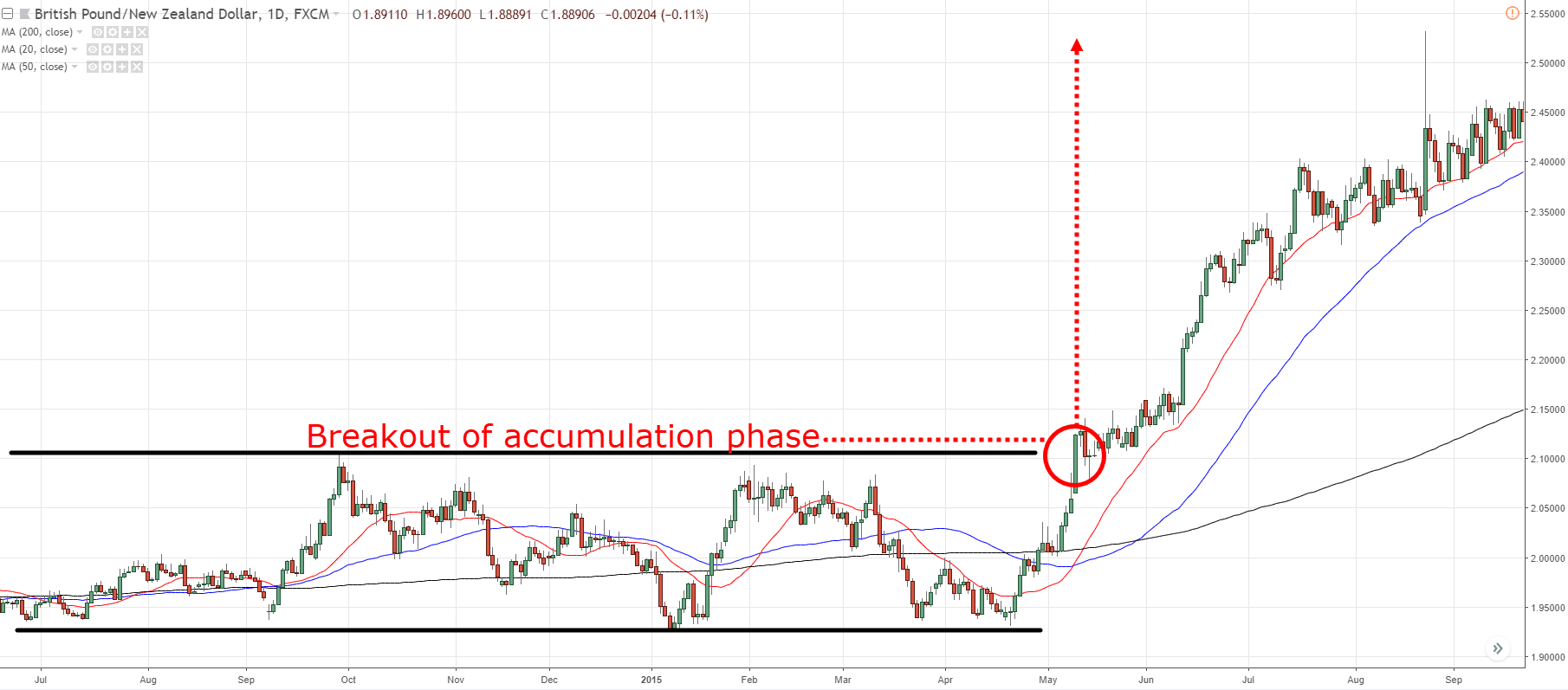

Stage 2: Advancing or momentum phase

As soon as the price breaks out of the range, the advancing phase begins. The uptrend will lead to higher highs and higher lows. Some characteristics of this phase are as follows:

- Can last from a few months to years

- Price is trading higher over time

- More up days than down days

- The short-term moving averages are above long-term moving averages

- Price is higher than the 200-day moving average

- The 200-day moving average is pointing upwards

- Due to strong interest, volatility is high at the later stage of this phase.

On the other hand, if there is a downtrend, the price will have lower highs and lower lows. It will also stay below the long-term moving average. In a downtrend, there will also be more down days than up days.

During uptrends, traders can enter long positions on pullbacks to the moving average. In the case of a downtrend, traders can enter short positions since the price is likely to continue edging lower. The one thing that you want to avoid is to go short during an uptrend. You should always look to trade with the trend (whenever the price pulls to the moving average), as this will allow you to get the most out of your buck.

