Trading robots, also known as bots, have grown in popularity in recent years. Indeed, computer programmers are the most sought-after and highly-paid professionals, where hedge funds and investment banks look to employ. Bots help traders identify many trading opportunities at once and automate their trading. Let us look at the best risk management strategies you should resort to when using trading bots.

Be careful with bots you buy

Building trading bots is a complicated process because of the skillset required. To build a robot from scratch, you will need excellent trading and programming skills. The most common programming language used when creating the algorithms are python, MQL, and Java.

Unfortunately, most people don’t have knowledge and experience in these fields when they take up trading. Therefore, they turn to the Internet, where they can download free bots or even buy them. If you use MetaTrader, the MQL 4/5 website is an excellent place to buy these experts.

To be clear, most of these bots are good at what they do. However, before you spend your money on a bot, we recommend that you take a lot of caution.

There are several warning signs to look at:

- Look at the claims made by the provider – be careful about bot-makers that claim constant double-digit returns per day.

- Compatibility – identify whether the bot is compatible with your trading platform.

- Use a free trial – if possible, use a free trial provided by the bot developer.

- Investigate their reviews – most providers have reviews with excellent pictures. Do a reverse image search to see whether those are stock images. For example, the pictures below are from a bot provider. But doing a quick reverse search shows that they are just stock pictures.

Investigate bot reviews/claims.

Build your bots using strategies you know

Ideally, a trading bot should be a tool that makes it easier for you to trade. As such, you should build a bot that automates your trading strategy. If you are a swing trader who has successfully used a double moving average strategy for years, you should build a bot that uses the same strategy.

The same is true for all indicators that you use, including the Bollinger bands, moving average convergence divergence (MACD), and the Relative Strength Index.

There are several benefits to doing this. First, if you use indicators and strategies that you know well, it will make your trading easy. Second, it will guarantee your long-term success. Furthermore, you have already used it for years.

Similarly, if you are buying a bot, we suggest you buy one that uses a strategy that you know about. This will be an easier process compared to buying bots that you don’t understand.

Always back-test your trading bots

The most important risk management strategy when using trading robots is to always back-test them. This is a process where you use historical data to gauge the performance of a bot. There are several strategies for doing this type of testing.

However, the most common one is to use tools that are available in most trading platforms, including the MetaTrader and TradingView. There are several steps of back-testing a bot in MT5:

- Install the bot – you should install the trading robot in your MT4/5.

- Open the strategy-tester – you can find this tool in the view tab. Alternatively, you can press CTRL+R.

