Volatility and liquidity are the bread and butter of a trader. The former refers to the ups and downs in the instrument’s price due to pressure buyers and sellers impose simultaneously. At the same time, the latter is the amount of trading volume that helps an investor go long or short on his executions immediately. The combined activity of traders in currencies constitutes a daily trading volume of a whopping 6 trillion dollars.

Different FX pairs depict various levels of movements and volume over a certain period. It is essential to understand the crucial reasons behind this phenomenon to better capitalize on volatility. Our article will highlight all the vital currency pairs that one must know and the appropriate time and ways to trade them.

What is a currency pair?

A currency pair reflects the price of one currency against another. The first one is called the base and the second one refers to the quote. By looking at the FX pair, you can know the amount of quote currency needed to get a single base unit. You can profit in the market by buying forex, i.e., purchasing base currency and selling quote currency, and vice versa.

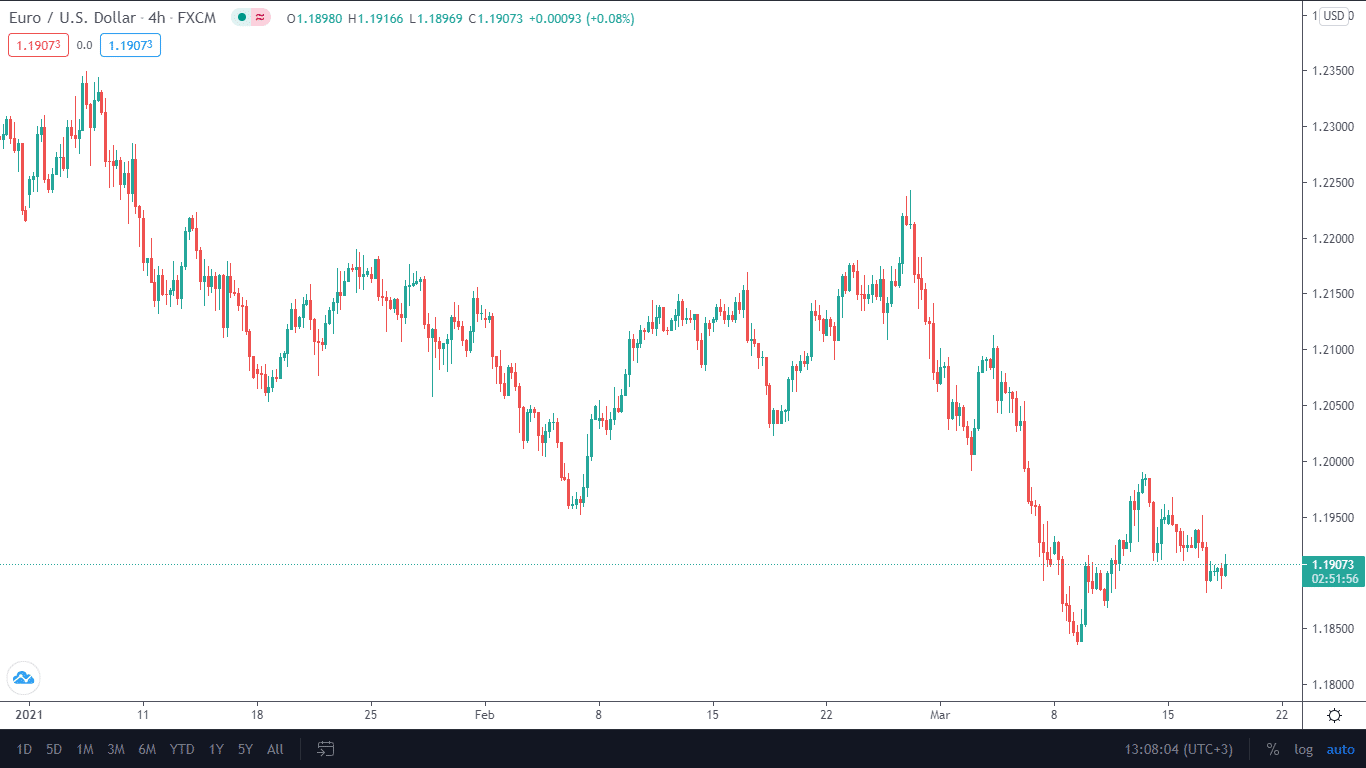

To understand better, let us take an example of EUR/USD. Here EUR stands for Euro and is the base while the USD is the United States dollar and is the quote. If the pair is trading at 1.13000, then it means that to get a single Euro, you have to give 1.13000 USD from your pocket.

Major currency pairs

Major currency pairs are those that constitute a significant trading volume in trading forex. They are EUR/USD, GBP/USD, USD/JPY, and USD/CHF. Some investors also like to include USD/CAD, AUD/USD, and NZD/USD in this category. EUR/USD comes as a winner amongst these regarding liquidity, followed by USD/JPY and GBP/USD.

What drives the major currency pairs?