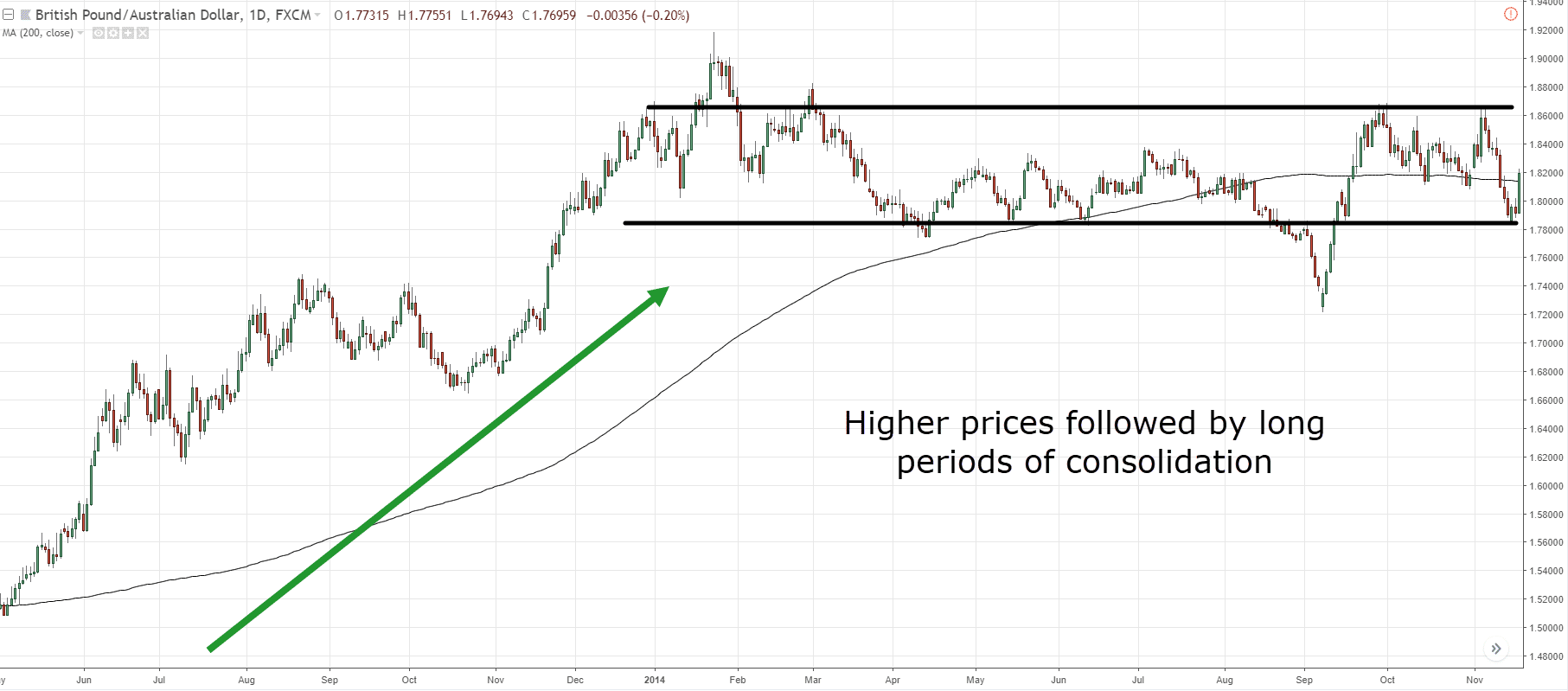

Stage 3: Distribution phase

This next phase comes after the price trends in a direction for a while. Similar to the accumulation period, it can last for quite some time and often appears to be a consolidation period. In this phase, price is consolidated in a range while the long-term moving average flattens. Some characteristics of the distribution phase are as follows:

- Arises after a price rise of 6 months or more

- Can last for months or sometimes years

- During an uptrend, it appears like a long period of consolidation

- Price is contained within a range, and bears and bulls are in equilibrium

- The price fluctuates around the 200-day moving average

- The traders’ close attention leads to high volatility.

The best trading strategy to use during the distribution phase is to trade the range itself. That means that a trader can go long at the lows, and short at the highs of the range.

However, one thing that you should avoid doing is to trade in the middle of the range.