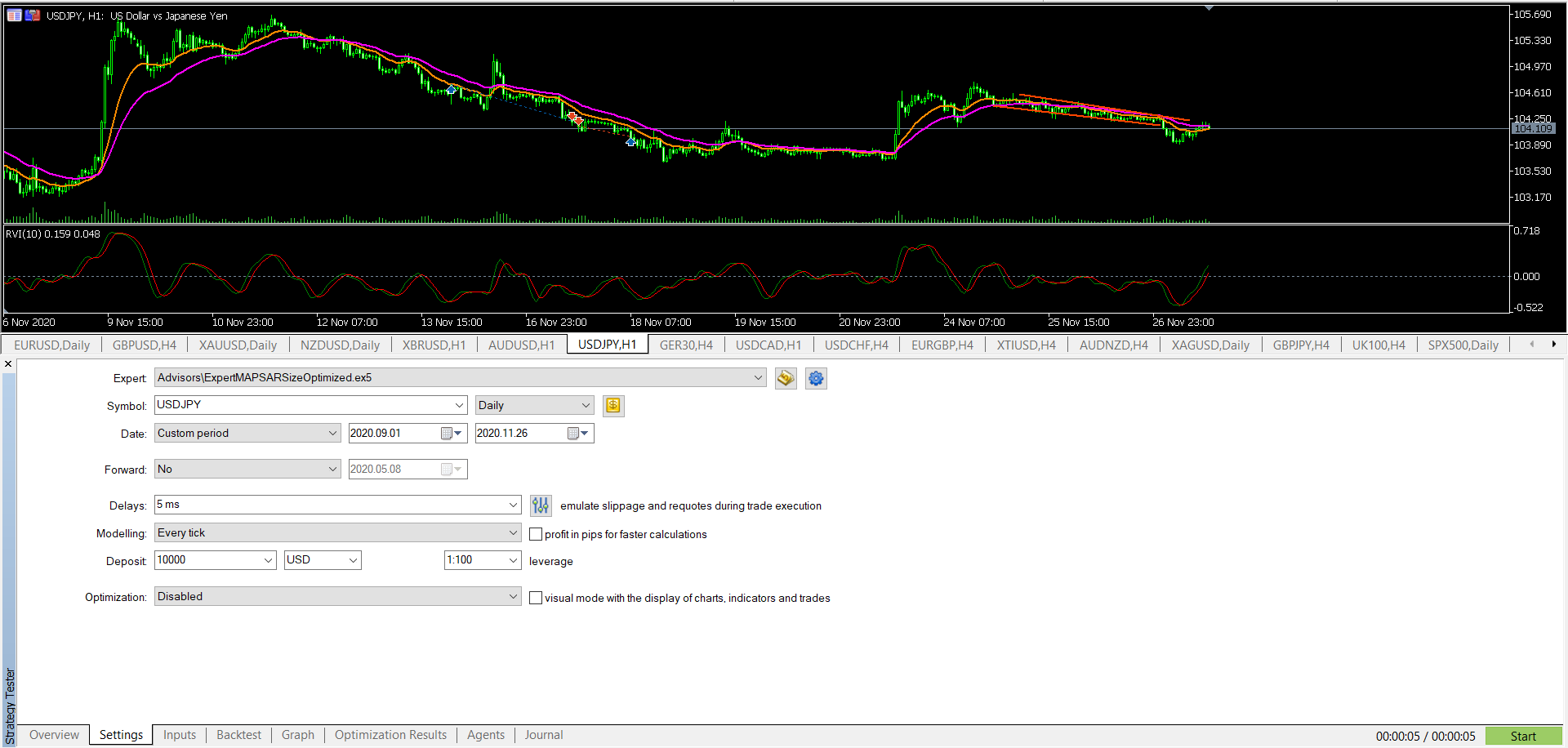

- Input your variables and run the test. These variables include the bot, your preferred currency, duration of the back-test, preferred time chart, delays, and your initial deposit, as shown below.

The chart below is a good example of how to back-test. We are testing a bot known as ExpertMAPSAR on the USD/JPY pair. We are using a custom period, and we have an initial deposit of $10,000. We have also selected a 5ms delay and are using a 1:100 leverage.