As all of these FX pairs have the United States dollar, any news that comes out of the superpower has a good impact. Traders are seen scanning the charts to find correlations amongst them. Individual information coming out of Europe, Great Britain, and Japan are also influential, while commodities-based economies of Canada, New Zealand, and Australia are responsible for their part.

Image 1. A major currency pair chart of EUR/USD. Notice the clear and beautiful price action patterns created by the participation of millions of traders.

When should you trade the majors?

The best time to trade these pairs is when the individual economy and banks are open to trade. At that hour, you will find the best volatility and liquidity to capitalize on. Knowing trading sessions can help you in this regard. The London and New York sessions are the favorites amongst market participants.

| LOCAL TIME | EST | GMT |

| Sydney Open – 7:00 AM Sydney Close – 4:00 PM |

3:00 PM

12:00 AM |

8:00 PM

5:00 AM |

| Tokyo Open – 9:00 AM

Tokyo Close – 6:00 PM |

7:00 PM

4:00 AM |

12:00 AM

9:00 AM |

| London Open – 8:00 AM

London Close – 4:00 PM |

3:00 AM

11:00 AM |

8:00 AM

4:00 PM |

| New York Open – 8:00 AMNew York Close – 5:00 PM |

8:00 AM

5:00 PM |

1:00 PM

10:00 PM |

Table 1. An overview of trading sessions.

Minor currency pairs

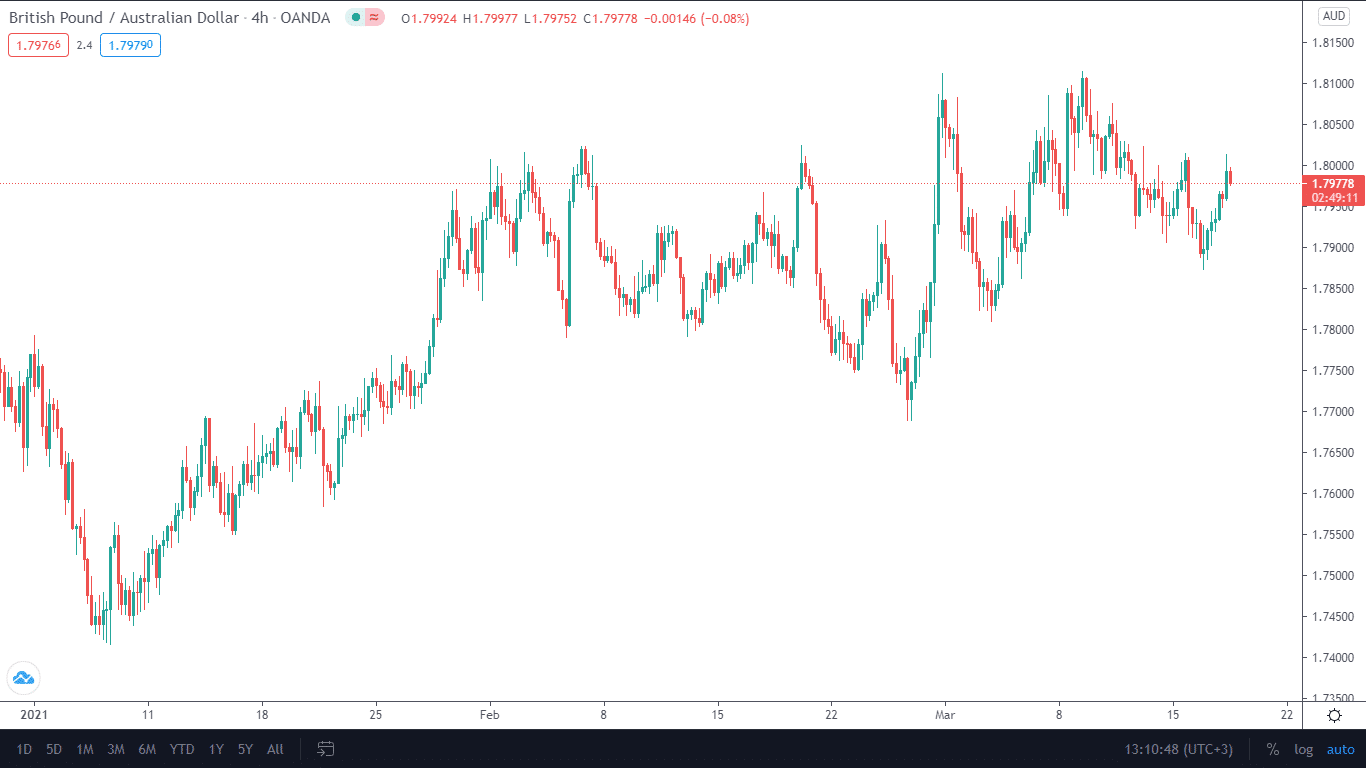

These types of currency pairs do not include United States dollars. It is a combination of other major currencies with one another, big or a smaller one. A few examples are EUR/GBP, EUR/AUD, GBP/JPY, NZD/JPY, CHF/JPY, etc.

