The Forex market is a competitive space where a trader not only needs a keen vision but also the right amount of patience. Fortunately, there are a lot of automated tools to generate trading signals in the forex market, based on the strategy or style chosen. Thus, as a trader, your first step should involve zeroing in on a trading setup or strategy that best caters to your trading style.

There is a myriad of indicators and charts available that can aid you in your pursuit of predicting the future of the forex market. However, they are of no use if you don’t know how to use them. Finding the right setup is a trial and error affair. The key here is to understand what you are doing and why, after which you analyze the results. Thus, testing your setup beforehand is the best way to minimize risk, and making the most out of future trading opportunities.

To understand how to use and apply charts, you need to consider some key elements. Here are seven tips for you to use while using charts in the forex market.

Knowing Setups

Before you start to test, you should be aware of the five major types of setups. This includes Technical setups, News-based setups, Big picture fundamental setups, Sentiment Setups, and Expert setups. You can either use these setups independently or combine them with others to create high probability, low risk/high reward trading ideas. However, as the essence of a good trading plan is simplicity, look to pick only those setups that suit your trading personality.

The above is the chart for EUR/USD on May 31, 2018. On this day, the Eurozone saw higher than anticipated inflation, causing the pair to open at about 1.1600, with a target of 1.1780. This indicates a bullish, long stance. A possible stop-loss can be put in at about 1.1510, which is not reached on the 30-minute chart. So here the setup occurs before a trade is executed and signals a trading opportunity. Once set up conditions exist, you don’t need to enter straightaway. Rather take your time with entry and look to increase the risk/reward on the trade.

Knowing Your Market Type

Market types make for excellent set-ups. Be aware of the market type you are in before you begin to trade. Market types include Bull normal, Bull volatile, Sideways quiet, Sideways volatile, and others. Additionally, consider using the transition from one market type to the next as the basis of your setup.

Select your currency pair

We have all heard that its best for us to stick to the major currency pairs such as GBP/USD and EUR/USD. While this is true most of the time, smarter traders might decide to trade the cross rates instead. As a trader, you should not be afraid to explore the full spectrum of currency pairs that are on offer. The cross rates often possess spreads that are very close to the majors. This is because fewer people specialize in them.

Use a trend filter

A trend filter is a setup that can help you to make systematic changes step by step that will improve your results over time. Simply apply a trend-following indicator to a chart and be sure to never trade against it. If the price is below the indicator, never purchase. If the price is above the indicator, never go short.

To check for the effectiveness of a trend filter, you can use a programmed back-test or conduct a manual back-test by looking at the charts. MetaTrader and other reputed trading platforms provide simple ways of conducting back-tests. However, manual testing is always preferred over computerized back-tests as it offers more insights.

Some important trend filters include the following:

- 10-day Exponential Moving Average

- 25-period moving average displaced by 5 periods for short-term trends

- Moving Average Convergence Divergence

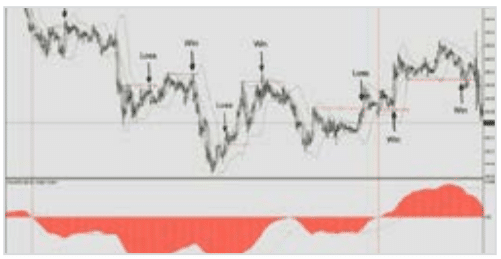

Let’s look at an example of how a trend filter works. We take the MACD 70/200/70. In the chart below, a simple support and resistance trading system are operating. It buys on support in an uptrend and sells on resistance in a downtrend. The exit is found on the opposite support or resistance level. Here each winning trade has a risk/reward ratio of 3:1.

Using Chart Patterns, Trend lines, and Support & resistance levels smartly

If you have gathered enough comprehensive knowledge about how charting works, the triangles, Fibonacci levels, and wedges can be considered perfect set-ups. However, never be in a hurry to enter a trade when you identify a potential pattern for the first time. To improve the risk/reward on the trade, you can move to a lower timeframe.

Using News based set-ups

There are many traders that are attracted to the thrill of the news announcement. Whether there is a lack of emotion and discipline in the market, it presents a profit potential for traders who are prepared and patient. Some types of news, such as NFP, retail sales, FOMC, CPI, and trade balance can have a greater impact than others.

Fundamentals can provide good setups

Most fundamental information can provide good setups. If you are holding long-term positions, interest rates and central bank bias are two very important fundamental set-ups to consider

After 2008, central banks belonging to a number of major developed nations decreased interest rates to near zero. After this, their main tool became quantitative easing which involves injecting cash into the economy in exchange for debt. This bias towards easing has a telling impact on currency pair movements.

Thus as a trader, you should tune in to the easing or tightening proclivity of central banks to get an idea about which direction they want to trade. Directional biases like this caused by fundamentals can make good setups for longer-term trades.

Do not Forget Interest Rates

In this context, the interest rate differential between nations is one of the best predictive tools for currency movements. As currency trading is perceived to be a type of leveraged fixed interest trading, a currency pair with a higher rate is an attractive long-term buy. When there is demand, undeniably the price increases.

In addition to this, interest rates have a very substantial impact on your account balance. When purchasing a currency pair with a lower interest rate, the interest charges are likely to be deducted from your account on a daily basis.

Final Thoughts

Unlike in the past, there is a good deal of readily accessible information regarding forex trading online. However, with so much advice, it can be difficult for the uninitiated to start picking out the right one.