Bot back-testing example

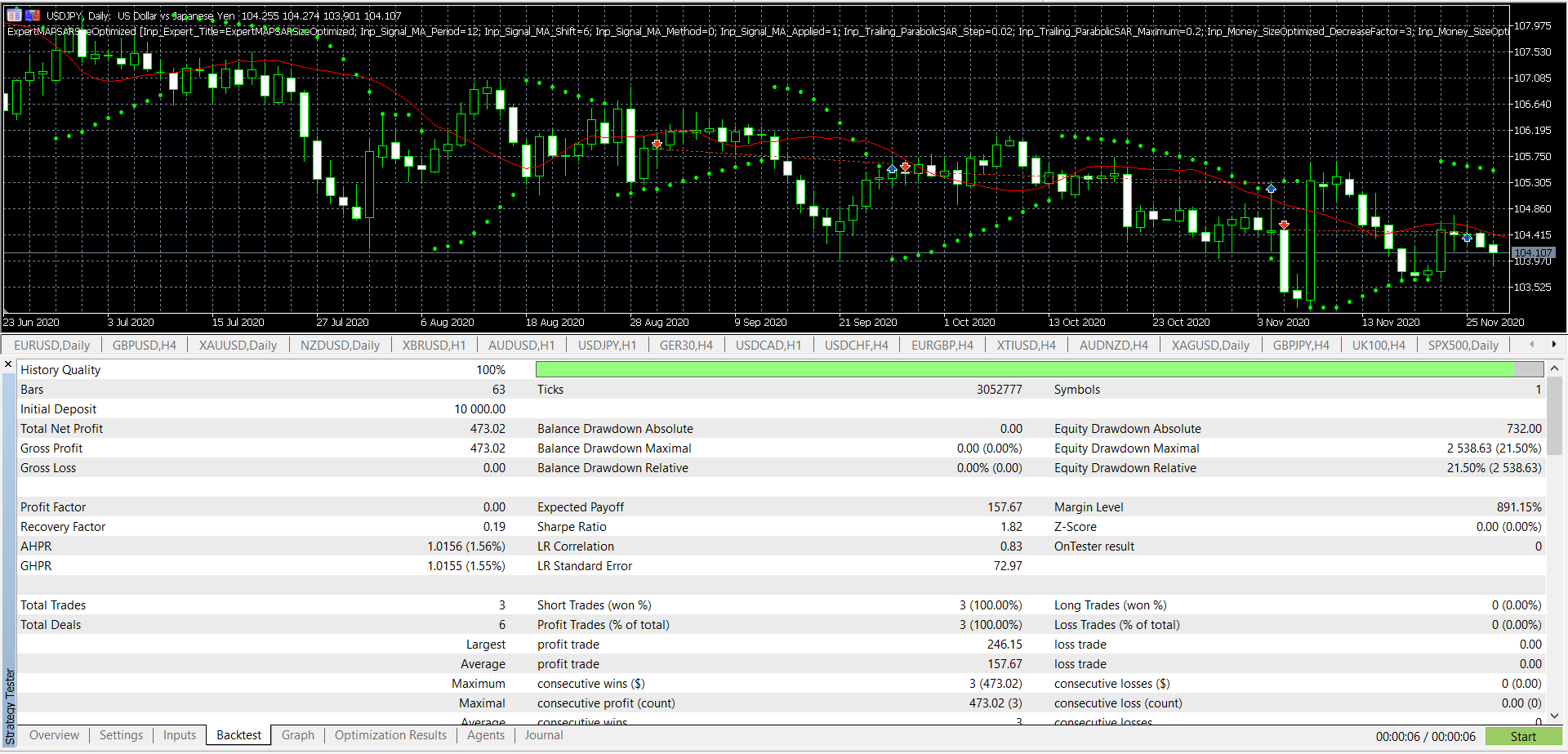

The chart below is the result of the back-testing process. During the analysis period, the bot opened three trades, which were all positive. It had a net profit of $473.

Back-test results

You should spend a lot of time at this stage to avoid making significant mistakes. Here are several tips that will guide you:

- Stress-test the bot in all market conditions.

- Use the same amount you will be trading with when you start using the bot.

- Test different currencies.

- Spend at least two months testing the bot.

Always have a stop loss and take profit in your bots

A stop loss is probably the most important tool in your risk management toolbox. For starters, a stop loss is a tool that automatically stops your trades when your maximum loss level is reached. It will close the trade even when you are not present.

When building a bot, we recommend that you do so with your Risk/Reward ratio in mind. If you have an account with $10,000 and you have the risk-reward ratio of 4%, it means that the maximum loss you can take per trade is $400. Therefore, program that into your bot.

Similarly, you can incorporate a trailing stop loss in your algorithm. Unlike a stop loss that is fixed, the trailing one will always move with the price and capture potential profits.

Pay close attention to your leverage

Leverage is an important part of day trading because it helps to maximize your returns. Without it, most traders would not be able to access and trade profitably. Ideally, leverage is similar to a loan that brokers advance to you.

Leverage is usually provided in the form of a ratio. If you have a $100 account and select leverage of 1:100, it means that you can trade as if you had $10,000.

If your leveraged trades go well, it means that you will make more money. At the same time, if the trades go south, it means that you can even lose more money than you have in your account and end up in the read.

Therefore, we recommend that you use relatively small leverage, whether you are using robots or trading manually. Doing that will help you prevent significant losses and sustain your account for a longer period.

Final thoughts

Trading using robots or algorithms can be highly rewarding. However, it can be the riskiest approach because the bots will often initiate trades when you are not there. Therefore, using these simple risk management strategies can help you maximize your returns and keep your trading safe.