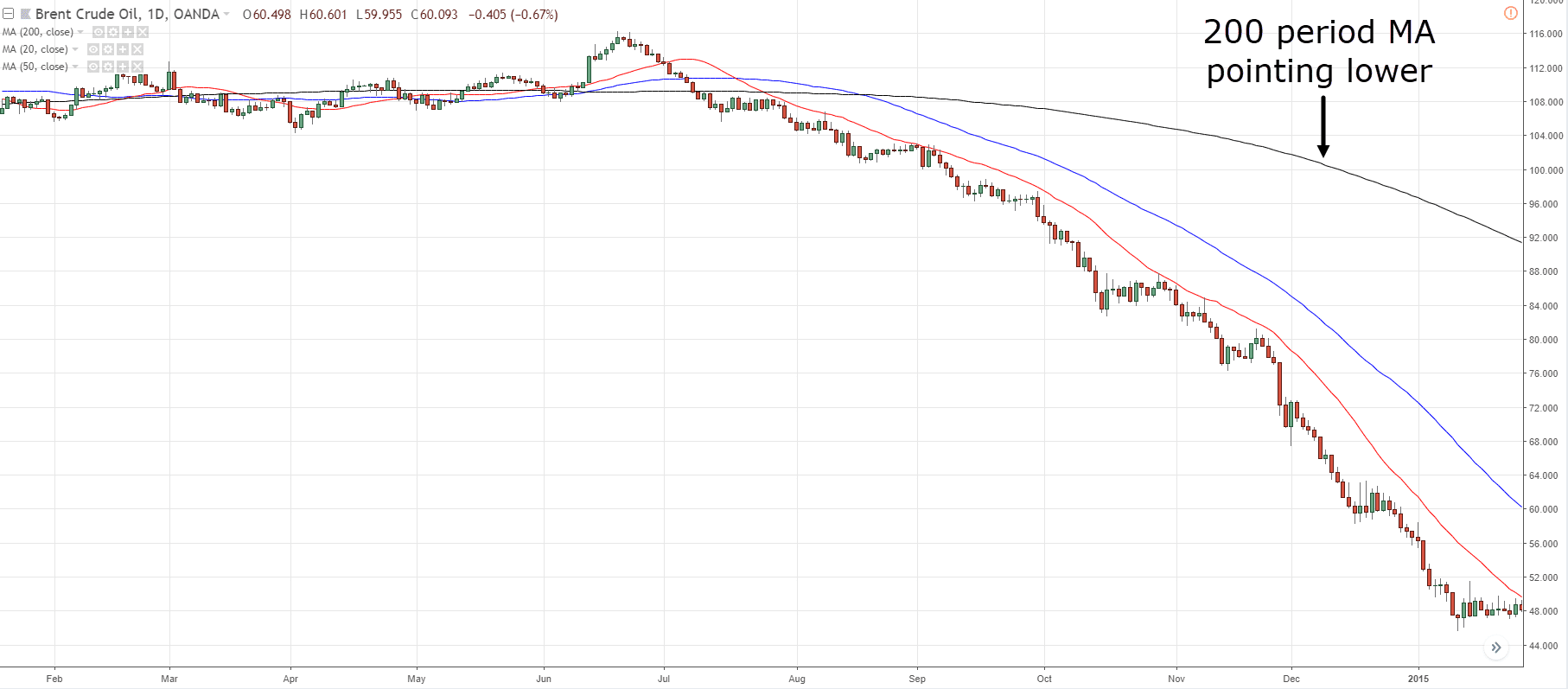

Stage 4: Declining or deflation phase

After the distribution phase, the price breaks down and goes into a deflation phase. It is a downtrend that consists of lower highs and lows. At this stage, those who do not cut their losses become long-term investors. Some characteristics of the declining phase are as follows:

- Can last from a few months to years

- Price series form lower highs and lows

- More down days than up days are seen

- Price trades lower over time

- Short-term moving averages are well below the long-term moving averages

- The 200-day moving average is point downwards

- Price is lower than the 200-day moving average

- Panic and fear in the market lead to high volatility.

In this phase, price resumes its long-term trend. For instance, if the price was trending upwards before it started trading in a range, it is expected for the uptrend to return. But if the uptrend has run its course, then it can reverse and move in the opposite direction. This is why the traders have to be watchful since the price can break out in either direction.

In this phase, a strategy that utilizes trend following is ideal in capturing the market movement and to profit on the underlying trend or the new emerging trend. One thing to note is that a trader should never go long during a downtrend. The path of least resistance is to the downside, which will allow you to get the most out of your buck.

Final words

Identifying forex trends and their various stages is imperative if a trader wants to recognize the ideal entry and exit points and make profits. There are a few basic strategies that traders should be aware of in that regard. Traders should look to trade in the direction of the trend when the market is trending. On the other hand, traders should look to trade the ranges during the consolidation phases – entering long at support levels and short at the resistance levels.

Traders who have a thorough understanding of the four stages of forex trends have a much more significant advantage over other speculators. Though it can be quite hard to recognize the bottom of the accumulation stage or the top of the advancing phase, traders can profit from following the overall trend and selling as soon as the uptrends show hints of a slowdown (or entering the distribution stage).

Here, traders with an aggressive approach can also short-sell the market and gain from the declining phase and the lower prices associated with it. The stages in the market can occur in any time frame for each chart.