These types of pairs are affected by similar factors driving the majors. The amount of volatility and liquidity is low that often leads to higher spreads. You will find out that the price movements are incredibly high in some pairs, such as GBP/AUD and GBP/JPY, due to the British economy.

Image 2. A GBP/AUD chart on the H4 time frame. If you can contrast this with image 1, you will find a big difference in volatility.

You can choose to trade on these pairs as per your liking. Do not stay on the charts in between trading sessions. That is where the most slippage and troubles occur.

Exotic currency pairs

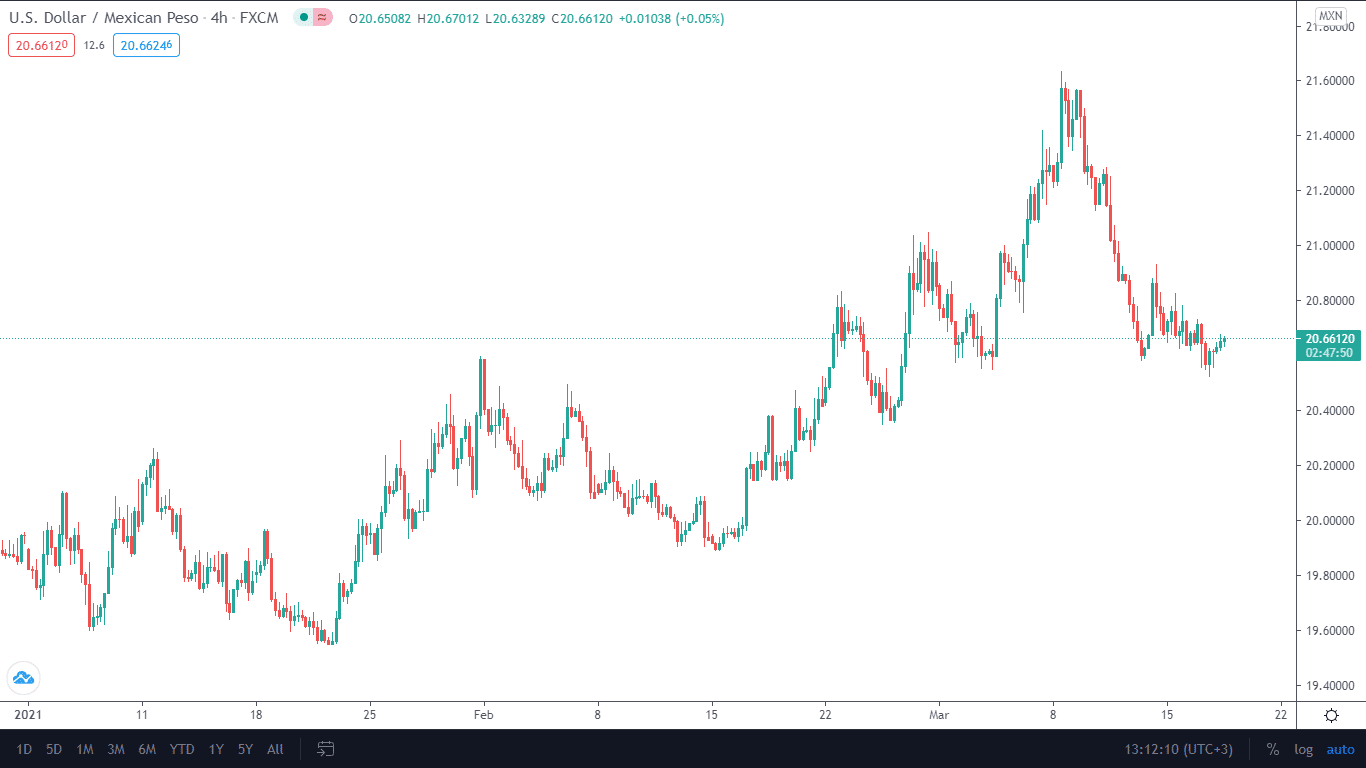

Exotic currency pairs represent a developing economy on the quote and a developed one on the base side. For example, USD/MXN, EUR/TRY, GBP/PKR, etc.

Image 3. An exotic pair of USD/MXN on the H4 time frame. Price action patterns are still relevant.

Political and economic instability have a significant impact on the movement of these FX pairs. The amount of liquidity is thin, often leading to a big shift in an instrument’s value. You can use trend, range, and breakout trading; however, always be cautious of the spreads.

Best tips for trading currencies

The following tips will help you in terms of trading major, minor and exotic pairs:

- Choose the currency pairs that have good liquidity and decent volatility.

- Use an appropriate time frame according to your strategy. Different currencies will show various stories depending on the period.

- Try to use forecasts and analysis by top investors.

- Always determine the amount of loss or gain caused by the movement of a pipette.

- Carefully use leverage to your advantage.

End of the line

Major currency pairs are a massive attraction for traders who prefer decent volatility and high liquidity. Having a basic knowledge of currencies that you should trade beforehand is essential to reach higher levels. Your strategy may also perform better in some pairs and during certain hours of the trading day.