Overview

The speed and efficiency at which electronic trading happens worldwide nowadays can make us forget about the parties responsible for such to occur. At any time during set market hours, anyone can buy a small or large volume of an instrument and have an order confirmed in a matter of seconds on a trading platform.

Furthermore, if a trader wanted to sell the same instrument at its current price, this action would also happen in a few seconds. These processes are so seamless that it’s rare to think there are organizations that make this possible, and these are known as ‘market makers.’

The basics of ‘market making’

Markets makers are known as such since they essentially create the market where participants can seamlessly buy or sell without delays or lags. In a fundamental sense, for example, any time a buyer wants to buy a financial instrument requires there to be a seller willing to sell that instrument to them. Without a market maker, the buyer would need to spend time and resources to find an individual seller to buy from. Many real-life analogies illustrate the role of market makers perfectly, including one that is very much related to forex.

There are numerous currency or forex exchanges in places like malls and airports that allow clients to convert a wide variety of international currencies. If someone was traveling overseas soon and needed to exchange $500 into euros, the exchange is necessary to ensure this trade is possible. Without an exchange, one would have to physically find an individual willing to give them euros for their US dollars.

These exchanges keep enough cash in different currencies to facilitate the many everyday transactions. In an identical vein, the market maker in any financial market always has enough of these instruments (worth tens of millions of dollars at least) to make this process operate in milliseconds. With such astronomical volume, it allows millions of traders worldwide to connect and trade due to the liquidity. Liquidity isn’t just about the number of participants, but the speed traders can ‘get in and out’ of the markets.

For example, if someone bought a stock for $100 and then it went up to $300 later on the same day, they could get out with a profit instantaneously due to the liquidity. We should remember that in this example, for an investor to exit selling at $300 means there needs to be someone willing to buy at this price. Every transaction in any market needs a counterparty for it to occur, just like in the real world. Without market makers, the trades between buyers and sellers may be tremendously slower, resulting in thinner trading volumes (i.e., reduced liquidity).

How market makers make money

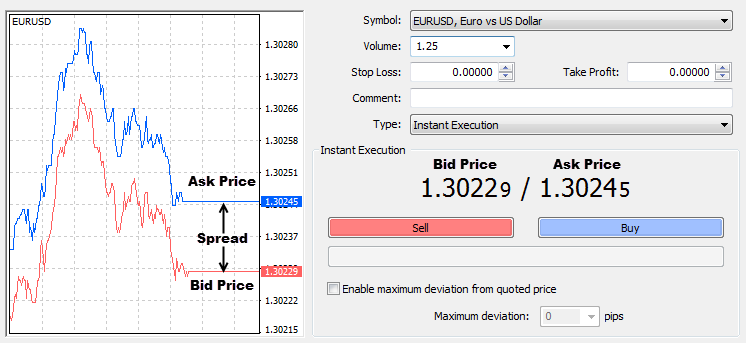

How market makers make money is mainly through the spread, which is a concept that any trader needs to understand on a trade-by-trade basis. The spread is the difference between the bid and the ask price.

The differences between liquidity providers and market makers

The terms ‘liquidity providers’ and ‘market makers’ are used interchangeably, though confusion still exists over the differences. Technically, a liquidity provider in any financial market is a market maker. Where the confusion may arise is that traditionally, the known liquidity providers are typically large financial institutions (mainly banks) that provide a myriad of different financial services to all kinds of clients, one of which is ‘market making’ in financial markets.

However, nowadays, any organization or even an individual can legally strictly be a market maker without being a bank or large financial firm. So, a difference can exist in this sense, except for whether the market maker only deals with ‘market making’ or other services.

The perceived conflict of interest for market makers

For at least a decade, trading communities have perceived sole market makers (organizations that primarily deal with ‘market making’) to trade against their clients. Any trader, from retail to institutional, is rarely immune to this practice. Numerous brokers have received the label of being market makers. This perceived conflict of interest exists in virtually all financial markets. On the one hand, ‘market making’ is perfectly legal because without it, no market could exist.

On the other hand, the prevalent issue is that market makers can act against the interest of their clients by manipulating price through various known techniques like slippage, spread widening, additional fees, and requoting. From the perspective of retail traders, this kind of malpractice is tough to detect. Such manipulation is a massive transgression in the industry, leading to many regulators demanding brokers to adhere to preferable execution standards.

Conclusion

How money circulates in the markets is all due to market makers and how they contribute to the liquidity. There could be more services in the industry (such as brokers) that are market makers than we think. Though the term has garnered a bad reputation, we still need market makers.

The only challenge is the conflict of interest, which is challenging to identify from a retail standpoint. As a result, the knowledge of STP (straight-through processing) brokers has come to the fore, though even this factor comes with caveats. Ultimately, traders should conduct detailed research on any financial institution they deal with.